TIDMIGP

RNS Number : 7446R

Intercede Group PLC

22 November 2012

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2012

Intercede (AIM: IGP.L) is a leading producer of Identity and

Credential Management software, called MyID, which manages the

secure registration, issuance and life cycle of digital identities

for a wide range of uses.

SUMMARY

-- Sales of GBP3,508,000 (H1 2011: GBP3,528,000);

-- Loss before tax of GBP185,000 (H1 2011: Profit before tax of GBP653,000);

-- Basic and fully diluted loss per share of 0.2p (H1 2011: Earnings per share of 1.4p);

-- Continued programme of investment to expand market presence and sales infrastructure, develop

products and create additional revenue streams;

-- Cash balances of GBP7,183,000 at 30 September 2012 (30 September 2011: GBP6,563,000) demonstrating

financial strength of business;

-- Launch of management solution for Microsoft Windows 8 Virtual Smart Cards.

Richard Parris, Chairman & Chief Executive of Intercede,

said today:

"We have continued to make good commercial progress in

challenging markets while resolutely laying the ground for our

future strategic development.

As governments and corporations become increasingly aware that

identity assurance is a critical cornerstone of cyber security, the

need for Intercede's MyID software platform is becoming more widely

recognised. To exploit this opportunity we have made excellent

progress in developing a number of new solutions and partnerships

that we expect to announce in the coming months.

We are confident and committed to our investment plan in support

of Intercede's 2020 vision for high growth in the medium to long

term. In the short term shareholders should be comforted that, in

spite of a period of increased investment, our cash position is

stronger than ever."

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Richard Parris, Chairman & Chief

Executive

Andrew Walker, Finance Director

FinnCap Tel. +44 (0)20 7220 0500

Stuart Andrews, Corporate Finance

Rose Herbert, Corporate Finance

Joanna Weaving, Corporate Broking

Pelham Bell Pottinger Tel. +44 (0)20 7861 3112

Archie Berens

About Intercede

Intercede(R) is a security software provider whose MyID(R)

identity management platform enables global organisations and

governments to create trusted digital identities for employees and

citizens on secure devices such as smartcards, smartphones and

tablets. MyID enables the protection of IP, assets, and digital

content, delivering trusted digital identities as the cornerstone

of cyber security strategies for government, defence, financial

services and other industries.

The Company operates in global markets (including the US, Europe

and Middle East) and works with large international partners

including BT, Gemalto, HP, Microsoft, Oberthur, SafeNet, Symantec

and Thales to deliver flexible digital identity solutions that are

interoperable with other existing technologies and which are

tailored to customer needs.

Corporations such as Boeing, Booz Allen Hamilton and Lockheed

Martin, and governments including the USA, UK and Kuwait, trust

Intercede's deep expertise to deliver effective solutions. The

company's technology achievements reflect an investment of 300 plus

man years of development, exemplary speed of deployment and

adherence to international standards including FIPS 201, where MyID

was the first electronic personalization product to obtain GSA

approval. This trust is reflected in Intercede's rate of repeat

business with its customers, which typically runs at 70-80% of

annual revenues.

Intercede has been developing ID management systems since 1992

and MyID is currently deployed by end customers located in 24

countries. The company is headquartered in the UK, listed on the

London Stock Exchange AIM: IGP and ISO 9001 and TickIT

certified.

For more information visit http://www.intercede.com

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2012

Chairman's Statement

Introduction

I am pleased to announce Intercede's interim results for the six

month period ended 30 September 2012. We have continued to make

good commercial progress, whilst also laying the ground for our

longer term strategic development. We remain convinced that as

governments and corporations become increasingly concerned about

cyber security issues, our proprietary MyID technology will be

recognised as a vital asset in this area.

Financial Results

Revenues in the period totaled GBP3,508,000 compared to

GBP3,528,000 in the previous year. This is a creditable performance

in markets which continue to be challenging. An GBP84,000 loss for

the period compares to a GBP700,000 profit in the prior year which

reflects the strategic investment programme we have put in place to

accelerate the growth of the business.

The Company continues to be cash generative. Through careful

cash management, the cash balance at the end of September was

GBP7,183,000 compared to GBP6,968,000 at the end of March 2012 and

GBP6,563,000 at the end of September 2011, representing a year on

year increase of GBP620,000. Shareholders should be comforted that,

in spite of a period of increased investment, our financial

position is stronger than ever.

