Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) today

announced financial results for the quarter ended June 30, 2024.

Connor Teskey, President of Brookfield Asset

Management stated, “We had another strong quarter, which included

$68 billion of capital raised. There is strong momentum in our

Credit business, providing solutions to our partners globally. We

also continue to see unprecedented opportunities in our Renewable

Power and Transition business, as evidenced by the recent

partnership with Microsoft and our agreement to acquire Neoen, one

of the world’s leading renewable power operators. With one of the

largest pipelines of over 230,000 megawatts of renewable power in

operation and under development, and our rapidly growing data

center platforms, which has seen its US capacity grow four fold

over the last two years, we are the infrastructure leader behind

the ongoing AI revolution.”

He continued, “We now have approximately $1

trillion of assets under management. This reflects the dedication

and talent of our over 2,400 investment and asset management

professionals and nearly a quarter-million operating employees

around the world, and is a testament to our commitment to serving

our clients and delivering attractive, consistent risk-adjusted

returns over the long term.”

Operating Results

Brookfield Asset Management

Ltd.

Net income for Brookfield Asset Management Ltd.

(BAM), the publicly traded entity, totaled $124 million for the

quarter (2023 - $109 million). BAM owns an approximate 27% interest

in our asset management business with the other approximate 73%

owned by Brookfield Corporation. In order to provide meaningful

comparative information, the discussion that follows relates to the

financial results on a 100% basis for our asset management business

(Brookfield Asset Management).

Brookfield Asset Management1

|

For the periods ended June 30 |

Three Months Ended |

Twelve Months Ended |

|

(US$ millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Fee-Related Earnings2 |

$ |

583 |

|

$ |

548 |

|

$ |

2,281 |

|

$ |

2,194 |

|

|

Add back: equity-based compensation costs and other3 |

|

41 |

|

|

47 |

|

|

188 |

|

|

150 |

|

|

Less: cash taxes |

|

(76 |

) |

|

(68 |

) |

|

(220 |

) |

|

(161 |

) |

|

Distributable Earnings2 |

$ |

548 |

|

$ |

527 |

|

$ |

2,249 |

|

$ |

2,183 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee-related earnings per share |

$ |

0.36 |

|

$ |

0.34 |

|

$ |

1.40 |

|

$ |

1.34 |

|

|

Distributable earnings per share |

$ |

0.34 |

|

$ |

0.32 |

|

$ |

1.38 |

|

$ |

1.33 |

|

|

Net income attributable to Brookfield Asset

Management |

$ |

495 |

|

$ |

455 |

|

$ |

1,804 |

|

$ |

1,870 |

|

|

See endnotes |

|

|

|

|

|

|

Operating Highlights

Financial Results

Fee-bearing capital reached $514 billion at the

end of the second quarter, up $74 billion or 17% over the past year

and up $55 billion or 12% from the prior quarter.

Brookfield Asset Management’s fee-related

earnings were $583 million ($0.36 / share) for the quarter

and $2.3 billion ($1.40 / share) over the last twelve months,

up 6% and 4% over the same periods in the prior year,

respectively.

Distributable earnings were $548 million ($0.34

/ share) for the quarter and $2.2 billion ($1.38 / share) over the

last twelve months, up 4% and 3% over the same periods in the prior

year, respectively.

Brookfield Asset Management began managing

capital on behalf of AEL in May; therefore second quarter results

only reflect the impact of half a quarter of fees from this

mandate. On an annualized basis, FRE and DE at the end of the

quarter were $2.5 billion and $2.4 billion, up 11% and 12% from a

year ago, respectively.

Fundraising

We raised $68 billion in the second quarter of

2024. Notable fundraising updates during the second quarter

include:

- Within our credit franchise, we

raised $61 billion of capital, including $49 billion of insurance

capital from AEL. We also raised capital in our opportunistic

credit fund, our life sciences income fund, and our value

opportunities fund. Additionally, we held a first close of $500

million in the latest vintage of our music royalty platform,

Primary Wave.

- We raised $4.0 billion of capital

in our renewable power and transition business, and expect

additional closes for our Global Transition flagship and a first

close for our Catalytic Transition fund later this year.

