TIDMVOY

RNS Number : 2405W

Voyager Life PLC

17 August 2022

17 August 2022

Voyager Life plc

("Voyager" or the "Company")

Final results & Notice of AGM

Voyager, the health and wellness company supplying high-quality

Cannabidiol (CBD), hemp seed oil and hemp-related products, is

pleased to provide the Company's audited results for the period

ended 31 March 2022.

Highlights include:

-- Revenue of GBP178,000

-- Cash of GBP1.43 million as at 31 March 2022 (cash of GBP1.17 million as at 12 August 2022)

-- Total assets of GBP2.3 million and net assets of GBP1.6 million

-- Four revenue lines (online, own stores, third party stores, private label & white label)

-- Two brands (Voyager and Ascend Skincare)

-- Manufacturing division established: VoyagerCann

-- 53 formulated products (one of the widest CBD ranges in the

UK) and, in its own stores, 270 SKUs (stock-keeping units)

-- Hemp Shampoo for Pets awarded best pet grooming product at PATS Sandown

Voyager is also pleased to confirm that on 16 August 2022 the

Company's annual report and accounts for the year ended 31 March

2022 and notice of Annual General Meeting ("AGM") were posted to

Voyager's shareholders. The AGM will be held at 11.00 am on Friday

9 September 2022, at the Company's offices at Tay House, Riverview

Business Park, Friarton Road, Perth, Perthshire PH2 8DF.

Copies of the annual report and accounts and notice of AGM are

available on the Company's website: https://www.voyagerlife.uk

Nick Tulloch, Chief Executive Officer and Founder of Voyager,

said: "In a little over 12 months since our listing on Aquis, we

have one of the largest product ranges amongst UK CBD companies,

opened three stores and established our reputation in the industry

as a trusted and reliable partner.

"As I have said before, it is our financial performance on which

we expect to be judged. In spite of our rapid expansion, we have

kept a tight rein on costs as revenue has developed considerably

over the year. We are still near the beginning of our story but we

have a strong balance sheet, a growing distribution capability

across a number of different categories and a wide product range to

attract different customers. Our business is advancing all the time

and only last week we saw record takings from our retail stores in

St Andrews, Edinburgh and Dundee.

"CBD remains a competitive industry but our several

differentiating factors - our own stores, our extensive product

range, our manufacturing capability, our well-funded business -

increasingly set us apart. Prospective customers are now beginning

to seek us out, rather than the other way around. We are building a

brand and that will take time but our foundations of integrity and

impeccable service are resonating with customers.

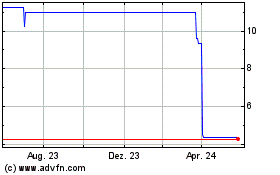

"Our share price remains a frustration - at current levels we

trade not far from our cash level and at a discount to our net

assets - but our morale is high and we are confident that the

successes we are seeing day to day in our business will in time

translate into recognition by investors."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

S

Enquiries:

Voyager

Nick Tulloch - nick@voyagerlife.uk / 01738 317 693

http://voyagerlife.uk

Cairn Financial Advisers LLP (AQSE Corporate Adviser)

Ludovico Lazzaretti or Liam Murray +44 (0) 20 72130 880

Notes to Editors:

About Voyager

Voyager was founded in 2020 and is based in Perth, Scotland. The

Company's primary objective is the formulation and supply of high

quality CBD and hemp seed oil products although it also produces

several other complementary products, the majority of which are

manufactured from the hemp plant. Its product categories include a

pet range which has rapidly developed into one of the Company's

best sellers. The Company sells online, through third party stores

and in its own stores which are located in St Andrews, Edinburgh

and Dundee. The Company has two principal retail brands: Voyager,

focused on health & wellness, and Ascend Skincare, our beauty

range. Voyager products are currently available from Cornwall to

Shetland in over 100 online and brick-and-mortar outlets.

The Company's philosophy of plant-based health and wellness is

embodied in its mission statement and hashtag of "Choose you". With

an experienced team and a product line created in line with the

UK's regulatory regime, Voyager aims to become the trusted brand in

this increasingly popular health and wellness space.

Through Voyager's bespoke skincare product creation and

development division , voyagerCann , the Company also offers a full

turnkey service to other CBD and cosmetics companies assisting them

in developing and launching new products.

Website and social media links:

Voyager:

https://voyagercbd.com/

https://www.instagram.com/voyagercbd/

https://twitter.com/voyagercbd

https://www.linkedin.com/company/voyager-cbd/

https://www.facebook.com/voyagercbd/

voyagerCann:

https://voyagercann.com/

https://www.instagram.com/voyagercann/

https://twitter.com/voyagercann/

https://www.linkedin.com/company/voyagercann/

https://www.facebook.com/voyagercann/

Forward Looking Statements

These forward-looking statements are not historical facts but

rather are based on the Company's current expectations, estimates,

and projections about its industry; its beliefs; and assumptions.

Words such as 'anticipates,' 'expects,' 'intends,' 'plans,'

'believes,' 'seeks,' 'estimates,' and similar expressions are

intended to identify forward-looking statements. These statements

are not a guarantee of future performance and are subject to known

and unknown risks, uncertainties, and other factors, some of which

are beyond the Company's control, are difficult to predict, and

could cause actual results to differ materially from those

expressed or forecasted in the forward-looking statements. The

Company cautions security holders and prospective security holders

not to place undue reliance on these forward-looking statements,

which reflect the view of the Company only as of the date of this

announcement. The forward-looking statements made in this

announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

CHAIRMAN'S STATEMENT

It is a pleasure to present Voyager's first annual report and

accounts, covering the period from our incorporation in November

2020 to our financial year end at 31 March 2022. We can reflect on

those 17 months, and the time since, with a great sense of

achievement. Today we employ a team of 25 based in four separate

locations. We have over 50 formulated products between our Voyager

and Ascend Skincare brands as well as many more formulations

available through VoyagerCann, our manufacturing division.

Voyager's products are available at numerous locations, online and

bricks-and-mortar, across the United Kingdom and all of this has

been realised in less than two years of trading and, we believe, at

a fraction of the budget that many of our competitors have

spent.

The first part of the period under review saw four fundraisings

as we took Voyager from a standing start to one of the highest

profile CBD companies in the UK. Most notable of these was raising

GBP874,000 in four days on Seedrs, setting the tone for a number of

other CBD crowdfunding campaigns in the following 12 months, and

completing our IPO on the Aquis Stock Exchange Growth Market just

four months later. The second half of the period was far lighter on

corporate actions with just one event - the acquisition of the

trade and assets of a CBD manufacturing business from liquidation.

But if ever proof was needed of quality trumping quantity, this

acquisition, since renamed VoyagerCann, completed for just

GBP9,000, within months provided a springboard to a new division

for the Company and an elevated position within our industry. Along

with taking our own product development in house, we now

manufacture for several other well-known CBD companies.

Away from corporate activity, other notable features of the

period were our ongoing product development giving us one of the

widest ranges of UK-based CBD companies, opening three stores in

Scotland, re-branding during the summer of 2021 and subsequently

overhauling our websites in the autumn. I said at the time of our

interim results last year that customers like our brand and are

impressed with our products. We excel in face-to-face sales and

this remains the case in 2022. The team have been busy with trade

fairs, attending nine already this year, and we are confident that

increasing the size of our sales team will deliver results.

