false

0001166003

0001166003

2023-10-30

2023-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): October 30, 2023

XPO, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-32172 |

|

03-0450326 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

Five American Lane, Greenwich, Connecticut 06831

(Address of principal executive offices)

(855)

976-6951

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

XPO |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging growth company ¨ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

| Item 2.02. |

|

Results of Operations and Financial Condition. |

On October 30, 2023, XPO, Inc. (the “Company”)

issued a press release announcing its results of operations for the fiscal quarter ended September 30, 2023. A copy of the press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing

of the Company under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such

filing.

| Item 9.01. |

|

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 30,

2023 |

XPO, INC. |

| |

|

| |

By: |

/s/ Kyle Wismans |

| |

|

Kyle Wismans |

| |

|

Chief Financial Officer |

Exhibit 99.1

XPO Reports Third

Quarter 2023 Results

GREENWICH, Conn. – October 30,

2023 – XPO (NYSE: XPO) today announced its financial results for the third quarter 2023, reflecting a solid performance

in a soft industry environment for freight transportation. The company reported diluted earnings from continuing operations per share

of $0.72 and adjusted diluted earnings from continuing operations per share of $0.88.

| Third Quarter

2023 Summary Results |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Three

months ended September 30, | |

Revenue | | |

Operating

Income (Loss) | | |

Adjusted

EBITDA(1) | |

| (in

millions) | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| North American Less-Than-Truckload

Segment | |

$ | 1,228 | | |

$ | 1,205 | | |

$ | 161 | | |

$ | 162 | | |

$ | 241 | | |

$ | 240 | |

| European Transportation Segment | |

| 752 | | |

| 741 | | |

| 8 | | |

| 10 | | |

| 44 | | |

| 43 | |

| Corporate | |

| - | | |

| - | | |

| (15 | ) | |

| (33 | ) | |

| (7 | ) | |

| (21 | ) |

| Total | |

$ | 1,980 | | |

$ | 1,946 | | |

$ | 154 | | |

$ | 139 | | |

$ | 278 | | |

$ | 262 | |

| Three

months ended September 30, | |

Net

Income(2) | | |

Diluted

EPS(3) | | |

Adjusted

Diluted EPS(1)(3) | |

| (in

millions, except for per-share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Total | |

$ | 86 | | |

$ | 92 | | |

$ | 0.72 | | |

$ | 0.79 | | |

$ | 0.88 | | |

$ | 0.95 | |

| (1) Reconciliations

of adjusted EBITDA and adjusted diluted EPS are provided in the attached financial tables |

| (2) Net

income from continuing operations attributable to common shareholders |

| (3) Diluted

earnings from continuing operations per share |

Mario Harik, chief executive officer of XPO, said, “Our third

quarter results exceeded expectations, with solid growth in revenue and profitability, and strong forward momentum. We delivered year-over-year

revenue growth of 2%, and adjusted EBITDA growth of 6%, with 50 basis points of adjusted EBITDA margin expansion.

“In North American LTL, we’re improving every aspect of

the business that impacts customer service and value creation. Our third quarter adjusted operating ratio of 86.2% improved sequentially

by 140 basis points, and outpaced seasonality by 370 basis points. This was driven by gains in volume, pricing and labor productivity.

Our damage claims ratio was a company-best 0.4% — a significant improvement from 1.2% two years ago, when we launched our LTL 2.0

plan.

“We also captured more share in the quarter, as customers responded

to our focus on service and investments in capacity. Our yield growth, excluding fuel, accelerated to 6.4%, reflecting the benefit of

numerous pricing initiatives underway. We expect to further accelerate yield growth in the fourth quarter.”

Harik continued “It’s exciting to take large steps forward

across the business as we execute our plan. We’re making excellent progress, and I’m confident that we’re still in the

early innings of realizing XPO’s full potential.”

Third Quarter Highlights

For the third quarter 2023, revenue was $1.98 billion, compared to

$1.95 billion for the same period in 2022. The year-over-year increase in revenue was due primarily to higher tonnage per day and yield,

excluding fuel, in the North American LTL segment, partially offset by lower fuel surcharge revenue.

Net income from continuing operations attributable to common shareholders

was $86 million for the third quarter 2023, compared with $92 million for the same period in 2022. Operating income was $154 million for

the third quarter, compared with $139 million for the same period in 2022. Diluted earnings from continuing operations per share was $0.72

for the third quarter, compared with $0.79 for the same period in 2022.

