Commodity Currencies Gain On Upbeat China Trade Data

07 November 2024 - 5:36AM

RTTF2

The Commodity-linked currencies such as Australia, the New

Zealand and the Canadian dollars strengthened against their major

currencies in the Asian session on Thursday, after data showed that

China's exports expanded the most in more than two years in

October, while imports declined at a sharper-than-expected pace due

to weaker domestic demand.

The official data showed that the China's exports grew 12.7

percent on a yearly basis, following an increase of 2.4 percent in

September, customs data revealed. Shipments were forecast to climb

only 5.0 percent.

On the other hand, imports dropped 2.3 percent annually after a

0.3 percent rise in the previous month. Economists had forecast

imports to drop 1.5 percent.

As a result, the trade surplus surged to $95.7 billion from

$81.7 billion in the previous month and remained well above

economists' forecast of $73.5 billion.

In recent years, exports acted as the major growth driver, while

weak domestic activity and the property market downturn damped

consumption.

Donald Trump's second term as the U.S. President is likely to

pose headwinds to Chinese trade. In his pre-election campaign,

Trump vowed to impose tariffs of between 60 and 100 percent on

Chinese imports.

It is believed a Trump administration will scale back government

regulations and be less hostile to mergers and acquisitions but

policies such as tax cuts and tariffs could trigger price

pressures.

Trader's focus shifted to interest-rate decisions from the Bank

of England and the Federal Reserve due later in the day.

In economic news, data from the Australian Bureau of Statistics

showed that the total number of building approvals issued in

September was up a seasonally adjusted 4.4 percent on month, coming

in at 14,842. That was in line with expectations following the 3.9

percent drop in August.

On a yearly basis, overall approvals climbed 6.8 percent.

In the Asian trading today, the Australian dollar rose to nearly

a 3-1/2-month high of 102.27 against the yen and a 2-week high of

1.6214 against the euro, from yesterday's closing quotes of 101.56

and 1.6234, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 101.56 against the yen and 1.60

against the euro.

Against the Canadian and the New Zealand dollars, the aussie

advanced to a 3-day high of 0.9212 and a 2-day high of 1.1076 from

Wednesday's closing quotes of 0.9154 and 1.1057, respectively. The

aussie may test resistance around 0.93 against the loonie and 1.12

against the kiwi.

The aussie edged up to 0.6637 against the U.S. dollar, from

yesterday's closing value of 0.6568. The next possible upside

target for the aussie is seen around the 0.68 region.

The NZ dollar rose to a 3-1/2-month high of 92.43 against the

yen and a 2-week high of 1.7934 against the euro, from yesterday's

closing quotes of 91.82 and 1.8061, respectively. The kiwi may test

resistance around 96.00 against the yen and 1.77 against the

euro.

Against the U.S. dollar, the kiwi edged up to 0.6004 from

Wednesday's closing value of 0.5938. If the kiwi extends its

uptrend, it is likely to find resistance around the 0.61

region.

The Canadian dollar rose to more than a 3-month high of 111.19

against the yen, from yesterday's closing value of 110.93. If the

loonie extends its uptrend, it is likely to find resistance around

the 112.00 area.

Against the U.S. dollar and the euro, the loonie advanced to

1.3871 and 1.4916 from Wednesday's closing quotes of 1.3938 and

1.4953, respectively. On the upside, 1.36 against the greenback and

1.48 against the euro are seen as the next resistance levels for

the loonie.

Looking ahead, Eurostat releases euro area retail sales figures

for September at 5:00 am ET. Economists expect sales to grow 0.4

percent on month after a 0.2 percent rise in August.

At 7:00 am ET, the Bank of England will announce its interest

rate decision for November. At the end of two-day policy meeting,

the Monetary Policy Committee of the BoE is expected to lower the

bank rate to 4.75 percent from 5.00 percent.

In the New York session, U.S. weekly jobless claims data and

wholesale inventories for September are set to be released.

At 2:00 pm ET, The U.S. Federal Open Market Committee (FOMC)

announces its interest rate decision, but uncertainty over the

future policy easing escalated after Donald Trump won the U.S.

presidential election. The bank is expected to lower its benchmark

interest rate by 25 basis points to 4.75 percent at its November

meeting.

At 2:30 pm ET, the U.S. Fed chair Jerome Powell is scheduled to

speak at a press conference following the announcement of U.S. Fed

monetary policy.

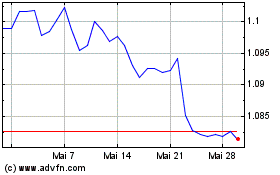

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Okt 2024 bis Nov 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Nov 2023 bis Nov 2024