Is Money Beginning To Flow Back Into DeFi?

09 Februar 2023 - 12:00PM

NEWSBTC

Ultrasound Money data reveals that there has been a surge in

activity in decentralized finance (DeFi) protocols, with Uniswap

leading the line. In the past week, Uniswap-related activities led

the ETH “burn” leaderboard on Ultrasound Money, flipping OpenSea,

the world’s leading non-fungible token (NFT) marketplace. This

development is despite OpenSea coming on top of Uniswap last month.

Uniswap Flips OpenSea The flipping in the short term could indicate

that users are beginning to funnel their activities and funds to

Uniswap, and by extension, DeFi protocols in Ethereum. It

should be noted that the funds burnt are from coins

passed through the Uniswap Universal router. It is one of the two

smart contracts, together with Permit2, released by Uniswap Labs,

the team behind the DEX, in late November 2022. The Uniswap

Universal Router combines ERC20 and NFT swapping into a single swap

router. When users integrate Permit2, a smart contract that allows

“token approvals to be shared and managed across different

applications,” they can swap multiple fungible ERC-20 tokens and

NFTs in a single transaction, saving gas fees.

Uniswap launched NFT trading on November 30, 2022.

OpenSea’s monthly trading volumes peaked at over $4.85 billion in

January 2021 before dropping to as low as $125 million in January

2023. Despite the contraction, the NFT marketplace was able to

outperform the Uniswap Universal Router in the number of ETH it has

burned. Related Reading: Over $16 Million Of Donald Trump

NFTs Traded On OpenSea As an illustration, Ethereum burnt 5,695 ETH

in the last 30 days. Meanwhile, Uniswap’s activities resulted in

5,175 ETH being burnt in the same period. However, the DEX,

Uniswap, has been the most active platform in the last week,

surpassing OpenSea. The Ethereum network overhauled its gas

auctioning system, introducing burning after implementing EIP-1559.

With this, more ETH would be destroyed based on activity.

Uniswap Versus Other DEXes Uniswap is the largest multi-token DEX

in crypto, allowing users in multiple EVM-compatible platforms to

swap tokens without an intermediary. The exchange launched in late

2018 and currently manages over $4 billion of assets, emerging as

the sixth largest DeFi protocol, trailing Lido Finance, Aave,

MakerDAO, Curve—a stablecoin-only DEX, and Convex Finance. Related

Reading: Venture Capital Firm Votes Against Uniswap Deploying On

BNB Smart Chain Dune data shows that Uniswap commands 70%

of the total ETH DEX market share. It has a weekly trading volume

of $8,570,219,237, flipping Curve, which, as mentioned earlier, has

a larger total value locked (TVL). Despite the larger TVL, Curve’s

trading volumes are comparatively lower than Uniswap at

$1,260,371,355. DeFiLlama statistics reveal that PancakeSwap,

with a TVL of $2.59 billion, is the second most active DEX. It

commands average weekly volumes of $2.18 billion. Feature image

from Flickr, Chart from TradingView

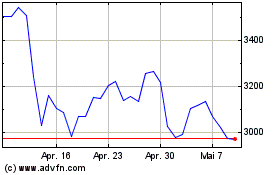

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024