UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarter ended September 30, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission file number: 333-234358

| Pony Group Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| Delaware | | 83-3532241 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

Engineer

Experiment Building, A202

7 Gaoxin South Avenue, Nanshan District

Shenzhen, Guangdong Province

People’s Republic of China

(Address of principal executive offices)

+86 755 86665622

(Issuer’s telephone number)

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | PNYG | | OTC Market |

Indicate by check mark whether the Registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 13, 2023, there were 11,500,000 shares of common stock, par value $0.001 per share, issued and outstanding.

PONY GROUP INC.

FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2023

TABLE OF CONTENTS

PART I

- FINANCIAL INFORMATION

Item 1. Interim Financial Statements.

PONY GROUP INC., AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 27,131 | | |

$ | 49,803 | |

| Accounts receivables | |

| 12,693 | | |

| 10,723 | |

| Other receivables | |

| 269 | | |

| 285 | |

| Other receivables-related parties | |

| 8,998 | | |

| 8,998 | |

| Total current assets | |

| 49,091 | | |

| 69,809 | |

| | |

| | | |

| | |

| Total assets | |

$ | 49,091 | | |

$ | 69,809 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,423 | | |

$ | 31,343 | |

| Other payable- related parties | |

| 473,238 | | |

| 378,753 | |

| Other current liability | |

| 29,210 | | |

| 15,257 | |

| Total current liabilities | |

| 503,871 | | |

| 425,353 | |

| Total liabilities | |

$ | 503,871 | | |

$ | 425,353 | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Ordinary shares, $0.001 par value, 70,000,000 shares authorized, 11,500,000 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| 11,500 | | |

| 11,500 | |

| Additional paid-in capital | |

| 176,000 | | |

| 176,000 | |

| Accumulated other comprehensive income | |

| 23,334 | | |

| 6,360 | |

| Accumulated deficit | |

| (665,614 | ) | |

| (549,404 | ) |

| Total stockholders’ equity | |

| (454,780 | ) | |

| (355,544 | ) |

| Total liabilities and stockholders’ equity | |

$ | 49,091 | | |

$ | 69,809 | |

The accompanying notes are integral to these unaudited condensed consolidated

financial statements.

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For The Three Months Ended

September 30, | | |

For The Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 38,102 | | |

$ | 22,847 | | |

$ | 141,496 | | |

$ | 76,411 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 19,944 | | |

| 6,523 | | |

| 65,415 | | |

| 38,116 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 18,158 | | |

| 16,324 | | |

| 76,081 | | |

| 38,295 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General & administrative expenses | |

| 31,965 | | |

| 46,306 | | |

| 192,374 | | |

| 284,429 | |

| R&D expense | |

| - | | |

| 6,559 | | |

| - | | |

| 23,816 | |

| Total operating expenses | |

| 31,965 | | |

| 52,865 | | |

| 192,374 | | |

| 308,245 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operation | |

| (13,807 | ) | |

| (36,541 | ) | |

| (116,293 | ) | |

| (269,950 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| 6 | | |

| (7,150 | ) | |

| 83 | | |

| (7,589 | ) |

| Total other income (expense) | |

| 6 | | |

| (7,150 | ) | |

| 83 | | |

| (7,589 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (13,801 | ) | |

| (43,691 | ) | |

| (116,210 | ) | |

| (277,539 | ) |

| Provision for income tax | |

| - | | |

| - | | |

| - | | |

| - | |

| Net Loss | |

$ | (13,801 | ) | |

| (43,691 | ) | |

| (116,210 | ) | |

| (277,539 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Income | |

| 1,836 | | |

| 15,237 | | |

| 16,974 | | |

| 24,498 | |

| Comprehensive loss | |

| (11,965 | ) | |

| (28,454 | ) | |

| (99,236 | ) | |

| (253,041 | ) |

Basic and diluted loss per common share | |

| (0.001 | ) | |

| (0.004 | ) | |

| (0.010 | ) | |

| (0.024 | ) |

| Weighted average number of shares outstanding | |

| 11,500,000 | | |

| 11,500,000 | | |

| 11,500,000 | | |

| 11,500,000 | |

The accompanying notes are integral to these unaudited condensed consolidated

financial statements.

