TIDMIGP

RNS Number : 0375F

Intercede Group PLC

11 June 2012

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2012

Intercede, one of the world's leading digital identity software

providers, today announces its preliminary results for the year

ended 31 March 2012.

SUMMARY

- Continued robust financial performance:

-- Sales revenues increased from GBP6.9m to GBP7.0m

-- Profit before tax of GBP0.9m (2011: GBP2.0m)

-- Fully diluted EPS 1.4p (2011: 4.1p)

-- Increased cash balances of GBP7.0m at 31 March 2012 (2011: GBP6.0m)

- New customer accounts contributed 21% of total sales with the

number of user licences issued rising to over 5 million.

- Sales in North America have grown strongly as a result of

several big wins to contribute over 64% of total sales.

- Significant development of technology to manage virtual

identity credentials and security of mobile devices.

- Collaboration on multiple tender responses for large scale US Federal identity programs.

- Implementations at a broad range of global customers including

ANZ Bank, Booz Allen Hamilton, BASF, Boeing, HealthSmart Australia,

Lockheed Martin and Swedbank.

- Increasing managed service/Software as a Service (SaaS)

activity; revenues in excess of GBP0.5m.

- Additional office space and staff recruitment in the UK and US

to support next phase of growth.

Richard Parris, Chairman & Chief Executive of Intercede,

said today:

"There is an increasingly irresistible case for believing that

the digital identity market is rapidly moving to mass adoption. For

an organisation to fully exploit this opportunity, it needs to have

developed a suitably robust technology platform, entrenched itself

in the market and scaled up its infrastructure. Intercede has spent

many years achieving the first two of these and I'm pleased to

report that we have made significant progress towards achieving the

third. The investment we have made this year in our sales and

delivery capability gives us a real competitive advantage.

Our pipeline of commercial opportunities continues to grow as we

seek to deepen our penetration of the markets where Intercede's

MyID digital identity technology has become an industry standard.

There are also a number of new technology-led trends which provide

additional opportunities for Intercede; for example mobile device

security and the deployment of digital patient identities in

healthcare. The outlook is therefore extremely positive."

About Intercede

Intercede(TM) is a security software provider whose MyID(R)

identity management platform enables global organisations and

governments to create trusted digital identities for employees and

citizens on secure devices such as smartcards, smartphones and

tablets. MyID(R) enables the protection of IP, assets, and digital

content, delivering trusted digital identities as the cornerstone

of cyber security strategies for government, defence, financial

services and other industries.

The Company operates in global markets (including the US, Europe

and Middle East) and works with large international partners

including BT, Gemalto, HP, Microsoft, Oberthur, SafeNet, Symantec

and Thales to deliver flexible digital identity solutions that are

interoperable with other existing technologies and which are

tailored to customer needs.

Corporations such as Boeing, Booz Allen Hamilton and Lockheed

Martin, and governments including the USA, UK and Kuwait, trust

Intercede's deep expertise to deliver effective solutions. The

Company's technology achievements reflect an investment of 300 plus

man years of development, exemplary speed of deployment and

adherence to international standards including FIPS 201, where

MyID(R) was the first electronic personalisation product to obtain

GSA approval. This trust is reflected in Intercede's rate of repeat

business with its customers, which typically runs at 70-80% of

annual revenues.

Intercede has been developing ID management systems since 1992

and MyID(R) is currently deployed by end customers located in 24

countries. The company is headquartered in the UK, listed on the

London Stock Exchange (AIM: IGP) and is ISO 9001 and TickIT

certified.

For more information visit http://www.intercede.com

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558111

Richard Parris, Chairman & Chief

Executive

Andrew Walker, Finance Director

FinnCap Tel. + 44 (0)20 7600 1658

Sarah Wharry/Rose Herbert, Corporate

Finance

Joanna Weaving, Corporate Broking

Pelham Bell Pottinger Tel. +44 (0)20 7861 3112

Archie Berens

Chairman's Statement

Financial and Operational Highlights

Significant progress has been made this year in building a

platform for a step change in performance as the market for

identity management moves towards mass adoption. Highlights

include:

-- Continued robust financial performance

- Sales revenues increased from GBP6.9m to GBP7.0m

- Profit before tax of GBP0.9m (2011: GBP2.0m)

- Fully diluted EPS 1.4p (2011: 4.1p)

- Cash balances of GBP7.0m at 31 March 2012 (2011: GBP6.0m)

-- Over 5 million licences issued to users of identity credentials.

