Project Gemini Reaches Financial Close

15 Mai 2014 - 12:04AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OR ITS POSSESSIONS. ANY FAILURE TO COMPLY WITH THIS RESTRICTION

MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW.

Northland Power Inc. ("Northland" or "the Company")

(TSX:NPI)(TSX:NPI.PR.A)(TSX:NPI.PR.C)(TSX:NPI.DB.A)(TSX:NPI.DB.B) announces

closing of project financing for 600 MW project Gemini.

-- At EUR2.8 billion (approximately C$4.2 billion), it is the largest

project financing to date for an offshore wind farm;

-- Strong equity consortium consisting of Northland Power Inc., Siemens

Financial Services, Van Oord Dredging and Marine Contractors BV and N.V.

HVC;

-- Two-contract structure for turbine supply and project construction

minimizes risk;

-- Strong revenues through Netherlands sustainable energy subsidy (SDE)

program;

-- Gemini will play an important role in achieving European Union's

Renewable Energy Directive calling on all Member States to reach a 20%

share of energy from renewable sources by 2020;

-- To date, Gemini is the largest offshore wind farm in the North Sea,

which has one of the most reliable wind resources in the world.

Northland today announced that Gemini, a 600MW offshore wind project located

approximately 85 kilometres off the coast of the Netherlands in the North Sea

has reached financial close, having placed all of the EUR2.8 billion of equity

and debt required for the project. More than 22 parties, including 12 commercial

creditors, 4 public financial institutions, together with 1 pension fund and

Northland as subordinated debt lenders, and the 4 members of the equity

consortium were involved in the signing of the financing contracts. Gemini is

the largest-ever project financed offshore wind farm.

"Today's announcement is a major achievement for Northland," noted John Brace,

CEO of Northland Power. "We are very pleased with the extraordinary effort put

forth by the project's financiers, as financial close was achieved in record

time for a project of this nature. As the largest project financing in the

offshore wind sector, today's results validate the high quality of the project

and illustrate Northland's evolution from a leading Canadian power producer to

an international company taking on world-class projects. We continue to

demonstrate our track record of utilizing innovative financing structures and

delivering superior results and significant growth, and believe Gemini is just

the beginning for Northland in the burgeoning offshore wind sector."

Gemini is owned by a consortium consisting of Northland Power (60%), Siemens

Financial Services (SFS - 20%), Van Oord Dredging and Marine Contractors BV (Van

Oord - 10%) and N.V. HVC (HVC - 10%). SFS is an affiliate of Siemens, one of the

world's leading providers of eco-friendly technology. Van Oord is a leading

Netherlands-based international marine contractor with an excellent track record

in offshore wind farm construction and a leading position as EPC contractor in

offshore wind projects. HVC is a leading utility company of and for 48 Dutch

municipalities and six water regulatory authorities. Their mission is to help

the participating authorities achieve their goals in the field of energy,

climate, waste and raw materials.

Northland Power, SFS, Van Oord and HVC have provided combined equity of more

than EUR400 million. In addition, Northland Power and the Danish pension fund

PKA have provided subordinated loans totalling EUR200 million.

Northland's total investment, including its equity investment, share purchase

and subordinated loan to Gemini, is approximately C$565 million. Northland has

provided additional contingent equity support to the project in the form of

letters of credit totalling EUR94.8 million, and expects a previously issued

letter of credit totalling EUR24 million to be returned shortly after financial

close.

Northland has entered into foreign exchange contracts with several members of

its corporate banking syndicate to effectively fix the foreign exchange

conversion rate on substantially all projected Euro-denominated cash inflows

from Project Gemini throughout the 15 year SDE term at a weighted average

conversion rate of approximately 1.67 Canadian dollars per Euro.

Northland has taken a lead role in completing the remaining outstanding

development activities since its participation announcement in August 2013, and

intends to continue its active leadership role in the consortium during

construction and operations. Concurrent with financial closing, Gemini's major

construction and supply contracts and Northland's purchase of its shares in the

project all became effective. The project has now commenced construction, and is

expected to reach full commercial operations in 2017.

