Mercialys Ramps up Its Development With the Acquisition in Two Phases of the Investment Management Company Imocom Partners, the French Retail Park Market Leader

12 September 2023 - 5:45PM

Business Wire

Regulatory News:

Mercialys (Paris:MERY) is announcing today that it has signed a

firm agreement with a view to acquiring the investment management

company Imocom Partners. The transaction is structured in two

phases. In 2023, Imocom Partners’ shareholders will sell 30% of its

capital to Mercialys for a price of Euro 7 million. The remaining

70% will be acquired by Mercialys during the first half of 2025

following an interim period during which the current management

team will accompany and support the company’s development. The

price for this second tranche will be adjusted in line with the

performances of the investment management company and the

underlying fund. Each of these two stages is subject to prior

authorization from the French Financial Markets Authority

(AMF).

Imocom Partners manages the OPPCI fund ImocomPark, whose shares

are reserved primarily for institutional investors and family

offices. This fund, with a maturity of 2032, holds a portfolio of

33 retail parks in France, with a total rental area of over 385,000

sq.m, let to around 400 tenants. The fund’s assets represent a

value of Euro 670 million including transfer taxes and generate

Euro 40 million of annual rental income. Thanks to Imocom Partners’

continued development since it was founded in 2011, this management

company is today positioned as a market leader in the retail park

segment.

This investment will enable the two companies to develop a

partnership, while ensuring compliance with the regulations

concerning potential conflicts of interest and the independence of

Imocom Partners for managing the OPPCI fund. The sites managed by

Mercialys and Imocom Partners share core features on a number of

different levels, making it possible to capitalize on their

respective areas of real estate know-how: anchoring in out-of-town

areas in key consumption areas of urban hubs, accessibility of the

retail offering and rents for retailers, proximity-based retail

mixes aimed at satisfying essential everyday needs.

The value creation for the two companies will include stronger

visibility in relation to tenant retailers and extended digital and

environmental expertise, as well as an increased capacity to carry

out retail or mixed real estate development projects in a context

of the greater importance of ensuring effective control over

artificial ground cover.

Mercialys and Imocom Partners believe that the retail real

estate sector has solid fundamentals over the medium term and

opportunities to generate value supported by the context of

pressures on land reserves, linked in particular to the French

“Climate and Resilience” Law. The development of new retail

property funds therefore represents a major potential source of

value creation. Mercialys will be able to invest, alongside

institutional investors, in new funds created by the investment

management company.

Vincent Ravat, Mercialys’ Chief Executive Officer: “Through this

operation, Mercialys will benefit from revenues generated by the

investment management company’s activity, as well as a stronger

presence alongside retailers and investors, and the capacity to

invest in portfolios of retail real estate assets looking beyond

its own capabilities. Mercialys will also be able to make its

extensive range of expertise in terms of lettings, asset

management, marketing or CSR available to support the funds

managed. This will move forward while ensuring compliance with the

regulations governing the investment management company for

outsourcing tasks or functions. By 2025, Mercialys will become the

sole shareholder of Imocom Partners. Between now and then, we know

that we will be able to count on the current management team’s

experience and quality to continue actively developing the

company”.

Bruno de Scorbiac and Laurent de Sayve, co-founders and managers

of Imocom Partners: “Mercialys’ arrival in our capital highlights

the confidence of this major retail real estate player in our

positioning and the continued growth of our activities. We will

combine our expert capabilities and benefit from Mercialys’

experience to take a further step forward with our development,

enabling us to move more quickly and go further, benefiting our key

stakeholders, tenant retailers, end consumers, communities and

investors”.

On this operation, Mercialys was supported by Lacourte Raquin

Tatar for legal, regulatory and tax aspects, Mazars for financial

aspects, and Flichy Grangé for social aspects. The sellers were

advised by Rothschild & Co, Bryan Cave Leighton Paisner and

Impulsa.

* * *

This press release is available on

www.mercialys.com.

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At June 30, 2023, Mercialys

had a real estate portfolio valued at Euro 3.0 billion (including

transfer taxes). Its portfolio of 2,054 leases represents an

annualized rental base of Euro 172.8 million. Mercialys has been

listed on the stock market since October 12, 2005 (ticker: MERY)

and has “SIIC” real estate investment trust (REIT) tax status. Part

of the SBF 120 and Euronext Paris Compartment B, it had 93,886,501

shares outstanding at December 31, 2022.

About Imocom Authorized by the AMF, ImocomPartners is an

investment management company that has invested since 2011 in

retail parks on behalf of institutional investors and family

offices. Through its management of one dedicated vehicle, the OPPCI

investment fund ImocomPark, the company develops a responsible

model with its stakeholders that combines financial performance

with social and environmental value creation. With a portfolio of

Euro 670 million including transfer taxes invested in 33 retail

parks and 386,000 sq.m of space under management, ImocomPark is

positioned as the leading OPPCI fund focused on retail parks in

France.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2022 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230912327258/en/

Analyst and investor Olivier Pouteau Tel: +33 (0)6 30 13

27 31 Email: opouteau@mercialys.com

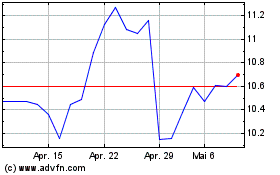

Mercialys (EU:MERY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

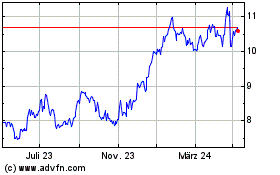

Mercialys (EU:MERY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024