Amounts due to brokers are payables for securities purchased (in

a regular way transaction) that have been contracted for but not

yet delivered on the reporting date. Refer to the accounting policy

for 'financial liabilities, other than those classified as at fair

value through profit or loss' for recognition and measurement.

Amounts due from brokers include margin accounts and receivables

for securities sold (in a regular way transaction) that have been

contracted for but not yet delivered on the reporting date. Refer

to accounting policy for 'loans and receivables' for recognition

and measurement.

Interest revenue and expense

Interest revenue and expense are recognised in the statement of

comprehensive income for all interest-bearing financial instruments

using the effective interest method.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Dividend revenue and expense

Dividend revenue is recognised when the Group's right to receive

the payment is established. Dividend revenue is presented gross of

any non-recoverable withholding taxes, which are disclosed

separately in the consolidated statement of comprehensive income.

Dividend expense relating to equity securities sold short is

recognised when the shareholders' right to receive the payment is

established.

Stated capital

Ordinary shares are classified as equity.

Provision

A provision is recognised when and only when there is a present

obligation (legal or constructive) as a result of a past event, and

it is probable that an outflow embodying economic benefits will be

required to settle that obligation and a reliable estimate can be

made of the amount of the obligation. Provisions are reviewed at

each reporting date and adjusted to reflect the current best

estimate.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank. Cash

equivalents are short term, highly liquid investments that are

readily convertible to known amounts of cash and which are subject

to an insignificant risk of change in value.

Related parties

For the purposes of these consolidated financial statements,

parties are considered to be related to the Group if they have the

ability, directly or indirectly, to control the Group or exercise

significant influence over the Group in making financial and

operating decisions, or vice versa, or where the Group is subject

to common control or common significant influence. Related parties

may be individuals or other entities.

3. CHANGES IN ACCOUNTING POLICY AND DISCLOSURES

The accounting policies adopted are consistent with those of the

previous financial year, except for the following amendments to

IFRS effective as of 1 January 2012:

-- IAS 12 Income Taxes (Amendment) - Deferred Taxes: Recovery of Underlying Assets

-- IFRS 1 First-Time Adoption of International Financial

Reporting Standards (Amendment) - Severe Hyperinflation and Removal

of Fixed Dates for First-Time Adopters IFRS 7 Financial

Instruments: Disclosures (Amendments)

-- IFRS 7 Financial Instruments : Disclosures - Enhanced Derecognition Disclosure Requirements

The adoption of the standards or interpretations is described

below:

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

3. CHANGES IN ACCOUNTING POLICY AND DISCLOSURES (CONTINUED)

IAS 12 Income Taxes (Amendments) - Deferred Taxes: Recovery of

Underlying Assets

The amendment clarified the determination of deferred tax on

investment property measured at fair value and introduces a

rebuttable presumption that deferred tax on investment property

measured using the fair value model in IAS 40 should be determined

on the basis that its carrying amount will be recovered through

sale. It includes the requirement that deferred tax on

non-depreciable assets that are measured using the revaluation

model in IAS 16 should always be measured on a sale basis. The

amendment is effective for annual periods beginning on or after 1

January 2012 and has had no effect on the Group's financial

position, performance or its disclosures.

IFRS 1 First-Time Adoption of International Financial Reporting

Standards (Amendment) - Severe Hyperinflation and Removal of Fixed

Dates for First-Time Adopters

The IASB provided guidance on how an entity should resume

presenting IFRS financial statements when its functional currency

ceases to be subject to hyperinflation. The amendment is effective

for annual periods beginning on or after 1 July 2011. The amendment

had no impact on the Group.

IFRS 7 Financial Instruments: Disclosures - Enhanced

Derecognition Disclosure Requirements

The amendment requires additional disclosure about financial

assets that have been transferred but not derecognised to enable

the user of the Group's financial statements to understand the

relationship with those assets that have not been derecognised and

their associated liabilities. In addition, the amendment requires

disclosures about the entity's continuing involvement in

derecognised assets to enable the users to evaluate the nature of,

and risks associated with, such involvement. The amendment is

effective for annual periods beginning on or after 1 July 2011. The

Group does not have any assets with these characteristics so there

has been no effect on the presentation of its financial

statements.