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGE IN STOCKHOLDERS’ EQUITY

(Unaudited)

For

the Three and Nine Months Ended September 30, 2023

| | |

Common stock | | |

Additional

Paid-In | | |

Accumulated

Other

Comprehensive

Income | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Loss) | | |

Deficit | | |

Total | |

| Balance as of December 31, 2022 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | 6,360 | | |

$ | (549,404 | ) | |

$ | (355,544 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| (899 | ) | |

| - | | |

| (899 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (57,052 | ) | |

| (57,052 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of March 31, 2023 | |

| 11,500,000 | | |

| 11,500 | | |

| 176,000 | | |

| 5,461 | | |

| (606,456 | ) | |

| (413,495 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 16,037 | | |

| - | | |

| 16,037 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (45,357 | ) | |

| (45,357 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2023 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | 21,498 | | |

$ | (651,813 | ) | |

$ | (442,815 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 1,836 | | |

| - | | |

| 1,836 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (13,801 | ) | |

| (13,801 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2023 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | 23,334 | | |

$ | (665,614 | ) | |

$ | (454,780 | ) |

For

the Three and Nine Months Ended September 30, 2022

| | |

Common stock | | |

Additional

Paid-In | | |

Accumulated

Other

Comprehensive

Income | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Loss) | | |

Deficit | | |

Total | |

| Balance as of December 31, 2021 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | (10,158 | ) | |

$ | (280,326 | ) | |

$ | (102,984 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| (442 | ) | |

| - | | |

| (442 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (116,340 | ) | |

| (116,340 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of March 31, 2022 | |

| 11,500,000 | | |

| 11,500 | | |

| 176,000 | | |

| (10,600 | ) | |

| (396,666 | ) | |

| (219,766 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 9,703 | | |

| - | | |

| 9,703 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (117,508 | ) | |

| (117,508 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2022 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | (897 | ) | |

$ | (514,174 | ) | |

$ | (327,571 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 15,237 | | |

| - | | |

| 15,237 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (43,691 | ) | |

| (43,691 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2022 | |

| 11,500,000 | | |

$ | 11,500 | | |

$ | 176,000 | | |

$ | 14,340 | | |

$ | (557,865 | ) | |

$ | (356,025 | ) |

The accompanying notes are integral to these unaudited condensed consolidated

financial statements.

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For The Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flow from operating activities: | |

| | |

| |

| Net Loss | |

$ | (116,210 | ) | |

$ | (277,539 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (1,970 | ) | |

| 45,563 | |

| Other receivable | |

| 16 | | |

| 25 | |

| Accounts payable | |

| (29,920 | ) | |

| (5,965 | ) |

| Other payable | |

| 13,953 | | |

| (95,919 | ) |

| Cash used in operating activities | |

| (134,131 | ) | |

| (333,835 | ) |

| | |

| | | |

| | |

| Cash flow from financing activities: | |

| | | |

| | |

| Advance from related party | |

| 94,485 | | |

| 91,513 | |

| Cash provided by financing activities | |

| 94,485 | | |

| 91,513 | |

| | |

| | | |

| | |

| Effects of currency translation on cash | |

| 16,974 | | |

| 24,498 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (22,672 | ) | |

| (217,824 | ) |

| Cash at beginning of the period | |

| 49,803 | | |

| 266,011 | |

| Cash at end of period | |

$ | 27,131 | | |

$ | 48,187 | |

The accompanying notes are integral to these unaudited condensed consolidated

financial statements.

PONY GROUP INC., AND SUBSIDIARIES

NOTES FOR THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - ORGANIZATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Organization and Operations

PONY GROUP INC, (The “Company” or

“PONY”) was incorporated on January 7, 2019 in the state of Delaware.

On March 7, 2019, Pony Group Inc (the “Purchaser”),

and Wenxian Fan, the sole owner of PONY LIMOUSINE SERVICES LIMITED (“Pony HK”), entered into a Stock Purchase Agreement (the

“Purchase Agreement”), pursuant to which Wenxian Fan (the “Seller”) would sell to the Purchaser, and the Purchaser

will purchase from the Seller, 10,000 shares of Pony HK, which represented 100% of the shares. On March 7, 2019, this transaction was

completed.

Pony HK is a limited corporation formed under

the laws of Hong Kong on April 28, 2016, which was formed by FAN WENXIAN. Its registered office is located at FLAT/RM 01 11/F, LUCKY COMM

BLDG, 103 DES VOEUX RD WEST, SHEUNG WAN, HONG KONG. The business nature of the Company is to provide cross boarder limousine services

to customers. On February 2, 2019, Universe Travel Culture & Technology Ltd. (“Universe Travel”) was incorporated as a

wholly-owned PRC subsidiary of Pony HK.

