Prospectus Filed Pursuant to Rule 424(b)(4) (424b4)

13 Mai 2021 - 12:08PM

Edgar (US Regulatory)

Filed

pursuant to Rule 424(b)(4)

Registration No. 333-255757

Prospectus

Supplement

(To

Prospectus dated May 10, 2021)

4,700,637

Common Units

1,611,000

Pre-funded Units

Common

Units Consisting of

One Share of Common Stock and

One Series A Warrant to Purchase One Share of Common Stock and

One Series B Warrant to Purchase One-Half of a Share of Common Stock

Pre-funded

Units Consisting of

One Pre-funded Warrant and

One Series A Warrant to Purchase One Share of Common Stock and

One Series B Warrant to Purchase One-Half of a Share of Common Stock

This

prospectus supplement (“Supplement”) modifies, supersedes and supplements information contained in, and should be

read in conjunction with, that certain prospectus, dated May 10, 2021, of Alset EHome International Inc. (the “May 10 Prospectus”).

This Supplement is not complete without, and may not be delivered or used except in connection with, the May 10 Prospectus.

The

information in this Supplement modifies and supersedes, in part, the information in the May 10 Prospectus. Any information that

is modified or superseded in the May 10 Prospectus shall not be deemed to constitute a part of the May 10 Prospectus, except as

modified or superseded by this Supplement.

See

“Risk Factors” beginning on page 8 of the May 10 Prospectus, for risk factors and information you should consider before

you purchase securities.

The

risk factor below supersedes the risk factor titled “If you purchase Common Units or Pre-funded Units in this offering,

and accounting for our acquisition of 4,775,523 shares of American Pacific Bancorp, Inc.’s (“APB”) Class B common

stock, representing 86.44% of the total issued and outstanding common stock of APB on March 12, 2021, you will experience immediate

dilution in the common stock included in the Common Units or Pre-funded Units you purchase. You will experience further dilution

if we issue additional equity securities in future financing transactions.” in the “Risk Factors” section of

the May 10 Prospectus.

If

you purchase Common Units or Pre-funded Units in this offering, and accounting for our acquisition of 4,775,523 shares of American

Pacific Bancorp, Inc.’s (“APB”) Class B common stock, and other acquisitions on March 12, 2021, you will experience

immediate dilution in the common stock included in the Common Units or Pre-funded Units you purchase. You will experience further

dilution if we issue additional equity securities in future financing transactions.

Giving

effect to our receipt of approximately $29 million of estimated net proceeds, after deducting underwriting discounts and commissions

and estimated offering expenses payable by us from our sale of Common Units and Pre-funded Units, our pro forma as adjusted net

tangible book value as of December 31, 2020, would have been $31,454,263, or $2.11 per share (not including transactions after

December 31, 2020, except four acquisitions from Mr. Chan Heng Fai on March 12, 2021 and this offering). This amount represents

an immediate increase in net tangible book value of $1.83 per share of our common stock to existing stockholders and an immediate

dilution in net tangible book value of $2.96 per share of our common stock to new investors purchasing in this offering. In addition,

you could experience further dilution if the Warrants issued in this offering are exercised. If we issue additional common stock,

or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including investors who purchase

shares of common stock in this offering, may experience additional dilution, and any such issuances may result in downward pressure

on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities in any future

offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors

purchasing shares or other securities in the future could have rights superior to existing stockholders.

The

date of this prospectus supplement is May 12, 2021.

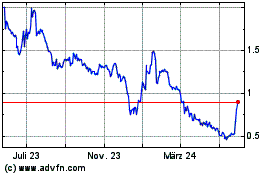

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

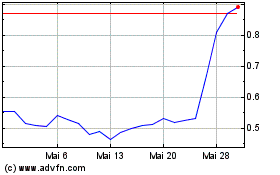

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025