-- Large scale corporate identity card projects continued with

implementations for global customers including: ANZ Bank, Booz

Allen Hamilton, BASF, Boeing, HealthSmart Australia, Lockheed

Martin and Swedbank.

-- Large scale border security project with a US partner;

initial revenues in excess of GBP0.6m.

-- Services to support major MyID system upgrades in US Federal

Aviation Authority, Kuwait Public Authority for Civil Information,

Road Safety Authority Ireland.

-- MyID and Software as a Service (SaaS) sales to support a

North American managed service organisation and the securing of

three other SaaS customers. Recognised revenue in the period

exceeds GBP0.5m.

-- Success with major systems integrators, collaborating on

multiple tender responses for large scale US Federal identity

programs requiring Personal-Identity-Verification (PIV) and

PIV-Interoperable (PIV-I) solutions. Revenues are expected from

this investment in the next period.

-- Technology developments

- Over-the-air (OTA) provisioning of digital certificates to mobile devices.

- MyID extension to manage virtual identity credentials on

Trusted Platform Modules (TPM) in anticipation of the forthcoming

release of Windows 8.

- Near Field Communications (NFC) technology to support the use

of mobile devices featuring NFC for personal identity

verification.

- MyID improvements including the release of MyID v8 Enterprise

SP2 and MyID v9 PIV Service Pack.

-- International Standards: ISO 9001 and TickIT certification announced on 14 September 2011.

-- Business expansion: additional office space and staff

recruitment in the UK and US to support the next phase of

Intercede's growth.

Results

In the year ended 31 March 2012, revenue increased by 1.3% from

GBP6,872,000 to GBP6,964,000 at a gross margin of 98.4%.

Good progress has been made growing our sales and delivery

capabilities. North American sales have increased to GBP4,450,000

(2011: GBP3,965,000) and Intercede has expanded its office in

Reston, Virginia, to support further growth.

The operating profit for the period was GBP829,000 which

compares to GBP1,952,000 in the previous year. As at 31 March 2012,

the Group had cash balances of GBP6,968,000; an increase of

GBP922,000 from 2011.

During the year Intercede delivered a profit before tax of

GBP910,000 (2011: GBP2,005,000), reflecting the fourth consecutive

full year of profitability. The reduced profit is, as previously

indicated, due to increased investment in our infrastructure,

technology development and sales capacity.

Intercede has invested in supporting strategic partnerships in

North America and in the Germany, Austria, Switzerland region of

continental Europe.

Key Performance Indicators

-- The level of exports has further increased to 89% (2011: 80%).

-- Within that, the proportion of revenue attributable to North

American customers has continued to grow from 58% to 64%. This is

important because it both fuels and justifies our ongoing

investment in this major market.

-- The level of repeat business with existing customers remains

high at 79% (2011: 73%) which reflects the level of trust placed in

MyID as a critical component of their IT security

infrastructure.

-- Against a backdrop where government spending continues to be

subject to an increased level of scrutiny, the level of private

sector customers has further increased from 48% to 52% year on

year.

Product Development

In response to complex cyber and physical security threats, the

US Federal Identity Credential and Access Management (ICAM)

initiative is demanding greater reliance on

Personal-Identity-Verification (PIV) credentials. In the previous

year this has driven the development of new core capabilities

within the MyID platform.

The adoption by the private sector of digital identities that

either interoperate or are compatible with US government PIV

standards has gained market traction. This has resulted in the

development of PIV-Interoperable (PIV-I) and

Commercial-Identity-Verification (CIV) products and services that

are derivative of MyID's core PIV functionality.

The international market for national identity cards and

identity provider credentials requires ongoing development work to

accommodate diverse standards and a high degree of country specific

integration. Intercede continues to develop the MyID platform to

ensure it remains scalable and appropriate for large national

deployments building on its experience in Kuwait and the UK.

Intercede's MyID product suite is undergoing extensive

development to support new form factors such as smart phones and

tablet computers for both business and consumer applications.

The Board continues to support ongoing investment in existing

and new product capability to maximise the potential of market

leadership and to ensure Intercede is best placed for future

exploitation.

Strategy

The Group's 2011-12 Business Goals were as follows:

-- Invest in sales and marketing.

