Current Report Filing (8-k)

06 Juli 2021 - 10:06PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 1, 2021

|

ALSET

EHOME INTERNATIONAL INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

|

001-39732

|

|

83-1079861

|

|

(State

of incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

4800

Montgomery Lane, Suite 210

Bethesda,

Maryland 20814

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (301) 971-3940

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Stock, $0.001 par value

|

|

AEI

|

|

The

Nasdaq Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

July 1, 2021, Alset EHome International Inc. (the “Company”) and the Company’s subsidiary Hengfai Business Development

Pte Ltd. entered into an Executive Employment Agreement (the “Employment Agreement”) with the Company’s Co-Chief Executive

Officer, Chan Tung Moe (the “Executive”). Pursuant to the Employment Agreement, Mr. Chan’s compensation will include

a fixed salary of $10,000 per month. In addition, Mr. Chan will be paid a signing bonus of $60,000. The term of the Employment Agreement

ends on June 30, 2024. Chan Tung Moe is the son of our Chief Executive Officer, Chairman and majority shareholder, Chan Heng Fai.

The

foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the

complete text of the Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective

as of July 1, 2021, the Board of Directors of the Company has appointed Chan Tung Moe as the Co-Chief Executive Officer of the Company.

Since

2015 Chan Tung Moe has held various positions with several of the Company’s subsidiaries and affiliated entities and currently

holds a key position as a director and Co-Chief Executive Officer of the Company’s Singapore Exchange-listed subsidiary, Alset

International Limited. He also currently serves as Co-Chief Executive Officer and Director of the Company’s subsidiary, LiquidValue

Development Inc. Since 2020 Mr. Chan has served as a director of New York Stock Exchange listed Document Security Systems, Inc. and Director

of Corporate Development of American Medical REIT Inc.

From

2014 to 2015 Mr. Chan was the Chief Operating Officer of Hong Kong Stock Exchange listed Zensun Enterprises Limited (formerly known as

Heng Fai Enterprises Limited) and was responsible for that company’s global business operations consisting of REIT ownership and

management, property development, hotels and hospitality, as well as property and securities investment and trading. Prior to that, from

2006 till 2014, he was an executive director and Chief of Project Development of Singapore Exchange-listed SingHaiyi Group Ltd, overseeing

its property development projects. He was also a non-executive director of the Toronto Stock Exchange-listed RSI International Systems

Inc., a hotel software company, from 2007 to 2016.

Mr.

Chan has a diverse background and experience in the fields of property, hospitality, investment, technology and consumer finance. He

holds a Master’s Degree in Business Administration with honors from the University of Western Ontario, a Master’s Degree

in Electro-Mechanical Engineering with honors and a Bachelor’s Degree in Applied Science with honors from the University of British

Columbia.

Chan

Tung Moe is the son of our Chief Executive Officer, Chairman and majority shareholder, Chan Heng Fai.

On

July 1, 2021, the Company and Hengfai Business Development Pte Ltd. entered into an Executive Employment Agreement with the Company’s

Co-Chief Executive Officer, Chan Tung Moe. The description of the Employment Agreement set forth in Item 1.01 above is incorporated herein

by reference thereto.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ALSET

EHOME INTERNATIONAL INC.

|

|

|

|

|

|

Date:

July 6, 2021

|

By:

|

/s/

Rongguo Wei

|

|

|

Name:

|

Rongguo

Wei

|

|

|

Title:

|

Co-Chief

Financial Officer

|

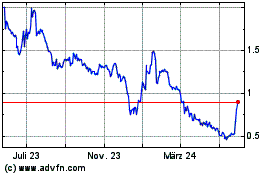

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

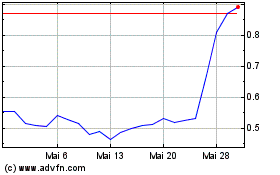

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025