Winfarm : Sharp growth in results for the 2021 financial year.

2022: reaffirmed confidence in a tense environment that demands

vigilance.

PRESS RELEASE Loudéac, 30 March

2022

Sharp growth in results for the 2021

financial year

Revenue up +9.3%

High gross margin maintained, and profitability

increased

2022:

reaffirmed confidence in a tense

environment that demands vigilance

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), No. 1 French distance-seller for the farming

industry, today announced strong growth in its

consolidated annual results for the 2021 financial year.

On 30 March 2022, the Board of Directors

approved the consolidated financial statements for the financial

year ended 31 December 2021. These financial statements have been

reviewed by the statutory auditors and the certification reports

are currently being prepared. The consolidated financial statements

for the 2021 financial year are available on the company's website

in the investor section.

|

Consolidated data, French accounting standards, Audited financial

statements in €m |

2021 |

2020 |

Δ |

|

Revenue |

108.1 |

98.9 |

+9% |

|

Gross margin |

36.1 |

33.2 |

+9% |

|

As a % of revenue |

33.5% |

33.6% |

stable |

|

EBITDA |

4.9 |

2.7 |

+81% |

|

As a % of revenue |

4.5% |

2.7% |

+1.8 pt |

|

Sponsorship and image rights expenses 1 |

(0.2) |

(3.3) |

|

|

Adjusted EBITDA2 |

5.1 |

6.0 |

-15% |

|

As a % of revenue |

4.7% |

6.0% |

-1.3 pt |

|

Depreciation, amortisation and provisions |

(3.1) |

(2.3) |

ns |

|

Operating income/loss |

2.2 |

0.7 |

x 3.3 |

|

Financial income/loss |

(0.1) |

(0.1) |

ns |

|

Non-recurring profit/loss |

- |

0.2 |

ns |

|

Corporate tax |

(0.7) |

(0.6) |

ns |

|

Share of net income of companies accounted for by the equity method

3 |

- |

0.1 |

ns |

|

Net income (Group share) |

1.4 |

0.5 |

x 2.8 |

CONSOLIDATED REVENUE GROWTH OF

+9.3%

In 2021, WINFARM recorded consolidated revenue

of €108.1m, up +9.3% (+2.8% organic growth), integrating BTN de

Haas, acquired in July 2021, for a contribution of €6.4m over the

year.

Agro-supply (89%

of annual revenue), under the Vital Concept brand, posted revenue

of €96.7m, up 13% compared to 2020.

WINFARM continued to benefit in particular from

the momentum of the horse and landscape diversification markets,

whose sales showed high growth rates in 2021 of +28% and +54%

respectively. These performances confirm the still very significant

growth pool of these markets, which had already posted strong

growth in previous years, +23% and +42% respectively in 2019, and

+33% and +88% respectively in 2020.

Agronutrition (9% of annual

revenue), under the Alphatech brand, posted revenue of €9.8m,

having suffered from the economic downturn over the financial year,

penalised in particular by the health environment with restrictive

measures for trade outside France. As a reminder, Alphatech

generates over 50% of its revenue abroad.

The launch of a new operational division at

Alphatech in H1 2021 sparked fresh momentum that has already been

illustrated by double-digit sales growth in the last two months of

the year and which is expected to continue in the coming

months.

SUSTAINED INCREASE IN GROSS MARGIN AND

PROFITABILITY

The increase in activity resulted in a rise in

gross margin of +9% to €36.1m. This accounted for 33.5% of 2021

revenue, compared with 33.6% in 2020. Against a backdrop of

widespread inflation in commodity costs, this performance

demonstrates the Group's ability to effectively pass on the

purchase price increases recorded over the period.

Agro-supply EBITDA increased by +58% to €6.8

million, representing an EBITDA margin of €7.0% (+2 points), under

the combined effect of the reduction in sponsorship and image

rights expenses, the contribution of BTN de Haas, acquired in July

2021, in the amount of €702k, an increase in the average basket on

the markets for diversification of the horse and landscape and

control of employee numbers.

Agronutrition's EBITDA was resilient in a

context of declining activity, coming out at €0.7m compared to

€0.4m in 2020, for an EBITDA margin of 7.3% over the year.

