Chainlink Traders Capitulate After 10% Plunge: Bottom Here?

10 Juli 2024 - 11:30PM

NEWSBTC

On-chain data shows that Chainlink investors have been realizing

significant losses recently, a sign that the price plunge has put

fear into their minds. Chainlink FUD Could Lead Towards Bottom

Formation According to data from the on-chain analytics firm

Santiment, LINK investors have just shown their largest

capitulation event of the year. The indicator of relevance here is

the “Network Realized Profit/Loss,” which keeps track of the net

amount of profit or loss that Chainlink traders are realizing right

now. The metric works by going through the blockchain history of

each coin sold to see what price it was moved at before this. If

this previous price for any coin was less than the spot price it’s

being transferred at now, then the coin’s sale is realizing some

profit. Related Reading: Bitcoin Now Forming Pattern That Last Led

To It Blasting Off Similarly, transactions of coins of the opposite

type would lead to loss realization instead. The indicator adds up

these profits and losses for the entire network and then calculates

their difference to find the net situation. When the value of the

Network Realized Profit/Loss is positive, it means the investors as

a whole are realizing profits. On the other hand, the negative

metric suggests that loss-taking is the dominant form of selling in

the market. Now, here is a chart that shows the trend in the

Chainlink Network Realized Profit/Loss over the past few months: As

is visible in the above graph, the Chainlink Network Realized

Profit/Loss has seen a negative spike recently, suggesting that

LINK investors have realized some large losses. This significant

loss-taking spree from the LINK traders has come as the

cryptocurrency’s price has gone through a significant drawdown over

the past few weeks. The coin is down almost 10% in the last seven

days alone. Given this timing, it would appear that these investors

have been scared by the bearish price action so much that they have

decided to exit the market at a loss. In the same chart, the

analytics firm has also attached the data for another metric, the

Age Consumed, which keeps track of whether dormant coins are

moving. Related Reading: Solana Mirroring 2021 Bullish Pattern,

Crypto Analyst Reveals It would seem like this indicator also

spiked alongside the loss-taking from the investors, implying that

even some holders previously sitting tight have been shaken out by

the price plunge. This FUD in the market can benefit Chainlink, as

historically, the asset has been more likely to bottom out when

fear is ripe among the investors. As Santiment highlighted in the

graph, a red spike in the indicator also proved bullish for LINK in

April. LINK Price Chainlink is trading around $12.8 when writing,

down around 3% over the last 24 hours. Featured image from Dall-E,

Santiment.net, chart from TradingView.com

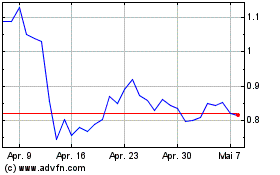

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024