Ripple Labs Future Under Trump: CEO Brad Garlinghouse Outlines Vision For 2025

21 November 2024 - 7:30AM

NEWSBTC

In a recent interview with FOX Business, Brad Garlinghouse, CEO of

Ripple Labs, shared insights on the so-called “Trump trade”

impacting crypto prices, as evidenced by Bitcoin’s recent streak of

consecutive all-time highs over the past 48 hours.

Garlinghouse also discussed how Ripple, and the broader digital

asset industry, fit into the upcoming regulatory landscape expected

under President-elect Donald Trump in the coming year. Ripple CEO

Optimistic About Trump’s Pro-Crypto Stance Garlinghouse emphasized

that since its inception, Ripple has focused on addressing the

inefficiencies of traditional cross-border payments, which he

described as “slow and expensive.” By utilizing XRP, the company

aims to streamline these transactions, making them faster and more

cost-effective. However, the CEO criticized the Biden

administration’s stance on digital assets, referring to it as an

“unlawful war” against the industry. He expressed optimism that

with Trump’s pro-crypto approach, the landscape may be

transforming. Related Reading: BlackRock Bitcoin ETF Options Surge:

December 20 Call Signals BTC Price Target Of $180,000 When asked

about the potential for increased revenue opportunities in the US

under the upcoming regulatory changes, Garlinghouse explained that

the US Securities and Exchange Commission’s (SEC) lawsuit against

XRP had effectively “frozen” Ripple’s market potential in the

country. Currently, 95% of Ripple’s customer base is located

outside the US, with Garlinghouse pointing out that the company

cannot fully realize growth in a market where regulatory clarity is

lacking. Garlinghouse observed that while the cryptocurrency

industry is flourishing in countries like China, Japan, the UK, and

Switzerland, the US has lagged behind in embracing digital

assets. Ripple’s CEO expressed hope that the anticipated

deregulation under Trump would lead to clearer guidelines, allowing

agencies like the SEC and the Commodity Futures Trading Commission

(CFTC) to play a constructive role in shaping the industry.

Garlinghosue criticized the existing regulatory framework,

particularly the application of the Howey Test, which he believes

fails to adequately address the unique characteristics of the

crypto sector. He also underscored the need for updated regulations

that reflect the realities of an industry that has developed

significantly over the past decade. US As Digital Asset Hub In

Coming Years During the interview, FOX Business highlighted

comments from Coinbase’s Chief Policy Officer, Faryar Shirzad,

regarding the private meeting between Trump and Brian Armstrong,

CEO of Coinbase. Shirzad noted that Trump has expressed a

willingness to engage with the crypto industry, fostering a vision

for the US to become the global leader in digital assets.

Garlinghouse echoed these sentiments, recognizing Coinbase’s

influential role in advocating for the cryptocurrency agenda during

the election campaign. Related Reading: Bitcoin Rally Driven By

U.S. Coinbase Investors – Top Analyst Shares Metrics As speculation

mounts regarding potential candidates for the SEC chair position

under Trump—names like Dan Gallagher, Teresa Goody, and

Commissioner Mark Uyeda have surfaced—Garlinghouse emphasized the

importance of the new chair working collaboratively with Congress

to address regulatory gaps that contribute to confusion in the

market. Garlinghouse concluded with an optimistic outlook, stating

that he believes a new era for cryptocurrency is on the horizon in

the US. He envisions the country becoming a central hub for digital

assets and blockchain technology over the next five to ten years.

At the time of writing, XRP is trading at $1.10, marking a massive

104% surge in just two weeks since Trump’s election victory.

However, the token is still trading 67% below its all-time high of

$3,040, which it reached nearly seven years ago. Featured image

from DALL-E, chart from TradingView.com

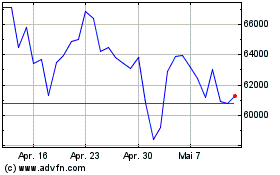

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024