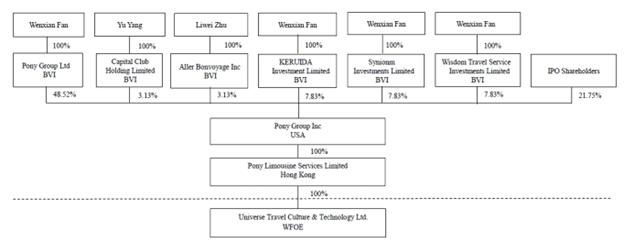

Details

of the Company’s structure as of September 30, 2023 are as follow:

Reverse

Merger Accounting – Since Pony HK and Pony US were entities under Ms. Fan’s common control prior to the “Purchase

Agreement” was executed, and because of certain other factors, including that the member of the Company’s executive management

is from Pony HK, Pony HK is deemed to be the acquiring company for accounting purposes and the Merger was accounted for as a reverse merger

and a recapitalization in accordance with generally accepted accounting principles in the United States (“GAAP”). These unaudited

consolidated financial statements reflect the historical results of Pony HK prior to the Merger and that of the combined Company

following the Merger, and do not include the historical financial results prior to the completion of the Merger. Common stock and the

corresponding capital amounts of the Company pre-Merger have been retroactively restated as capital stock shares.

Basis

of Accounting and Presentation - The accompanying financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America.

Cash and Cash Equivalents –

For purpose of the statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of 90

days or less to be cash equivalents.

Accounts Receivable -

The customers are required to make payments when they book the services, otherwise, the services will not be arranged. Sometimes, the

Company extends credit to its group clients.

As

of September 30, 2023 and December 31, 2022, accounts receivable was $12,693 and $10,723, respectively. The Company

considers accounts receivable to be fully collectible and determined that an allowance for doubtful accounts was not necessary.

Pony

HK, a 100% subsidiary of the Company, has agreements with its major clients that

the payments for the services rendered be settled every six months. There was no client that accounted for over 10% of

the revenue for Pony HK in the nine months ended September 30, 2023.

Universe

Travel Culture & Technology Ltd. (“Universe Travel”) was incorporated as a wholly-owned PRC subsidiary of Pony HK,

has agreements with three major clients. For the nine months ended September 30, 2023, the

following clients accounted for over 10% of the revenue for Universe Travel: Shenzhen Zhongke Hengjin with 24.84%; Shenzhen Eryuechuer

Culture & Technology., Ltd, with 17.88%;

and Shenzhen Shangjia Electronic Technology., Ltd with 15.25%

Revenue

Recognition - The Company recognizes revenue in accordance with ASC 606. The core principle of ASC606 is to recognize

revenue when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to

be received for those goods or services. ASC 606 defines a five-step process to achieve this core principle, which includes: (1) identifying

contracts with customers, (2) identifying performance obligations within those contracts, (3) determining the transaction price, (4) allocating

the transaction price to the performance obligation in the contract, which may include an estimate of variable consideration, and (5)

recognizing revenue when or as each performance obligation is satisfied. Our sales arrangements generally ask customers to pay in advance

before any services can be arranged. The company recognizes revenue when each performance obligation is satisfied. Documents and terms

and the completion of any customer acceptance requirements, when applicable, are used to verify services rendered. The Company has no

returns or sales discounts and allowances because services rendered and accepted by customers are normally not returnable.

Cost

of revenue – Cost

of revenue includes cost of services rendered during the period, net of discounts and sales tax.

Income Taxes –

Income tax expense represents current tax expense. The income tax payable represents the amounts expected to be paid to the taxation authority.

Hong Kong profits tax has been provided at the rate of 16.5% on the estimated assessable profit for the period.

Foreign

Currency Translation - Pony HK’s functional currency is the Hong Kong Dollar (HK$) and Universe Travel Culture

& Technology Ltd.’s functional currency is the Renminbi (RMB). The reporting currency is that of the US Dollar. Assets,

liabilities and owners’ contribution are translated at the exchange rates as of the balance sheet date. Income and expenditures

are translated at the average exchange rate of the year.

