October To Remember: Descending Broadening Wedge Says Bitcoin Is Going To $90,000

19 September 2024 - 12:00PM

NEWSBTC

Crypto analyst Jelle has highlighted a bullish pattern on the

Bitcoin chart, which he predicts could send its price as high as

$90,000. He also provided a timeline for when this parabolic rally

could begin. This comes amid a bullish outlook for the flagship

crypto following the Fed rate cuts. Descending Broadening

Wedge Could Send Bitcoin To $90,000 In an X post, Jelle mentioned a

descending broadening wedge pattern that had formed on Bitcoin’s

chart. He claimed that the pattern has a price target of $90,000

and added that he expects the price breakout to this target to

begin in October. The analyst also remarked that the fourth quarter

of this year should be “fun” for Bitcoin. Related Reading:

Ethereum In 2021 Vs. 2024: Fractal Suggests Major Breakout In Q4

Indeed, based on history, Bitcoin could enjoy significant returns

throughout October, November, and December of this year. The

flagship crypto has recorded positive monthly returns in the fourth

quarter of the last two halving years. Moreover, Q4 always yields

the highest returns of the year for Bitcoin. Meanwhile, in

another X post, Jelle highlighted key price levels that Bitcoin

needs to break above to ride to a new all-time high (ATH) and this

$90,000 price target. He remarked that claiming $62,000 will be a

good start for the flagship crypto and that once the price breaks

above $65,000, there will be no stopping the train to a new

ATH. Bitcoin’s current ATH stands at $73,000, a price level

reached in March earlier this year. However, analysts like Jelle

have continued to suggest that it is still way below the crypto’s

market peak in this bull run. There is also the possibility of

Bitcoin rising above $100,000 in this bull run. Standard

Chartered predicts that BTC could reach this price level this year.

The bank has also predicted that Bitcoin could rise to as high as

$150,000 if Donald Trump wins the election. BTC’s Bull Case

Just Got Stronger Jelle also mentioned that Bitcoin’s bull case

grew stronger following the Fed rate cuts. The US Federal Reserve

announced a 50 basis point (bps) interest rate cut on September 18,

a move widely regarded as bullish for the flagship crypto. The

crypto analyst mentioned that expansionary policy is on the horizon

with looser monetary back in place. Related Reading: Fantom

To $2: Here’s What’s Driving The FTM Price Recovery More liquidity

is expected to flow into risk assets like Bitcoin, sparking a price

surge in the crypto’s price, which has remained stagnant for a

while due to low demand. The bulls also look to be back following

the rate cuts, which could signal a bullish reversal for BTC.

Crypto analyst Ali Martinez recently revealed that 61.95% of top

traders on Binance are going long on the flagship crypto. Before

now, there was a bearish sentiment among these traders, as NewsBTC

reported that 51.41% of them were shorting Bitcoin. At the

time of writing, Bitcoin is trading at around $61,900, up over 2%

in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

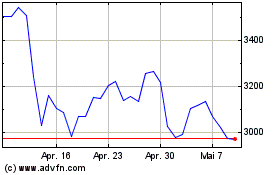

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Mär 2025