PARROT: 2023 FULL-YEAR EARNINGS

PRESS

RELEASE Paris,

France, March 15, 2024 - 8:00am CET

2023 FULL-YEAR

EARNINGS

Revenues of €65.0m (-8% at constant exchange

rates)

2023 strategic plan effectively reduced costs

over the second half of the year

Net cash at end-December of €28.1m, in line with

the Group’s ambitions for development

New Defense & Security microdrone currently

being finalized

The Parrot group, a European leader for

professional microdrones, recorded €65m of consolidated revenues in

2023, down 10% (-8% at constant exchange rates). The robust

commercial development in 2023, following strong revenue growth in

2022 (+32%), illustrates the current volatility in a changing and

complex environment. The Group, in a buoyant geopolitical context

for its activities, rolled out some significant changes in 2023. It

has effectively adapted thanks to the three core pillars from the

strategic plan announced in July: (i) focusing the microdrone

technological roadmap on Defense and Security, (ii) improving

operations for the photogrammetry business, and (iii) stopping

production in China and switching to South Korea, complementing the

industrial organization already in place in the United States.

Operating expenditure was reduced by more than €11m between the

first half and second half of the year, in line with expectations,

to reach, at the end of 2023, a level in line with the Group’s

ambitions for development.

While the interest in secure and

autonomous microdrones is highlighted by the preponderance of new

technologies in the current conflicts, Parrot is working to meet

the technological and operational challenges faced to ensure the

success of its new microdrone, a key driver for 2024.

2023 full-year earnings

The consolidated and annual financial statements

for the year ended December 31, 2023 were approved by the Board of

Directors on March 14, 2024. The audit procedures have been carried

out by the statutory auditors and the reports will be issued once

the necessary procedures have been completed. The Universal

Registration Document will then be published on

https://www.parrot.com/uk/corporate/reports.

|

CONSOLIDATED INCOME STATEMENT (IFRS, €m) |

Dec 31, 2023(12 months) |

Jun 30, 2023(6 months) |

Dec 31, 2022(12 months) |

Year-on-year change |

|

Revenues |

65.0 |

31.6 |

71.9 |

-10% |

|

Microdrones |

33.2 |

15.5 |

39.2 |

-15% |

|

Photogrammetry |

31.8 |

16.1 |

32.7 |

-3% |

|

Cost of sales |

-18.0 |

-7.4 |

-16.0 |

+13% |

|

Gross margin |

47.0 |

24.1 |

56.0 |

-16% |

|

% of revenues |

72.3% |

76.5% |

77.8% |

|

|

Research and development costs |

-45.5 |

-26.1 |

-43.6 |

+4% |

|

% of revenues |

-70.0% |

-82.8% |

-60.6% |

|

|

Sales and marketing costs |

-12.3 |

-7.0 |

-11.1 |

+11% |

|

% of revenues |

-18.9% |

-22.1% |

-15.4% |

|

|

Administrative costs and overheads |

-11.7 |

-7.1 |

-14.7 |

-20% |

|

% of revenues |

-18.1% |

-22.5% |

-20.5% |

|

|

Production and quality costs |

-4.7 |

-2.5 |

-5.5 |

-15% |

|

% of revenues |

-7.3% |

-8.0% |

-7.6% |

|

|

Income from ordinary operations |

-27.3 |

-18.5 |

-19.0 |

-44% |

|

% of revenues |

-42.0% |

-58.8% |

-26.4% |

|

|

Other operating income and expenses |

-2.8 |

-3.2 |

-0.9 |

+211% |

|

EBIT |

-30.0 |

-21.8 |

-19.9 |

-52% |

|

% of revenues |

-46.2% |

-68.9% |

-27.6% |

|

|

Income from cash and cash equivalents |

0.0 |

0.0 |

0.0 |

- |

|

Gross finance costs |

-0.3 |

-0.1 |

-0.5 |

- |

|

Net finance costs |

-0.3 |

-0.1 |

-0.5 |

- |

|

Other financial income and expenses |

-2.0 |

-0.8 |

2.1 |

- |

|

Financial income and expenses |

-2.3 |

-0.9 |

1.6 |

- |

|

Share in income from associates |

-0.5 |

-0.3 |

-1.0 |

-50% |

|

Tax |

-0.1 |

0.0 |

-0.4 |

-75% |

|

Net income |

-33.0 |

-22.9 |

-19.7 |

-68% |

|

Net income (Group share) |

-32.4 |

-22.5 |

-19.5 |

-66% |

|

% of revenues |

-50.0% |

-71.4% |

-27.1% |

|

|

Non-controlling interests |

-0.5 |

-0.4 |

-0.2 |

-150% |

The Parrot group generated €65.0m of

consolidated revenues in 2023, down 10% (-8% at constant exchange

rates). Revenues for professional microdrones came to €33.2m,

compared with €39.2m in 2022 (-15%, and -14% at constant exchange

rates). Photogrammetry revenues totaled €31.8m, compared with

€32.7m (-3%, and -1% at constant exchange rates).