We have always said that we will hold ourselves to the highest

standards of corporate governance and customer service and during

our rapid growth phase we have never wavered from those core

principles. In Nikki Cooper and Jill Overland, our board of

directors is not only gender balanced but also sufficiently

independent of the business. Their sage advice and unerring support

of all we do has been a bedrock on which the Company has developed.

In Nick Tulloch, we have a founder and chief executive who

continues to defy conventional wisdom on how much can be done in a

day's work, driving the Company forward on multiple fronts.

In spite of all this activity, we have remained true to our

strategy of conservative management of our business and finances.

Our total assets stood at GBP2.3 million at 31 March 2022 and,

importantly, as at 12 August 2022 our cash balances are GBP1.17

million giving us ample runway to develop Voyager into a successful

business.

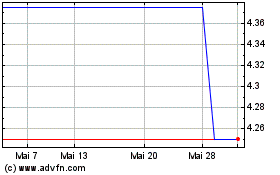

Two disappointments during the period have been the performance

of our share price along with the rigid stance taken by the FSA on

novel foods. In our view, Voyager's business is on track and, in

many respects, the platform we have established for our business

exceeds our expectations as expressed in our Admission Document of

last year. Nevertheless the CBD sector, particularly in the listed

company category, has failed to deliver for investors, perhaps due

to unrealistic business plans and, in some cases, self-inflicted

problems contributing to significant share price declines

elsewhere. Voyager, also not helped by persistent low liquidity on

Aquis, has fallen with other companies in the sector in share price

terms.

However, we continue to believe that our strong balance sheet

and professional management sets us apart from many and,

furthermore, collaboration with our peers represents the fastest

route to success in this rapidly growing industry. To that end, we

regularly examine opportunities in the sector, both for corporate

activity or commercial cooperation, and we have made a small number

of proposals to other businesses. In line with our wider management

philosophy, we will not be drawn into paying substantial premiums

or taking unnecessary risk. Furthermore, as our fundamental

objective is mutual cooperation, only an amicable solution where a

prospective partner welcomes our involvement is acceptable to us.

We believe that UK CBD companies will continue to struggle with

regulation, high levels of competition and high cash burn coupled

with a waning investor appetite. Voyager's business and financial

position is strong, so we are in no hurry but we will continue to

examine consolidation and partnership opportunities.

On 31 March 2022, the Food Standards Agency ("FSA") published

its initial list of ingestible CBD products permitted for sale in

England and Wales until such time as they are either authorised or

rejected. Currently, no CBD products have been authorised for sale

by the FSA with most of the list still classified as "awaiting

evidence". At present, Voyager's ingestible CBD products are not

included on the list although, from what the Directors understand

based on our interactions with the FSA, the only impediment to the

Company's inclusion is that the FSA has only assessed brands that

were on the market on 13 February 2020, being the date of the FSA's

original announcement of its policy on CBD products and prior to

Voyager's incorporation. The Directors are aware of other products

currently on the FSA's list that were apparently launched after

that date and so should have been excluded as well as other brands

on the list who have changed their ownership, formulations or

sources of ingredients.

We have made representations to the FSA that the current policy

is inconsistent and does not achieve what it originally set out to

do, namely help consumers identify which products are safe to use.

Put simply, how can it be right that changing a formulation or even

the country from which CBD is obtained is considered acceptable but

applying a different label is somehow inappropriate. Voyager's

external manufacturing partner is on the list with several products

and ingredients that match our formulations so we remain confident

that the products we have been selling will, in time, be fully

approved at which point Voyager-labelled products can be sold

without restriction. In the meantime, we continue to lobby the FSA

for a fairer and more consistent approach to the CBD industry.

The majority of sales of ingestible CBD products that we make

are transacted out of Scotland and so not within the FSA's

authority. Nevertheless our strategy is to expand our business both

across the UK and internationally and the direction of travel of

regulators around the world is to define criteria under which CBD

should be sold, a concept that we whole-heartedly support. We will

therefore continue to work proactively with regulators and our

manufacturing partners to ensure all Voyager products meet the

required standards of safety, transparency and quality.

Despite the current frustrations with the novel foods process,

it is worth noting that ingestible CBD products form less than 20%

of the CBD-based products currently sold by Voyager and,

furthermore, as we continue to expand our skincare and topical

ranges, this figure will fall further.

We enter our second full year of trading in a strong position

and with confidence levels high. We are in a competitive industry

but also an industry that values integrity and transparency. We

know there is much work to do to realise our ambitions but I could

not be more pleased with how our voyage is progressing. As ever,

all of the Voyager board welcome shareholder interaction and

feedback and we hope to see as many of our investors as possible at

our inaugural AGM on 9 September 2022. Notice for the meeting is

set out in our annual report.

Eric Boyle

Non-Executive Chairman

16 August 2022

CEO'S REVIEW

From the outset, Voyager's strategy has been to become a

recognised CBD and plant-based health & wellness brand.

Achieving that means that we must develop revenues across multiple

products and sales' channels and I am pleased to report that, by

the end of the period under review, we had four sources of

income:

-- Online sales - comprising our own website along with third

party sites and online marketplaces

-- Sales through third party stores

-- Sales through our own stores in St Andrews, Edinburgh and Dundee

-- White label and private label skincare manufacturing through our VoyagerCann division

A little over a year ago, Voyager comprised solely online sales.

Today these are eclipsed by other parts of our business and notably

our own stores. We do not profess to be counter-cyclical attempting

to reverse the direction of retail traffic from the internet back

to the high street but, instead, we recognise that our products are

inherently personal in nature. Not only is taste, texture and scent

a key part of a customer's decision in what to buy but the reasons

for adding CBD, or other plant-based therapies, into a person's

health & wellness routine is for many of us a step into the

unknown. Voyager's stores are designed as knowledge centres with

our sales staff on hand to guide and assist customers in their

decision making. Likewise, when we supply to other businesses, we

provide point of sale assistance, staff training and detailed

descriptions of our products. It has been of no surprise to us that

bricks-and-mortar sales have exceeded our online revenue. The week

just finished has been our most successful to date with takings of

GBP7,000 in our own stores.

Nevertheless internet sales, and particularly those on one of

our own websites, remain our highest margin returns and, with our

product range now more substantial than many of our competitors and

growing recognition of our brand, we are continuing to invest in

this part of our business.