-- Grow UK revenues by participating in the UK Government's

recently announced Identity Assurance (IDA) programme.

-- Exploit the growing PIV-I market in the US in partnership

with major US systems integrators and aerospace and defence

contractors.

-- Further collaboration with Microsoft.

-- Establish Intercede MyID as a platform for issuing

trustworthy identities on mobile devices.

-- Expand our ecosystem through strategic partnerships including selective investments.

-- Secure participation in additional large scale national identity card projects.

-- Develop the value of the Intercede MyID brand through

participation in industry conferences, standards groups and the use

of new media in order to extend the influence and reach of our

sales channels.

Intercede has delivered against these objectives with solid

progress:

-- A sales director has been appointed and additional sales

staff have been recruited. The website has been re-launched

(www.intercede.com) and Racepoint, an international

technology-focused PR firm, has been hired to extend the reach of

our marketing activities.

-- Intercede has been actively engaged with the UK Cabinet

Office in the IDA consultation programme. Intercede also met the

Prime Minister's Business and Defence advisors in the No 10 Policy

Unit to discuss the Government's support of technology SMEs and

Intercede's success as a UK software exporter. The Company has

fully engaged with the Department for Business Innovation &

Skills and Intercede's growth opportunities were recently reviewed

with Lord Green, the Minister of State for Trade and Industry.

-- As the PIV market has moved out of the US Federal Government

into the private sector, the market for PIV-Interoperable

credentials delivered by SaaS has emerged. Intercede has teamed

with a number of new entrants to this market.

-- Intercede has developed a solution to manage virtual smart

cards in a Windows 8 environment.

-- Intercede has also developed an OTA solution for issuing

identity credentials to secure elements in smart phones in

partnership with a number of major mobile security companies.

-- A number of strategic alliances in emerging markets and

technology areas have been initiated, exemplified by the

announcement of a partnership with HP.

-- Intercede is participating in US state and local verified

identity programs and is also awaiting the outcome of a number of

national ID card bids through partners.

-- Intercede's profile continues to grow through participation

in a number of industry conferences and standards groups. In

February 2012, a trade reception was hosted by Intercede at the

British Consulate in San Francisco and attracted more than 80

attendees, including several CEOs and Presidents from some of

Silicon Valley's most influential digital security companies. Our

active participation in the Transglobal Secure Collaboration

Program is proving to be particularly helpful in influencing

customers within the Aerospace & Defence sector. Our attendance

at industry events can now be followed on Twitter at

@intercedemyid.

The Group's 2012-13 Business Strategy is as follows:

-- Corporate development

- Continue to invest in sales and marketing in order to increase the pipeline of opportunities.

- Position MyID as the convergence platform of choice for the

next generation of physical access control systems (PACS) as an

extension of our support of ICAM.

- Be the partner of choice for provisioning digital identities to mobile devices.

- Invest in intellectual property protection.

-- Product and innovation

- Exploitation of existing MyID product in maturing markets.

- Development of new product to target the mobile device market.

- Development of a SaaS model and the positioning of MyID as a

core technology to sell to third party SaaS providers supporting

the PIV-I and CIV markets.

- Close alignment with the release of Microsoft Windows 8.

-- Regional sales growth

- Emphasis on US market.

- Build stronger collaborations with resale and OEM partners.

- Develop sales channels to service Latin America.

Intellectual Property

Intercede continues to invest to protect its intellectual

property and trademarks. During the year a number of additional

patent applications have been filed in our key markets.

Intercede has worked with legal counsel in both Europe and the

United States to protect our registered MyID trademark. This

continues to be an expensive process; however Intercede considers

that the MyID trademark has significant commercial value.

Vision and Outlook

Intercede currently has more than 5 million digital identities

actively managed by MyID. Intercede's Vision is to have more than

100 million identities under management by its MyID software by

2020. This Vision anticipates that the 20-fold increase in volume

will yield a 10-fold increase in revenue and a doubling in the cost

base. This is a very attractive business model. On the basis of

this, Intercede is planning additional investment in the next 12

months to ensure the Company is best placed to exploit this

opportunity and to maximise the medium and long term returns to

shareholders.

