Bitcoin aSOPR Fails Retest Of Historical Bull-Bear Junction

11 August 2022 - 9:00PM

NEWSBTC

On-chain data shows the Bitcoin aSOPR indicator has found

resistance at the historical junction between bull and bear

markets. Bitcoin aSOPR Fails Retest Of The “Value=1” Line As

pointed out by an analyst in a CryptoQuant post, the BTC aSOPR has

been rejected from the breakeven mark recently. The “Spent Output

Profit Ratio” (or SOPR in short) is an indicator that tells us

whether Bitcoin investors are selling at a loss or at a profit

right now. The metric works by looking at the on-chain history of

each coin being sold to see what price it was last moved at. If the

previous selling price of any coin was less than the current value

of BTC, then that particular coin has just been sold at a profit.

While if it’s otherwise, then the coin realized some loss. Related

Reading: Ethereum Investors Close 300k Long Positions on Bitfinex,

Rally To Stop Soon? A modified version of this indicator, the

“Adjusted SOPR” (aSOPR), excludes from its calculations all those

coins that were held for less than 1 hour before being sold. The

benefit of this modification is that it removes all noise from the

data that wouldn’t have had any significant implications on the

market. Now, here is a chart that shows the trend in the Bitcoin

aSOPR over the past coupe of years: Looks like the value of the

metric has been below one in recent days | Source: CryptoQuant When

the value of the aSOPR is greater than one, it means the average

investor is selling at a profit right now. On the other hand, the

metric being lesser than the threshold suggests the overall market

is moving coins at a loss. As you can see in the above graph, the

analyst has marked the relevant zones of trend for the Bitcoin

aSOPR. It seems like during bull markets, the “1” value of the

metric has acted as support, while during bears it has provided

resistance. Related Reading: Glassnode: Bitcoin Long-Term Holders

Have Shifted To Distribution Recently The significance of this line

is that its the breakeven mark for investors as at this value

holders are just breaking even on their selling. During bulls,

investors think of this line as a good buying opportunity, but in

bears they see it as an ideal selling point. Recently, the aSOPR

attempted a retest of this mark, however, it was rejected back into

the loss zone. If the historical pattern is anything to go by, this

current trend would mean Bitcoin is still stuck in a bear market.

BTC Price At the time of writing, Bitcoin’s price floats around

$24.5k, up 7% in the past week. The value of the crypto has surged

up during the past day | Source: BTCUSD on TradingView Featured

image from Peter Neumann on Unsplash.com, charts from

TradingView.com, CryptoQuant.com

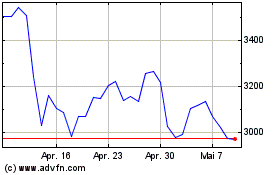

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024