- Within our infrastructure business,

we raised a total of $900 million, primarily within our private

wealth and perpetual infrastructure funds. This fundraising within

our supercore infrastructure fund was the highest quarterly total

for this strategy since 2022.

- Within our real estate business, we

raised $1.1 billion, including additional capital for the fifth

vintage of our opportunistic real estate flagship fund, bringing

the total fund strategy to approximately $9 billion, with

additional closes expected before year end.

- We raised over $500 million of

capital in our private equity business, including capital for

Pinegrove Capital Partners, bringing that total fund size to

approximately $800 million.

Deployment and Recent Deal Announcements

In the second quarter, we deployed or committed to deploy

approximately $20 billion of capital into investments across a

number of high-quality businesses and assets.

Notable deployments in the quarter include:

- Deployed $6.0 billion across our credit portfolio, including

$2.2 billion across the eleventh and twelfth vintages of our

opportunistic credit flagships and $1.1 billion within our

strategic credit fund.

- Deployed $1.5 billion across our real estate platform,

including approximately $500 million into a U.S. Multifamily

Portfolio in the fifth vintage of our opportunistic real estate

flagship fund.

- Deployed approximately $500 million out of the first vintage of

our global transition flagship fund, including approximately $200

million towards our investment in a Latin American-focused power

provider.

Notable commitments include:

- In June, we entered into an agreement to acquire a majority

stake in Neoen, a global, leading, pure-play renewable development

business. This transaction is a key strategic investment in the

second vintage of our global transition flagship fund and we expect

the transaction to be closed by the first quarter of 2025.

- Also in June, we purchased GEMS Education, a premier private

education provider based in the Middle East, with its founder

representing $2.0 billion in equity. This was closed into our

Strategic Initiatives fund and Middle East fund, along with other

partners, and underscores our commitment to investing in this

high-growth region. The deal is expected to be completed in the

third quarter.

- Subsequent to quarter-end, we announced the acquisition of

nVent Electric’s electrical thermal solutions business for $850

million of equity. This business is the leading designer and

manufacturer of electric heat trace systems and products, which are

mission critical and enable operational safety and efficiency for

many essential industries.

Uncalled Fund Commitments and Cash on Hand

As of June 30, 2024, we had a total of $107 billion of uncalled

fund commitments.

- Uncalled fund commitments include

$51 billion which is not currently earning fees, but which will

earn approximately $510 million of fees annually once

deployed.

In addition, we held $1.9 billion of cash and equivalents on our

balance sheet as of June 30, 2024.

Recent Strategic Transactions

We announced several strategic transactions during the

quarter:

- In April, we acquired an additional

5% interest in Oaktree, which brings our ownership stake to

approximately 73%.

- In May, Pinegrove Capital Partners,

a manager focused on technology secondary solutions that we own

through our joint venture with Sequoia Heritage, signed a

definitive agreement to acquire SVB Capital, the asset management

division of SVB Financial. SVB Capital is a multi-strategy

investment platform that manages a series of venture capital fund

of funds, as well as other funds focused on private technology and

life science companies throughout the innovation

economy.

Regular Dividend Declaration

The board of directors of Brookfield Asset

Management Ltd. declared a quarterly dividend of $0.38 per share,

payable on September 27, 2024, to shareholders of record as of the

close of business on August 30, 2024.

End Notes

- Reflects full period results unless

otherwise noted on a 100% basis for Brookfield Asset Management,

being Brookfield Asset Management ULC and its subsidiaries,

including its share of the asset management activities of partly

owned subsidiaries.

- See Reconciliation of Net Income to

Fee-Related Earnings and Distributable Earnings on page 6 and

Non-GAAP and Performance Measures section on page 8.

