AS AT 30 JUNE 2013

Notes As at As at

30 June 30 June

2013 2012

--------- ---------

USD USD

ASSETS

Financial assets at fair value

through profit or loss 5(a) 51,038,216 38,216,419

Trade and other receivables 6 1,160,571 1,157,142

Cash and cash equivalents 3,031,033 4,960,190

----------- -----------

Total assets 55,229,820 44,333,751

=========== ===========

EQUITY AND LIABILITIES

Liabilities

Financial liabilities at fair value

through profit or loss 5(b) 5,479,421 5,358,713

Trade and other payables 8 1,520,732 209,931

Total liabilities 7,000,153 5,568,644

----------- -----------

Equity

Share capital 7 426,303 426,303

Share premium 38,092,003 38,484,202

Retained earnings/(losses) 9,352,924 (415,563)

----------- -----------

Equity attributable to equity holders

of the parent 47,871,230 38,494,942

Non-controlling interest 358,437 270,165

Total equity 48,229,667 38,765,107

----------- -----------

Total equity and liabilities 55,229,820 44,333,751

=========== ===========

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Issued Share Retained Non controlling Total

capital premium profit Total interest equity

-------- ----------- ------------ ------------ ---------------- ------------

Notes USD USD USD USD USD USD

At 01 January 2012 426,303 38,705,880 675,220 39,807,403 273,007 40,080,410

Total Comprehensive

income for the period - - 1,692,704 1,692,704 20,652 1,713,356

Other comprehensive

income - - - - - -

Dividend - (443,355) - (443,355) - (443,355)

At 31 December 2012 426,303 38,262,525 2,367,924 41,056,752 293,659 41,350,411

Total comprehensive

income for the period 6,985,000 6,985,000 64,778 7,049,778

Dividend (170,522) (170,522) (170,522)

At 30 June 2013 426,303 38,092,003 9,352,924 47,871,230 358,437 48,229,667

======== =========== ============ ============ ================ ============

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

Notes For the Period For the Period

Ended 30 Ended 30

June 2013 June 2012

--------------- ---------------

USD USD

Cash flows from operating activities

Comprehensive income/ (loss) for the

period 7,049,777 (1,093,625)

Adjustment for:

Interest income (337,420) (235,302)

Dividend income (932,097) (1,885,893)

(Gain)/ loss on financial assets at

fair value through profit or loss (7,391,461) 1,805,228

(Gain)/ loss on financial liabilities

at fair value through profit or loss (246,236) 442,561

Operating losses before working capital

changes (1,857,437) (967,032)

Increase in other receivables and

prepayments (54,077) (138,256)

Decrease in other payables and accrued

expenses 1,023,984 (54,673)

-------------- -------------

Net cash used in operating activities (887,530) (1,159,960)

-------------- -------------

Purchase of financial assets at fair

value through profit or loss 5(a) (16,106,663) (5,093,528)

Disposal of financial assets at fair

value through profit or loss 5(a) 14,619,208 7,521,595

Purchase of financial liabilities

at fair value through profit or loss 5(b) (2,304,319) -

Disposal of financial liabilities

at fair value through profit or loss 5(b) 3,484,092 1,503,412

Interest received 239,099 169,690

Dividend received 524,081 1,456,706

-------------

Net cash generated from investing

activities 455,498 5,557,875

-------------- -------------

Cash flows used in financing activities

Dividend paid (170,522) (221,678)

-------------

Net cash flow used in financing activities (170,522) (221,678)

-------------- -------------

Net (decrease)/ increase in cash and

cash equivalents (602,554) 4,176,237

Cash and cash equivalents at 1 January 3,633,587 783,953

-------------

Cash and cash equivalents at 30 June 3,031,033 4,960,190

============== =============

AFRICA OPPORTUNITY FUND LIMITED

CORPORATE INFORMATION

FOR THE PERIOD 1 JANUARY 2013 TO 30 JUNE 2013

Date of

appointment

DIRECTOR:

CHAIRMAN: : Robert Knapp 25 June 2007

NON EXECUTIVE DIRECTORS: : Francis Daniels 21 June 2007

Christopher Gradel 25 June 2007

Christopher Agar 25 June 2007

Shingayi Mutasa 25 June 2007

Myma Belo-Osagie 25 June 2007

REGISTERED OFFICE : PO Box 309 GT

Ugland House

South Church Street

George Town

Grand Cayman

Cayman Islands

REGISTRAR : Anson Registrars Limited

Anson Place, Mill Court

La Charroterie, St. Peter's

Port

Guernsey GY1 3WX

Channel Islands

NOMINATED ADVISER : Grant Thornton UK LLP

30 Finsbury Square

London EC2P 2YU

United Kingdom

CORPORATE BROKER : LCF Edmond de Rothschild Securities Limited

5 Upper St. Martin's

Lane

London WC2H 9EA

United Kingdom

AFRICA OPPORTUNITY FUND LIMITED

CORPORATE INFORMATION

FOR THE PERIOD 1 JANUARY 2013 TO 30 JUNE 2013

ADMINISTRATOR : International Proximity

Fifth Floor, Ebene Esplanade

24 Cybercity

Ebene

Mauritius

Africa Opportunity Partners

INVESTMENT MANAGER : Limited

PO Box 309 GT

Ugland House

South Church Street

George Town

Grand Cayman

Cayman Islands

AUDITORS : Ernst & Young

9(th) Floor, NeXTeracom Tower

I

Cybercity

Ebene

Mauritius

Credit Suisse Securities (USA)

PRIME BROKER: : LLC

Eleven Madison Avenue

3rd Floor

New York, NY 10010

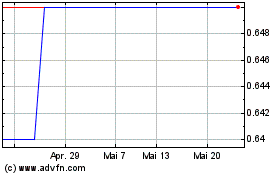

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

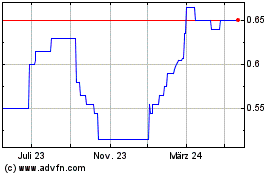

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024