The validity of this Vision is reinforced by a new White House

Report that was published on 23 May 2012 "Digital Government:

Building a 21(st) Century Platform to Better Serve the American

People". The report addresses mobility and getting government

information to the public via mobile devices. The strategy focuses

on three objectives:

-- Enable citizens and the growing mobile workforce to access

high-quality digital government information and services anywhere,

anytime, on any device.

-- Institute an information-centric model for interoperability

and openness to deliver better digital government services at a

lower cost.

-- Update and implement policies to buy and manage devices,

applications and data in smart, secure and affordable ways.

According to written analyses, the plan highlights the

importance of agencies being open and interoperable by asking them

to develop IT infrastructures and adopt technologies that will

empower the practice of access anywhere, anytime, on any device. It

places a premium on "secure" - with the phrase attached to nearly

every activity - and acknowledges that the goal of openness may

compete with the need for security.

The plan gives the departments of Defense and Homeland Security

and the National Institute of Standards and Technology (with whose

standards Intercede complies) responsibility for developing

standards for expanding the secure use of mobile and wireless

devices within one year.

Secure digital identities for both Federal employees and US

citizens are critical to this call for action by the White House

and its enactment will stimulate a large market for the Intercede

MyID product line.

In 2012-2013, Intercede will focus on two core drivers of

business growth as a foundation for realising its 2020 Vision:

-- Deepening our penetration of existing markets, where MyID has

already been particularly applicable; and

-- Tapping into new technology-led trends where growth opportunities are developing.

Deepening our penetration of existing markets

-- PIV smartcards

- Intercede is emerging as the dominant supplier in the PIV

smartcard market in the Federal and corporate space. As existing

PIV contracts are rebid and new contract opportunities emerge,

Intercede will compete on the basis of technical excellence,

life-time value for money and reference sites.

- Framework contracts are in place with a US service provider to

meet an emerging opportunity for first responder and citizen

benefit smartcards in West Virginia. If successful it is

anticipated other states will follow the same model.

- Discussions are in progress to supply MyID to a number of

leading additional aerospace and defence companies.

- Intercede is seeking to expand the number of licences issued

under recent border security and national identity projects.

-- Software as a Service (SaaS)

- Several managed service organizations have built PIV-I SaaS

solutions based on MyID, potentially providing Intercede with

significant long term revenue streams. One service is in

production, the others will go public in the next few months.

- Together with partners Deep-Secure and adept4, we launched the

world's first secure email service based on TSCP specification

(TSCP is the Transglobal Secure Collaboration Program, a

co-operative forum of leading aerospace and defence companies and

government agencies working together to develop an open standards

based security framework).

Harnessing new technology opportunities and trends

-- Government as a catalyst for creating a market for identity provision to citizens

- Intercede is participating in a consortium of leading US

companies, trade organisations and service providers in bidding for

a share of grant funding from the National Program Office for the

National Strategy for Trusted Identities in Cyberspace (NSTIC). If

successful, the consortium will build a pilot infrastructure to

demonstrate the governance, security and privacy requirements of

digital identities in support of the world's leading consumer

economy.

- In the UK, we are participating in a consortium bidding to win

the first contract under the HMG Identity Assurance Program to

supply up to 22m secure digital identities for citizens claiming

Universal Credit from the Department of Work and Pensions. Whatever

the outcome, other opportunities are expected to follow.

-- US healthcare sector

- As the sector undergoes structural reform resulting from

President Obama's 'Patient Protection and Affordable Care Act',

Intercede is working with healthcare organisations to ensure a

share of the digital identity market that will emerge.

-- Mobile device security

- Two recent developments are likely to provide a significant

market opportunity for Intercede to license MyID to manufacturers,

service providers and end users:

1) The impending release by Microsoft of its Windows 8 operating

system will introduce support for virtual smartcards on the Trusted

Platform Modules (TPM) already embedded in the motherboards of most

laptops and PCs. This will enable any new Windows platform to

operate at the same level of security as if it had a smart card

physically inserted. Each virtual smart card can be issued and

managed by MyID.

2) ARM Holdings, together with Intercede's existing partners,

Gemalto and Giesecke & Devrient, announced their intention to

form a new company to develop a Trusted Execution Environment (TEE)

for smart connected devices. This will allow Global Platform

standards to be used to inject secure identities into the next

generation of smartphones.

- In most cases there will be a need for the TPM or TEE to be

bound to the trusted electronic identity of the user. Intercede

intends to ensure MyID can be used to manage digital identities

within the TPM or TEE environment.

