RNS Number:4672F

Crown Place VCT PLC

10 October 2007

10 October 2007

CROWN PLACE VCT PLC

Preliminary announcement of final results for the sixteen months ended 30 June

2007.

Crown Place VCT PLC ("the Company"), managed by Close Ventures Limited, today

announces the preliminary results for the sixteen months ended 30 June 2007. The

announcement has been approved by the Board of Directors on 9 October 2007.

Financial Highlights

Shareholder value since launch

Proforma (i) Proforma (i)

Murray VCT Murray VCT 2 Crown Place

PLC PLC VCT PLC*

Previous holders of shares in:

Dividends per share paid to 30 June 2007 (pence per share) (ii) 33.71 34.72 29.23

Net asset value (pence per share) as at 30 June 31.91 38.15 44.84

2007 (i)

65.62 72.87 74.07

(i) The proforma shareholder value is based on the dividends paid to 30

June 2007 per share, with a pro-rata net asset value per share based upon

the proportion of shares received by Murray VCT PLC (now renamed CP1

VCT PLC) and Murray VCT 2 PLC (now renamed CP2 VCT PLC) shareholders at the

time of the merger with Crown Place VCT PLC on 13 January 2006.

(ii) Prior to 6 April 1999, venture capital trusts were able to add 20% to

dividends, and figures for the period until 6 April 1999 are included at

the gross equivalent rate actually paid to shareholders.

* Formerly Murray VCT 3 PLC

In addition to the dividends paid above, the Directors have declared a first

dividend for the period ending 30 June 2008 out of 1.25 pence per Crown Place

VCT PLC share (0.8 pence to be paid out of revenue profits and 0.45 pence out of

realised capital gains), subject to approval from HM Revenue & Customs. The

record date and payment date for this dividend will be announced on the London

Stock Exchange RNS Service.

Reference to the 'Group' in this announcement is reference to Crown Place VCT

PLC and its subsidiaries CP1 VCT PLC and CP2 VCT PLC.

For further information, please contact:

Patrick Reeve/ Emil Gigov Roddi Vaughan-Thomas

Close Ventures Limited Peregrine Communications Group

Tel: 020 7422 7830 Tel: 020 7223 1552

www.closeventures.co.uk

Chairman's statement

Overview

I am pleased to present the results for the 16 month period to 30 June 2007.

During this period the Group made significant progress in transforming the

investment portfolio into a broadly based portfolio which combines a strong

income stream with protection of capital, as well as offering the prospect for

capital growth. The Company paid dividends totalling 3.3 pence per share in the

period, which are tax free to investors. The dividends were paid out of income

and realised capital profits and are in line with the Group's strategy to pay

regular and predictable dividends to shareholders. At the same time the net

asset value per share increased from 43.0 pence at the start of the period to

44.8 pence as at 30 June 2007. Total shareholder value created in the 16 month

period was 5.1 pence per share, or 11.9%.

Results

In the 16 months to 30 June 2007, the Group made a revenue profit after tax of

#1.4 million and a total profit after tax of #3.8 million. Total annualised

expenses as a percentage of net assets, excluding non-recurring items and

management performance fees, were 3.1% compared with 4.8% for the year to 28

February 2006. Cost savings from the merger in January 2006 are in line with

the forecasts made at that time.

The net asset value per share increased to 44.8 pence compared to 43.0 pence at

the beginning of the period and 44.3 pence at 31 December 2006, the latest

interim report date.

The Company has now utilised in full the tax losses carried forward from

previous years and therefore it is expected that the tax charge will increase in

future years.

Portfolio review

During the period the Group made considerable progress in realising the older

investments and reinvesting the proceeds in investments that are more suited to

the overall portfolio investment policy. Full or partial realisations were made

from seven unquoted investments, the proceeds of which were at or above book

value. The total consideration received was #4.8 million. Following the period

end the Group realised a further #3.4 million from the sale of RMS Europe Group

Limited and The Bold Pub Company Limited and the repayment of outstanding loan

stock by Palgrave Brown (Holdings) Limited. These proceeds are reflected in the

valuations.

The value of the investment portfolio increased during the period. In the

unquoted portfolio, RMS Europe Group Limited, House of Dorchester Limited, PSCA

International Limited and Tower Bridge Health Clubs Limited performed strongly

and this has been reflected in the valuations. Against this, we have reduced

the valuation of Unique Communications Group Limited, J&S Marine Limited and the

Crown Hotel Harrogate Limited. The prospects for many of the companies in the

unquoted portfolio are promising, although this is yet to be translated in

increased financial performance and hence valuations. Xceleron Limited, which

is well positioned to deliver strong growth and profitability in the coming

year, is an example of a company in this category.