Adjusted net income from continuing operations attributable to common

shareholders, a non-GAAP financial measure, was $105 million for the third quarter, compared with $110 million for the same period in

2022. Adjusted diluted earnings from continuing operations per share (“adjusted diluted EPS”), a non-GAAP financial measure,

was $0.88 for the third quarter, compared with $0.95 for the same period in 2022.

Adjusted earnings before interest, taxes, depreciation and amortization

(“adjusted EBITDA”), a non-GAAP financial measure, was $278 million for the third quarter, compared with $262 million for

the same period in 2022.

The company generated $236 million of cash flow from operating activities

in the third quarter, and ended the quarter with $355 million of cash and cash equivalents on hand, after $133 million of net capital

expenditures.

Reconciliations of non-GAAP financial measures in this press release

are provided in the attached financial tables. Seasonality is compared to the same period for the past five years excluding 2020.

Results by Business Segment

| · | North American Less-Than-Truckload (LTL): The segment generated revenue

of $1.23 billion for the third quarter 2023, compared with $1.21 billion for the same period in 2022. On a year-over-year basis,

shipments per day increased 7.8%, tonnage per day increased 3.1%, and yield, excluding fuel, increased 6.4%. Including fuel, yield increased

0.8%. |

Operating income was $161 million for the third quarter 2023,

compared with $162 million for the same period in 2022. Adjusted operating ratio, a non-GAAP financial measure, was 86.2%, compared with

85.6% a year ago, reflecting a sequential improvement of 140 basis points, compared with the second quarter in 2023.

Adjusted EBITDA for the third quarter 2023 was $241 million,

compared with $240 million for the same period in 2022. The year-over-year increase in adjusted EBITDA was due primarily to higher tonnage

per day and yield, excluding fuel, partially offset by lower fuel surcharge revenue and pension income.

| · | European Transportation: The segment generated revenue of $752 million

for the third quarter 2023, compared with $741 million for the same period in 2022. |

Operating income was $8 million for the third quarter 2023,

compared with $10 million for the same period in 2022. Adjusted EBITDA was $44 million for the third quarter 2023, compared with $43 million

for the same period in 2022.

Conference Call

The company will hold a conference call on Monday, October 30,

2023, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817.

A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors.

The conference will be archived until November 29, 2023. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853;

international callers dial +1-201-612-7415. Use participant passcode 13741540.

About XPO

XPO, Inc. (NYSE: XPO) is one of the largest providers of asset-based

less-than-truckload (LTL) transportation in North America, with proprietary technology that moves goods efficiently through its

network. Together with its business in Europe, XPO serves approximately 50,000 customers with 563 locations and 38,000 employees.

The company is headquartered in Greenwich, Conn., USA. Visit xpo.com for more information, and connect with XPO on Facebook,

X, LinkedIn, Instagram and YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission

(“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly

comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

XPO’s non-GAAP financial measures in this press release include:

adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis and for

corporate; adjusted EBITDA margin on a consolidated basis; adjusted net income from continuing operations attributable to common shareholders;

adjusted diluted earnings from continuing operations per share (“adjusted diluted EPS”); adjusted operating income for our

North American Less-Than-Truckload and European Transportation segments; and adjusted operating ratio for our North American Less-Than-Truckload

segment.

We believe that the above adjusted financial measures facilitate analysis

of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business

segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying

businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable

to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our

operating performance.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income from continuing

operations attributable to common shareholders and adjusted diluted EPS include adjustments for transaction and integration costs, as

well as restructuring costs and other adjustments as set forth in the attached tables. Transaction and integration adjustments are generally

incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting

fees, stock-based compensation, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to

integration and transformation activities) and certain costs related to integrating and converging IT systems. Restructuring costs primarily

relate to severance costs associated with business optimization initiatives. Management uses these non-GAAP financial measures in making

financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that adjusted EBITDA and adjusted EBITDA margin improve

comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation

and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective

of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted

net income from continuing operations attributable to common shareholders and adjusted diluted EPS improve the comparability of our operating

results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our

core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring

costs and other adjustments as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio

improve the comparability of our operating results from period to period by removing the impact of certain transaction and integration

costs and restructuring costs, as well as amortization expenses as set out in the attached tables.