The exchange rates used to translate amounts in

HK$ and RMB into USD for the purposes of preparing the financial statements were as follows:

| September 30, 2023 |

|

|

|

|

| Balance sheet |

|

HK$7.83 to US $1.00 |

|

RMB 7.29 to US $1.00 |

| Statement of operation and other comprehensive income |

|

HK$7.83 to US $1.00 |

|

RMB 7.03 to US $1.00 |

| December 31, 2022 |

|

|

|

|

| Balance sheet |

|

HK$7.80 to US $1.00 |

|

RMB 6.89 to US $1.00 |

| September 30, 2022 |

|

|

|

|

| Statement of operation and other comprehensive income |

|

HK$7.85 to US $1.00 |

|

RMB 6.85 to US$1.00 |

Recent accounting pronouncements

The Company does not believe that any recently

issued but not yet effective accounting standards, if currently adopted, would have a material effect on the consolidated financial position,

statements of operations and cash flows.

NOTE 2 - GOING CONCERN

The

Company had net loss of $116,210 during the nine months ended September

30, 2023 and has accumulated deficit of $665,614

at September 30, 2023. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows

from operations to meet its obligations and/or obtain additional financing, as may be required.

The accompanying financial statements have been

prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s

ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability

and classification of assets or the amounts and classification of liabilities that may result should the Company be unable to continue

as a going concern.

Management’s Plan to Continue as a Going

Concern

In order to continue as a going concern, the Company

will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include

(1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s products, (3) short-term and long-term

borrowings from banks, and (4) short-term borrowings from stockholders or other related party (ies) when needed. However, management cannot

provide any assurance that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going

concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure

other sources of financing and attain profitable operations.

NOTE

3 - RELATED PARTY TRANSACTIONS

Amount

of receivable from shareholders is due to the company declaring a 6,000 to 1 stock split. After the stock split, the par value of the

common stocks was $0.001 per share. The shareholders should pay the consideration of $8,998 to the company. The Company used a

retroactive basis to present the nominal shares, the considerations and receivable form shareholders also should be represented.

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Receivable from shareholders | |

$ | 8,998 | | |

$ | 8,998 | |

| Total due from related parties | |

$ | 8,998 | | |

$ | 8,998 | |

Ms. Wenxian Fan, the director, loaned working

capital to Pony HK with no interest and paid on behalf of Pony HK for the subcontracted services and employee salaries.

The Company has the following payables to Ms. Wenxian Fan:

| | |

September 30,

2023 | | |

December 31,

2022 | |

| To Wenxian Fan | |

$ | 473,238 | | |

$ | 378,753 | |

| Total due to related parties | |

$ | 473,238 | | |

$ | 378,753 | |

NOTE

4 - MAJOR SUPPLIERS AND CUSTOMERS

The

Company purchased majority of its subcontracted services from one major supplier during the nine months ended September 30,

2023: Changying Business Limited for 24.51% of the cost.

NOTE 5 - SUBSEQUENT EVENTS

Management

has evaluated subsequent events through November 13, 2023, the date which the financial statements were available to be issued.

All subsequent events requiring recognition as of September 30, 2023 have been incorporated into these financial statements and there

are no subsequent events that require disclosure in accordance with FASB ASC Topic 855, “Subsequent Events.”

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

The following discussion and analysis of our

results of operations and financial condition should be read together with our consolidated financial statements and the notes thereto

and other financial information, which are included elsewhere in this Report. Our financial statements have been prepared in accordance

with U.S. GAAP. In addition, our financial statements and the financial information included in this Report reflect our organizational

transactions and have been prepared as if our current corporate structure had been in place throughout the relevant periods.

Overview

We were incorporated in the State of Delaware

on January 7, 2019. We are a travel service provider. We currently provide car services to individual and group travelers. We currently

offer carpooling, airport pick-up and drop-off, and personal driver services for travelers between Guangdong Province and Hong Kong. We

collaborate with car fleet companies and charge a service fee by matching the traveler and the driver. We officially launched our online

service through our “Let’s Go” mobile application in December 2019 to provide multi-language services to international

travelers coming to visit China. Redefining the user experience, we aim to provide our users with comprehensive and convenient service

offerings and become a one-stop travel booking resource for travelers. While network scale is important, we recognize that transportation

happens locally. We currently operate in two markets – Guangdong Province and Hong Kong and plan to expand our offering in more

oversea markets.

Plan of Operations

In

January 2019, we started our Research and Development (“R&D”) project mobile Lets Go App (“App”) designed

to have multi-language interface to attract users from around the world, focusing on providing one-stop travel services to foreigners

traveling in China, for both leisure and business.