Key events during the period and subsequently

Date Event

November 2020

* Voyager incorporated

* Seed funding of GBP500,000

* First employee joins and office opens

January 2021

* Second employee joins

February 2021

* Voyager becomes the first multi-product CBD company

to complete a crowdfunding campaign in the UK,

raising GBP874,000 in less than a week

March 2021

* Headcount doubles

April 2021

* Voyager moves to a larger office

* Private placement of GBP741,000 completed

May 2021

* First sales to trade customers made

* Lease signed on St Andrews store

June 2021

* Nikki Cooper and Jill Overland join the board

* IPO on Aquis raising a further GBP400,000

July 2021

* First store opens (St Andrews)

August 2021

* Re-branding of Voyager complete

September 2021

* CBD skincare line launched

* Pet range also expands with the launch of a hemp

shampoo and odour neutraliser

October 2021

* Re-launch of VoyagerCBD.com

* Second store opens (Edinburgh)

November 2021

* Third store opens (Dundee)

December 2021

* Acquisition of the trade and assets of Cannafull

February 2022

* Re-launch of Cannafull as VoyagerCann, providing

white label and private label skincare for other CBD

companies

* Voyager commences manufacturing its own topical and

skincare products

* Re-launch of Ascend Skincare, our multi-award winning

beauty brand

March 2022

* Hemp shampoo for pets named as best new grooming

product at PATS Sandown

May 2022

* Voyager moves to new premises in Perth

June 2022

* Voyager becomes the only UK CBD company to offer a

refillable service for CBD products

July 2022

* Voyager's range of formulated products exceeds 50

August 2022

* Ascend Skincare launches two new products - a

cleansing butter and a moisturiser

* Best week of sales to date at Voyager's three stores

Since incorporation, the breakdown of our revenue across our

three business lines has been well balanced with online sales

accounting for 21%, trade customers 24% and our own stores, as we

would expect at this stage, leading with 55%. Going forward, we

expect the Company's primary growth driver to be trade customers,

both those for finished products and those seeking white label or

private label products manufactured by our VoyagerCann

division.

Our distribution reach has grown considerably in the past twelve

months. In the early part of our development we kept a record of

the number of stores and websites stocking Voyager products. As we

have grown, this metric has become less relevant - stores

inevitably vary considerably by size and order frequency and,

through our distributor partnerships, we are now not necessarily

aware of every location that Voyager products are available for

sale. Instead, we track revenue and the quality of communication

with our trade partners. Importantly, for a young company, Voyager

has developed several partnerships with well-known names in the

retail sector including CLF, Thompson and Morgan, the Range and

Wayfair which highlight the mainstream appeal of our brand and

product range.

The growth of our distribution capabilities has been supported

by the development of an extensive product range of 53 formulated

products and a total of 270 SKUs (stock keeping unit) in our

stores. Not only does this improve the shopping experience for its

customers but it also enables the Company to stock products that

are exclusive to its stores. We have also been pleased to welcome

guest brands to our stores. As well as increasing the element of

choice for customers, the Board's view is that, during this early

growth phase of the CBD industry, companies such as Voyager will

prosper by collaborating with our peers and we continue to keep our

door open to like-minded management teams to work together on joint

initiatives.

At present, guest brands in our stores are Nooro, Zenbears,

Herbotany Health, Hey Jane and Cellular Goods. We have also

collaborated online with Rebel Wines and expect to welcome a sixth

guest brand soon.

Despite the rapid growth of Voyager, we continue to keep a tight

rein on costs. This spring we moved from a serviced office to a

1,600 square foot premises, still located in Perth, which now

comprises our head office, product storage and manufacturing

facility.

A feature of the first half of the 2022 calendar year has been

the re-emergence of trade fairs across the UK. As with many other

new brands selling personal products, we see far greater success in

sales when we are face-to-face with buyers and, in this regard,

trade buyers are no different to retail customers. Consequently, we

have invested heavily in trade fair attendance this year, attending

nine so far this year in different locations around the UK and with

a further four booked. To an extent there has been some

experimentation to determine events that are most successful for us

but the pattern that is emerging - and that we will follow going

forward - is that beauty and pet events represent our biggest

successes for Voyager whilst white label events suit VoyagerCann.

The likelihood in 2023 is that we will attend fewer events in the

UK but will divert that time and budget to a limited number of

events in Europe.

Voyager has continued to grow since the period end and now

employs 25 people of which 11 are based in our head office in Perth

and the remainder work in our stores. We have regularly applied

for, and received, employer support from central and local

governments and ten members of the team have been funded by grants.

With Covid pandemic arrangements coming to an end, certain aspects

of this funding are no longer available but the Company continues

to make use of government support where available. In late March,

we applied for and received GBP2,126 through the Digital Boost

grant which covered 50 per cent. of the cost of certain IT

expenditure. We were also exempted from non-domestic rates during

the period at any of our premises as we benefited from retail and

hospitality relief.

As I stated at the time of our interim results, we have

experienced challenges around the availability of employees in

common with many other UK companies. In particular, it has taken

longer to fill our quota of Kickstart and other employer incentives

than we hoped. Our expansion may well have been faster had there

been greater availability of labour. However, in the context of the

Company overall, this has for the most part been no more than an

inconvenience and, more recently, we have seen a marked increase in

applicants for roles that we advertise suggesting that the labour

market is loosening up to a degree.

Elsewhere we are seeing rising costs within our business model.

This is most notable in utility services with electricity and gas

charges at all of our premises increasing during the early months

of 2022. As is our management style, we have examined ways to

contain these costs, both through more efficient appliances and

instilling a culture of turning off what isn't being used but it

seems inevitable that utility charges will rise for us this

year.

Worldwide cost increases also impacted our purchases of raw

materials. Items such as glass containers, cardboard packaging and

essential oils are all more expensive than they were a year ago.

VoyagerCann is able to pass these costs onto our customers and, for

Voyager and Ascend Skincare, these costs generally remain a small

part of the overall product and, at present, are not influencing

our business to any material extent. Nevertheless we are mindful of

maintaining margins and so we have sought to offset increases by

buying in bulk or sourcing certain materials from overseas. In that

regard, a more positive development is that logistics delays that

we experienced in the latter part of 2021 have for the most part

returned to normal. Furthermore, as predicted at the time of our

interim results, the most expensive ingredient in our products,

namely wholesale CBD, continues to fall in line with hemp

prices.

During the summer and autumn of 2021 we purchased two Fiat

Fiorino vans. Both vans are decorated with Voyager's logo and

contact details and so provide mobile advertising as well as

cost-effective transport for the team. Based on their combined

mileage to date, we estimate that we have already saved around

GBP5,000 compared with the alternative of paying staff a mileage

allowance to use their own vehicles. I said at the time of our

interim results that, based on our projected rate of use, pay back

on each van could be less than two years. Rising fuel prices may

marginally extend that period but, nevertheless, the vans have been

an excellent investment for the Company and, with the robust price

of second hand commercial vehicles across the UK, a valuable

asset.

In common with many other businesses, Voyager started as one

person with an idea - it existed initially on little more than my

enthusiasm and a basic website. I am grateful to our chairman, Eric

Boyle, and the original founding directors, Paul Mendell and Kyle

Swingle, who saw the opportunity and provided the support and

encouragement to turn that idea into a company. It is just two

years since VoyagerCBD.com was registered as a domain but the

company we have created exceeds all of the goals we envisioned at

the outset.

I have said before that we will not be distracted by the vanity

of opening stores and launching products. The unerring focus of the

Voyager team is to build the profile of our brands and increase our

revenue. In our extensive product range, growing network of

distribution contracts, own stores, and manufacturing capability,

we have given ourselves a strong platform from which to grow and we

have every reason to be optimistic about the development of the

Company.