-- Bring Your Own Device (BYOD)

- As the market opportunity to enable employee owned mobile

devices to be used for business purposes becomes mainstream, we are

making significant investment in the MyID platform to enable the

secure provision of identities and credentials to BYOD devices. New

partnerships will be announced shortly.

-- The Internet of Things

- Making significant investment in the MyID platform to extend

the secure provisioning of identities from people to any

internet-connected, real or virtual entity. This provides the

potential to use MyID to manage tens of billions of people and

items.

In summary, our pipeline of commercial opportunities continues

to grow as we seek to deepen the penetration of markets where

Intercede's MyID product has become an industry standard. There are

also a number of new technology-led trends which provide additional

opportunities for Intercede. The outlook is therefore extremely

positive.

Richard Parris

Chairman & Chief Executive

Business and Finance Review

Introduction

The Group has embarked upon a period of substantial investment

in order to be able to take full advantage of the opportunities it

has created for itself. This is considered to be appropriate,

notwithstanding a backdrop of challenging trading conditions, as

the scale of the potential market for our MyID technology continues

to grow and new related markets are emerging.

Business Development

The Group's overall objective is to put in place the platform

and processes to accelerate revenue growth fuelled by increasing

investment in new markets and new partners. A number of

opportunities are opening up as a result of the progress made to

date. The challenge is how to obtain the resources required for

expansion into areas such as mobile, whilst continuing to develop

the core MyID digital identity technology in conjunction with

existing and potential new partners.

The Group had 70 employees and contractors as at 31 March 2012,

which represents a substantial increase in experience and expertise

over the past two to three years, a time during which we have

established a major US and European presence. Selective investment

has also increased across a variety of other areas during the same

period, for example;

-- Sales and marketing including participation in trade

exhibitions/conferences and membership of industry bodies such as

Intellect and the Transglobal Secure Collaboration Program;

-- Partner development and support;

-- Technical and product development;

-- Quality management processes; and

-- Office and IT infrastructure and equipment;

The Group entered 2012/13 with a larger order book and pipeline

than ever before. Whilst experience tells us that project delays

can and will happen for a variety of reasons, we remain focused on

the action we can take to ensure that we are best placed to deal

with any changes to project timings.

Financial Results

Revenue for the year ended 31 March 2012 was GBP6,964,000 (2011:

GBP6,872,000) with no one project representing more than 15% of

total revenue (2011: 22%). Over the last three years, exports have

increased from 56% to 89% of total revenue.

Whilst gross profit margins remain high, the increase in costs

resulting from the selective investment in additional resources

outlined above has resulted in a reduction in operating profit from

GBP1,952,000 to GBP829,000. Staff costs continue to represent the

main area of expense, representing 77% of total operating costs

(2011: 81%). Intercede had 70 employees and contractors as at 31

March 2012 (2011: 64). The average number of employees and

contractors increased from 58 to 68 year on year.

Expenditure on research and development (R&D) activities

totalled GBP2,071,000 (2011: GBP1,601,000). In accordance with

International Financial Reporting Standards, the Board has

continued to determine that all internal R&D costs incurred in

the year are expensed. No development expenditure has been

capitalised as at 31 March 2012 (2011: GBPnil).

Finance income for the year was GBP81,000 (2011: GBP53,000) as

the Group has continued to generate cash and increase the level of

interest bearing short term deposits despite increased levels of

investment.

A GBP233,000 taxation charge for the period (2011: GBP7,000)

primarily reflects the de-recognition of the deferred tax asset

that had previously been recognised in respect of prior year

trading losses as it is considered less probable that those losses

will be utilised within the foreseeable future. Whilst the Group

has been profitable for four consecutive years, it is a beneficiary

of the UK Government's efforts to encourage innovation by allowing

100% (2011: 75%) of qualifying R&D expenditure to be offset

against taxable profits. Given the increased level of R&D

expenditure outlined above, this has resulted in the current period

being converted from a taxable profit to a taxable loss.

Against the backdrop of a further increase in the R&D tax

credit to 125% with effect from 1 April 2012 and the introduction

of the patent box regime (which provides for a reduction of

corporation tax on profits from patented inventions), the Group has

GBP4,091,000 (2011: GBP3,168,000) of prior year tax losses

available for carry forward.