- Equity-based compensation costs and

other income includes Brookfield Asset Management's portion of

partly owned subsidiaries investment income, realized carried

interest, and other items.

|

Brookfield Asset Management Ltd. Statement of Financial

Position |

|

|

|

UnauditedAs at(US$ millions) |

June 30,2024 |

December 31,2023 |

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

10 |

$ |

9 |

|

Investment in Brookfield Asset Management |

|

3,330 |

|

2,270 |

|

Due from affiliates |

|

769 |

|

886 |

|

Other assets |

|

76 |

|

40 |

|

Total Assets |

$ |

4,185 |

$ |

3,205 |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Accounts payable and other |

$ |

709 |

$ |

859 |

|

Due to affiliates |

|

216 |

|

261 |

|

Total Liabilities |

|

925 |

|

1,120 |

|

|

|

|

|

|

| Equity |

|

|

|

|

|

Total Equity |

|

3,260 |

|

2,085 |

|

Total Liabilities and Equity |

$ |

4,185 |

$ |

3,205 |

|

Brookfield Asset Management Ltd. Statement

of Operating Results |

|

|

|

Unaudited |

Three Months Ended |

|

For the periods ended June 30 Three Months Ended(US$ millions,

except per share amounts) |

|

2024 |

|

|

2023 |

|

|

Equity accounted income |

$ |

130 |

|

$ |

114 |

|

|

Compensation and other expenses |

|

(6 |

) |

|

(5 |

) |

|

Net Income |

$ |

124 |

|

$ |

109 |

|

|

Net income per share of common stock |

|

|

|

|

|

|

|

Diluted |

$ |

0.30 |

|

$ |

0.28 |

|

|

Basic |

$ |

0.30 |

|

$ |

0.28 |

|

|

Brookfield Asset Management Statement of Financial

Position |

|

|

|

UnauditedAs at (US$ millions) |

|

June 30,2024 |

|

December 31,2023 |

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

1,931 |

$ |

2,667 |

|

Accounts receivable and other |

|

562 |

|

588 |

|

Investments |

|

8,276 |

|

7,522 |

|

Due from affiliates |

|

2,358 |

|

2,504 |

|

Deferred income tax assets and other assets |

|

1,020 |

|

1,009 |

|

Total Assets |

$ |

14,147 |

$ |

14,290 |

|

Liabilities |

|

|

|

|

|

Accounts payable and other |

$ |

1,899 |

$ |

1,799 |

|

Due to affiliates |

|

997 |

|

986 |

|

Deferred income tax liabilities and other |

|

2,274 |

|

2,206 |

|

|

|

5,170 |

|

4,991 |

|

|

|

|

|

|

|

Equity |

|

8,977 |

|

9,299 |

|

|

|

|

|

|

|

Total Liabilities and Equity |

$ |

14,147 |

$ |

14,290 |

|

Brookfield Asset Management Statement of Operating

Results |

|

|

|

Unaudited |

Three Months Ended |

|

For the periods ended June 30 (US$ millions, except per share

amounts) |

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

Management fee and incentive distribution revenues |

$ |

821 |

|

$ |

770 |

|

|

Carried interest income, net of amounts attributable to

Corporation |

|

54 |

|

|

54 |

|

|

Other revenue, net |

|

41 |

|

|

161 |

|

|

Total Revenues |

|

916 |

|

|

985 |

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

Compensation, operating, and general and administrative

expenses |

|

(368 |

) |

|

(348 |

) |

|

Interest expense |

|

(5 |

) |

|

(5 |

) |

|

Total Expenses |

|

(373 |

) |

|

(353 |

) |

|

Other income |

|

64 |

|

|

75 |

|

|

Share of income from equity accounted investments |

|

53 |

|

|

29 |

|

|

Income Before Taxes |

|

660 |

|

|

736 |

|

|

Income tax expense |

|

(142 |

) |

|

(156 |

) |

|

Net Income |

|

518 |

|

|

580 |

|

|

Net income attributable to Brookfield Corporation |

|

23 |

|

|

125 |

|

|

Net income attributable to Brookfield Asset

Management |

$ |

495 |

|

$ |

455 |

|

|

Net income per share |

|

|

|

|

|

|

|

Diluted |

$ |

0.30 |

|

$ |

0.28 |

|

|

Basic |

$ |

0.30 |

|

$ |

0.28 |

|

|

SELECT FINANCIAL INFORMATION |

|

|

|

RECONCILIATION OF NET INCOME TO FEE-RELATED EARNINGS AND

DISTRIBUTABLE EARNINGS |

|

|

|

Brookfield Asset Management |

|

|

|

Unaudited |

Three Months Ended |

|

For the periods ended June 30 (US$ millions) |

|