Outlook

Objectives in the coming months include:

-- Targeted campaigns through social media and affiliate marketing to further boost online sales.

-- Continued growth of the Company's network of trade partners

through attendance at trade fairs and conferences and growing the

sales team.

-- Ongoing development of our own stores through local events,

the growing product range and the introduction of guest brands.

-- Establishing VoyagerCann as a trusted manufacturing partner for the CBD and hemp industry.

The Directors recognise that, although growing strongly, the CBD

market in the UK and overseas remains highly competitive and,

furthermore, that the competition is not always on a level playing

field with several companies continuing to sell what the Directors

believe are sub-standard products and make unsubstantiated health

claims. The confusion caused by the delayed publication of the

FSA's list of CBD companies that it validated under the novel foods

regulations has created further challenges. However, it is for this

reason that the Directors remain confident in Voyager's strategy.

As the market continues to grow and customers become better

informed and more discerning, they believe that responsible and

trusted brands like Voyager will thrive in the long term.

Nick Tulloch

Chief Executive Officer

16 August 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Notes Period ended

31 March 2022

GBP'000

Revenue 3 178

Cost of sales 6 (99)

Gross profit 79

Administrative expenses 6 (797)

Other operating income 5 39

Operating loss (679)

Net finance expense 9 (16)

IPO associated costs (106)

Loss on ordinary activities before taxation (801)

Taxation on loss on ordinary activities 10 -

Total comprehensive loss for the period attributable to the equity holders (801)

---------------

Loss per share (basic and diluted) attributable to the equity holders (pence) 11 (9.0p)

---------------

The period to which this consolidate statement of comprehensive

income applies was the 17 month period from 12 November 2020 to 31

March 2022.

There was no other comprehensive income in the period. All

activities relate to continuing operations.

The accompanying notes form part of these financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Notes At 31 March 2022

GBP'000

NON-CURRENT ASSETS

Intangible assets 12 3

Tangible assets 13 57

Right-of-use assets 14 644

Trade and other receivables: falling due after one year 17 20

724

-----------------

CURRENT ASSETS

Inventory 16 145

Trade and other receivables: falling due within one year 17 24

Cash and cash equivalents 18 1,425

-----------------

1,594

-----------------

TOTAL ASSETS 2,318

-----------------

CURRENT LIABILITIES

Trade and other payables 19 (97)

NON-CURRENT LIABILITIES

Trade and other payables 20 (604)

TOTAL LIABILITIES (701)

-----------------

NET ASSETS 1,617

-----------------

EQUITY

Share capital 21 93

Share premium 22 1,508

Share based payments reserve 23 67

Retained loss (51)

TOTAL EQUITY 1,617

-----------------

Voyager Life plc is registered in Scotland with number

SC680788.

The financial statements were approved by the Board of Directors

on 16 August 2022 and signed on their behalf by:

Eric Boyle Nick Tulloch

The accompanying notes form part of these financial

statements

CONSOLIDATED AND COMPANY STATEMENT OF CHANGES IN EQUITY

Share capital Share Premium Share based Retained earnings Total equity

Payments Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at - - - - -

incorporation

Loss for the period - - - (801) (801)

Issue of shares 93 2,427 - - 2,520

Share issue costs - (138) - - (138)

Reserves transfer - (750) - 750 -

Shares based

remuneration - (31) 67 - 36

At 31 March 2022 93 1,508 67 51 1,617

The accompanying notes form part of these financial

statements.

The Company's only subsidiary (Voyager Life, LLC) did not trade

during the period and consequently there is no difference between

the Group's consolidated statement of changes in equity and the

Company statement of changes in equity.

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Share capital Amount subscribed for share capital at the

nominal value of GBP0.01 per ordinary share

Share premium Amount subscribed for share capital in excess

of nominal value, net of share issue costs

Share based Amounts recognised for share-based payment

payments reserve transactions including share options granted

to employees and other parties

Retained earnings Cumulative net gains and losses recognised

/ (loss) in the consolidated statement of comprehensive

income

CONSOLIDATED AND COMPANY CASHFLOW STATEMENT

Notes 2022

Cash flow from operating activities GBP'000

Loss for the period (801)

Adjustments for:

Depreciation charges - tangible fixed

assets 13/14 57

Finance expenses 9 16

Exchange rate balance -

Share based remuneration 23 67

Operating cashflow before working

capital movements (661)

Increase in inventories 16 (145)

Increase in trade and other receivables 17 (44)

Increase in trade and other payables 60

Net cash outflow from operating activities (790)

--------

Cashflows from investing activities

Purchase of tangible fixed assets 13 (67)

Purchase of intangible assets 12 (3)

Deposit paid for right-of-use asset 14 (65)

Net cash used in investing activities (135)

--------

Cashflows from financing activities

Repayment of lease liabilities (1)

Proceeds from issue of shares, net

of issue costs 21 2,351

Net cash generated by financing activities 2,350

--------

Net increase in cash and cash equivalents 1,425

Cash and cash equivalents at the

end of the period 18 1,425

--------

The accompanying notes form part of these financial

statements.

The Company's only subsidiary (Voyager Life, LLC) did not trade

during the period and consequently there is no difference between

the Group's consolidated cashflow statement and the Company

cashflow statement.

NOTES TO THE FINANCIAL STATEMENTS

1. GENERAL INFORMATION

1.1 Group

Voyager Life plc ("Voyager" or "the Company") and its subsidiary

(together "the Group") are primarily involved in the development

and retail of products for the health and wellness market. The

Company is a public limited company and is incorporated and

domiciled in Scotland. The Company was incorporated on 12 November

2020 with Company Registration Number SC680788 and its registered

office and principal place of business is Tay House, Riverview

Business Park, Friarton Road, Perth, PH2 8DF, United Kingdom.

1.2 Company income statement

The Company has taken advantage of Section 408 of the Companies

Act 2006 and has not included its own profit and loss account in

these financial statements. The loss for the financial period dealt

with in the accounts of the Company amounted to GBP801,000.

2. PRINCIPAL ACCOUNTING POLICIES

2.1 Basis of preparation

The Consolidated Financial Statements of the Group and Company

have been prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and regulations made under it. The Consolidated Financial

Statements have been prepared under the historical cost convention.

The principal accounting policies are set out below and have,

unless otherwise stated, been applied consistently for all periods

presented in these Consolidated Financial Statements.

The financial statements are prepared in pounds sterling and

amounts are rounded to the nearest thousand.

2.2 Basis of consolidation

The Group financial information incorporates the financial

information of the Company and its subsidiary undertaking, drawn up

to 31 March 2022.

The subsidiary included is as follows is as follows:

Entity name Country Registered Nature of % voting

of incorporation address business rights and

shares held

Voyager Life US 402 Orofino Non-trading 100% of common

LLC Dr, Castle stock

Rock, Colorado

CO 80108

Subsidiaries are entities over which the Company has control.

The Company controls an entity when the Company is exposed to, or

has rights to, variable returns from its involvement with the

entity and has the ability to affect those returns through its

power over the entity. Consolidation of a subsidiary begins when

the Company obtains control over the subsidiary and ceases when the

Company loses control of the subsidiary.