The AIM portfolio also performed well during the period and the Group realised

substantial gains from the sale of its holdings in Tanfield Group plc, Dobbies

Garden Centres plc, Careforce Group plc, Cello Group plc, Synexus Clinical

Research plc and Talarius plc. The total proceeds from such realisations during

the period were #6.9 million against cost of #2.6 million. Following the period

end, the Group realised a further #0.8 million by selling its remaining holdings

in Dobbies Garden Centres plc and Zetar plc, and further reducing its investment

in Cello Group plc.

The split of the existing unquoted portfolio value by broad investment category

is depicted below:

http://www.rns-pdf.londonstockexchange.com/rns/4672f_-2007-10-10.pdf

The proportion of asset-based investments, representing those companies with

freehold or long leasehold property assets, increased from 22% at the beginning

of the period, to 50% as at 30 June 2007. At the same time, the proportion of

development capital investments decreased from 73% to 39%.

Since the appointment of Close Ventures Limited as managers of the fund in April

2005, investment in asset-backed companies has increased as a proportion of the

portfolio, providing greater security to the Group. Over the period since Close

Ventures' appointment, the annualised return to shareholders (excluding merger

costs and shareholder action costs ) has been 7.2%.

New investments

The Group made 16 new investments in the period for a total cost of #5.3

million. These include the #1 million investment in Kew Green VCT (Stansted)

Limited, the owner and operator of the Express by Holiday Inn hotel at Stansted

Airport, the #1 million investment in Kensington Health Clubs Limited, a new

freehold health and fitness club development in Olympia, London and the #0.6

million investment in Chichester (Holdings) Limited to fund the Management

Buyout of this profitable drinks distribution business. A list of the

investments in the unquoted portfolio is given in the financial statements.

In addition to the above, #2.2 million was invested in existing portfolio

companies including The Crown Hotel Harrogate Limited, Tower Bridge Health Clubs

Limited, Grosvenor Health Limited, The Dunedin Pub Company VCT Limited and

Novello Pub Limited.

The Group is one of a small number of venture capital trusts that are able to

invest in hotels and care home companies. These two sectors, which provide a

good fit with the portfolio investment strategy, are not permitted investments

for venture capital trusts raised after 1997, thus differentiating the Group

from other VCTs.

Dividends

The Group paid three dividends during the period totalling 3.3 pence per share

(2.5 pence annualised), which is significantly higher than the annual dividend

of 1.0 pence per share suggested at the time of the merger. The first dividend

of 1.25 pence per share was paid on 22 September 2006; a second dividend of 1.25

pence per share was paid on 19 January 2007; and a third dividend of 0.8 pence

per share was paid on 15 June 2007. These dividends are free of tax to

shareholders. The Group's policy is to pay regular and predictable dividends to

investors out of revenue income and realised capital gains. Subject to the

performance of the investment portfolio, the Board will aim to maintain an

annualised dividend distribution of 2.5 pence per share, representing a tax free

yield of 5.6% based on net asset value as at 30 June 2007.

Share buy backs

As set out in the interim report to 31 December 2006, it is the Company's policy

to continue to buy back shares in the market, subject to the overall constraint

that such purchases are in the Company's interest, including the maintenance of

sufficient resources for investment in existing and new investee companies. The

Company bought back 4,684,265 shares in the period under review, at prices

ranging from 35 pence per share to 40 pence per share. As at the period end,

the Group held 7,260,410 Ordinary Shares in Treasury, representing 9.5% of the

issued share capital (excluding Treasury shares). These shares may be re-issued

at a future date.

Outlook

The investment portfolio performed well during the 16 month period to 30 June

2007 and the performance since that date has been in line with the Board's

expectations. Compared with the beginning of the period, the portfolio has a

broader base, with a larger proportion of asset backed investments. While your

Board is cautious on the outlook of the broader UK economy, the majority of the

investee companies have little or no bank debt and therefore are not directly

exposed to the recent volatility of the credit markets. In addition, the Group

has substantial cash balances enabling it to take advantage of investment

opportunities as they arise. As a result, your Board believes that the Group is

well positioned for the future.