Review of Operations

As previously reported, the goals for the current financial

period are to increase sales and marketing efforts in promoting

MyID and to extend product development in areas such as mobile

devices and integration with the newly released Microsoft Windows

8. I am pleased to report that we are making good progress on both

fronts.

The average number of employees and contractors increased from

67 to 74 year on year in support of these goals. Staff costs

continue to represent the main area of expense totalling 72% of the

total operating costs during the period (2011: 79%).

Much of this expansion has been in the US, our largest market.

Our product has been known at the highest levels of government for

a number of years and that brand recognition has extended into the

commercial sector. We were delighted that nearly 100 US government

and business leaders attended our reception in Washington DC last

month, "The Future of Identity Assurance." Attendees included

senior executives from the US federal and state governments,

federal contractors as well as Intercede customers and technology

partners.

We have also launched our MyID management solution for Microsoft

Windows 8 Virtual Smart Cards (VSCs), including desktop, laptop and

tablet devices. Delivering a smart card level of security without

the smart card, the solution ensures only known people on known

devices can access company information.

There have also been a number of commercial successes and

industry milestones achieved in the period, including the

following:

-- MyID installations in support of managed service providers;

-- Delivery of services to support major MyID system upgrades; and

-- Ground breaking R&D to support the use of mobile devices as identity

devices.

As we reported in our trading update in October, we have secured

a number of new customers in the European and US markets, who are

expected to contribute to revenues in the second half of the year.

We are also making good progress on a number of large bid

opportunities with major corporates and governments, several of

which are expected to yield revenues before the end of the

financial period.

We continue to invest in developing additional routes to market.

These include supporting managed service providers who will offer

MyID as a Cloud service in support of their entry into the newly

emerging Identity Provider market place. This will provide a new

source of annuity revenue with greater visibility, which we expect

to commence towards the end of the current financial year, and to

increase thereafter.

The mobile market is clearly an area of significant opportunity

for us, as consumers and workers spend increasing amounts of time

using smart phones and other devices. Protecting identities, and

thus the data contained in the devices, is more important than

ever. We are working with industry majors with a view to our market

leading technology being used in mobile applications. We expect

these initiatives to start producing revenues in the next financial

year.

Outlook

As noted above, we have made good commercial and operational

progress in the first half of the year. First half trading was in

line with expectations and we anticipate several new contracts will

begin generating revenue in the second half of the year.

Our planned investment in expanding our technology leadership

into the managed service, Cloud and mobile device sectors is

starting to bear fruit with increasing partnership engagements with

a number of major industry players. This underpins our focus on

building a business and technology platform to deliver our

previously declared high growth 2020 vision. We remain confident

that this strategy will maximise long term shareholder value.

Richard Parris

Chairman & Chief Executive

22 November 2012

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2012

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3,508 3,528 6,964

Cost of sales (20) (94) (112)

------------ ------------ ----------

Gross profit 3,488 3,434 6,852

Administrative expenses (3,717) (2,817) (6,023)

------------ ------------ ----------

Operating (loss)/profit (229) 617 829

Finance income 44 36 81

------------ ------------ ----------

(Loss)/profit before tax (185) 653 910

Taxation 101 47 (233)

------------ ------------ ----------

(Loss)/profit for the period (84) 700 677

------------ ------------ ----------

Total comprehensive income attributable

to owners of the company (84) 700 677

Earnings per share (pence)

- basic (0.2)p 1.4p 1.4p

- diluted (0.2)p 1.4p 1.4p

------------ ------------ ----------

Consolidated Balance Sheet

As at 30 September 2012

As at As at As at

30 September 30 September 31 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 624 162 183

Deferred tax - 280 -

624 442 183

------------ ------------ --------

Current assets

Trade and other receivables 1,104 1,460 1,311

Cash and cash equivalents 7,183 6,563 6,968

8,287 8,023 8,279

------------ ------------ --------

Total assets 8,911 8,465 8,462

------------ ------------ --------

Equity

Share capital 487 484 484

Share premium account 232 86 110

Other reserves 1,508 1,508 1,508

Retained earnings 3,946 3,833 3,930

__________

------------ ------------ --------

Total equity 6,173 5,911 6,032

Current liabilities

Trade and other payables 890 772 910

Deferred revenue 1,848 1,782 1,520

2,738 2,554 2,430

------------ ------------ --------

Total equity and liabilities 8,911 8,465 8,462

------------ ------------ --------

Consolidated Statement of Changes in Equity

As at 30 September 2012

Share Share Other Retained Total

capital premium reserves earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2012 484 110 1,508 3,930 6,032