In 2023, the Group recorded a gross margin of

€47.0m, with a rate of 72.3%. This change (-5.5pts) reflects the

product mix, with the growth in sales of third-party equipment

(with lower margins than software) which aim to expand the

addressable market for photogrammetry, and the provisions linked to

the new industrial strategy and the launch of a new microdrone.

The Group reduced its operating expenditure by

-€11.2m (-26%) between the first half and second half of 2023. At

end-December 2023, the Group’s workforce - permanent and fixed-term

contracts - represented 404 people, compared with 542 at December

31, 2022. 51% are deployed on microdrones and 49% on

photogrammetry. In line with the progress with its technological

roadmap, the Group limited its use of external providers (16 versus

44 at December 31, 2022).

Over the year, R&D, at -€45.5m was

maintained to respond to the challenges involved with the new

generations of products. Nevertheless, the completion of various

development projects enabled the Group to reduce this area of

spending by €6.7m (-26%) between the first half and second half of

2023. 62% of the Group’s workforce, based exclusively in Europe,

are focused on innovation.

Sales and marketing costs came to €12.3m for

2023, with a €1.7m (-24%) decrease between the first half and

second half of 2023. They support an organization that generated

42% of its sales on the American continent, 38% in Europe and 20%

elsewhere around the world. This breakdown changed only slightly

between 2022 and 2023.

Administrative costs and overheads represent

€11.7m for 2023, with a €2.5m (-35%) reduction between the first

half and second half of 2023, thanks to the combined efforts of all

of the Group’s business units.

Production and quality costs totaled €4.7m in

2023, with a €0.3m (-12%) reduction between the first half and

second half of 2023. This level is moderated by the non-recurring

costs linked to the industrial organization’s transfer from China

to South Korea.

2023 current operating incomes came to -€27.3m.

The microdrones business represented -€17.4m, including -€6.0m for

the second half of the year. The photogrammetry business came to

-€6.4m, with -€0.8m for the second half of the year. The other

expenses (-€3.5m in 2023) are attributable to Parrot SA.

The -€2.8m of other operating income and

expenses for 2023 include the reorganization costs for -€6.3m, in

line with the estimates published in July 2023, partially

offset by the +€3.4m of income generated by the disposal of a

minority interest.

Change in the cash position

The Group had €28.1m of net cash at end-December

2023 (compared with €44.8m at end-June 2023 and €68.5m at

end-December 2022). The Group does not have any financial debt.

Over the second half of the year, operational cash consumption was

reduced to €16.9m, with €5.3m in relation with the strategic plan,

partially offset by the research tax credit of €1.4m.

Cash flow from operating activities totaled

€40.7m, reflecting the resources allocated to operations and the

increase in working capital requirements (+€11.0m, including +€9.6m

in H1 2023), linked primarily to the strategic plan and

particularly the new industrial organization and the finalization

of a new generation of microdrones.

Cash flow from investment activities came to

€4.5m in 2023. Parrot sold its interest in the company Sky-Hero,

receiving €5.5m, which offset the €0.9m of investments made in

2023.

Cash flow from financing activities came to

€4.4m, including €2.5m for the repayment of lease liabilities with

the application of IFRS 16 and €1.5m of capital investments in two

minority interests.

Outlook

While the interest in secure and autonomous

microdrones is highlighted by the preponderance of new technologies

in the current conflicts, Parrot is working to meet the

technological and operational challenges faced to ensure the

success of its new microdrone, which is driving trends in 2024.

In the photogrammetry sector, the expansion of

the addressable market, capitalizing in particular on complementary

equipment, is a key area for growth, as in 2023.

Efficient implementation of the strategic plan,

coupled with rigorous management of operations and investments,

ensure that the Group has the financial capacity to pursue its

development ambitions.

Next financial date

2024 first-quarter revenues: Thursday May 16,

2024

ABOUT THE PARROT GROUP

Parrot is Europe's leading commercial microUAV

group. With a strong international presence, the Group designs,

develops and markets a complementary range of micro-UAV equipment

and image analysis software (photogrammetry) dedicated to

companies, large groups and government organizations. Its offer is

mainly centered on three vertical markets: (i) Defense and

Security, (ii) Inspection, 3D mapping and Geomatics, (iii) and

Precision agriculture.