2024 |

|

|

2023 |

|

|

Net income |

$ |

518 |

|

$ |

580 |

|

|

Add or subtract the following: |

|

|

|

|

|

|

|

Provision for taxes1 |

|

142 |

|

|

156 |

|

|

Depreciation and amortization2 |

|

3 |

|

|

3 |

|

|

Carried interest allocations3 |

|

(55 |

) |

|

(114 |

) |

|

Carried interest allocation compensation3 |

|

(40 |

) |

|

(3 |

) |

|

Other income and expenses4 |

|

(24 |

) |

|

(72 |

) |

|

Interest expense paid to related parties5 |

|

5 |

|

|

5 |

|

|

Interest and dividend revenue5 |

|

(36 |

) |

|

(40 |

) |

|

Other revenues6 |

|

— |

|

|

(31 |

) |

|

Share of income from equity accounted investments7 |

|

(53 |

) |

|

(29 |

) |

|

Fee-related earnings of partly owned subsidiaries at our

share7 |

|

77 |

|

|

65 |

|

|

Compensation costs recovered from affiliates8 |

|

45 |

|

|

22 |

|

|

Fee Revenues from BSREP III & other9 |

|

1 |

|

|

6 |

|

|

Fee-Related Earnings |

|

583 |

|

|

548 |

|

|

Cash taxes10 |

|

(76 |

) |

|

(68 |

) |

|

Add back: equity-based compensation costs and other11 |

|

41 |

|

|

47 |

|

|

Distributable Earnings |

$ |

548 |

|

$ |

527 |

|

- This adjustment removes the impact

of income tax provisions on the basis that we do not believe this

item reflects the present value of the actual tax obligations that

we expect to incur over the long-term due to the substantial

deferred tax assets of Brookfield Asset Management.

- This adjustment removes the

depreciation and amortization on property, plant and equipment and

intangible assets, which are non-cash in nature and therefore

excluded from Fee-Related Earnings.

- These adjustments remove unrealized

carried interest allocations and the associated compensation

expense, which are excluded from Fee- Related Earnings as these

items are unrealized in nature.

- This adjustment removes other

income and expenses associated with non-cash fair value

changes.

- This adjustment removes interest

and charges paid or received involving related party loans.

- This adjustment adds back other

revenues earned that are non-cash in nature.

- These adjustments remove our share

of partly owned subsidiaries’ earnings, including items 1) to 6)

above and include its share of partly owned subsidiaries’

Fee-Related Earnings.

- This item adds back compensation

costs that will be borne by affiliates and are non-cash in

nature.

- This adjustment adds back base

management fees earned from funds that are eliminated upon

consolidation and other items.

- Represents the impact of cash taxes

paid by the business.

- This adjustment adds back

equity-based compensation and other income associated with

Brookfield Asset Management’s portion of partly owned subsidiaries’

investment income, realized carried interest and other items.

Additional Information

The Letter to Shareholders and the Supplemental

Information for the three months and twelve months ended June 30,

2024 contain further information on the company’s strategy,

operations and financial results. Shareholders are encouraged to

read these documents, which are available on BAM’s website.

The statements contained herein are based

primarily on information that has been extracted from our financial

statements for the quarter ended June 30, 2024, which have been

prepared using U.S. GAAP. The amounts have not been audited by

BAM’s external auditor.

BAM’s board of directors has reviewed and

approved this document, including the summarized unaudited

consolidated financial statements, prior to its release.

Information on our dividends can be found on our

website under Stock & Distributions - Distribution History

section at bam.brookfield.com.

Quarterly Earnings Call Details

Investors, analysts and other interested parties

can access BAM’s Second Quarter 2024 Results, as well as the Letter

to Shareholders and Supplemental Information, on its website under

the Reports & Filings section at bam.brookfield.com.