Issue of shares, net of costs 3 122 - - 125

Employee share option scheme

charge - - - 100 100

Total comprehensive income - - - (84) (84)

At 30 September 2012 487 232 1,508 3,946 6,173

------- ------- -------- -------- -------

At 31 March 2011 484 86 1,508 3,113 5,191

Employee share option scheme

charge - - - 20 20

Total comprehensive income - - - 700 700

At 30 September 2011 484 86 1,508 3,833 5,911

--- ----- ----- -----

At 31 March 2011 484 86 1,508 3,113 5,191

Issue of shares, net of costs - 24 - - 24

Employee share option scheme

charge - - - 140 140

Total comprehensive income - - - 677 677

At 31 March 2012 484 110 1,508 3,930 6,032

Consolidated Cash Flow Statement

For the period ended 30 September 2012

6 months

ended 6 months ended Year ended

30 September 30 September 31 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating (loss)/profit (229) 617 829

Depreciation 45 33 67

Employee share option scheme charge 100 20 140

Decrease/(increase) in trade and other

receivables 306 (615) (461)

Increase in trade and other payables 308 410 287

------------ -------------- ----------

Cash generated from operations 530 465 862

Taxation 4 47 47

------------ -------------- ----------

Net cash generated from operating activities 534 512 909

------------ -------------- ----------

Investing activities

Interest received 42 33 73

Purchases of property, plant and equipment (486) (28) (84)

------------ -------------- ----------

Net cash (used by)/generated from investing

activities (444) 5 (11)

------------ -------------- ----------

Financing activities

Proceeds on issue of shares 125 - 24

------------ -------------- ----------

Net cash from financing activities 125 - 24

------------ -------------- ----------

Net increase in cash and cash equivalents 215 517 922

Cash and cash equivalents at the beginning

of the period 6,968 6,046 6,046

------------ -------------- ----------

Cash and cash equivalents at the end

of the period 7,183 6,563 6,968

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2012.

The Group is not required to apply IAS 34 Interim Financial

Reporting at this time.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2012 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders prior to the

end of December 2012 and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the UK. The Directors consider that

the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

UK 331 399 779

Rest of Europe 403 377 814

North America 2,555 2,368 4,450

Rest of World 219 384 921

-------------- -------------- ----------

3,508 3,528 6,964

-------------- -------------- ----------

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of research and development claims and US

corporation tax payable. There is no charge for UK corporation tax

due to the availability of losses brought forward from prior

years.

4 (Loss)/Earnings per share

The calculations of the (loss)/earnings per ordinary share are

based on the (loss)/profit for the period and the weighted average

number of ordinary shares in issue during each period. The basic

and diluted loss per share are the same as potential dilution

cannot be applied to a loss making period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (84) 700 677

Number Number Number

Weighted average number

of shares - basic 48,613,486 48,365,005 48,367,939

- diluted 50,228,664 49,120,843 49,662,277

Pence Pence Pence

(Loss)/Earnings per share - basic (0.2)p 1.4p 1.4p

- diluted (0.2)p 1.4p 1.4p

-------------- -------------- ----------

The increase in the weighted average number of shares used for

the calculation of diluted earnings per share reflects the grant of

share options to directors and senior managers during July, August

and December 2011.

5 Dividend

The Directors do not recommend the payment of a dividend.

6 Changes in equity

Between 14 March and 14 June 2012, certain employees and a

Director of the Company exercised options over a total of 370,000

ordinary shares at an exercise price of 40.5p per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFSTLTLLFIF

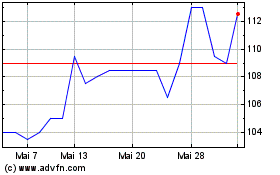

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024