Investments in subsidiaries are accounted for at cost less

impairment.

Where necessary, adjustments are made to the financial

information of subsidiaries to bring accounting policies into line

with those used for reporting the operations of the Group. All

intra-group transactions, balances, income and expenses are

eliminated on consolidation.

2.3 Going concern

The financial statements have been prepared on a going concern

basis which assumes that the Company will continue in operational

existence for the foreseeable future.

The Company has been generating revenues from the sale of CBD

and other plant-based health & wellness products and this is

forecast to continue although, for the time being, revenues have

not proved sufficient to support all of its overheads. However, as

explained above, revenues have increased in quantum during the

period and, furthermore, the Company has continued to open up new

sources of revenue, particularly through new customer accounts.

This has continued following the period end.

The Company is currently financed through investment by its

shareholders and during the period the Company raised GBP2.5

million, before costs, from the issue of shares. The Company made a

loss for the period of GBP801,000 before taxation and foreign

exchange adjustments. Nonetheless, the Company held bank balances

of GBP1.425 million at the year end.

In assessing whether the going concern assumption is

appropriate, the Directors take into account all available

information for the foreseeable future, in particular for the

twelve months from the date of approval of the financial

statements. This information includes management prepared cash

flows forecasts, the Company's current cash balances and the

Company's existing and projected monthly running costs. The

Directors have a reasonable expectation that the Company have

adequate resources to continue in operational existence for the

foreseeable future. Thus, they continue to adopt the going concern

basis of accounting in preparing the financial statements.

2.4 Revenue recognition

Revenue is recognised at the fair value of the consideration

received and represents amounts receivable for goods provided in

the normal course of business net of sales incentives, discounts,

returns and VAT.

Revenue is recognised when the performance obligations have been

satisfied and the goods have been delivered to the customer. It is

the Company's policy to sell its products to the end customer with

a right of return within 30 days. Accumulated experience is used to

estimate such returns at the time of sale at a portfolio level

(expected value method). The number of products returned has been

small and it is highly probable that a significant reversal in

cumulative revenue recognised will not occur.

Sale of goods - trade customers

Sales to trade customers may be on the basis of delayed payment

terms. Invoices are generated at the time of order and goods are

typically despatched on the same day. Revenue from the sales of

goods is recognised when confirmation of delivery to the customer

has been received under the terms of the contract and when the

significant risks and rewards of ownership have been transferred to

the customer.

Sale of goods - retail

Sales are recognised when the goods have been sold to the

customer in-store and the performance obligations have been

satisfied, namely when the customer is in possession of the

products. Retail sales are usually paid in cash or by credit or

debit card. The recorded revenue is the gross amount of the sale

and the credit card fees are charged to administrative

expenses.

Sale of goods - online

Payment of the transaction price is due immediately when the

customer purchases the product and delivery is arranged in-house.

Revenue is recognised when the goods are dispatched and the

performance obligations have been satisfied. On-line sales are

typically paid for by credit or debit card. The recorded revenue is

the gross amount of the sale and the credit card fees are charged

to administrative expenses.

2.5 Foreign currency translation

a) Functional and presentation currency

Items included in the Historic Financial Information of the

Group's entities are measured using the currency of the primary

economic environment in which the entity operates (the 'functional

currency'). The functional currency of the Group is pounds

sterling. The Historic Financial Information is presented in pounds

sterling which is the Company's and Group's functional currency and

amounts are rounded to the nearest thousand.

b) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at period-end exchange rates

of monetary assets and liabilities denominated in foreign

currencies are recognised in the Consolidated Statement of

Comprehensive Income.

2.6 Employee benefits - defined contribution pension costs

The Company operates a defined contribution plan for its

employees. A defined contribution plan is a pension plan under

which the Company pays fixed contributions into a separate entity.

Once the contributions have been paid, the Company has no further

payment obligations.

The contributions are charged to the statement of comprehensive

income as they become payable in accordance with the rules of the

scheme. Differences between contributions payable in the year and

contributions actually paid are shown as either accruals or

prepayments in the statement of financial position.

2.7 Investment in subsidiaries

Investment in subsidiaries comprises shares in the subsidiaries

stated at cost less provisions for impairment.

2.8 Financial assets including trade and other receivables

Initial Recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Group when it arises or when

the Group becomes part of the contractual terms of the financial

instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

-- the asset is held within a business model whose objective is

to collect contractual cash flows; and

-- the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is derecognised, modified or impaired.

Derecognition

A financial asset is derecognised when:

-- the rights to receive cash flows from the asset have expired, or

-- the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b) has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

Impairment

The Company recognizes an allowance for expected credit losses

(ECLs) for all debt instruments not held at fair value through

profit or loss. ECLs are based on the difference between the

contractual cash flows due in accordance with the contract and all

the cash flows that the Company expects to receive, discounted at

an approximation of the original expected interest rate (EIR). The

expected cash flows will include cash flows from the sale of

collateral held or other credit enhancements that are integral to

the contractual terms.

ECLs are recognized in two stages. For credit exposures for

which there has not been a significant increase in credit risk

since initial recognition, ECLs are provided for credit losses that

result from default events that are possible within the next

12-months (a 12-month ECL). For those credit exposures for which

there has been a significant increase in credit risk since initial

recognition, a loss allowance is required for credit losses

expected over the remaining life of the exposure, irrespective of

the timing of the default (a lifetime ECL).

For trade receivables (not subject to provisional pricing) and

other receivables due in less than 12 months, the Company applies

the simplified approach in calculating ECLs, as permitted by IFRS

9. Therefore, the Company does not track changes in credit risk,

but instead, recognizes a loss allowance based on the financial

asset's lifetime ECL at each reporting date.

The Company considers a financial asset in default when

contractual payments are 90 days past due. However, in certain

cases, the Company may also consider a financial asset to be in

default when internal or external information indicates that the

Company is unlikely to receive the outstanding contractual amounts

in full before taking into account any credit enhancements held by

the Company. A financial asset is written off when there is no

reasonable expectation of recovering the contractual cash flows and

usually occurs when past due for more than one year and not subject

to enforcement activity.

At each reporting date, the Company assesses whether financial

assets carried at amortized cost are credit impaired.

A financial asset is credit-impaired when one or more events

that have a detrimental impact on the estimated future cash flows

of the financial asset have occurred.

2.9 Financial liabilities including trade and other payables

Financial liabilities measured at amortised cost using the

effective interest rate method include trade and other payables

that are short term in nature. Financial liabilities are

derecognised if the Company's obligations specified in the contract

expire or are discharged or cancelled.

Trade payables other payables are non-interest bearing and are

stated at amortised cost using the effective interest method.

2.10 Intangible assets

Identifiable intangible assets are recognised when the Company

controls the asset, it is probable that future economic benefits

attributed to the asset will flow to the Company and the cost of

the asset can be reliably measured.

Intangible assets with finite lives are stated at acquisition

cost less accumulated amortisation less any identified impairment.

The amortisation period and method are reviewed at least annually

and adjusted as appropriate.

Intangible assets comprise those acquired at the time of the

acquisition of the Cannafull brand, website and customer lists and

are being amortised on a straight-line basis over the expected

useful economic life of 3 years which has been deemed by the

Directors to be an appropriate period. Amortisation is charged to

administrative expenses.