To participate in the Conference Call today at

11:00 a.m. ET, please preregister at https://register.vevent.com/

register/BIfc7713ee998f400c8d32e654adb9f59d. Upon registering, you

will be emailed a dial-in number, and unique PIN.

The Conference Call will also be webcast live at

https://edge.media-server.com/mmc/p/7edugn7v. For those unable to

participate in the Conference Call, the telephone replay will be

archived and available until August 7, 2025, or available on our

website at bam.brookfield.com.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM,

TSX: BAM) is a leading global alternative asset manager with

approximately $1 trillion of assets under management across

renewable power and transition, infrastructure, private equity,

real estate, and credit. We invest client capital for the long-term

with a focus on real assets and essential service businesses that

form the backbone of the global economy. We offer a range of

alternative investment products to investors around the world —

including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors. We draw on

Brookfield’s heritage as an owner and operator to invest for value

and generate strong returns for our clients, across economic

cycles.

Please note that Brookfield Asset Management

Ltd.’s previous audited annual and unaudited quarterly reports have

been filed on EDGAR and SEDAR+ and can also be found in the

investor section of its website at bam.brookfield.com. Hard copies

of the annual and quarterly reports can be obtained free of charge

upon request.

For more information, please visit our website at

bam.brookfield.com or contact:

|

Media:Kerrie McHugh HayesTel: (212) 618-3469Email:

kerrie.mchugh@brookfield.com |

Investor Relations:Jason FooksTel: (866)

989-0311Email: jason.fooks@brookfield.com |

| |

|

Non-GAAP and Performance

Measures

This news release and accompanying financial

information are based on generally accepted accounting principles

in the United States of America (“U.S. GAAP”).

We make reference to Distributable Earnings

(“DE”), which is referring to the sum of its fee-related earnings,

realized carried interest, realized principal investments, interest

expense, and general and administrative expenses; excluding

equity-based compensation costs and depreciation and amortization.

The most directly comparable measure disclosed in the primary

financial statements of Brookfield Asset Management for DE is net

income. This provides insight into earnings received by the company

that are available for distribution to common shareholders or to be

reinvested into the business.

We use Fee-Related Earnings (“FRE”) and DE to

assess our operating results and the value of Brookfield’s business

and believe that many shareholders and analysts also find these

measures of value to them.

We disclose a number of financial measures in

this news release that are calculated and presented using

methodologies other than in accordance with U.S. GAAP. These

financial measures, which include FRE and DE, should not be

considered as the sole measure of our performance and should not be

considered in isolation from, or as a substitute for, similar

financial measures calculated in accordance with U.S. GAAP. We

caution readers that these non-GAAP financial measures or other

financial metrics are not standardized under U.S. GAAP and may

differ from the financial measures or other financial metrics

disclosed by other businesses and, as a result, may not be

comparable to similar measures presented by other issuers and

entities.

We provide additional information on key terms

and non-GAAP measures in our filings available at

bam.brookfield.com.

Notice to Readers

BAM is not making any offer or invitation of any

kind by communication of this news release and under no

circumstance is it to be construed as a prospectus or an

advertisement.

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of the

U.S. Securities Act of 1933, the U.S. Securities Exchange Act of

1934, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations (collectively, “forward-looking

statements”). Forward- looking statements include statements that

are predictive in nature, depend upon or refer to future results,

events or conditions, and include, but are not limited to,

statements which reflect management’s current estimates, beliefs

and assumptions regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies, capital management and outlook of BAM, Brookfield Asset

Management and its subsidiaries, as well as the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and which are in turn based on our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors

management believes are appropriate in the circumstances. The

estimates, beliefs and assumptions of BAM are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Forward-looking statements are typically identified by

words such as “target”, “project”, “forecast”, “expect”,

“anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”,

“intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and

similar expressions. In particular, the forward-looking statements

contained in this news release include statements referring to

future results, performance, achievements, prospects or

opportunities of BAM, Brookfield Asset Management or the Canadian,

U.S. or international markets.

