Madison Pacific Properties Inc. announces the results for the three months ended November 30, 2023 and declares dividend

13 Januar 2024 - 1:00AM

Madison Pacific Properties Inc. (the Company) (TSX: MPC and MPC.C),

a Vancouver-based real estate company announces the results of

operations for the three months ended November 30, 2023 and

declares dividend.

The results reported are pursuant to

International Financial Reporting Standards (IFRS) for public

companies.

For the three months ended November 30, 2023,

the Company is reporting net loss of $57.8 million (2022: net

income of $6.6 million); cash flows generated from operating

activities before changes in non-cash operating balances of $1.6

million (2022: cash flow from operating activities before changes

in non-cash operating balances of $1.8 million); and loss per share

of $0.97 (2022: income per share of $0.11). Included in net loss is

a provision of $51.2 million (2022: $nil) for uncertain tax

positions recognizing a tax liability for unpaid taxes and

estimated interest and provisions against the carrying value of the

Company’s tax deposits and deferred tax assets related to unused

carryforward amounts. Also included in net loss is a net loss on

the fair value adjustment on investment properties of approximately

$8.0 million (2022: net gain of $0.3 million).

As previously reported in the Company’s

Consolidated Financial Statements, the Company and certain

subsidiaries had received from the Canada Revenue Agency (“CRA”)

and Alberta Tax and Revenue Administration (“ATRA”) tax notices of

reassessment for various taxation years. The reassessments deny the

application and usage of certain non-capital losses, capital

losses, deductions and investment tax credits arising from prior

years. The Company and its subsidiaries had filed notices of

objection and notices of appeal to the reassessments with the CRA

and ATRA.

The appeal with the Tax Court of Canada (“TCC”)

for one of the reassessed companies, Madison Pacific Properties

Inc., was heard in 2020, 2022 and in 2023 (the “MPP Appeal”). The

TCC released its judgement on the MPP Appeal on December 27, 2023

in favour of the CRA’s position, confirming the CRA’s

reassessments. The decision denied Madison Pacific Properties

Inc.’s ability to use certain carryforward losses for certain

taxation years within its 2009 to 2017 taxation years.

Based on the decision of the TCC in respect of

the MPP Appeal and other related factors, including the accounting

criteria under IFRS regarding tax contingencies, the Company has

recorded a full provision of $19.6 million against the carrying

value of the tax deposits and deferred tax assets related to unused

carryforward amounts and a liability for uncertain tax positions of

approximately $31.6 million for unpaid taxes and estimated interest

for all three tax reassessments. The total of these amounts, $51.2

million, was recognized to income tax expense of $36.7 million and

interest expense on uncertain tax positions of $14.5 million in the

Interim Consolidated Statement of (Loss) Income and Comprehensive

(Loss) Income for the three months ended November 30, 2023.

The Company and its counsel are evaluating

whether to appeal the decision issued by the TCC and will evaluate

its defense positions in respect of the two other reassessed

subsidiaries.

As at November 30, 2023, the Company owns

approximately $687 million in investment properties, including the

Company’s proportionate share of properties held through joint

operations.

As at the date of this Press Release, the

Company’s investment portfolio comprises 56 properties with

approximately 1.9 million rentable sq. ft. of industrial and

commercial space and a 50% interest in three multi-family rental

properties with a total of 109 units. Approximately 98.75% of

available space within the industrial and commercial investment

properties is currently leased. The Company’s development

properties include a 50% interest in the Silverdale Hills Limited

Partnership which currently owns approximately 1,400 acres of

residential designated development lands in Mission, British

Columbia.

For a review of the risks and uncertainties to

which the Company is subject, see its most recently filed annual

and interim MD&A.

The Company is pleased to announce that a $.0525

per share dividend on each of the Class B voting common shares and

Class C non-voting shares will be payable February 21, 2024 to

shareholders of record on February 6, 2024. The dividend is

considered an “eligible dividend” for tax purposes.

| Contact: |

Mr. John

Delucchi |

Ms. Bernice

Yip |

| |

President & CEO |

Chief Financial Officer |

| Telephone: |

(604) 732-6540 |

(604) 732-6540 |

| |

|

|

| Address: |

389 West 6th Avenue |

|

| |

Vancouver, B.C. V5Y 1L1 |

|

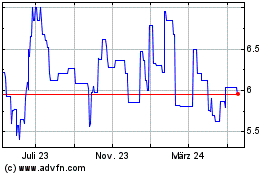

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

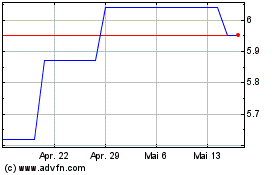

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024