2.11 Tangible fixed assets

Tangible fixed assets are measured at historical cost less

accumulative depreciation and any accumulative impairment losses.

Historical cost includes expenditure that is directly attributable

to bringing the assets to the location and condition necessary for

it to be capable of operating in the manner intended by

management.

Depreciation is provided on all tangible fixed assets at rates

calculated to write off the cost, less estimated residual value, of

each asset on a straight-line basis over its expected useful life,

as follows:

Fixtures, fittings and equipment 3-5 years

Motor vehicles 4 years

Right-of-use assets over the lease term

Useful economic lives and estimated residual values are reviewed

annually and adjusted as appropriate.

2.12 Impairment testing of intangible and tangible assets

At each balance sheet date, the Company assesses whether there

is any indication that the carrying value of any asset may be

impaired. If any such indication exists, the recoverable amount of

the asset is estimated in order to determine the extent of the

impairment loss (if any).

2.13 Leases

Leases are accounted for under IFRS 16. IFRS 16 distinguishes

leases and service contract on the basis of whether an identified

asset is controlled by a customer. A model where a right-of-use

asset and a corresponding liability are recognised for all leases

by lessees (i.e. all on balance sheet) except for short term leases

and leases of low value assets.

The right-of use asset is initially measured at cost and

subsequently measured at cost (subject to certain exceptions) less

accumulated depreciation and impairment losses, adjusted for any

remeasurement of the lease liability. The lease liability is

initially measured at the present value of the lease payments that

are not paid at that date. Subsequently the lease liability is

adjusted for interest and lease payments, as well as the impact of

lease modifications, amongst others.

2.14 Inventory

Inventory is measured at the lower of cost and estimated selling

price less costs to complete and sell. Cost is determined using the

first in first out (FIFO) method. The carrying amount of inventory

sold is recognised as an expense in the period in which the related

revenue is recognised and earned.

2.15 Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand,

that are readily convertible to a known amount of cash and are

subject to an insignificant risk of change in value.

2.16 Equity

Share capital is determined using the nominal value of shares

that have been issued.

The Share premium account includes any premiums received on the

initial issuing of the share capital. Any transaction costs

associated with the issuing of shares are deducted from the Share

premium account, net of any related income tax benefits.

Equity-settled share-based payments are credited to a

Share-based payment reserve as a component of equity until related

options or warrants are exercised.

Retained loss includes all current and prior period results as

disclosed in the income statement.

2.17 Share-based payments

During the period, the Company issued share options to employees

and share warrants to certain advisers as part of their fees.

Equity-settled share-based payments are measured at fair value

(excluding the effect of non market-based vesting conditions) at

the date of grant. The fair value so determined is expensed on a

straight-line basis over the vesting period, based on the Company's

estimate of the number of shares that will eventually vest and

adjusted for the effect of non market-based vesting conditions.

Fair value is measured using a Monte Carlo pricing model. The

key assumptions used in the model have been adjusted, based on

management's best estimate, for the effects of non-transferability,

exercise restrictions and behavioural considerations.

2.18 Taxation

The tax expense for the period comprises current tax. Tax is

recognised in the income statement, except to the extent that it

relates to items recognised directly in equity. In this case the

tax is also recognised directly in other comprehensive income or

directly in equity, respectively.

The current income tax charge is calculated on the basis of the

tax laws enacted or substantively enacted at the end of the

reporting period in the countries where the Group operates and

generates taxable income. Management periodically evaluates

positions taken in tax returns with respect to situations in which

applicable tax regulation is subject to interpretation. It

establishes provisions where appropriate on the basis of amounts

expected to be paid to the tax authorities.

Deferred tax represents the tax expected to be payable or

recoverable on the temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes

and the amounts used for taxation purposes. The Company has tax

losses which can be used to offset future profits. A deferred tax

asset is recognised only to the extent that it is probable that

future taxable profits will be available against which the asset

can be utilised. No deferred tax asset has been recognised in the

current period.

2.19 Research and development

The Company undertakes research and development activities with

the aim of formulating and developing new bespoke CBD and hemp

products. Research and development costs (principally staff costs

and ingredients) are expensed as incurred.

2.20 Government grants

Government grants are not recognised until there is reasonable

assurance that the Company will comply with the conditions attached

to them and that the grants will be received.

Government grants that are receivable as compensation for

expenses or losses already incurred or for the purpose of giving

immediate financial support with no future related costs are

recognised as other income in the profit and loss in the period in

which they become receivable.

2.21 Critical accounting judgements and key sources of estimation uncertainty

In the process of applying the entity's accounting policies,

management makes estimates and assumptions that have an effect on

the amounts recognised in the financial information. Although these

estimates are based on management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates. The key assumptions concerning the future, and other key

sources of estimation uncertainty at the balance sheet date, that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial period, are those relating to the valuation of share

based payments.

2.22 Standards, amendments and interpretations to existing

standards that are not yet effective and have not been early

adopted by the Group

During the financial year, the Group has adopted the following

new IFRSs (including amendments thereto) and IFRIC interpretations

that became effective for the first time.

Standard Effective date, annual

period beginning on

or after

COVID-19 - Related rent concessions 1 April 2021

(Amendment to IFRS16)

Amendments to IFRS 9, IAS 39 and IFRS 1 January 2021

17 - Interest Rate Benchmark Reform

(Phase 2)

Amendments to IFRS 3:Business Combinations 1 January 2022

-Reference to the Conceptual Framework

Amendments to IAS 16: Property, Plant 1 January 2022

and Equipment

Amendments to IAS 37: Provisions, Contingent 1 January 2022

Liabilities and Contingent Assets

Annual Improvements to IFRS Standards 1 January 2022

2018-2020 Cycle

Their adoption has not had any material impact on the

disclosures or amounts reported in the financial statements.

Standards issued but not yet effective:

At the date of authorisation of these financial statements, the

following standards and interpretations relevant to the Group and

which have not been applied in these financial statements, were in

issue but were not yet effective. In some cases these standards and

guidance have not been endorsed for use in the European Union.

Standard Effective date, annual

period beginning on

or after

Amendments to IAS 1 - Classification TBC

of liabilities as current or non-current

Amendments to IAS 1 and IFRS Practice TBC

Statement 2 - Disclosure of accounting

policies

Amendments to IAS 8 - Definition of TBC

accounting estimate

Amendments to IFRS 10 and IAS 28 - Postponed

Sale or contribution of assets between

an investor and its associate or joint

venture

Amendments to IAS 12: Income Taxes TBC

-Deferred Tax related to Assets and

Liabilities arising from a Single Transaction

The directors are evaluating the impact that these standards

will have on the financial statements of Group.

2.23 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating

decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as Nick Tulloch.

All operations and information are reviewed together so that at

present there is only one reportable operating segment.

3. REVENUE

Revenue arising from the sale of goods by type is analysed

as:

2022

GBP'000

Shop revenue 98

Trade sales 43

Own website and other sales 37

-------------------

Total revenue 178

-------------------

4. SEGMENT REPORTING

Operating segments are not reported on as there are no

determined segments. There is deemed to be only one segment being

the development and retail of the products for the health and

wellness market and as such the information presented to the Chief

Operating Decision Maker ("CODM") is the same as that set out in

the primary statements. All revenue has been generated in the UK

and is recognised at a point in time.

