FRNT Financial Inc. (TSXV:FRNT) (OTCQB:FRFLF)

(FSE:XZ3) (the “

Company” or

“

FRNT”) today announces the closing of its

previously announced brokered private placement offering (the

“

Offering”) for aggregate gross proceeds of

approximately $1.24 million.

Under the terms of the Offering, the Company

issued 2,070,000 units (“Units”), at a price of

C$0.60 per Unit, for aggregate gross proceeds of approximately

$1.24 million. Fort Capital Securities Ltd. (the

“Agent”) acted as sole agent and bookrunner in

connection with the Offering.

Each Unit consists of one common share of the

Company (a “Common Share”) and one-half of one

Common Share purchase warrant (each whole warrant, a

“Warrant”). Each Warrant entitles the holder

thereof to purchase one Common Share (each, a “Warrant

Share”) at an exercise price of C$0.90 until May 21, 2027,

subject to accelerated expiry in the event the volume-weighted

average closing price of the Common Shares on the TSX Venture

Exchange (the “TSXV”) is $1.20 or more for ten

(10) consecutive trading days, in which case the Company may

accelerate the expiry date of the Warrants to the date that is

thirty (30) days following the issuance of a news release by the

Company announcing such acceleration.

The Company intends to use the net proceeds of

the Offering to continue scaling its business and building out its

capital base, and for working capital and general corporate

purposes.

In connection with the Offering and as

consideration for their services, the Company paid to the Agent a

cash commission of $74,520 and issued to the Agent 124,200 warrants

of the Company (the “Broker Warrants”). Each

Broker Warrant entitles the holder thereof to acquire one Unit at a

price of C$0.60 at any time on or before May 21, 2027.

The Units were offered pursuant to the listed

issuer financing exemption (the “Listed Issuer Financing

Exemption”) as outlined in Part 5A of National Instrument

45-106 -- Prospectus Exemptions (“NI 45-106”) in

the provinces of Alberta, British Columbia and Ontario as well as

certain offshore jurisdictions. An offering document related to the

portion of the Offering conducted under the Listed Issuer Financing

Exemption has been filed on the Company’s profile on SEDAR+ at

www.sedarplus.com.

The Common Shares and Warrants issuable from the

sale of Units under the Listed Issuer Financing Exemption are not

subject to a hold period in accordance with Canadian securities

laws and are immediately freely tradeable, while the Broker

Warrants and underlying securities are subject to a four-month hold

period.

The securities offered pursuant to the Offering

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “U.S. Securities

Act”), or any U.S. state securities laws, and may not be

offered or sold in the “United States” or to, or for the account or

benefit of, “U.S. persons” (as such terms are defined in Regulation

S under the U.S. Securities Act) absent registration under the U.S.

Securities Act and any applicable U.S. state securities laws or

compliance with an applicable exemption from such registration

requirements. This press release does not constitute an offer to

sell or the solicitation of an offer to buy nor will there be any

sale of the securities in any State in which such offer,

solicitation or sale would be unlawful.

David Washburn, President of the Company, and

Alex McAulay, Chief Financial Officer of the Company each

participated in the Offering, purchasing 100,000 Units and 41,667

Units, respective, and the Offering accordingly constitutes a

“related party transaction” pursuant to Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The Offering is exempt

from (i) the formal valuation requirement of MI 61-101 pursuant to

the Section 5.5(b) of MI 61-101, as the common shares are not

listed or quoted on any of the stock exchanges or markets listed in

Section 5.5(b) of MI 61-101, and (ii) the minority shareholder

approval requirement of MI 61-101 pursuant to Section 5.7(1)(a) of

MI 61- 101, as the fair market value of the Units issued does not

exceed 25% of the Company’s market capitalization. A material

change report was not filed by the Company at least 21 days before

the closing of the Offering, as the participation of such insiders

was not determined until shortly prior to closing and the Company

wished to close expeditiously to confirm funds for the Offering.

The Offering was approved by all of the independent directors of

the Company.

Upon completion of the Offering:

|

|

(a) |

|

Mr. Washburn owns and controls an aggregate of 593,198 Common

Shares and convertible securities entitling him to acquire an

additional 1,853,930 Common Shares representing approximately 1.59%

of the issued and outstanding Common Shares as of May 21, 2024 (or

approximately 6.26% calculated on a partially diluted basis,

assuming the exercise of the 1,853,930 convertible securities

only); and |

| |

|

|

|

| |

(b) |

|

Mr. McAulay owns and controls an

aggregate of 41,667 Common Shares and convertible securities

entitling him to acquire an additional 520,833 Common Shares

representing approximately 0.11% of the issued and outstanding

Common Shares as of May 21, 2024 (or approximately 1.49% calculated

on a partially diluted basis, assuming the exercise of the 520,833

convertible securities only). |

| |

|

|

|

About FRNT FRNT is an

institutional capital markets and advisory platform focused on

digital assets. FRNT, through a technology-forward and compliant

operation, aims to bridge the worlds of traditional and web-based

finance. Partnering with both financial institutions and crypto

native firms, FRNT operates 5 synergistic business lines including

deliverable trading services, institutional structured derivative

products, merchant banking, advisory and consulting, and principal

investments & trading. Co-founded in 2018 by CEO Stéphane

Ouellette, FRNT is a global firm headquartered in Toronto,

Canada.

FRNT Financial Inc. Chief

Executive OfficerStéphane Ouelletteinvestors@frnt.io833

222-3768https://frnt.io

Neither the TSXV nor its regulation

services provider (as that term is defined in policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

statements” and “forward-looking information” within the meaning of

applicable law which may include, without limitation, statements

relating to the use of proceeds of the Offering, the receipt of

final TSXV approval in respect of the Offering, acceleration of the

expiry date of the Warrants, the technical, financial and business

prospects of the Company, its assets and other matters. Generally,

forward-looking statements and forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, “believes”, or variations of such words and

phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. All forward-looking statements and forward-looking

information are based on reasonable assumptions that have been made

by the Company as at the date of such information. Forward-looking

statements and forward-looking information are subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking statements and forward-looking

information, including but not limited to: the general risks

associated with the speculative nature of the Company’s business,

current global financial conditions, uncertainty of additional

capital, price volatility, no history of earnings, government

regulation in the industries in which the Company operates,

political and economic risk, absence of public trading market,

arbitrary offering price, dilution to the Company’s common shares,

dependence on key personnel, currency fluctuations, insurance and

uninsured risks, competition, legal proceedings, conflicts of

interest and lack of dividends. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements and forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or forward-looking information. The

Company does not undertake to update any forward-looking statement

or forward-looking information that is included herein, except in

accordance with applicable securities laws.

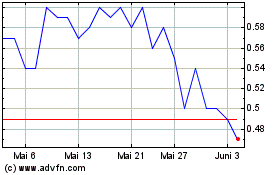

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024