Australian Dollar Falls On U.S. Trump Tariff Threats

12 November 2024 - 1:10AM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Tuesday, amid concerns about possible tariffs

on Chinese imports by U.S. President-Elect Donald Trump.

Markets are nervous as they seek clarity on U.S. President-elect

Donald Trump's policy proposals, including increased tariffs, and

await key U.S. inflation reading later in the week for directional

cues.

Though the markets are optimistic that Trump's policies such as

tax reductions and deregulation will help boost corporate earnings,

they see an uptick in inflation amid proposed increase in tariffs

that will complicate the US Fed's interest-rate plans.

Weakness in mining stocks amid tumbling metal prices, also led

to the downtrend of the currency.

Crude oil closed sharply lower, weighed down by a stronger

dollar and concerns about demand. West Texas Intermediate Crude oil

futures for December ended down $2.34 or 3.6 percent at $68.04 a

barrel.

In the Asian trading today, the Australian dollar fell to a

6-day low of 0.6550 against the U.S. dollar, from yesterday's

closing value of 0.6574. On the downside, 0.63 is seen as the next

support level for the aussie.

Against the yen and the euro, the aussie slipped to 100.56 and

1.6248 from Monday's closing quotes of 101.05 and 1.6201,

respectively. If the aussie extends its downtrend, it is likely to

find support around 99.00 against the yen and 1.66 against the

euro.

Against the Canada and the New Zealand dollars, the aussie edged

down to 0.9135 and 1.0997 from yesterday's closing quotes of 0.9154

and 1.1021, respectively. The next possible downside target for the

aussie is seen around 0.90 against the loonie and 1.08 against the

kiwi.

Looking ahead, Germany CPI data for October and U.K. jobs data

for October, are due to be released in the pre-European

session.

In the European session, Germany ZEW economic sentiment for

November is set to be released.

In the New York session, U.S. NFIB business optimism index for

October, Canada building permits for September, U.S. Redbook

report, U.S. consumer inflation expectations for October are slated

for release.

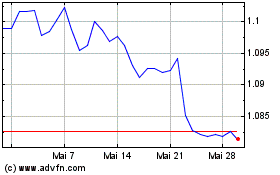

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Okt 2024 bis Nov 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Nov 2023 bis Nov 2024