A profit for the year of GBP677,000 (2011: GBP1,998,000)

resulted in a basic and fully diluted earnings per share of 1.4p

(2011: 4.1p).

Funding

As at 31 March 2012, the Group had cash balances totaling

GBP6,968,000 (2011: GBP6,046,000). The increase in cash balances

principally reflects a GBP909,000 inflow from operating activities

(2011: GBP1,415,000).

The Group has no debt and, following the Capital Reduction which

was registered by the Registrar of Companies on 30 October 2010, is

in a position to commence the payment of dividends as and when the

Board considers this to be appropriate.

Summary

The Group has delivered another robust trading and financial

performance. As a result we enter the new financial year with GBP7m

of cash available to fuel our accelerated growth plans.

Andrew Walker

Finance Director

INTERCEDE GROUP plc

Consolidated Statement of Comprehensive Income for the year

ended 31 March 2012

Notes 2012 2011

GBP'000 GBP'000

Continuing operations

Revenue 2 6,964 6,872

Cost of sales (112) (22)

__________ __________

Gross profit 6,852 6,850

Administrative expenses (6,023) (4,898)

__________ __________

Operating profit 829 1,952

Finance income 81 53

__________ __________

Profit before tax 910 2,005

Taxation 3 (233) (7)

__________ __________

Profit for the year 677 1,998

__________ __________

Total comprehensive income attributable

to owners of the company 677 1,998

Earnings per share (pence) 4

- basic 1.4p 4.1p

- diluted 1.4p 4.1p

__________ __________

There is no other comprehensive income for the year.

The accompanying notes are an integral part of these financial

statements.

INTERCEDE GROUP plc

Consolidated Balance Sheet at 31 March 2012

Notes 2012 2011

GBP'000 GBP'000

Non-current assets

Property, plant and

equipment 183 167

Deferred tax 3 - 280

__________ __________

183 447

__________ __________

Current assets

Trade and other receivables 1,311 841

Cash and cash equivalents 6,968 6,046

__________ __________

8,279 6,887

__________ __________

Total assets 8,462 7,334

__________ __________

Equity

Share capital 6 484 484

Share premium account 110 86

Other reserves 1,508 1,508

Retained earnings 3,930 3,113

__________ __________

Total equity 6,032 5,191

__________ __________

Current liabilities

Trade and other payables 910 790

Deferred revenue 1,520 1,353

__________ __________

2,430 2,143

__________ __________

Total equity and liabilities 8,462 7,334

__________ __________

The accompanying notes are an integral part of these financial

statements.

INTERCEDE GROUP plc

Consolidated Statement of Changes in Equity for the year ended

31 March 2012

Share Share Other Retained Total

capital premium reserves earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2010 4,413 4,718 1,508 (7,497) 3,142

Capital reduction (note

6) (3,931) (4,718) - 8,649 -

Issue of shares, net of

costs (note 6) 2 86 - - 88

Purchase of treasury shares

(note 6) - - - (37) (37)

Total comprehensive income - - - 1,998 1,998

_______ ________ ________ ________ _______

At 31 March 2011 484 86 1,508 3,113 5,191

Issue of shares, net of

costs (note 6) - 24 - - 24

Employee share option scheme

charge - - - 140 140

Total comprehensive income - - - 677 677

_______ ________ ________ _______ _______

At 31 March 2012 484 110 1,508 3,930 6,032

________ ________ ________ _______ _______

The accompanying notes are an integral part of these financial

statements.

INTERCEDE GROUP plc

Consolidated Cash Flow Statement for the year ended 31 March

2012

2012 2011

GBP'000 GBP'000

Cash flows from operating activities

Operating profit 829 1,952

Depreciation 67 51

Employee share option scheme charge 140 -

(Increase)/decrease in trade and

other receivables (461) 116

Increase/(decrease) in trade and

other payables 287 (697)

__________ __________

Cash generated from operations 862 1,422

Taxation 47 (7)

__________ __________

Net cash generated from operating

activities 909 1,415

__________ __________

Investing activities

Interest received 73 50

Purchases of property, plant and

equipment (84) (134)

__________ __________

Net cash from investing activities (11) (84)

__________ __________

Financing activities

Proceeds on issue of shares 24 88

Purchase of treasury shares - (37)

__________ __________

Net cash from financing activities 24 51

__________ __________

Net increase in cash and cash equivalents 922 1,382

Cash and cash equivalents at the

beginning of the year 6,046 4,664

__________ __________

Cash and cash equivalents at the

end of the year 6,968 6,046

__________ __________

The accompanying notes are an integral part of these financial

statements.

