Euro Falls As Coronavirus Fears Linger

10 Februar 2020 - 7:07AM

RTTF2

The euro declined against its major opponents in the early

European session on Monday, as concerns over the impact of the

outbreak of coronavirus dampened risk sentiment.

The head of the World Health Organization said the thousands of

coronavirus cases in the Chinese city of Wuhan, the center of the

epidemic, is likely "just the tip of the iceberg."

"There have been some concerning instances of onward 2019nCoV

spread from people with no travel history to China. The detection

of a small number of cases may indicate more widespread

transmission in other countries," tweeted Ghebreyesus,

Director-General of the WHO.

"In an evolving public health emergency, all countries must step

up efforts to prepare for 2019nCoV's possible arrival and do their

utmost to contain it should it arrive. This means lab capacity for

rapid diagnosis, contact tracing and other tools in the public

health arsenal," he said.

The death toll totaled 908 and the number of confirmed cases has

risen over 40,000, according to the World Health Organization.

Survey from the behavioral research institute Sentix showed that

Eurozone investor sentiment eroded in February, after rising in the

previous three months, as investor grew concerned about the

economic outlook amid the uncertainty created by the coronavirus

outbreak in China.

The investor confidence index dropped to 5.2 from 7.6 in

December.

The euro edged down to 0.8476 against the pound, from a 6-day

high of 0.8504 seen at 2:45 am ET. The euro is seen finding support

around the 0.83 region.

The euro pulled back to 1.0945 against the greenback, from a

high of 1.0958 set at 12:00 am ET. The next possible support for

the euro is seen around the 1.08 level.

The euro eased to 1.0696 against the franc, down from a 4-day

high of 1.0714 hit at 9:30 pm ET. On the downside, 1.06 is possibly

seen as the next support level for the euro.

The euro retreated to 120.13 versus the yen, not far from a

1-week low of 119.97 recorded in the previous session. If the euro

extends decline, 118.00 is possibly seen as its next support

level.

Data from the Ministry of Finance showed that Japan posted a

current account surplus of 524.0 billion yen in December - up 12.8

percent on year.

That exceeded expectations for a surplus of 464.7 billion yen

following the 1,436.8 billion yen surplus in November.

The euro was trading at 1.7078 versus the kiwi, down from a

6-day high of 1.7125 set at 7:15 pm ET. Further downtrend may take

the currency to a support around the 1.68 region.

The euro fell to near a 2-week low of 1.4548 versus the loonie

and held steady thereafter. The pair had finished Friday's deals at

1.4563.

The single currency held steady against the aussie, after

falling as low as 1.6331 at 1:15 am ET. At Friday's close, the pair

was worth 1.6398.

Looking ahead, Canada housing starts for January are set for

release at 8:15 am ET.

Fifteen minutes later, Canada building permits for December will

be released.

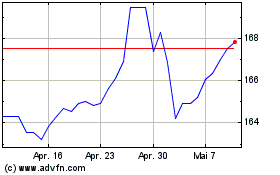

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

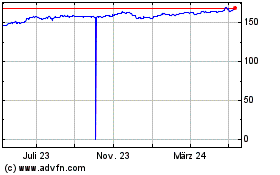

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024