Its ANAFI range of microUAVs, recognized for

their performance, robustness and ease of use, features an open

source architecture and meets the highest cybersecurity standards.

Its Pix4D photogrammetry software suite for mobile and drone

mapping is based on advanced technical expertise and offers

solutions tailored to the specificities of the verticals it

addresses.

The Parrot Group, founded in 1994 by Henri

Seydoux its Chairman, CEO and main shareholders, designs and

develops its products in Europe, and is headquartered in Paris.

Today, it has over 500 employees worldwide and carries out the vast

majority of its sales internationally. Parrot has been listed on

Euronext Paris since 2006 (FR0004038263 - PARRO). For more

information: www.parrot.com, www.pix4d.com

CONTACTS

| Investors,

analysts, financial mediaMarie Calleux - T.: +33 1 48 03 60

60parrot@calyptus.net |

Tech &

corporate mediaChris Roberts - T.: +33 1 48 03 60

60pr@parrot.com |

APPENDICES

Quarterly revenues

|

REVENUES €m and % of revenues |

Q3 20233 months |

Q4 20233 months |

Q3 20223 months |

Q4 20223 months |

|

A |

Professional microdrones |

8.0 |

53% |

*9.8 |

54% |

13.9 |

63% |

10.0 |

51% |

|

C |

Photogrammetry |

7.1 |

47% |

8.5 |

46% |

8.1 |

37% |

9.5 |

49% |

|

D |

Parrot SA |

0.2 |

- |

0.2 |

|

0.3 |

- |

0.2 |

1% |

|

E |

Intragroup eliminations |

-0.2 |

- |

-0.2 |

|

-0.3 |

- |

(0.2) |

(1)% |

|

|

PARROT GROUP TOTAL |

15.1 |

100% |

18.3 |

100% |

21.9 |

100% |

19.5 |

100% |

* Including -€0.2m from legacy products.

Segment reporting for 2023

|

IFRS (€’000 and % of revenues) |

Microdrones |

Photogrammetry |

Other(1) |

Total |

|

Revenues |

33,256 |

31,762 |

(37) |

64,981 |

|

Income from ordinary operations |

(17,379) |

(6,429) |

(3,459) |

(27,267) |

(1) Parrot S.A. and ancillary or non-strategic activities.