Overall, consolidated EBITDA rose sharply by

+81% to €4.9m, representing 4.5% of sales for 2021 versus 2.7% in

2020 (6.0% adjusted EBITDA margin in 2020, if we include

sponsorship and image rights expenses for €3.3m in 2020, the

contract for which ended at the end of 2020).

After taking into account depreciation,

amortisation and provisions for €3.1m, operating income multiplied

by 3 to reach to €2.2m, compared to €0.7m in 2020.

Incorporating financial income of €0.1m and the

tax expense of €0.7m, net income Group share is multiplied by 2.8

to reach €1.4m, compared to €0.5m in 2020.

A STRENGTHENED FINANCIAL

STRUCTURE

As at 31 December 2021, the company posted

equity of €22.7m for financial debt of €21.8m (including amounts

due to credit institutions, financial liabilities on financial

leases, current bank loans and contributions to current accounts),

down €2.3m compared to 2020.

Cash stood at €12.2m, including the proceeds

from the exercise of the overallotment option related to the

fundraising carried out in December 2020 as part of the company’s

IPO.

REAFFIRMED CONFIDENCE IN

2022 IN A TENSE ENVIRONMENT THAT DEMANDS VIGILANCE

The beginning of 2022 has been characterised by

a continued rise in the cost of commodities, encouraging WINFARM to

be extremely vigilant. While WINFARM managed to pass on all

purchase price increases in 2021 to its sales prices, a prolonged

continuation of these increases in 2022 could temporarily penalise

the Group's margins.

Apart from these economic factors, WINFARM

reiterates its confidence in achieving another year of growth in

2022.

To this end, WINFARM will draw on the revival of

its Agronutrition business, with a new management team that came

into force in 2021, and the provision of new sales resources to

address three new regions abroad: Southeast Asia, Latin America and

the Middle East.

In addition, WINFARM plans to launch the

construction of an extension of the food supplement plant in H1

2022, for a total investment of €3.5m, which will contribute to the

nutrition activity from the second half of 2023.

In the Agro-supply business, WINFARM will

continue its voluntary acquisition strategy by expanding its

customer base, particularly by addressing new market segments such

as grain producers, increasing the average basket through greater

customisation of online offers and capitalising on its subsidiaries

in Belgium and the Netherlands to conquer new international

markets, particularly in Flanders.

After the successful acquisition of BTN de Haas

in 2021, WINFARM intends to pursue its external growth strategy,

particularly on the international front, which presents

high-potential opportunities, but also in France with a view to

consolidating its positions.

In the longer term, the Group reconfirms its

objectives to achieve revenue of around €200m and an EBITDA margin

of around 6.5% by 2025. Half of this acceleration in growth would

be achieved through organic growth and half through external

growth.

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture.

With a vast catalogue of more than 15,500

product references (seeds, phytosanitary, harvesting products,

etc.), two-thirds of which are own brands, WINFARM has more than

45,000 customers in France, Belgium and the Netherlands.

By 2025, WINFARM aims to achieve revenue of

around €200m and an EBITDA margin of about 6.5%.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, financial

communicationsBenjamin LEHARI+33 (0) 1 56 88 11

11winfarm@actifin.fr |

ACTIFIN, financial press relationsJennifer

JULLIA+33 (0)1 56 88 11 19jjullia@actifin.fr |

1 The Group has sponsored a professional cycling

team under a 3-year contract. In 2020, WINFARM reported on adjusted

EBITDA, restated for these costs, for the purpose of presenting the

Group’s economic performance without taking these specific expenses

into account. From 2021, the securities sponsor contract became a

partnership agreement and the Group decided to return to an EBITDA

without restatement.

2 EBITDA restated for expenses related to

cycling sponsorship and image rights

3 22% stake in Pineau Cycling Evolution (cycling

team) sold on 25/06/2020

- WINFARM_PR_EN_2021_results_final

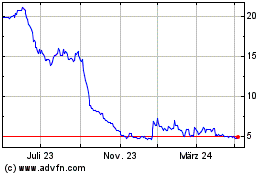

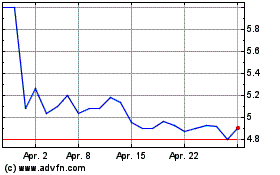

Winfarm (EU:ALWF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024