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2012

NOTES

1. The financial information set out in this announcement does

not constitute the Group's Statutory Accounts for the years ended

31 March 2011 or 2012, but is derived from those accounts.

Statutory Accounts for 2011 have been delivered to the Registrar of

Companies and those for 2012, which have been approved by the Board

of Directors, will be delivered following the Group's Annual

General Meeting. The Company's auditors have reported on those

accounts; their reports were unqualified and did not contain

statements under Section 498 of the Companies Act 2006.

The Annual General Meeting of the Company will be held at 11.00

am on Wednesday 26 September 2012 at Lutterworth Hall. Copies of

the full Statutory Accounts will be despatched to shareholders in

due course. Copies will also be available on the website

(www.intercede.com) and from the registered office of the Company:

Lutterworth Hall, St. Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2. SEGMENTAL REPORTING

All of the Group's revenue, operating profits and net assets

originate from operations in the United Kingdom. The Directors

consider that the activities of the Group constitute a single

business segment. The split of revenue by geographical destination

of the end customer can be analysed as follows:

2012 2011

GBP'000 GBP'000

UK 779 1,369

Rest of Europe 814 928

North America 4,450 3,965

Rest of World 921 610

__________ _________

6,964 6,872

__________ _________

3. TAXATION

The tax charge comprises:

2012 2011

GBP'000 GBP'000

Current year - UK corporation tax - -

Current year - UK deferred tax (280) -

Current year - US corporation tax (12) (7)

Prior year - US corporation tax (11) -

Research and Development tax credits

relating to prior years 70 -

__________ _________

(233) (7)

__________ _________

The deferred tax asset that had previously been recognised in

respect of prior year trading losses has been de-recognised as the

combined effect of increased expenditure on research and

development and an increase in the level of R&D tax credits

claimable serves to make it less probable that those losses will be

utilised within the foreseeable future. The Group has unused tax

losses of GBP4,091,000 (2011: GBP3,168,000) and unrecognised

deferred tax assets of GBP982,000 calculated at the UK corporation

tax rate of 24% that came into effect from 1 April 2012 (2011:

GBP544,000 calculated at the previous UK corporation tax rate of

26%).

4. EARNINGS PER ORDINARY SHARE

The calculations of earnings per ordinary share are based on the

profit for the financial year and the weighted average number of

ordinary shares in issue during each year.

2012 2011

GBP'000 GBP'000

Profit for the year 677 1,998

__________ _________

Number Number

Weighted average number of shares -

basic 48,367,939 48,239,997

- diluted 49,662,277 48,735,005

__________ __________

Pence Pence

Earnings per share - basic 1.4 4.1

- diluted 1.4 4.1

__________ __________

The increase in the weighted average number of shares used for

the calculation of diluted earnings per share reflects the grant of

share options to directors and senior managers during July, August

and December 2011.

5. DIVIDEND

The Directors do not recommend the payment of a dividend.

6. SHARE CAPITAL

2012 2011

GBP'000 GBP'000

Authorised

481,861,616 ordinary shares of 1p each

(2011: 481,861,616) 4,819 4,819

__________ __________

Issued and fully paid

48,428,005 ordinary shares of 1p each

(2011: 48,365,005) 484 484

___________ __________

On 24 September 2010, shareholder approval was obtained at a

General Meeting of the Company to cancel the share premium account

and to cancel and extinguish the deferred shares. This Capital

Reduction was registered by the Registrar of Companies on 30

October 2010.

On 30 November 2010, certain employees and a Director of the

Company exercised options over a total of 187,000 ordinary shares

at an exercise price of 47p per share. On 3 December 2010, the

Company subsequently purchased 57,975 of these shares at a price of

63.06p per share. The shares purchased, none of which relate to

options exercised by a Director, are held as treasury shares.

On 14 March 2012, certain employees exercised options over a

total of 63,000 ordinary shares at an exercise price of 40.5p per

share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KMGGVKRLGZZM

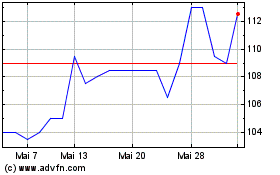

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024