Patrick Crosthwaite

Chairman

9 October 2007

Consolidated Income Statement

Audited Audited

Sixteen months to 30 June 2007 Year to 28 February 2006

Revenue Capital Total Revenue Capital Total

#'000 #'000 #'000 #'000 #'000 #'000

Investment income and 2,519 - 2,519 1,073 - 1,073

deposit interest

Investment management fees (291) (872) (1,163) (160) (481) (641)

Other expenses (509) 23 (486) (351) (955) (1,306)

Non-recurring operating (4) - (4) (749) - (749)

expenses

Operating profit/(loss) 1,715 (849) 866 (187) (1,436) (1,623)

Gains on investments - 2,932 2,932 - 2,504 2,504

Profit/(loss) before 1,715 2,083 3,798 (187) 1,068 881

taxation

Taxation (294) 273 (21) 42 - 42

Profit/(loss) for the 1,421 2,356 3,777 (145) 1,068 923

period

Basic and diluted return 1.79 2.97 4.76 (0.32) 2.35 2.03

per Ordinary share (pence)

(excluding Treasury shares)

The total column of this statement represents the Group's income statement,

prepared in accordance with International Financial Reporting Standards ('

IFRS'). The supplementary revenue and capital reserve columns are prepared under

guidance published by the Association of Investment Companies.

The consolidated income statement for the sixteen months to 30 June 2007

includes the results of the subsidiaries CP1 VCT PLC and CP2 VCT PLC.

The (loss)/profit for the year ended 28 February 2006 includes results from the

subsidiaries CP1 VCT PLC and CP2 VCT PLC from the date of acquisition on 13

January 2006.

All revenue and capital items in the above statement derive from continuing

operations.

Consolidated Balance Sheet

Audited Audited

30 June 2007 28 February 2006

#'000 #'000

Non-current assets

Investments 26,237 30,969

Current assets

Trade and other receivables 322 1,496

Cash and cash equivalents 8,367 4,846

8,689 6,342

Total assets 34,926 37,311

Current liabilities

Trade and other payables (552) (694)

Total assets less current 34,374 36,617

liabilities

Non-current liabilities

Provision for bank guarantees - (1,662)

Total liabilities (552) (2,356)

Net assets 34,374 34,955

Equity attributable to

equityholders

Ordinary share capital 8,392 8,610

Share premium 14,422 14,422

Capital redemption reserve 468 250

Own shares held (2,849) (1,908)

Retained earnings 13,941 13,581

Total shareholders' funds 34,374 34,955

Net asset value per Ordinary

share (pence) (excluding

Treasury shares) 44.8 43.0

The consolidated balance sheets as at 30 June 2007 and at 28 February 2006

include the balance sheets of the subsidiaries CP1 VCT PLC and CP2 VCT PLC.

These financial statements were agreed by the Board of Directors, and authorised

for issue on 9 October 2007.

Company Balance Sheet

Audited Audited

30 June 2007 28 February 2006

#'000 #'000

Fixed assets

Fixed asset investments 26,237 30,969

Investment in subsidiary 17,978 17,506

undertakings

44,215 48,475

Current assets

Debtors 313 806

Cash at bank 3,900 1,327

4,213 2,133

Total assets 48,428 50,608

Creditors: amounts falling due (14,054) (15,066)

within one year

Total assets less current 34,374 35,542

liabilities

Provision for bank guarantees - (587)

Total liabilities (14,054) (15,653)

Net assets 34,374 34,955

Capital and reserves

Called up share capital 8,392 8,610

Share premium 14,422 14,422

Capital redemption reserve 468 250

Own shares held (2,849) (1,908)

Retained earnings 13,941 13,581

Total shareholders' funds 34,374 34,955

Net asset value per Ordinary

share (pence) (excluding

Treasury shares) 44.8 43.0

This Company balance sheet has been prepared in accordance with UK GAAP.

These financial statements were approved by the Board of Directors, and

authorised for issue on 9 October 2007.

