Ethereum’s Potential To Outshine Bitcoin: 7 Predictions For The 2025 Crypto Landscape

15 Januar 2025 - 5:30AM

NEWSBTC

In a recent social media post, market expert VirtualBacon shared

seven key predictions that could shape the cryptocurrency landscape

in 2025. Central to these predictions is the assertion that

Ethereum (ETH) may outshine Bitcoin (BTC) in terms of performance,

even as Bitcoin continues to hold a dominant position in the

market. Expert Predicts A New Crypto Bull Run In 2025 With

Bitcoin approaching the significant $100,000 mark once again after

a sharp correction over the past weeks and altcoin exchange-traded

funds (ETFs) on the horizon, the expert believes that the current

crypto bull run is only just beginning. Related Reading: XRP Price

Dominates: Outperforming Bitcoin With Confidence VirtualBacon poses

an intriguing question: Is 2025 the year when cryptocurrencies

break all previous records? The anticipation surrounding potential

market movements is palpable, especially given the bullish

sentiment fueled by Bitcoin’s recent price surge and the impending

introduction of altcoin ETFs. The expert reflects on the

previous year’s predictions, noting that Bitcoin reached $80,000,

crypto gaming gained traction, and Trump’s return to the political

scene significantly boosted market momentum. Looking ahead,

VirtualBacon predicts a longer, slower bull cycle extending

potentially into the fourth quarter of 2025. This forecast is

underpinned by the Federal Reserve’s cautious approach to

liquidity, which is expected to mitigate the risks of sudden market

crashes. The likelihood of a recession is projected to drop

to 33%, signaling a period of relative stability. Bitcoin’s

dominance is anticipated to rise, largely driven by institutional

demand, with spot ETFs already holding approximately 5% of

Bitcoin’s supply. While altcoins may lag initially,

VirtualBacon asserts that this “slower cycle” is seen as a

“blessing,” providing ample time for growth and maturation within

the market. Will Ethereum Outperform Bitcoin This Year? One of the

most consequential factors influencing the crypto market in 2025 is

anticipated massive liquidity injections. The US debt crisis is

likely to compel the Federal Reserve to implement quantitative

easing, thereby expanding its balance sheet and flooding markets

with cash. Additionally, a revaluation of gold—potentially

adjusting from $42 per ounce to around $2,000—could create even

more liquidity in the system. Such conditions typically lead to

inflation, which is historically associated with rising asset

prices, suggesting that cryptocurrencies may thrive in this

environment. However, despite these optimistic predictions,

VirtualBacon casts doubt on the likelihood of a US Bitcoin Reserve

Act passing in 2025. The proposal for the US Treasury to acquire

one million Bitcoin over five years faces significant hurdles,

particularly in securing taxpayer support for such a massive

expenditure. Related Reading: Cardano (ADA) Under Pressure:

Struggles to Reclaim Lost Ground On the regulatory front,

VirtualBacon anticipates that pro-crypto legislation may favor

altcoins, particularly through the proposed Fit for the 21st

Century Act. This legislation could provide a clearer

regulatory framework for cryptocurrencies, designating

decentralized tokens like Layer-1 blockchains as commodities under

the Commodity Futures Trading Commission (CFTC), while less

decentralized assets would fall under the Securities and Exchange

Commission (SEC). With Paul Atkins, a pro-crypto advocate,

potentially leading the SEC, major cryptocurrencies may flourish,

although smaller startups could face challenges navigating the new

landscape, according to the expert. The prediction of altcoin ETFs

gaining traction is another exciting prospect for 2025.

VirtualBacon expects ETFs for cryptocurrencies such as Litecoin,

HBAR, XRP, and Solana to emerge, driven by their unique statuses

and pending legal resolutions. With Ethereum ETFs already

drawing institutional interest, a similar pattern could unfold for

these altcoins, further accelerating institutional adoption in the

crypto market. Perhaps the most captivating prediction is that

Ethereum could outperform Bitcoin, potentially doubling Bitcoin’s

returns in 2025. With institutional investors increasingly favoring

ETH over BTC in recent months, along with historical performance

trends favoring Ethereum in the first half of the year, the stage

is set for significant growth in the Ethereum ecosystem.

VirtualBacon estimates end-of-year prices of approximately $200,000

for Bitcoin and $14,000 for Ethereum, presenting ambitious yet

“potentially attainable targets” given the expected influx of

liquidity and institutional support. As of this writing, BTC is

trading at $95,840, recording gains of over 4% in the 24-hour time

frame. Similarly, ETH is trading at $3,200, recording even higher

gains of nearly 6% in the same time frame. Featured image from

DALL-E, chart from TradingView.com

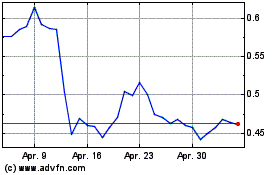

Cardano (COIN:ADAUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Cardano (COIN:ADAUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025