In April 2019, we rolled out basic version which

supports carpooling, car rental, airport pick-up and/or drop-off, etc., ready for download at Apple App store; the basic version has an

interface in Chinese language only. In May 2019, we rolled out the second version which has an enhanced interface in both Chinese and

English language which supports payment through PayPal. By the end of 2019, we rolled out third version of the App which has multi-language

interface to attract users from all-over the world. In January 2020, we officially launched the App.

We

intend to attract users from outside of China to use our App and expand our offerings on the App to serve as a one-stop shop to book tickets,

reserve hotels, rent a car and hire English speaking drivers.

Our goal is to grow to an international player

in the travel service market. To accomplish such goal, we will cooperate with other businesses which have capital, marketing and technology

resources or products. We expect to recruit more workforce and talents, and develop new technologies and products.

Results of Operations

For the

three and nine months ended September 30, 2023 compared to September 30, 2022

Revenue

For

the three months ended September 30, 2023 and 2022, revenues were $38,102 and

$22,847, respectively, with an increase of $15,255 over the same period

in 2022. The increase was due to our subsidiary Universe Travel providing technology development services to Shenzhen Zhongke Hengjin

Technology Co., Ltd in the amount of $14,724 during the three months ended September

30, 2023.

For

the nine months ended September 30, 2023 and 2022, revenues were $141,496 and $76,411 respectively,

with an increase of $65,085 over the same period in 2022. From

January to September 2023, Universe Travel provided technology development services to its

three major clients, Shenzhen Eryuechuer Culture & Technology., Ltd, Shenzhen Shangjia Electronic Technology., Ltd and Shenzhen Zhongke

Hengjin Technology Co., Ltd, which generated $81,637 in revenue

for the Company during the nine month ended September 30,

2023.

Cost of Revenue

Cost

of revenue for the three months ended September 30,

2023 and 2022 were $19,944 and $6,523, respectively, with an increase of $13,421

over the same period in 2022. The increase was mainly due to the increase of revenue , thus the cost of revenue increased accordingly.

Cost

of Revenue for the nine months ended September 30, 2023 and 2022 were $65,415 and

$38,116, respectively, with an increase of $27,299 over the same

period in 2022. The increase was mainly due to the increase of revenue, thus the cost of revenue increased accordingly.

Gross Profit

Gross

profits were $18,158 and $16,324 for the three months ended September

30, 2023 and 2022. The gross profit margin as a percentage of sales were 47.7% and 71.4% for the three months ended September 30, 2023

and 2022, respectively. Since our staff could provide application development services based

on the Wechat platform

without additional costs, technology development services have a higher

gross profit margin. The decrease of gross profit margin for the three months ended September 30, 2023 compared to the same period

of 2022 was due to the fact that technology development services accounted for lower proportion of revenue for the three months ended

September 30, 2023.

Gross

profits were $76,081 and $38,295 for the nine months ended September 30,

2023 and 2022, respectively. The gross profit margin as a percentage of sales for the nine months ended September 30, 2023 and

2022 were 53.8% and 50.1%, respectively. The increase of gross profit

margin was due to Universe Travel providing technology development services to

its three major clients during the nine months ended September 30, 2023. This service provided has a higher gross profit margin

and led to the increase of the total gross profit margin.

Operating Expenses

Operating

expenses for the three months ended September 30, 2023 and 2022 were $31,965

and $52,865, respectively, for a decrease of $20,900. The decrease of

operating expenses was mainly due to decrease of a service fee paid for OTC listing

and other consulting services fees as compared to the prior period.

Operating

expenses for the nine months ended September 30, 2023 and 2022 were $192,374 and $308,245, respectively, a decrease of $115,871

from the same period in 2022. The decrease was mainly due to service fee paid for OTC listing and other consulting services fees in the

prior period.

Other (Expense)Income

Other

income consists of interest income and exchange gain (loss) for the three months ended September 30, 2023 and 2022, the net other

income was $6 compared to net other expense $7,150 for the same period

last year. This was mainly due to the change of exchange rate and the increase of average cash balances.

For

the nine months ended September 30, 2023 and 2022, the net other income was $83 when it was a net other expense of $7,589 in the

same period last year. This was mainly due to the change of exchange rate and the increase of average cash balances.