Standards issued but not yet effective

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Group's financial

statements are disclosed below.

IAS 1 Presentation of Items of Other Comprehensive Income -

Amendments to IAS 1

The amendments to IAS 1 change the grouping of items presented

in other comprehensive income (OCI). Items that will never be

reclassified (or 'recycled') to profit or loss at a future point in

time (for example, actuarial gains and losses on defined benefit

plans and revaluation of land and buildings) would be presented

separately from items that could be reclassified (for example, net

gain on hedge of net investment, exchange differences on

translation of foreign operations, net movement on cash flow hedges

and net loss or gain on available-for-sale financial assets). The

amendment affects presentation only and has no impact on the

Group's financial position or performance. The amendment became

effective for annual periods beginning on or after 1 July 2012, and

has been applied in the Group's first annual report after becoming

effective.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

3. CHANGES IN ACCOUNTING POLICY AND DISCLOSURES (CONTINUED)

IAS 19 Employee Benefits (Revised)

The IASB has issued numerous amendments to IAS 19. These range

from fundamental changes such as removing the corridor mechanism

and the concept of expected returns on plan assets to simple

clarifications and re-wording. The amendment becomes effective for

annual periods beginning on or after 1 January 2013. This standard

is not applicable to the Group.

Standards issued but not yet effective

IAS 28 Investments in Associates and Joint Ventures (as revised

in 2011)

As a consequence of the new IFRS 11 Joint Arrangements, and IFRS

12 Disclosure of Interests in Other Entities, IAS 28 Investments in

Associates, has been renamed IAS 28 Investments in Associates and

Joint Ventures, and describes the application of the equity method

to investments in joint ventures in addition to associates. The

revised standard becomes effective for annual periods beginning on

or after 1 January 2013. This standard has no effect on the

Group.

IAS 32 Offsetting Financial Assets and Financial Liabilities -

Amendments to IAS 32

These amendments clarify the meaning of "currently has a legally

enforceable right to set-off". The amendments also clarify the

application of the IAS 32 offsetting criteria to settlement systems

(such as central clearing house systems) which apply gross

settlement mechanisms that are not simultaneous. These amendments

are not expected to impact the Group's financial position or

performance and become effective for annual periods beginning on or

after 1 January 2014.

IFRS 1 Government Loans - Amendments to IFRS 1

These amendments require first-time adopters to apply the

requirements of IAS 20 Accounting for Government Grants and

Disclosure of Government Assistance, prospectively to government

loans existing at the date of transition to IFRS. Entities may

choose to apply the requirements of IFRS 9 (or IAS 39, as

applicable) and IAS 20 to government loans retrospectively if the

information needed to do so had been obtained at the time of

initially accounting for that loan. The exception would give

first-time adopters relief from retrospective measurement of

government loans with a below-market rate of interest. The

amendment is effective for annual periods on or after 1 January

2013. The amendment has no impact on the Group.

IFRS 7 Disclosures - Offsetting Financial Assets and Financial

Liabilities - Amendments to IFRS 7

These amendments require an entity to disclose information about

rights to set-off and related arrangements (e.g., collateral

agreements). The disclosures would provide users with information

that is useful in evaluating the effect of netting arrangements on

an entity's financial position. The new disclosures are required

for all recognised financial instruments that are set off in

accordance with IAS 32 Financial Instruments: Presentation. The

disclosures also apply to recognised financial instruments that are

subject to an enforceable master netting arrangement or similar

agreement, irrespective of whether they are set off in accordance

with IAS 32. These amendments will not impact the Group's financial

position or performance and become effective for annual periods

beginning on or after 1 January 2013.

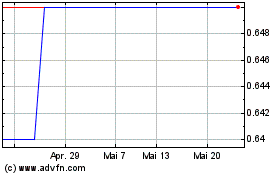

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

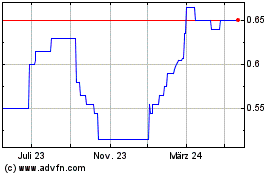

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024