Under a two-contract project structure Siemens will supply and erect the

turbines, and Van Oord will construct the rest of the wind farm; this approach

minimizes risk by reducing the number of interfaces in the construction of the

project to just one. In addition, Siemens will maintain the turbines over the

first 15 years of the project's life. The financial sector's confidence in

Gemini can be attributed to the robust structure of the project and to the

electricity revenue support through the Netherlands' SDE subsidy program, which

combined, provide a stable and solid investment opportunity.

Approximately 70% of the project's required financing has been provided via EUR2

billion of "non-recourse" senior secured construction and term debt financing

from twelve international commercial creditors, three export credit agencies and

the European Investment Bank. This type of financing requires a strong project

contract structure and entails a comprehensive due diligence process. Reflecting

the strength of the project, the Gemini senior financing was oversubscribed and

attracted a number of institutions that have not previously lent to the offshore

wind sector. The interest rate for the project has been hedged over the full

loan amortization period with an effective interest rate of approximately 4.75%.

The international commercial creditors are based in North America, Asia and

Europe and consist of ABN AMRO Bank, BNP Paribas, Bank of Tokyo-Mitsubishi UFJ,

Deutsche Bank, Export Development Canada, Natixis, Sumitomo Mitsui Banking

Corporation, Bank of Montreal, CIBC, Bank Nederlandse Gemeenten, Banco Santander

and CaixaBank. The three export credit insurers are EKF from Denmark, Euler

Hermes from Germany, and Delcredere/Ducroire from Belgium.

Once constructed, Gemini will be the largest wind farm in the North Sea,

providing enough clean energy to supply the needs of 1.5 million people

annually. Combining favourable sea bed conditions with one of the strongest and

most reliable wind resources in the world, the North Sea could produce enough

energy to power Europe four times over. Gemini will play an important role in

helping the Government of the Netherlands achieve renewable energy targets

mandated by the European Union's Renewable Energy Directive, which calls for all

Member States to reach a 20% share of energy from renewable sources by 2020.

As a result of the Closing, the maturity date of Northland's aggregate C$78.8

million principal amount of 5.00% Extendible Convertible Unsecured Subordinated

Debentures, Series B, issued in March, 2014, is automatically extended to June

30, 2019.

Note: Amounts related to Project Gemini are generally stated in the currency of

origin. Where noted as "approximately", certain euro amounts are stated in

Canadian Dollars at the approximate exchange rate in effect as of the date

hereof.

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland develops, builds, owns and operates facilities that

produce 'clean' (natural gas) and 'green' (wind, solar, and hydro) energy,

providing sustainable long-term value to shareholders, stakeholders, and host

communities.

The company owns or has a net economic interest in 1,379 MW of operating

generating capacity, with an additional 50 MW of generating capacity currently

in construction, and another 750 MW (439 MW net to Northland) of wind and solar

projects with awarded power contracts. The above includes Northland's majority

equity stake in Gemini, a 600 MW (360 MW net to Northland) offshore wind project

in the North Sea. Northland's cash flows are diversified over five

geographically separate regions and regulatory jurisdictions in Canada, Europe

and the United States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C, NPI.DB.A and NPI.DB.B, respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding plans for raising capital. These

statements are based upon certain material factors or assumptions that were

applied in developing the forward-looking statements, including management's

current plans, its perception of historical trends, current conditions and

expected future developments, as well as other factors that are believed to be

appropriate in the circumstances. Although these forward-looking statements are

based upon management's current reasonable expectations and assumptions, they

are subject to numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations include, but are not

limited to, operational risks, foreign exchange rates, regulatory risks, and the

variability of revenues from generating facilities powered by intermittent

renewable resources and the other factors described in the "Risks and

Uncertainties" section of Northland's 2013 Annual Report and Annual Information

Form, both of which can be found at www.sedar.com under Northland's profile and

on Northland's website www.northlandpower.ca. Northland's actual results could

differ materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on May 14, 2014. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Sarah Charuk

Director of Communications

416-886-8960

Sarah.charuk@northlandpower.ca

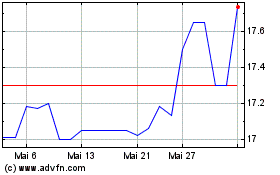

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024