Consolidated statement of changes in equity

Ordinary Capital Own

share Share Revaluation redemption shares Retained

capital premium reserve reserve held earnings Total

#'000 #'000 #'000 #'000 #'000 #'000 #'000

As at 28 February 2006 8,610 14,422 - 250 (1,908) 13,581 34,955

Purchase of own shares for (218) - - 218 - (816) (816)

cancellation

(including costs)

Cost of ordinary shares - - - - (941) - (941)

purchased for Treasury

(including dealing costs)

Net profit for the period - - - - - 3,777 3,777

Dividends paid in period - - - - - (2,601) (2,601)

As at 30 June 2007 8,392 14,422 - 468 (2,849) 13,941 34,374

As at 28 February 2005 3,995 - (15,287) 250 - 28,389 17,347

Adjustment in respect of IAS - - - - - (44) (44)

39

Reclassification of - - 15,287 - - (15,287) -

revaluation reserve

As at 1 March 2005 (restated 3,995 - - 250 - 13,058 17,303

and adjusted)

Net profit for the year - - - - - 923 923

Cost of ordinary shares - - - - (1,908) - (1,908)

purchased for Treasury

Shares issued in year 4,615 14,422 - - - - 19,037

Dividends paid in year - - - - - (400) (400)

As at 28 February 2006 8,610 14,422 - 250 (1,908) 13,581 34,955

Consolidated cash flow statement

Audited Audited

Sixteen months Year to

to 30 June 2007 28 February

2006

#'000 #'000

Cash flows from operating activities

Investment income received 2,549 1,087

Deposit interest received 347 30

Secretarial fees paid (85) (91)

Investment management fees paid (1,242) (694)

Other cash payments (634) (1,324)

Cash generated/(expended) from operations 935 (992)

Tax recovered 1,431 90

Net cash flows from/(used in) operating 2,366 (902)

activites

Cash flows from investing activities

Purchases ofinvestments (7,773) (2,169)

Disposals ofinvestments 14,949 6,349

Payment re loan guarantee (1,662) -

Net cash flows from investing activities 5,514 4,180

Cash flows from financing activities

Equity dividends paid (2,601) (400)

Cash acquired from subsidiaries at date - 3,791

of acquisition

Repurchase of Ordinary shares (817) (140)

Purchase of Ordinary shares for (941) (1,897)

Treasury

Net cash flows (used in)/from financing

activities (4,359) 1,354

Increase in cash and cash equivalents 3,521 4,632

Cash and cash equivalents at start of 4,846 214

period

Cash and cash equivalents at end of 8,367 4,846

period

The consolidated cash flow statement for the sixteen months to 30 June 2007

includes the transactions of the subsidiaries CP1 VCT PLC and CP2 VCT PLC.

The consolidated cash flow statements for the year ended 28 February 2006

include the transactions of the subsidiaries CP1 VCT PLC and CP2 VCT PLC from

the date of the acquisition on 13 January 2006.

Notes to the announcement

1. Details about the Manager

Crown Place VCT PLC is managed by Close Ventures Limited. Close Ventures Limited

is a subsidiary of Close Brothers Group plc and is authorised and regulated by

the Financial Services Authority.

2. Statutory accounts

The financial information set out in the announcement does not constitute the

Company's statutory accounts for the periods ended 30 June 2007 or 28 February

2006, as defined in Section 240 of the Companies Act 1985, but is derived from

those accounts. Statutory accounts for the year ended 28 February 2006 have been

delivered to the Registrar of Companies and those for 30 June 2007 will be

delivered following the Company's Annual General Meeting. The Auditors have

reported on those accounts; their reports were unqualified and did not contain

statements under section 237(2) or (3) of the Companies Act 1985.

Whilst the financial information included in this preliminary announcement has

been computed in accordance with International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient information to

comply with IFRSs. The Company expects to publish full financial statements

that comply with IFRSs within the next two weeks.

3. Accounting policies

The accounts have been prepared on the basis of the accounting policies set out

in the previous year's financial statements for the year ended 28 February 2006.

4. Basic and diluted return per share

Return per share has been calculated on 79,277,922 Ordinary shares being the

weighted average number of shares in issue in the period (excluding Treasury

shares).

There are no convertible instruments, derivatives or contingent share agreements

in issue for the Company hence there are no dilution effects to the return per

share. The basic return per share is therefore the same as the diluted return

per share.

5. Net asset value

The net asset value per share is based on net assets of #34,374,000 and on

76,660,024 Ordinary shares being the number of Ordinary shares in issue

(excluding Treasury shares) at the period end.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKKKDDBDDKKD

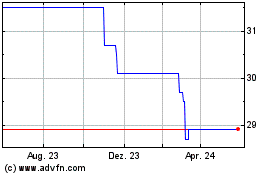

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024