Liquidity and Capital Resources

We have suffered recurring losses from operations and have an accumulated

deficit of $665,614 as of September 30, 2023. We had a cash balance of $27,131 and negative working capital of $454,780 as of September

30, 2023. The Company has incurred losses of $116,210 for the nine months ended September 30, 2023. Our financial statements have been

prepared assuming we will continue as a going concern; however, the above condition raises substantial doubt about our ability to do so.

The Company has not continually generated significant gross profits. Unless our operations generate a significant increase in gross profit

and cash flows from operating activities, our continued operations will depend on whether we are able to raise additional funds through

various sources, such as equity and debt financing, other collaborative agreements and/or strategic alliances. Our management is actively

engaged in seeking additional capital to fund our operations in the short to medium term. Such additional funds may not become available

on acceptable terms and there can be no assurance that any additional funding that we do obtain will be sufficient to meet our needs in

the long term.

Net

cash used in operating activities for the nine months ended September 30, 2023, amounted to $134,131,

compared to $333,835

net cash used in operating activities for the nine months ended September 30, 2022. The decrease of net cash used in operating activities

was due to the decrease of net loss.

There

were $0 cash used in investment activities for the nine months ended September 30, 2023 and 2022.

Net

cash provided by financing activities for the nine months ended September 30, 2023 amounted to $94,485, compared to net cash provided

by financing activities of $91,513 in the same period of 2022. The net cash provided by financing activities were from shareholders who

paid certain expenses on behalf of the Company.

Going Concern

The accompanying consolidated financial statements

have been prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about

the Company’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on

the recoverability and classification of assets or the amounts and classification of liabilities that may result should the Company be

unable to continue as a going concern.

In order to continue as a going concern, the Company

will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include

(1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s services, (3) short-term and long-term

borrowings from banks, and (4) short-term borrowings from stockholders or other related party(ies) when needed. However, management cannot

provide any assurance that the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as

a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually

to secure other sources of financing and attain profitable operations.

Critical Accounting Policies

The

discussion and analysis of the Company’s financial condition and results of operations are based upon the Company’s consolidated

financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America.

We continually evaluate our estimates, including those related to bad debts, the useful life of property and equipment and intangible

assets, and the valuation of equity transactions. We base our estimates on historical experience and on various other assumptions that

we believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying

values of assets and liabilities that are not readily apparent from other sources. Any future changes to these estimates and assumptions

could cause a material change to our reported amounts of revenues, expenses, assets and liabilities. Actual results may differ from these

estimates under different assumptions or conditions.

See Note 1 to our unaudited condensed consolidated

financial statements for a discussion of our significant accounting policies.

Off-Balance Sheet Arrangements

As

of September 30, 2023, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

As a smaller reporting company, we are not required to make disclosures

under this item.

Item 4. Controls and Procedures

Under

the supervision and with the participation of our management, including our principal executive officer and principal financial and accounting

officer, we conducted an evaluation of the effectiveness of our disclosure controls and procedures, as such term is defined in Rules 13a-15(e)

and 15d-15(e) under the Exchange Act. Based on this evaluation, our principal executive officer and principal financial and accounting

officer have concluded that as of September 30, 2023, our disclosure controls

and procedures were effective.

Disclosure controls and procedures are designed

to ensure that information required to be disclosed by us in our Exchange Act reports is recorded, processed, summarized, and reported

within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our

management, including our principal executive officer and principal financial officer or persons performing similar functions, as appropriate

to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control

over financial reporting during the year ended December 31, 2022 that have materially affected, or are reasonably likely to materially

affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors

There have been no material changes in our risk

factors from those disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Not applicable

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures

Not applicable

Item 5. Other Information.

Not applicable

Item 6. Exhibits

The following exhibits are filed as part of, or incorporated by reference

into, this Quarterly Report on Form 10-Q.