Although BAM believes that such forward-looking

statements are based upon reasonable estimates, beliefs and

assumptions, actual results may differ materially from the

forward-looking statements. Factors that could cause actual results

to differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: (i) our

lack of independent means of generating revenue; (ii) our material

assets consisting solely of our interest in Brookfield Asset

Management; (iii) challenges relating to maintaining our

relationship with Brookfield Corporation and potential conflicts of

interest; (iv) BAM being a newly formed company; (v) our liability

for our asset management business; (vi) inflationary pressures;

(vii) the impact on growth in fee-bearing capital of poor product

development or marketing efforts; (viii) our ability to maintain

our global reputation; (ix) volatility in the trading price of our

class A limited voting shares; (x) being subjected to numerous

laws, rules and regulatory requirements, and the potential

ineffectiveness of our policies to prevent violations thereof; (xi)

meeting our financial obligations due to our cash flow from our

asset management business; (xii) foreign currency risk and exchange

rate fluctuations; (xiii) requirement of temporary investments and

backstop commitments to support our asset management business;

(xiv) rising interest rates; (xv) revenues impacted by a decline in

the size or pace of investments made by our managed assets; (xvi)

the variability of our earnings growth, which may affect our

dividend and the trading price of our class A limited voting

shares; (xvii) exposed risk due to increased amount and type

of investment products in our managed assets; (xviii) difficulty in

maintaining our culture or managing our human capital; (xix)

political instability or changes in government; (xx) unfavorable

economic conditions or changes in the industries in which we

operate; (xxi) catastrophic events, such as earthquakes,

hurricanes, or pandemics/epidemics; (xxii) deficiencies in public

company financial reporting and disclosures; (xxiii) ineffective

management of sustainability considerations, and inadequate or

ineffective health and safety programs; (xxiv) the failure of

our information and technology systems; (xxv) us and our managed

assets becoming involved in legal disputes; (xxvi) losses not

covered by insurance; (xxvii) inability to collect on amounts owing

to us; (xxviii) information barriers that may give rise to

conflicts and risks; (xxix) risks related to our renewable power

and transition, infrastructure, private equity, real estate, and

other alternatives, including credit strategies; (xxx) risks

relating to Canadian and United States taxation laws; and (xxxi)

other factors described from time to time in our documents filed

with the securities regulators in Canada and the United States.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive and other

factors could also adversely affect future results. Readers are

urged to consider these risks, as well as other uncertainties,

factors and assumptions carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such

forward-looking statements, which are based only on information

available to us as of the date of this news release. Except as

required by law, BAM undertakes no obligation to publicly update or

revise any forward-looking statements, whether written or oral,

that may be as a result of new information, future events or

otherwise.

Past performance is not indicative nor a

guarantee of future results. There can be no assurance that

comparable results will be achieved in the future, that future

investments will be similar to historic investments discussed

herein, that targeted returns, growth objectives, diversification

or asset allocations will be met or that an investment strategy or

investment objectives will be achieved (because of economic

conditions, the availability of appropriate opportunities or

otherwise).

Target returns and growth objectives set forth

in this news release are for illustrative and informational

purposes only and have been presented based on various assumptions

made by BAM in relation to the investment strategies being pursued,

any of which may prove to be incorrect. There can be no assurance

that targeted returns or growth objectives will be achieved. Due to

various risks, uncertainties and changes (including changes in

economic, operational, political or other circumstances) beyond

BAM’s control, the actual performance of the business could differ

materially from the target returns and growth objectives set forth

herein. In addition, industry experts may disagree with the

assumptions used in presenting the target returns and growth

objectives. No assurance, representation or warranty is made by any

person that the target returns or growth objectives will be

achieved, and undue reliance should not be put on them.

Certain of the information contained herein is

based on or derived from information provided by independent

third-party sources. While BAM believes that such information is

accurate as of the date it was produced and that the sources from

which such information has been obtained are reliable, BAM makes no

representation or warranty, express or implied, with respect to the

accuracy, reasonableness or completeness of any of the information

or the assumptions on which such information is based, contained

herein, including but not limited to, information obtained from

third parties.

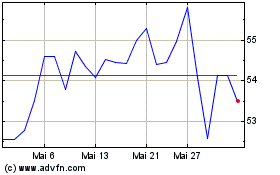

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024