Argonaut Gold (TSX: AR) today announced its full results for the

first quarter ended March 31, 2010.

Quarterly Highlights year over year

-- Total Tonnes mined up + 90%

-- Ore tonnes processed up + 102%

-- Gold Production up +72%

-- Cash cost per Oz. produced (El Castillo) down -10%

-- Revenue from Operations up +211%

-- Cash flow from Operations up +331%

-- New mining contract & fleet

-- New crushing contract & circuit

-- Cash and short-term investments $35MM

CEO Commentary:

Pete Dougherty, President and CEO, made the following comments

in regards to El Castillo's first quarter 2010 results: "El

Castillo has shown strong quarterly production results, with

significant year-over-year growth in production. Our exploration

success has provided a solid foundation for potential resource

& reserve expansion. The capital expansion program is well

underway with significant progress in the process and plant

expansion projects. These improvements provide me with comfort that

we will be able to achieve our goal of increasing overall

production by 60%+ to 47,000 ounces for 2010."

This press release should be read in conjunction with the

Company's unaudited consolidated interim financial statements for

the quarter-ended March 31, 2010 and associated Management's

Discussion and Analysis ("MD&A") which are available from the

Company's website www.argonautgoldinc.com, in the "Investors"

section under "Financial Filings", and on SEDAR www.sedar.com.

Summary of Production Results:

Year over year, total tonnes mined increased by +90%, with

approximately 1 million tonnes moved in March. The increase in

total tonnes mined is due to a larger more efficient truck fleet,

more heap leach capacity and improvements being made to the

crushing circuit capacity. We are targeting production of 1.5

million total tonnes per month in the latter part of the year. We

will achieve these results by replacing our 40 ton fleet with a new

larger 100 ton mining fleet and higher capacity loaders. This fleet

will begin to arrive on site during July with commissioning to

follow shortly thereafter. Tonnes of ore placed on the pads

increased over 100% to 1.3 million tonnes for the quarter. Crushed

ore increased to 314,405 tonnes or 58% quarter over quarter. The

new crushing equipment has been delivered, installed and is being

commissioned. This new equipment is anticipated to increase

crushing capacity to 300,000 tonnes per month in the future.

Gold production of 10,242 ounces in the first quarter of 2010

was a 72% increase compared to the first quarter of 2009. This

improvement was due to the increased mining and processing

capacities at the mine. Key operational metrics and production

statistics for the first quarter of 2010 compared to 2009 are

presented at the end of this press release in Table 1.

Cash cost of operations decreased 9% to $590 per ounce

reflecting increased ore tonnes to the pad and lower operating cost

per tonne mined offset by lower grade mined coupled with higher

chemical consumption associated with increased production.

Capital Expansion Program:

The 100x100 meter drill program has been completed ahead of

schedule and under budget. To-date we have expanded the

mineralization 400 to 500 meters to the south and 300 to 400 meters

east of the known pit boundary. We have embarked upon a new 50x50

meter drill program to further define the ore body. Investments to

expand crushing capabilities are well underway with all equipment

on site. Expansion of our heap leach pads has grown to include pads

5 & 6 being completed and commissioned. Permits to expand the

mine including pad 7, the east pad and the new processing facility

were granted. Currently, pads 7 and cell 1 of the east pad are

under construction. The plant modifications are well in hand with

anticipated carbon columns for the existing facility to arrive in

May with commissioning in June.

While the expansion improvements provide the framework for

meeting current projected production at El Castillo, drilling

success will allow for increases in future production by adding to

resources and reserves.

Summary of Financial Results:

Financial results for the first quarter of 2010 improved

significantly over the first quarter of 2009, as a result of higher

ounces of production. Revenue increased 172% to $9.3 million, from

increased production and higher gold prices. Cost of goods sold of

$9.3 million was high due to purchase price accounting fully

valuing all pad and finished goods inventory at the date of

acquisition of Castle Gold on December 30, 2009. Actual operating

costs were $590 per ounce reflecting lower grades mined and higher

chemical consumption associated with increased tonnage. Net loss

was $3.2 million reflecting the purchase price allocation and

amortization of the initial purchase of the project.

Looking forward:

Argonaut projects gold production of 47,000 ounces for 2010,

with an annualized run rate in December 2010 of 60,000 ounces per

year. We anticipate cash cost to be approximately $565 per

ounce.

Cash Requirements:

Our original capital expansion program of $10 Million has

increased to $15-20 million. After a successful phase 1 drilling

program, the company has elected to embark upon an expanded drill

program and increase the process facility capacity. The company

anticipates funding these capital needs from its operating cash

flow and cash on hand.

Reminder of Q1 2010 Financial Results Conference Call and

Webcast:

Argonaut Gold will host a conference call on Tuesday, May 18,

2010 at 9:30 am EDT to discuss the first quarter 2010 results and

provide an update of the Company's operating, exploration, and

development activities.

Participants may join the conference call by dialing 1 (888)

430-8701 or 1 (719) 325-2105 for calls outside of Canada and the

United States. The pass code is 8186640. The conference call may

also be accessed via webcast by visiting the Company's website,

www.argonautgoldinc.com.

A recorded playback of the conference call can be accessed after

the event until June 2, 2010 by dialing 1 (888) 203-1112 or 1 (719)

457-0820 for calls outside Canada and the United States. The pass

code for the conference call playback is 8186640, followed by the #

key.