SIGNATURES

In accordance with the requirements

of the Exchange Act, the registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PONY GROUP INC. |

|

| |

|

|

|

| Date: November 13, 2023 |

By: |

/s/ Wenxian Fan |

|

| |

Name: |

Wenxian Fan |

|

| |

Title: |

Chief Executive Officer

(Principal Executive Officer) and

Chief Financial Officer

(Principal Financial Officer) |

|

14

NONE

0.001

0.004

0.010

0.024

665614

0.2451

false

--12-31

Q3

518000

0001784058

7.83

7.29

7.83

6.85

0001784058

2023-01-01

2023-09-30

0001784058

2023-11-13

0001784058

2023-09-30

0001784058

2022-12-31

0001784058

us-gaap:RelatedPartyMember

2023-09-30

0001784058

us-gaap:RelatedPartyMember

2022-12-31

0001784058

2023-07-01

2023-09-30

0001784058

2022-07-01

2022-09-30

0001784058

2022-01-01

2022-09-30

0001784058

us-gaap:CommonStockMember

2022-12-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001784058

us-gaap:RetainedEarningsMember

2022-12-31

0001784058

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001784058

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001784058

2023-01-01

2023-03-31

0001784058

us-gaap:CommonStockMember

2023-03-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001784058

us-gaap:RetainedEarningsMember

2023-03-31

0001784058

2023-03-31

0001784058

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001784058

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001784058

2023-04-01

2023-06-30

0001784058

us-gaap:CommonStockMember

2023-06-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001784058

us-gaap:RetainedEarningsMember

2023-06-30

0001784058

2023-06-30

0001784058

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0001784058

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001784058

us-gaap:CommonStockMember

2023-09-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001784058

us-gaap:RetainedEarningsMember

2023-09-30

0001784058

us-gaap:CommonStockMember

2021-12-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001784058

us-gaap:RetainedEarningsMember

2021-12-31

0001784058

2021-12-31

0001784058

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0001784058

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001784058

2022-01-01

2022-03-31

0001784058

us-gaap:CommonStockMember

2022-03-31

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001784058

us-gaap:RetainedEarningsMember

2022-03-31

0001784058

2022-03-31

0001784058

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001784058

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001784058

2022-04-01

2022-06-30

0001784058

us-gaap:CommonStockMember

2022-06-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001784058

us-gaap:RetainedEarningsMember

2022-06-30

0001784058

2022-06-30

0001784058

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-09-30

0001784058

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001784058

us-gaap:CommonStockMember

2022-09-30

0001784058

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001784058

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001784058

us-gaap:RetainedEarningsMember

2022-09-30

0001784058

2022-09-30

0001784058

pginc:PonyLimousineServicesLimitedMember

2019-03-07

2019-03-07

0001784058

pginc:PonyLimousineServicesLimitedMember

2019-03-07

0001784058

pginc:PonyHKMember

pginc:ShenzhenZhongkeHengjinMember

2023-09-30

0001784058

pginc:ShenzhenZhongkeHengjinMember

2023-09-30

0001784058

pginc:ShenzhenEryuechuerCultureTechnologyLtdMember

2023-09-30

0001784058

pginc:ShenzhenShangjiaElectronicTechnologyLtdMember

2023-09-30

0001784058

country:HK

2023-01-01

2023-09-30

0001784058

currency:HKD

pginc:BalanceSheetMember

2023-09-30

0001784058

currency:USD

pginc:BalanceSheetMember

2023-09-30

0001784058

currency:CNY

pginc:BalanceSheetMember

2023-09-30

0001784058

currency:HKD

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2023-09-30

0001784058

currency:USD

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2023-09-30

0001784058

currency:CNY

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2023-09-30

0001784058

currency:HKD

pginc:BalanceSheetMember

2022-12-31

0001784058

currency:USD

pginc:BalanceSheetMember

2022-12-31

0001784058

currency:CNY

pginc:BalanceSheetMember

2022-12-31

0001784058

currency:HKD

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2022-09-30

0001784058

currency:USD

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2022-09-30

0001784058

currency:CNY

pginc:StatementOfOperationAndOtherComprehensiveIncomeMember

2022-09-30

0001784058

pginc:ReceivableFromShareholdersMember

2023-01-01

2023-09-30

0001784058

pginc:ReceivableFromShareholdersMember

2022-01-01

2022-12-31

0001784058

2022-01-01

2022-12-31

0001784058

pginc:WenxianFanMember

2023-01-01

2023-09-30

0001784058

pginc:WenxianFanMember

2022-01-01

2022-12-31

0001784058

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

pginc:SupplierOneMember

2023-01-01

2023-09-30

xbrli:shares

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:pure

In connection with the quarterly

report of Pony Group Inc. (the “Company”) on Form 10-Q for the quarter ended September 30, 2023, as filed with the Securities

and Exchange Commission on the date hereof (the “Report”), I, Wenxian Fan, Chief Executive Officer of the Company, certify,

pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that: