First Capital Sets the Record Straight on Sandpiper’s Misleading Statements

27 Februar 2023 - 12:42PM

Business Wire

First Capital REIT’s (“First Capital” or the

“REIT”) (TSX: FCR.UN) board of trustees (the “Board”)

is addressing a February 24, 2023 letter from Samir Manji, CEO of

Sandpiper Group (“Sandpiper”) and CEO of Artis Real Estate

Investment Trust (TSX: AX.UN) (“Artis”) to First Capital’s

unitholders that included a number of mischaracterizations.

The Board has repeatedly engaged in good faith with Sandpiper

and Artis (the “Sandpiper Group”) in an effort to avoid the

cost and distraction associated with a proxy contest. As

demonstrated in the support and cooperation agreement reached with

Vision Capital and Ewing Morris, the Board is willing to find

compromises that are beneficial to all unitholders. Unfortunately,

the Sandpiper Group’s demands continue to be self-serving,

unreasonable, not in the best interest of First Capital and its

unitholders, and disproportionate relative to their ownership

interest.

Sandpiper and Artis have a troubling track record. Sandpiper has

a history of value destruction at other REITs, including Artis, and

a pattern of self-dealing, poor corporate governance and

self-enrichment. Artis has been fundamentally changed, to the

detriment of its unitholders, by Mr. Manji and his fellow Sandpiper

nominees since they acquired control of its board of trustees. Mr.

Manji, who is the CEO of both Sandpiper and Artis, has substantial

conflicts of interest.

Extensive without prejudice discussions preceded our proposal to

appoint an independent, non-Sandpiper trustee to the Board. This

proposal was an attempt, after much back and forth, to grant the

Sandpiper Group representation on our refreshed Board while

guarding against the conflicts posed by Mr. Manji. Mr. Manji’s

characterization of it, including of the time that he had to

consider it, is misleading. His outright rejection of this proposal

makes it clear that he is intent on installing himself on the Board

to advance the interests of Sandpiper and Artis, rather than those

of First Capital and its unitholders.

The Board continues to focus on ensuring that First Capital is

positioned to drive value for all unitholders. It has

constructively engaged and continues to engage with all unitholders

and has also acted decisively to respond to unitholder feedback in

a balanced, pragmatic and considered manner. This is reflected in

the REIT’s successful Enhanced Capital Allocation and Portfolio

Optimization Plan and the refreshed Board that will be presented to

unitholders for their support.

Unitholders will receive detailed information about the matters

to be presented at the annual and special meeting of unitholders to

be held on March 28, 2023 (the “Meeting”), and the Board has

every confidence that unitholders will carefully consider that

information before deciding how to vote. At this time, there is no

need for unitholders to take any action in respect of the

Meeting.

First Capital Advisors

Kingsdale Advisors is acting as strategic shareholder advisor to

First Capital. Gagnier Communications is acting as communications

advisor to First Capital. Stikeman Elliott LLP is acting as legal

counsel to the Board. RBC Capital Markets is acting as financial

advisor to First Capital.

About First Capital REIT (TSX: FCR.UN)

First Capital owns, operates and develops grocery-anchored,

open-air centres in neighbourhoods with the strongest demographics

in Canada.

FORWARD-LOOKING STATEMENT ADVISORY

This press release contains forward-looking statements and

information within the meaning of applicable securities law,

including but not limited to the Meeting and matters relating

thereto. These forward- looking statements are not historical facts

but, rather, reflect First Capital’s current expectations and are

subject to risks and uncertainties that could cause the outcome to

differ materially from current expectations. Such risks and

uncertainties include, among others, general economic conditions;

tenant financial difficulties, defaults and bankruptcies; increases

in operating costs, property taxes and income taxes; First

Capital’s ability to maintain occupancy and to lease or release

space at current or anticipated rents; development, intensification

and acquisition activities; residential development, sales and

leasing; risks in joint ventures; environmental liability and

compliance costs and uninsured losses; and risks and uncertainties

related to the impact of the ongoing pandemic, epidemics or other

outbreaks on First Capital which are described in First Capital’s

MD&A for the year ended December 31, 2022 under the heading

“Risks and Uncertainties - Ongoing Pandemic, Epidemics or New

Outbreaks”. Additionally, forward- looking statements are subject

to those risks and uncertainties discussed in First Capital’s

MD&A for the year ended December 31, 2022, and in its current

Annual Information Form. Readers, therefore, should not place undue

reliance on any such forward-looking statements. First Capital

undertakes no obligation to publicly update any such

forward-looking statement or to reflect new information or the

occurrence of future events or circumstances except as required by

applicable securities law. All forward-looking statements in this

press release are made as of the date hereof and are qualified by

these cautionary statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230227005510/en/

For further information:

Adam Paul President & CEO (416) 216-2081

adam.paul@fcr.ca

Neil Downey Executive Vice President, Enterprise Strategies

& CFO (416) 530-6634 neil.downey@fcr.ca

Media: Dan Gagnier Gagnier Communications +1 646 569-5897

FirstCapital@gagnierfc.com

www.fcr.ca TSX: FCR.UN

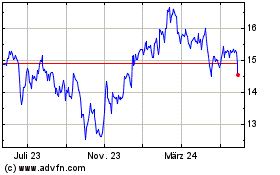

First Capital Real Estat... (TSX:FCR.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

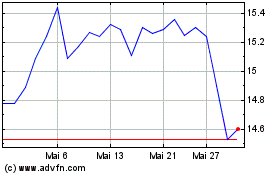

First Capital Real Estat... (TSX:FCR.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025