5. OTHER OPERATING INCOME 2022

GBP'000

Employment grants 33

Coronavirus business support grant 6

--------

39

--------

There are no unfulfilled conditions relating to the grant

schemes at 31 March 2022.

6. OPERATING EXPENSES BY NATURE 2022

GBP'000

Auditors Remuneration 28

Depreciation of tangible fixed assets 10

Depreciation of right-of-use assets 47

Share-based payments charge 36

Non-domestic rates 24

Non-domestic rates relief (24)

Foreign exchange losses 4

Short term operating lease costs 16

Wages and Salaries 420

Other operating costs 236

-------------------

797

-------------------

7. AUDITOR'S REMUNERATION

Fees payable in the period to PKF Littlejohn

LLP: 2022

GBP'000

Audit of the accounts of the parent

company 28

Other services - reporting accountant

for IPO and re-registration as a plc 32

60

-------------------

All work performed in relation to the "other services"

occurred prior to the Company's listing on the Aquis

Stock Exchange and prior to the engagement of PKF

Littlejohn LLP as auditors. During this period, the

Company was in a start-up phase and had minimal transactions.

8. STAFF NUMBERS AND COSTS

The average number of staff during the period, including

Directors, was 14.

The aggregate payroll costs of these persons were as

follows:

2022

GBP'000

Wages and salaries 420

Social security costs 29

Healthcare costs 1

Contributions to defined contribution

pension plans 10

460

Charge in respect of share-based

payments 36

496

----------------------------------

Directors' emoluments

The number of directors who received share options during the

period was 2.

There were no directors who exercised share options during the

period.

The directors' aggregate emoluments in respect of qualifying

services were:

Salary Pension Benefits Share based 2022

remuneration TOTAL

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- -------------- --------

Executive

Director:

N Tulloch** 67 7 1 23 98

-------- -------- --------- -------------- --------

67 7 1 23 98

-------- -------- --------- -------------- --------

Non-executive

Directors:

E Boyle* 34 - - 11 45

N Cooper*** 24 - - - 24

J Overland*** 24 - - - 24

-------- -------- --------- -------------- --------

82 - - 11 93

-------- -------- --------- -------------- --------

* Eric Boyle was appointed as Non-executive Chairman of the

Company pursuant to a letter of appointment dated 28 June 2021.

With effect from Admission to AQSE on 1 July 2021, Mr Boyle's

director's fee is GBP45,000 pa.

** Nick Tulloch was appointed as Chief Executive Officer of the

Company pursuant to a service agreement dated 28 June 2021. With

effect from Admission to AQSE on 1 July 2021, the basic salary

payable to Mr Tulloch is GBP90,000 per annum and in addition a

discretionary bonus in relation to each financial year which may be

payable in cash and/or shares. The Company is also required to make

a contribution equal to 10 per cent of Mr Tulloch's annual salary

into his personal pension and provide private medical insurance for

him and his family.

*** The Non-Executive Directors were both appointed on 8 June

2021, each with a salary of GBP30,000 per annum.

Key management

The Directors consider that key management personnel are the

Directors of Voyager Life plc.

9. NET FINANCE EXPENSES 2022

GBP'000

Net finance expenses comprise:

Finance charge on lease liabilities

for assets-in-use 16

-------------------

TAXATION

10. Recognised in the income statement 2022

GBP'000

Current tax -

Deferred tax -

Taxation charge/credit for the period -

--------------------

Loss on continuing operations before

tax (801)

--------------------

Tax using the UK corporation tax

rate of 19% (152)

Impact of costs disallowable for

tax purposes 45

Impact of temporary timing differences -

Impact of unrelieved tax losses -

carried forward

Taxation credit for the period 107

--------------------

The UK Government enacted changes to the UK tax rate

in 2020, resulting in the rate remaining at 19% (instead

of the previously intended reduction from 19% to 17%).

In the 2021 Budget, the UK Chancellor announced that

legislation would be proposed to increase the main rate

of corporation tax to 25% from 1 April 2023.

Tax has been calculated based on the rate of 19% which

was effective for the period. The taxation charge in

future periods will be affected by any changes to the

corporation tax rates in force in the countries in which

the Company operates.

At 31 March 2022, the Group had unutilised tax losses

of GBP107,000.

The deferred tax asset not provided for in the accounts

based on the estimated tax losses and the treatment

of temporary timing differences, is approximately GBP566,000.

11. LOSS PER SHARE

The calculation of the loss per share is based on the loss for

the financial period after taxation of GBP801,000 and on the

weighted average of ordinary shares in issue during the period.

The options outstanding at 31 March 2022 are considered to be

non-dilutive in that their conversion into ordinary shares would

not increase the net loss per share. Consequently, there is no

diluted loss per share to report for the period.

2022

Weighted average shares in issue 8,927,731

(Loss)/earnings (GBP'000) 801

(Loss)/earnings per share 9.0

12. INTANGIBLE ASSETS

Group and Company

Identifiable

assets

acquired

GBP'000

Cost

Additions 3

At 31 March 2022 3

------------------------

Amortisation

Charge for the -

period

At 31 March 2022 -

------------------------

Net book value

At 31 March 2022 3

------------------------

The intangible assets arose from the acquisition of the trade

and assets of Cannafull and Ascend Skincare in December 2021 and

primarily relate to the value of the brands, their websites and

social media platforms and customer lists. These are being

amortised over a period of 3 years.

13. TANGIBLE ASSETS

Group and Company Fixtures, Motor Total

fittings vehicles

and equipment

GBP'000 GBP'000 GBP'000

Cost

At incorporation - - -

Additions 45 22 67

At 31 March 2022 45 22 67

-------------------------- --------------------- -------------------

Depreciation

At incorporation - - -

Charge for the period (7) (3) (10)

At 31 March 2022 (7) (3) (10)

-------------------------- --------------------- -------------------

Net book value

At 31 March 2022 38 19 57

-------------------------- --------------------- -------------------

Certain fixed assets were acquired during the period by issue of

new ordinary shares to Fetlar Capital Limited (see note 28) with

the balance acquired for cash.

14. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES

The Company leases a number of properties for its retail

operations and has accounted for these arrangements under IFRS 16 -

Leases, which sets out the principles for recognition, measurement,

presentation and disclosure of leases.

The interest rates implicit in the leases of between 3% per

annum and 4% per annum have been applied. The leases are repayable

in monthly instalments. Each of the Company's leases for its three

retail premises is for an initial 10 year term and thereafter

extendable by agreement. The leases for its Dundee and St Andrews

premises contain break clauses at 3 years and 5 years respectively.

The Company makes assumptions in respect of rent review dates

within its internal planning and analysis.

