XRP Price Set To Hit $1 In March: Crypto Analyst

04 März 2024 - 6:00PM

NEWSBTC

In a recent technical analysis update, the crypto analyst known as

Dark Defender provided insights into the price movements of XRP

against the US dollar. The analyst employs the Elliott Wave Theory

to dissect the price movements of XRP. This approach, rooted in the

psychological patterns of market participants, illustrates price

trends through a distinct 5-3 wave cycle. This includes five waves

following the primary trend direction and three corrective waves.

According to Dark Defender, XRP is exhibiting an uptrend since

January of 2023, undergoing an “ABC” correction phase from November

2023 to February 2024. This phase set the stage for a new bullish

wave sequence. Hi all. I hope you had a great weekend. Let's first

check our previous pattern & update it.#XRP strolling strictly

around our Fibonacci level at $0.6462. The lines are clear &

accurate. Checking MACD, Ichimoku & RSI indicators, XRP is

expected to continue the uptrend as we… pic.twitter.com/fetf2IH7nl

— Dark Defender (@DefendDark) March 4, 2024 XRP Price Eyes $1 By

End Of March The current market dynamics of XRP are encapsulated in

a wave pattern marked from (1) to (4), as per Elliott Wave

principles. The initial wave peaked on February 16, 2024, reaching

close to $0.58, showcasing a strong market sentiment as the

subsequent second wave’s retracement was modest, halting at $0.525

rather than fully reverting to the starting point of wave (1).

Related Reading: Crypto Analyst Reveals Why Most Realistic XRP

Price Lies Between $13 And $39 XRP is currently navigating through

Wave (3), which is often the longest and most powerful, indicating

a potential surge towards the $0.81 mark. The forthcoming Wave (4)

is expected to be corrective, with a projection of a dip to around

$0.75, leading into a final thrust in Wave (5) targeting the

$0.9191 to $1 range by late March. Notably, Dark Defender’s

analysis also incorporates Fibonacci retracement levels, further

refining the predictive accuracy by identifying potential market

support and resistance points. The price of XRP has recently

surpassed a significant resistance level, which was previously

identified as a downtrend line (red) stemming from point (B) on the

chart. This breakout indicates a strong bullish signal, as the

resistance turned into a support level. Dark Defender highlighted

that the resistance has been “Eliminated,” suggesting that prior

price ceilings are no longer restricting upward movement. However,

a notable challenge lies ahead with the 161.8% Fibonacci level at

$0.6462, which has already repelled the price on several occasions.

Overcoming this barrier is crucial for sustaining Wave (3)’s

momentum. The analysis forecasts an ambitious breach above the

261.8% Fib level at $0.7707 during Wave (3), albeit with an

anticipated correction below this threshold in Wave (4), using the

November 2023 high as a pivotal support marker. Related Reading:

CEO Of German VC Firm Predicts XRP To Become ‘World Reserve Bridge

Currency’ For traders, these insights underscore the importance of

monitoring Fibonacci levels and wave patterns to gauge future

movements. Nonetheless, the subjective nature of wave analysis

necessitates corroborative evidence from other technical indicators

for a holistic market outlook. To this end, Dark Defender has

referenced additional technical tools, including the Moving Average

Convergence Divergence (MACD), the Ichimoku Cloud, and the Relative

Strength Index (RSI). Although the analysis does not visually

detail these indicators, the commentary suggests that all three

support a continued bullish trend for XRP, reinforcing the

prediction of an ongoing uptrend. He stated, “Checking MACD,

Ichimoku & RSI indicators, XRP is expected to continue the

uptrend as we predicted. At press time, XRP traded at $0.65216.

Featured image from Shutterstock, chart from TradingView.com

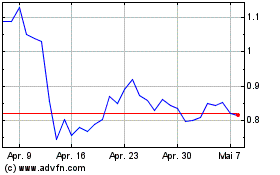

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024