ENDEAVOUR REPORTS THAT WET COMMISSIONING IS UNDERWAY AT ITS ITY CIL PROJECT

20 Februar 2019 - 11:47AM

ENDEAVOUR REPORTS THAT WET COMMISSIONING IS UNDERWAY AT ITS

ITY CIL PROJECT

View News Release in PDF

HIGHLIGHTS

- Over 8 million man-hours have been worked without a lost

time injury

- Construction is on-budget & two months ahead of schedule

with first gold pour expected in early Q2-2019

- Dry commissioning has been completed and wet commissioning

has commenced; demobilization of the construction team has also

commenced

- Ity is expected to produce 160 - 200koz in 2019 at an AISC

of $525 - 590/oz, with the bottom-end of production guidance

corresponding to the nameplate capacity

- Aggressive exploration program underway with seven drill

rigs active on the La Plaque target with the aim of publishing an

updated resource in Q2-2019

Abidjan, February 20, 2019 - Endeavour

Mining Corporation (TSX:EDV)(OTCQX:EDVMF) ("Endeavour") is pleased

to announce that excellent progress continues to be made at its Ity

CIL project in Côte d'Ivoire, as wet commissioning has commenced.

Construction is progressing on-budget with over 97% of the total

project complete and the first gold pour expected to occur two

months ahead of schedule in early Q2-2019.

Sébastien de Montessus, President & CEO,

stated: "We are proud of the key milestones achieved in recent

months as the project construction has been significantly

de-risked. We are excited to have commenced the commissioning phase

several months ahead of the initial schedule and look forward to

the first gold pour in early Q2-2019.

The start of production at Ity will be a

transformative moment for Endeavour. It will become, alongside

Houndé, our second flagship mine, and marks the end of several

years of large capital-intensive projects which will allow us to

focus on cash flow generation and generating returns on our capital

employed.

With seven drill rigs currently operating in the

Le Plaque area, we expect our additional exploration activity to

further demonstrate the potential of Ity."

Key milestones achieved to date include:

- Over 8 million man-hours have been worked without a lost time

injury.

- Overall project completion stands at more than 97%, tracking

approximately two months ahead of schedule.

- The project remains on-budget with the remaining cash outflow

for 2019 amounting to $50 - $60 million.

- Wet commissioning has commenced and, in preparation for

production, ore is expected to be introduced into the process plant

milling circuit in the coming days.

Image 1: Process Plant - Wet Plant

- The dry plant has been successfully commissioned.

Image 2 : Process Plant - Dry Plant

Image 3 : Site Aerial View

- The tailings storage facility construction is complete.

Image 4: Tailings Storage Facility

- The 11kV switch room and 11kV overhead power line have been

commissioned, the 90kV transmission line construction is nearly

complete, and the back-up power station has been commissioned.

Image 5 : Switchyard and Power Station

- The Daapleu haul bridge construction and river diversion have

been completed.

Image 6: Haul Bridge

- The resettlement of Daapleu is complete and the official

ceremony of handing over the houses took place on December 10,

2018.

Image 7: Village Resettlement

- Construction of the 312-room permanent employee camp, messing,

and staff recreation facilities are complete.

Image 8: Employee Permanent Camp

- Pre-stripping commenced at the Bakatouo and Ity Flat deposits

in late 2018.

Image 9: Mining Activity

- Demobilization of construction personnel has begun following

the completion of key construction milestones, and operating teams

are in place with training programs well underway.

- Ity is expected to produce 160 - 200koz in 2019 at an AISC of

$525 - 590/oz, with the bottom-end production guidance

corresponding to the nameplate capacity while the top-end factors

possible upsides such as an earlier start date, a quicker than

expected ramp-up and the plant producing above its nameplate.

- An aggressive exploration program is underway, with seven drill

rigs active on the La Plaque target with the aim of publishing an

updated resource in Q2-2019. For 2019, a total of 70,000-meters are

planned to be drilled in the Le Plaque area and on other nearby

targets.

QUALIFIED PERSONS

Jeremy Langford, Endeavour's Chief Operating

Officer - Fellow of the Australasian Institute of Mining and

Metallurgy - FAusIMM, is a Qualified Person under NI 43-101, and

has reviewed and approved the technical information in this news

release.

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

Brunswick Group LLP in London Carole Cable, Partner +44 7974

982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.

Endeavour operates 4 mines across Côte d'Ivoire

(Agbaou and Ity) and Burkina Faso (Houndé, Karma) which are

expected to produce 615-695koz in 2019 at an AISC of

$760-810/oz.

For more information, please visit

www.endeavourmining.com.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

- Image 1: Process Plant - Wet Plant.jpg

- View News Release in PDF Format.pdf

- Image 8: Employee Permanent Camp.jpg

- Image 7: Village Resettlement.jpg

- Image 2 : Process Plant - Dry Plant.jpg

- Image 3 : Site Aerial View.jpg

- Image 5 : Switchyard and Power Station.jpg

- Image 9: Mining Activity.jpg

- Image 4: Tailings Storage Facility.jpg

- Image 6: Haul Bridge.jpg

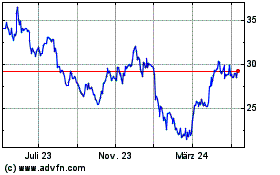

Endeavour Mining (TSX:EDV)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

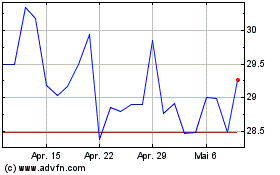

Endeavour Mining (TSX:EDV)

Historical Stock Chart

Von Dez 2023 bis Dez 2024