The carrying amounts of the right of use assets recognised and

the movements during the period are shown below:

Group and Company Property

GBP'000

Cost

At incorporation -

Additions 691

At 31 March

2022 691

Depreciation

At incorporation -

Charge for the period (47)

At 31 March

2022 (47)

Net book

value

At 31 March

2022 644

Group and Company

GBP'000

Lease liabilities recognised

during the period 626

Interest 16

Payments (1)

Balance at 31 March 2022 641

The maturity of the leases outstanding is as follows:

Company and Group

GBP'000

Current < 1 year 37

Non-current 2 - 5 years 259

Non-current > 5 years 345

Total Non-current 604

Total Lease liability at 31

March 2022 641

15. INVESTMENT IN SUBSIDIARY

2022

Company GBP'000

Investment in subsidiary -

----------------------

Subsidiary Company:

As at 31 March 2022, the Company had one subsidiary, Voyager

Life LLC, of which it owned 100%. Voyager Life LLC was incorporated

in the State of Colorado in the USA. Voyager Life LLC did not trade

in the period other than to hold a bank account which was closed in

March 2022. Subsequent to the balance sheet date, Voyager Life LLC

has been dissolved.

16. INVENTORY

Company and Group 2022

GBP'000

Finished products and consumables 145

-------------------

The provision held at 31 March 2022 for slow moving stock is

GBPnil. There are no material differences between the balance sheet

value of inventory and their replacement cost.

17. TRADE & OTHER RECEIVABLES

Group and Company 2022

GBP'000

Amounts falling due within

one year

Trade receivables (Net of

Bad Debt provision) 5

Other receivables 2

Prepayments and accrued income 17

-------------------

24

Amounts falling due after

one year

Other receivables 20

44

-------------------

All amounts in trade receivables are due within 3 months. The

non-collection risk on trade receivables is reflected in the level

of allowance for non-recovery of GBP1,000.

Other receivables relate to rent deposits.

The Directors consider that the carrying amount of trade and

other receivables approximates to their fair value. Fair values

have been calculated by discounting cash flows at prevailing

interest rates. See also Note 27.

18. CASH & CASH EQUIVALENTS

Group and Company 2022

GBP'000

Cash at bank 1,425

-------------------

Cash at bank comprises of balances held in current bank

accounts. The carrying amount of these assets approximates to their

fair value.

19. TRADE & OTHER PAYABLES

AMOUNTS FALLING DUE WITHIN

ONE YEAR

Group and Company Note 2022

GBP'000

Trade payables (4)

Accruals (54)

Pensions payable (2)

Right of use liability 14 (37)

(97)

-------------------

Trade payables and accruals principally comprise amounts

outstanding for trade purchases and continuing costs. The Directors

consider that the carrying amount of trade and other payables

approximates to their fair value. Fair values have been calculated

by discounting cash flows at prevailing interest rates. See also

Note 27.

20. TRADE & OTHER

PAYABLES

AMOUNTS FALLING

DUE AFTER

ONE YEAR

Group and Company 2022

GBP'000

Non-current right

of use

liabilities

Later than 1 year and not

later than 5 years 259

More than 5 years 345

-------------------

604

-------------------

21. SHARE CAPITAL 31 March 2022

GBP'000

Allotted called up

and fully paid:

9,252,920 ordinary

GBP0.01 shares 93

----------------------------------------------

The Company has only one class of share. All ordinary shares

have equal voting rights and rank pari passu for the distribution

of dividends and repayment of capital. The following changes to the

issued share capital of the Company have taken place since the

Company was incorporated:

Number Par value

of shares

issued

GBP'000

At incorporation on 12 November 2020 100 -

30 November 2020 Issue of shares 947,955 10

4 April 2021 Issue of shares 333,300 3

4 April 2021 Issue of shares pursuant

to a 3 for 1 bonus issue 3,844,065 38

8 April 2021 Issue of shares pursuant

to crowdfunding raise 1,487,844 15

23 April 2021 Issue of shares pursuant

to private funding raise 1,950,000 20

30 June 2021 Issue of shares pursuant

to the Company's IPO 689,656 7

Total issued in the period 9,252,920 93

---------- -----------

Number of shares in issue at 31 March

2022 9,252,920 93

---------- -----------

On 12 November 2020, the issued share capital of the Company was

GBP1 divided into 100 Ordinary Shares. The following changes to the

issued share capital of the Company have taken place since the

Company was incorporated:

(i) on 30 November 2020, the Company issued 273,900 fully

paid-up Ordinary Shares to Nick Tulloch, Eric Boyle and other

founding members of the Company;

(ii) on 30 November 2020, the Company issued 385,555 Ordinary

Shares for cash at a subscription price of 70 pence per Ordinary

Share to certain founding directors of the Company;

(iii) on 30 November 2020, the Company issued 288,500 Ordinary

Shares for cash at a subscription price of 77 pence per Ordinary

Share;

(iv) on 4 April 2021, the Company issued 333,300 Ordinary Shares

for cash at a subscription price of 124 pence per Ordinary

Share;

(v) on 4 April 2021, the Company issued 3,844,065 Ordinary

Shares by way of a bonus issue of three new Ordinary Shares for

every one Ordinary Share held;

(vi) on 8 April 2021, and taking account of the effect of the

bonus issue referred to in subparagraph (v) above, the Company

issued 1,487,844 Ordinary Shares for cash at a subscription price

of 31 pence per Ordinary Share;

(vii) on 23 April 2021, and taking account of the effect of the

bonus issue referred to in subparagraph (v) above, the Company

issued 1,950,000 Ordinary Shares for cash at a subscription price

of 38 pence per Ordinary Share;

(viii) on 20 May 2021, the Company reduced its capital through

the reduction of its share premium account by GBP750,000. Such

reduction of capital did not, however, affect the number of shares

in the capital of the Company in issue; and

(ix) on 30 June 2021, the Company issued 689,686 Ordinary Shares

for cash at an issue price of 58 pence pursuant to the Company's

IPO.

At 31 March 2022 there were warrants and options outstanding

over 1,181,234 unissued ordinary shares. Details of the warrants

and options outstanding are as follows:

Granted Exercisable Exercisable Number Exercise

from until Outstanding price

(p)

Warrants

30 June 2021 Any time until 30 June 2024 34,474 38

30 June 2021 Any time until 30 June 2024 102,394 58

136,868

-------------

Options

28 June 2021 Any time until 28 June 2031 998,566 19

11 October

2021 Any time until 11 October 2031 45,800 22

1,044,366

-------------

Total 1,181,234

-------------

The Directors held the following options at the beginning and

end of the period. As explained further in note 23, these options

only vest if the Company's share price exceeds a hurdle of 70 - 82

pence.

Director Date Award At 31 March Exercise Earliest Latest

of award in the 2022 price date of date of

period (pence) exercise exercise

28 June 28 June 28 June

E Boyle 2021 308,430 308,430 19 2023 2031

28 June 28 June 28 June

N Tulloch 2021 616,861 616,861 19 2023 2031

Total 925,291 925,291

-------- ------------

The market price of the shares at the year end was 14.5 pence

per share.

During the period, the minimum and maximum prices were 14.5

pence and 58 pence per share respectively.

Since the end of the period, 34,482 share options have been

forfeited by a member of staff who has left the Company leaving a

total of 1,009,884 options outstanding.

22. SHARE PREMIUM ACCOUNT

2022

GBP'000