Reminder of Annual General and Special Meeting of

Shareholders:

Argonaut invites all shareholders to attend the Annual General

and Special Meeting of Shareholders ("AGM") on Wednesday, May 19,

2010. The AGM will begin at 10:00 am EDT and will be held at the

Fairmont Royal York Hotel, located at 100 Front Street West,

Toronto, Ontario. During the meeting, senior management will

provide a general corporate update followed by an informal

questions-and-answers session.

Table 1 - Summary of Production Results

El Castillo Operating Statistics 3/31/2010 3/31/2009(i)

------------------------------------ -------------- --------------

Total Tonnes mined 2,890,313 1,509,900

Tonnes Ore 1,313,526 651,500

Tonnes Ore-direct to leach pad 999,121 452,900

Tonnes Crushed 314,405 198,500

Gold Grade (grams/tonne) 0.39 0.57

Gold Produced (ounces) 10,242 5,968

Cash cost per ounce produced $590 $650

(i)Note: Information obtained from Castle Gold Corporation press release

dated May 28, 2009.

About Argonaut

Argonaut is a Canadian gold company engaged in exploration, mine

development and production activities. Its primary assets being the

production-stage El Castillo Project and the exploration-stage La

Fortuna Project, both located in the State of Durango, Mexico.

Argonaut is a new venture created by former executive management

team members of Meridian Gold Inc. Creating the Next Quality

Mid-Tier Gold Producer in the Americas.

Non-GAAP Measures

"Cash cost" is a non-GAAP measure calculated in accordance with

the Gold Institute Production Cost Standard and includes site costs

for all mining (excluding deferred stripping costs), processing

administration, royalties and production taxes but exclusive of

depletion, depreciation, reclamation, financing costs, capital

costs and exploration costs. Cash cost is presented as we believe

that it represents an industry standard of comparison.

"Cash cost per ounce" is a non-GAAP measure derived from the

cash cost of ounces produced as a measure of total ounces

produced.

Cash cost per ounce is not a term defined under Canadian

generally accepted accounting principles, and does not have a

standard, agreed upon meaning. As such cash cost per ounce may not

be directly comparable to cash cost per ounce reported by similar

issuers.

Cautionary Language Regarding Forward-Looking Information

This news release contains certain forward-looking statements.

Forward-looking statements include but are not limited to those

with respect to the price of gold, the estimation of mineral

resources and reserves, the realization of mineral reserve

estimates, the timing and amount of estimated future production,

costs of production, capital expenditures, costs and timing of

development of new deposits, success of exploration activities,

permitting time lines, currency fluctuations, requirements for

additional capital, completion of capital projects, availability of

financing on acceptable terms, government regulation of mining

operations, environmental risks, unanticipated reclamation expenses

and title disputes or claims and limitations on insurance coverage.

In certain cases, forward-looking statements can be identified by

the use of words such as "goal", "targets", "objective", "plans",

"expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates", or

"does not anticipate", or "believes" or variations of such words

and phrases, or state that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved. Forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Argonaut Gold to be

materially different from any future results, performance or

achievement expressed or implied by the forward-looking statements.

Such risks and uncertainties include, among others, the actual

results of current exploration activities, conclusions of economic

evaluations, changes in project parameters, possible variations in

grade and ore densities or recovery rates, failure of plant,

equipment or processes to operate as anticipated, accidents, labour

disputes or other risks of the mining industry, delays in obtaining

government approvals or financing or in completion of development

or construction activities, risks relating to the integration of

acquisitions, to international operations, to the price of

gold.

Although Argonaut Gold has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. It is

important to note, that: (i) unless otherwise indicated,

forward-looking statements indicate the Company's expectations as

at the date of this news release; (ii) actual results may differ

materially from the Company's expectations if known and unknown

risks or uncertainties affect its business, or if estimates or

assumptions prove inaccurate; (iii) the Company cannot guarantee

that any forward-looking statement will materialize and,

accordingly, readers are cautioned not to place undue reliance on

these forward-looking statements; and (iv) the Company disclaims

any intention and assumes no obligation to update or revise any

forward-looking statement even if new information becomes

available, as a result of future events or for any other reason. In

making the forward-looking statements in this news release,

Argonaut Gold has made several material assumptions, including but

not limited to, the assumption that: (i) consistent supply of

sufficient inputs including power will be available to develop and

operate the project as planned; (ii) metal prices and exchange

rates experienced match those anticipated; (iii) mineral reserve

and resource estimates are accurate; (iv) the technology used to

develop and operate its project will and will continue to work

effectively; (vi) that labour and materials will be sufficiently

plentiful as to not impede the projects or add significantly to the

estimated cash costs of operations; and (vii) that the process and

plan expansion projects continue to be implemented

successfully.

Contacts: Argonaut Gold Nichole Cowles Investor Relations

Manager (775) 284-4422 x 101 nichole.cowles@argonautgoldinc.com

www.argonautgoldinc.com

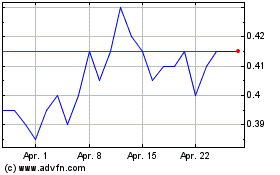

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

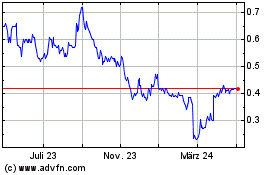

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024