The push to-wards widespread adoption of electric vehicles (EV)

is putting a strain on supplies of many critical commodities. For

example, lithium is essential to manufacture the batteries for

these vehicles. Several years ago, this in- creased demand led to a

boom for junior lithium exploration companies. As EV production

continues ramping up higher, a similar effect is underway for

cobalt. Even nick-el is trending sharply higher as a component in

these batteries

New technology is advancing development of more efficient

batteries incorporating manganese. All battery metals are now

surging in price due to the expectation of greater demand and

tighter supply. Manganese is only the latest metal to join that

trend. Rising demand for manganese in cathodes for lithium-ion

batteries has placed more urgent emphasis on developing new mine

supply for the metal.

As the EV market continues expanding, some estimates suggest

year-over-year manganese consumption will grow at a compound rate

of 23 per cent per annum just from increased battery manufacturing

demand. Where is all of this new supply going to come

from?

A U.S. presidential executive order was signed in February to

prioritize certain strategic elements, including manganese. This

may generate further support to fast-track development of advanced

deposits in the United States and Canada. There is no current mine

production for manganese within North America. However, the

province of New Brunswick was once considered a hub for manganese

deposits and mining.

It is fortunate that the management team of Manganese X Energy

Corp. (MN-TSX/VEN, $0.60; MNXXF-OTC, US$0.46) recognized this

historical importance several years ago, while

manganese was still largely off the radar for exploration. The

company was able to acquire the Houlton-Woodstock

manganese property for a bargain purchase price by

contemporary standards. Now dubbed the Battery Hill project, this

package of 55 claims comprising an area of 1228 hectares holds the

potential for a manganese mine development near the town of

Woodstock, N.B.

The highlight of this project is an enriched manganese deposit

encountered in five major zones within the property area. Of these,

the Moody Hill zone demonstrates the most attractive economic

potential for an open-pit mine. This advanced exploration

prospect is situated near surface, with higher-grade showings of

manganese sulphate originally identified through work programs

completed by a previous operator. The prospects for additional

discovery zones at untested areas of the property is also

appealing. Manganese X launched a drilling program late last year

to confirm and expand the deposit at the Moody Hill target area. A

program of 28 drill holes with a total of more than

4,500 metres of drilling was completed in

November. Favourable results were recently reported.

Several high-grade zones were encountered with average grades above

11 per cent MnO, or manganese (II) oxide, across wide

intervals of drill core.

Combined with previous drilling work, 53 drill

holes totalling 9,600 metres have been

completed. Manganese X has defined a large deposit area at Moody

Hill. This data is now being incorporated into a compliant resource

report for the project.

The company has also been actively evaluating the metallurgical

characteristics of the deposit. Manganese is encountered in more

than 50 different minerals and some of these may present

metallurgical challenges to efficient recovery under conventional

processing technology. However, mineralization from Battery Hill is

hosted in carbonate form, which is attractive since it can be

processed using conventional sulphuric acid leaching.

Sample material was submitted for evaluation through Kemet- co

Research, a consulting firm specializing in metallurgy and mineral

processing technology. A flow sheet has been designed for a circuit

tuned to mineralization from Battery Hill that indicates 85 per

cent of the manganese content may be recovered. The combination of

attractive grades and favourable metallurgy is a key

consideration toward achieving positive economic results in a

producing mine scenario. Data will be incorporated into a

preliminary economic assessment (PEA) following the completion of

the resource report.

Ultimately, the potential to commence mining at a domestic

manganese deposit is the catalyst that could lead to a much higher

market value for Manganese X Energy. However, another business unit

has been created outside of the resource sector that may also

create shareholder value. The wholly-owned subsidiary,

Disruptive Battery Corp. (DBC), was established to advance a

patented technology for air purification and delivery systems.

Common HVAC ventilation systems used in large buildings are

known threats for distribution of pathogens. A process has been

developed to mitigate and neutralize airborne and surface pathogens

carried in these HVAC systems.

Pure Biotics Air is now under development as a joint venture to

commercialize the technology. The process disperses a mist of

particles through air-circulation ducts to destroy viruses and

bacterial microbes on contact surfaces. The organic process is

effective protection against pathogens but is harmless to people

and animals.

A research program has been launched at the prestigious Virginia

State University laboratory facility where results may be confirmed

through high-powered electron microscopes to validate the

technology. If this testing regime is successful, it will open the

opportunity to work with hospitals and large commercial buildings

to incorporate safer air circulation.

As the core mineral resource strategy is focused on advancement

of the manganese project, the company has chosen to divest another

attractive property that they held, with leverage to graphite. The

Lac Aux Bouleaux graphite property is located

in Quebec, immediately adjacent to a formerly producing

graphite mine. The property will be spun out to shareholders

through the creation of a newly-listed junior

explorer, Graphano Energy Ltd.

A shareholder meeting is scheduled in April to approve the

process. Similar transactions have unlocked investment value for

other companies that have completed a spin-out of non- core

assets.

Manganese X is the most advanced company moving towards the

establishment of a manganese mine within North America. The ideal

geographical location of Battery Hill near the U.S. border, along

with access to support and infrastructure, provides an attractive

setting for development in this formerly active mining

district.

Favourable metallurgical characteristics also contribute

to- wards positive economics for a

potential mine development. As the company presents its

NI 43- 101 resource estimate and then commences a PEA for the

project, the timing for these events is ideal. Battery Hill may

emerge as a viable mine development prospect.

Meanwhile, the integrated approach is pursuing commercial

opportunities through the DBC subsidiary. The Pure Biotics

joint-venture strategy could advance as another

well-timed investment as public concern over airborne

pathogens is still very much a factor. Testing is expected to

commence shortly. With about $3 million in working capital on hand,

Manganese X is fully funded to advance its strategy.

This approach to building shareholder value has already

generated results. Manganese X has been one of the hottest junior

mining stories over the last few quarters. The stock has more than

doubled since the start of this year. The pace of activity will

support a bullish trading outlook as work continues.

Mike Kachanovsky is a freelance writer who specializes

in technology and junior mining stocks.

Investor's Digest of Canada can be found at www.adviceforinvestors.com

© Copyright 2021 by MPL Communications Inc., Reproduced by

permission of Investor's Digest of Canada, 133 Richmond St. W.,

Toronto, ON M5H 3M8

MANGANESE X ENERGY CORP.

Martin Kepman

CEO and Director

Email: martin@kepman.com

Tel: 1-514-802-1814

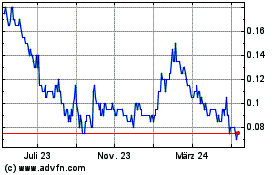

Manganese X Energy (TSXV:MN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

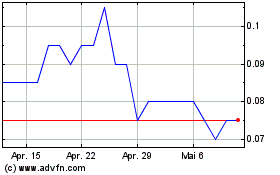

Manganese X Energy (TSXV:MN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024