FTSE 100 Recovers as Rescue Deal For SVB Lifts Sentiment

0752 GMT - The FTSE 100 rises 0.6% to 7447 points, recovering

after sustaining losses at the end of last week as a sharp rise in

the cost of Deutsche Bank's credit-default swaps sparked fresh

banking sector worries. The recovery comes as U.S. stocks are

expected to open higher after First Citizens Bank agreed to

purchase large parts of the assets of collapsed U.S. bank Silicon

Valley Bank. "It remains to be seen whether this relief rally is

justified until such time as the planks of banking uncertainty can

be removed once and for all, leading to an improvement in investor

confidence which is currently in scant supply," Interactive

Investor analyst Richard Hunter writes. (renae.dyer@wsj.com)

COMPANIES NEWS:

Belvoir 2022 Pretax Profit Fell on Higher Costs, Raises

Dividend

Belvoir Group PLC said Monday that pretax profit in 2022

slightly fell amid higher costs, and that it has increased its

dividend payout.

---

EDF's Acquisition of GE Operations Probed by UK Antitrust

Watchdog

The U.K.'s competition regulator said Monday that it is looking

into Electricite de France SA's deal to buy General Electric Co.'s

nuclear steam-power business.

---

Hyve Sees 1H Revenue of GBP95 Mln-GBP100 Mln

Hyve Group PLC said Monday that performance in its fiscal first

half has been in line with its expectations after it ran a full

schedule of events and that revenue in the period is seen at 95

million to 100 million pounds ($116.2 million-$122.3 million).

---

Plexus Holdings 1H Pretax Loss Widened on Higher Costs, Expects

Full-Year Revenue Below Views

Plexus Holdings PLC said Monday that its pretax loss for the

first half of fiscal 2023 widened on higher costs, and that revenue

for the year will be materially lower than market expectations.

---

Technology Minerals Raises GBP2.5 Mln from New Investor

Technology Minerals PLC said Monday that it has raised 2.5

million pounds ($3.1 million) via a share subscription and loan

note issue with a new investor and will use the money toward its

battery metals mining assets.

---

Dialight 2022 Pretax Profit Fell Despite Revenue Rising on

Volume, Price Increases

Dialight PLC said Monday that pretax profit fell in 2022 as its

margins were hit by inflation and supply-chain problems, but that

revenue rose on increases in volume and pricing.

---

CML Microsystems Sees FY 2023 Revenue, Profit in Line

CML Microsystems PLC said Monday that it expects to report

performance in line with market expectations for fiscal 2023, with

revenue of around 20.5 million pounds ($25.1 million) and pretax

profit close to GBP3.1 million.

---

Tlou Energy Raises A$200,000 to Fund Lesedi Project in

Botswana

Tlou Energy Ltd. said Monday that it has raised 200,000

Australian dollars (US$132,920) via the issue of shares and will

use the money toward the development of its Lesedi project in

Botswana.

---

Thungela Resources 2022 Profit Rose on Increased Coal Prices

Thungela Resources Ltd. said Monday that 2022 profit rose as

revenue surged on a significant increase in the price of coal, and

that because of South Africa's Transnet Freight Rail's performance

it was resetting its 2023 production outlook.

---

Pressure Technologies to Miss Reporting Deadline; Shares to be

Halted April 3

Pressure Technologies PLC said Monday that it won't be able to

meet the March 31 deadline to publish its fiscal 2022 accounts and

that its shares will therefore be suspended from trading on April

3.

---

Northamber 1H Pretax Loss Widened on Higher Costs

Northamber PLC said Monday its pretax loss for the first half of

fiscal 2023 widened on higher costs, and that the board remains

cautious due to economic uncertainty.

---

Tortilla Mexican Grill Swung to 2022 Pretax Loss on Inflationary

Costs

Tortilla Mexican Grill PLC said Monday that it swung to a pretax

loss in 2022 due to inflationary costs, but that revenue rose 20%

on year and that trading in 2023 so far has been in line with

expectations.

---

Severfield Sees FY 2023 in Line After Strong 2H

Severfield PLC said Monday that it expects to report fiscal 2023

performance in line with expectations after booking a strong second

half.

---

IQGeo Group 2022 Pretax Loss Narrowed on Increased Sales

IQGeo Group PLC said Monday that pretax loss for 2022 has

narrowed on the back of improved sales and broad-based progress

across all segments.

---

RTC Group Shares Fall on Swing to Pretax Loss

Shares in RTC Group PLC fell Monday after the company said it

swung to a pretax loss due to a challenging first half of 2022.

---

Equals Group Earnings, Revenue Rose in 2022; Buys Oonex for Up

to GBP4.1 Mln

Equals Group PLC said Monday that revenue and earnings grew in

2022 and that it was buying payments-services provider Oonex

SA.

---

Tandem Shares Fall After 1Q Sales Were Worse Than Expected, 2022

Profit Declined

Tandem Group PLC shares fell on Monday after the company said

sales have been slower than expected at the start of the year and

reported a fall in pretax profit for 2022.

---

Sirius Real Estate Appoints Chris Bowman as CFO

Sirius Real Estate Ltd. said Monday that it has appointed Chris

Bowman as chief financial officer with effect on Aug. 29.

---

Merit Group's Shares Rise After Selling Lease at London's

Shard

Shares of Merit Group PLC rose 17% in early trade on Monday

after the company said that it has sold its London office lease at

The Shard, saving it 2.3 million pounds ($2.8 million) over the

remaining term and after paying for new premises and other

costs.

---

Helium One 1H Pretax Loss Widened on Higher Costs

Helium One Global Ltd. said Monday that its pretax loss for the

first half of fiscal 2023 widened as administrative costs rose.

MARKET TALK:

Tortilla Mexican Grill Lacks Clear Near-Term Catalysts, Shore

Capital Says

0819 GMT - Tortilla Mexican Grill's 2022 results were in line

with expectations, and given there are no clear catalysts in the

near term, no substantial upgrades should be expected, Shore

Capital analysts Bradley Hughes and Greg Johnson write in a

research note. The U.K. fast-casual Mexican restaurant achieved

like-for-like revenue growth slightly ahead of expectations, 16.4%

against Shore Capital's 16.0% forecast, and its fourth quarter was

encouraging despite a challenging backdrop, Shore Capital says. "We

don't sense, at first glance, that the update today will lead to

material changes to our forecasts...nor do we see a clear catalyst

for upgrades," the analysts say. Shore Capital expects revenue of

GBP72 million and adjusted Ebitda of GBP4.7 million in 2023. Shares

are unchanged at 120 pence. (christian.moess@wsj.com)

Contact: London NewsPlus, Dow Jones Newswires;

(END) Dow Jones Newswires

March 27, 2023 04:43 ET (08:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

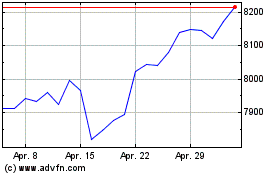

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024