FRNT Financial Provides Business Update Amid Improving Conditions, Adds Context to Revenue Timing Volatility

30 Mai 2024 - 11:18PM

FRNT Financial Inc. (TSXV: FRNT) (OTCQB:FRFLF)

(FSE:XZ3) (the “

Company” or

“

FRNT”) is pleased to provide a business update as

macro and cryptocurrency-market conditions improve. The Company is

seeing a significant uptick in business pipeline beyond what has

been seen historically, though experiencing volatility in the

timing of revenue realization. While such volatility is to be

expected as the industry emerges from aggressive bear-market

conditions, the Company believes the revenue-generation potential

of the business has re-rated and that recurring, more predictable

quarterly figures are on the horizon.

Advisory & Consulting

FRNT Financial has entered into a number of

engagements, advising crypto-related corporate clients with unique

financing needs and structures. These include a mix of M&A

mandates, minority financings, and structured financings. The

Company is engaged in over $500 million in notional mandates. While

execution risk remains, several mandates are in advanced stages and

are expected to conclude within the next 9-12 months.

Lending Origination

In the recent quarter, FRNT saw an influx of

indications from prospective borrowers of fiat currencies,

collateralized by digital assets. Client indications currently

amount to upwards of USD equivalent $100 million in notional, with

FRNT typically earning origination fees and spreads on such

transactions, if executed.

Trading Services

Claims Trading: FRNT remains engaged and

advising FTX claims holders following the 2022 bankruptcy. The

Company was one of the most active firms in consulting around such

transactions in 2023. With a minority of claims having traded to

date, FRNT believes the opportunity remains with the bankruptcy

estate now adding further clarity to the liquidation timing.

Derivatives: While regulated OTC-derivatives

trading was particularly impacted by the bear-market conditions of

the last two-years, the Company has seen renewed interest in such

structures. FRNT intends to launch an augmented version of its

historical ‘SEM-Trade’ derivatives-platform as this business-line

returns in the coming quarters.

Spot Services: After a year where many core spot

trading clients restructured or dissolved, FRNT is seeing an influx

of onboarding of new clients, achieving levels not seen since

2021.

Quote from Management

“The business of FRNT is emerging from a unique,

disruptive period where the institutional adoption of digital

assets was put on pause due to high-profile disasters in the

industry and a depressed macro environment,” said Stéphane

Ouellette, CEO of FRNT Financial. “As clear changes in sentiment

are emerging in key regions and regulatory clarity is improving,

FRNT is experiencing an incredible increase in demand for its

services. FRNT is one of the few institution-focused businesses in

the industry that has been able to stabilize operations after an

incredibly difficult period. We further expect, in the coming

quarters, as the industry normalizes, to see less volatile and more

predictable quarterly revenues.”

About FRNT FRNT is an

institutional capital markets and advisory platform focused on

digital assets. FRNT, through a technology-forward and compliant

operation, aims to bridge the worlds of traditional and web-based

finance. Partnering with both financial institutions and crypto

native firms, FRNT operates 5 synergistic business lines including

deliverable trading services, institutional structured derivative

products, merchant banking, advisory and consulting, and principal

investments & trading. Co-founded in 2018 by CEO Stéphane

Ouellette, FRNT is a global firm headquartered in Toronto,

Canada.

FRNT Financial Inc. Chief

Executive OfficerStéphane Ouelletteinvestors@frnt.io833

222-3768https://frnt.io

Neither the TSXV nor its regulation

services provider (as that term is defined in policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this press

release.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

statements” and “forward-looking information” within the meaning of

applicable law which may include, without limitation, statements

relating to revenue generation trends and potential, the conclusion

of advisory agreements, expectations regarding lending origination

and other Company operations, financial and business prospects of

the Company, its assets and other matters. Generally,

forward-looking statements and forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, “believes”, or variations of such words and

phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. All forward-looking statements and forward-looking

information are based on reasonable assumptions that have been made

by the Company as at the date of such information. Forward-looking

statements and forward-looking information are subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking statements and forward-looking

information, including but not limited to: the general risks

associated with the speculative nature of the Company’s business,

current global financial conditions, uncertainty of additional

capital, price volatility, no history of earnings, government

regulation in the industries in which the Company operates,

political and economic risk, absence of public trading market,

arbitrary offering price, dilution to the Company’s common shares,

dependence on key personnel, currency fluctuations, insurance and

uninsured risks, competition, legal proceedings, conflicts of

interest and lack of dividends. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements and forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or forward-looking information. The

Company does not undertake to update any forward-looking statement

or forward-looking information that is included herein, except in

accordance with applicable securities laws.

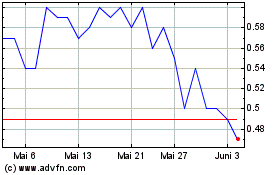

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024