Commodity Currencies Extend Slide Amid Risk Aversion

30 Oktober 2024 - 5:26AM

RTTF2

The Commodity-linked currencies such as Australia, the New

Zealand and the Canadian dollars extended its weakness against

major currencies in the Asian session on Wednesday amid risk

aversion, as traders are cautious and reluctant to take positions

ahead of the next week's U.S. presidential election and the U.S.

Fed's monetary policy decision. Concern about the tension in the

Middle East is also weighing on the markets.

Traders also looked ahead to a slew of U.S. economic data as

well as tech megacap earnings for directional cues.

Weakness in energy and financial stocks also led to the downturn

of the investor sentiment.

Crude oil prices settled lower again amid concerns crude

supplies will far exceed near term demand. West Texas Intermediate

Crude oil futures for December ended down $0.17 or about 0.25

percent at $67.21 a barrel.

The Australian dollar weakened against its major rivals,

following lower-than-expected Australia's third-quarter Consumer

Price Index (CPI) data, signaling a Reserve Bank of Australia

interest rate cut unlikely this year.

Data from the Australian Bureau of Statistics showed that the

consumer prices in Australia were up a seasonally adjusted 0.2

percent on quarter in the third quarter of 2024, said on Wednesday.

That was shy of expectations for an increase of 0.3 percent and

down from 1.0 percent in the previous three months.

On an annualized basis, inflation climbed 2.8 percent, exceeding

forecasts for 2.3 percent and down from 3.8 percent in the second

quarter. The trimmed mean was up 0.8 percent on quarter and 3.5

percent on year, while the weighted mean was up 0.9 percent on

quarter and 3.8 percent on year.

The commodity-linked currencies traded lower against their major

counterparts on Tuesday, as the crude oil prices fell amid rising

geopolitical tensions in the Middle East.

In the Asian trading today, the Australian dollar fell to nearly

a 2-month low of 1.6543 against the euro and an 8-day low of 100.19

against the yen, from yesterday's closing quotes of 1.6488 and

100.60, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.66 against the euro and 96.00

against the yen.

Against the U.S. and the Canadian dollars, the aussie slipped to

nearly a 3-month low of 0.6537 and nearly a 1-1/2-month low of

0.9102 from Tuesday's closing quotes of 0.6560 and 0.9128,

respectively. The aussie may test support near 0.64 against the

greenback and 0.90 against the loonie.

The aussie edged down to 1.0975 against the NZ dollar, from an

early high of 1.1006. On the downside, 1.08 is seen as the next

support level for the aussie.

The NZ dollar fell to nearly a 3-month low of 0.5950 against the

U.S. dollar and nearly a 2-1/2-month low of 1.8173 against the

euro, from yesterday's closing quotes of 0.5972 and 1.8108,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.57 against the greenback and 1.82 against the

euro.

Against the yen, the kiwi edged down to 91.25 from yesterday's

closing value of 91.58. The kiwi may test support near the 89.00

region.

The Canadian dollar fell to more than a 2-week low of 1.5064

against the euro, from yesterday's closing value of 1.5052. The

loonie may test support near the 1.51 region.

Against the U.S. dollar and the yen, the loonie edged down to

1.3925 and 110.03 from Tuesday's closing quotes of 1.3914 and

110.20, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.40 against the greenback and 107.00

against the yen.

Looking ahead, Germany unemployment data for October, Euro area

flash GDP data for the third quarter and consumer confidence for

October are set to released.

In the New York session, U.S. MBA weekly mortgage approvals

data, U.S. GDP data for the third quarter, U.S. core price index

for the third quarter, pending home sales data for September and

U.S. EIA crude oil data are slated for release.

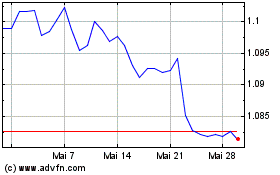

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Okt 2024 bis Nov 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Nov 2023 bis Nov 2024