IFRS consolidated balance

sheet

|

ASSETS (IFRS, €m) |

Dec 31, 2023 |

Dec 31, 2022 |

Jun 30, 2023 |

|

Non-current assets |

20.6 |

18.2 |

17.8 |

|

Other intangible assets |

0.1 |

0.2 |

0.1 |

|

Property, plant and equipment |

1.7 |

2.1 |

1.9 |

|

Right of use |

8.2 |

9.9 |

8.6 |

|

Investments in associates |

3.5 |

2.5 |

3.8 |

|

Financial assets |

6.6 |

3.0 |

3.1 |

|

Non-current lease receivables |

- |

- |

- |

|

Deferred tax assets |

0.5 |

0.4 |

0.4 |

|

Other non-current assets |

0.0 |

0.0 |

0.0 |

|

Current assets |

66.6 |

102.5 |

85.5 |

|

Inventories |

19.4 |

14.9 |

22.3 |

|

Trade receivables |

5.7 |

6.4 |

5.6 |

|

Tax receivables |

7.4 |

5.9 |

6.4 |

|

Other receivables |

6.1 |

6.6 |

6.4 |

|

Current lease receivables |

0.0 |

0.1 |

- |

|

Cash and cash equivalents |

28.1 |

68.5 |

44.8 |

|

Assets held for sale |

- |

2.5 |

- |

|

Total assets |

87.2 |

123.2 |

103.4 |

|

SHAREHOLDERS’ EQUITY AND LIABILITIES (IFRS, €m) |

Dec 31, 2023 |

Dec 31, 2022 |

Jun 30, 2023 |

|

Shareholders’ equity |

55.2 |

84.0 |

61.3 |

|

Share capital |

4.7 |

4.6 |

4.6 |

|

Additional paid-in capital |

331.6 |

331.7 |

331.7 |

|

Reserves excluding earnings for the period |

-258.4 |

-242.6 |

-262.0 |

|

Earnings for the period - Group share |

-32.5 |

-19.5 |

-22.5 |

|

Exchange gains or losses |

9.3 |

8.9 |

8.9 |

|

Equity attributable to Parrot SA shareholders |

54.7 |

83.1 |

60.7 |

|

Non-controlling interests |

0.5 |

1.0 |

0.6 |

|

Non-current liabilities |

11.6 |

12.5 |

11.4 |

|

Non-current financial liabilities |

0.0 |

- |

- |

|

Non-current lease liabilities |

6.4 |

7.6 |

6.6 |

|

Provisions for pensions and other employee benefits |

2.3 |

1.9 |

1.8 |

|

Deferred tax liabilities |

0.0 |

0.0 |

0.0 |

|

Other non-current provisions |

0.1 |

0.1 |

0.0 |

|

Other non-current liabilities |

2.6 |

3.0 |

3.0 |

|

Current liabilities |

20.5 |

26.7 |

30.6 |

|

Current financial liabilities |

- |

- |

- |

|

Current lease liabilities |

1.9 |

2.6 |

2.2 |

|

Current provisions |

3.0 |

2.2 |

9.1 |

|

Trade payables |

5.3 |

9.2 |

7.3 |

|

Current tax liabilities |

0.1 |

0.1 |

0.1 |

|

Other current liabilities |

10.2 |

12.6 |

11.9 |

|

Liabilities held for sale |

- |

- |

- |

|

Total shareholders’ equity and liabilities |

87.2 |

123.2 |

103.4 |

Consolidated cash-flow

statement

|

IFRS, €m |

Dec 31, 2023 |

Dec 31, 2022 |

Jun 30, 2023 |

|

OPERATING CASH FLOW |

|

|

|

|

Earnings for the period |

-33.0 |

-19.7 |

-22.9 |

|

Share in income from associates |

0.5 |

1.0 |

-0.3 |

|

Depreciation and amortization |

4.4 |

4.8 |

8.9 |

|

Capital gains and losses on disposals |

-3.3 |

0.6 |

-3.3 |

|

Tax expense |

0.1 |

0.4 |

0.0 |

|

Cost of share-based payments |

1.3 |

1.3 |

1.1 |

|

Other non-cash items |

|

3.1 |

- |

|

Net finance costs |

0.3 |

0.5 |

0.1 |

|

Cash flow from operations before net finance costs and tax |

-29.7 |

-8.0 |

-15.9 |

|

Change in working capital requirements |

-11.0 |

-12.0 |

-9.6 |

|

Tax paid |

0.0 |

-0.1 |

-0.1 |

|

Cash flow from operating activities (A) |

-40.7 |

-20.1 |

-25.7 |

|

INVESTING CASH FLOW |

|

|

|

|

Acquisition of property, plant and equipment and intangible

assets |

-0.8 |

-1.9 |

-0.4 |

|

Acquisition of financial assets |

-0.2 |

-0.1 |

-0.1 |

|

Disposal of property, plant and equipment and intangible

assets |

0.0 |

|

|

|

Disposal of subsidiaries, net of cash divested |

|

5.8 |

- |

|

Disposal of investments in associates |

|

1.8 |

- |

|

Disposal of financial assets |

5.5 |

3.3 |

5.6 |

|

Cash flow from investment activities (B) |

4.5 |

8.9 |

5.1 |

|

FINANCING CASH FLOW |

|

|

|

|

Equity contributions |

-1.6 |

-1.3 |

-1.6 |

|

Net finance costs |

-0.3 |

-0.5 |

-0.1 |

|

Repayment of short-term financial debt (net) |

-2.5 |

-3.3 |

-1.4 |

|

Repayment of other financing |

|

0.9 |

- |

|

Cash flow from financing activities (C) |

-4.4 |

-4.2 |

-3.1 |

|

NET CHANGE IN CASH (D = A+B+C) |

-40.6 |

-15.4 |

-23.5 |

|

Impact of change in exchange rates |

0.2 |

1.1 |

-0.2 |

|

CASH AND CASH EQUIVALENTS AT START OF PERIOD |

68.5 |

82.8 |

68.5 |

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

28.1 |

68.5 |

44.8 |

- PARROT_CP_FY-2023_20240318_EN_DEF

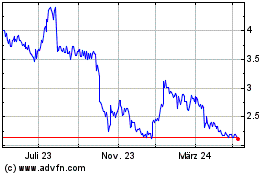

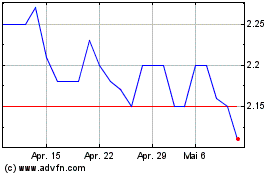

Parrot (EU:PARRO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Parrot (EU:PARRO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024