Forward-looking Statements

This release includes forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,”

“continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,”

“should,” “will,” “expect,” “objective,” “projection,” “forecast,”

“goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory”

or the negative of these terms or other comparable terms. These forward-looking statements are based on certain assumptions and analyses

made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as

well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown

risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different

from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors

that might cause or contribute to a material difference include the risks discussed in our filings with the SEC, and the following: the

effects of business, economic, political, legal, and regulatory impacts or conflicts upon our operations; supply chain disruptions, the

global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation

and labor and equipment shortages; our ability to align our investments in capital assets, including equipment, service centers, and warehouses

and other network facilities, to our customers’ demands; our ability to implement our cost and revenue initiatives; the effectiveness

of our action plan, and other management actions, to improve our North American LTL business; our ability to benefit from a sale, spin-off

or other divestiture of one or more business units; our ability to successfully integrate and realize anticipated synergies, cost savings

and profit improvement opportunities with respect to acquired companies; goodwill impairment, including in connection with a business

unit sale or other divestiture; fluctuations in currency exchange rates; fuel price and fuel surcharge changes; the expected benefits

of the spin-offs of GXO Logistics, Inc. and RXO, Inc. on the size and business diversity of our company; our ability to develop

and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability

to raise debt and equity capital; fluctuations in fixed and floating interest rates; our ability to maintain positive relationships with

our network of third-party transportation providers; our ability to attract and retain qualified drivers; labor matters; litigation; risks

associated with our self-insured claims; governmental or political actions; and competition and pricing pressures.

All forward-looking statements set forth in this release are qualified

by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized

or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking

statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking

statements except to the extent required by law.

Investor Contact

Brian Scasserra

+1 617-607-6429

brian.scasserra@xpo.com

Media Contact

Karina Frayter

+1 203-484-8303

karina.frayter@xpo.com

XPO, Inc.

Condensed

Consolidated Statements of Income

(Unaudited)

(In

millions, except per share data)

| | |

Three Months

Ended | | |

Nine Months

Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

Change

% | | |

2023 | | |

2022 | | |

Change

% | |

| Revenue | |

$ | 1,980 | | |

$ | 1,946 | | |

| 1.7 | % | |

$ | 5,804 | | |

$ | 5,887 | | |

| -1.4 | % |

| Salaries, wages and employee

benefits | |

| 809 | | |

| 739 | | |

| 9.5 | % | |

| 2,354 | | |

| 2,216 | | |

| 6.2 | % |

| Purchased transportation | |

| 437 | | |

| 480 | | |

| -9.0 | % | |

| 1,338 | | |

| 1,515 | | |

| -11.7 | % |

| Fuel, operating expenses and

supplies | |

| 406 | | |

| 425 | | |

| -4.5 | % | |

| 1,223 | | |

| 1,277 | | |

| -4.2 | % |

| Operating taxes and licenses | |

| 15 | | |

| 15 | | |

| 0.0 | % | |

| 45 | | |

| 44 | | |

| 2.3 | % |

| Insurance and claims | |

| 39 | | |

| 41 | | |

| -4.9 | % | |

| 129 | | |

| 145 | | |

| -11.0 | % |

| (Gains) losses on sales of property

and equipment | |

| 1 | | |

| (1 | ) | |

| -200.0 | % | |

| (4 | ) | |

| (3 | ) | |

| 33.3 | % |

| Depreciation and amortization

expense | |

| 110 | | |

| 99 | | |

| 11.1 | % | |

| 318 | | |

| 289 | | |

| 10.0 | % |

| Transaction and integration costs | |

| 8 | | |

| 2 | | |

| 300.0 | % | |

| 47 | | |

| 16 | | |

| 193.8 | % |

| Restructuring

costs | |

| 1 | | |

| 7 | | |

| -85.7 | % | |

| 35 | | |

| 15 | | |

| 133.3 | % |

| Operating

income | |

| 154 | | |

| 139 | | |

| 10.8 | % | |

| 319 | | |

| 373 | | |

| -14.5 | % |

| Other income | |

| (4 | ) | |

| (15 | ) | |

| -73.3 | % | |

| (12 | ) | |

| (42 | ) | |

| -71.4 | % |

| Debt extinguishment loss | |

| - | | |

| - | | |

| 0.0 | % | |

| 23 | | |

| 26 | | |

| -11.5 | % |

| Interest

expense | |

| 41 | | |

| 35 | | |

| 17.1 | % | |

| 126 | | |

| 103 | | |

| 22.3 | % |

| Income from continuing operations

before income tax provision | |

| 117 | | |

| 119 | | |

| -1.7 | % | |

| 182 | | |

| 286 | | |

| -36.4 | % |

| Income tax

provision | |

| 31 | | |

| 27 | | |

| 14.8 | % | |

| 48 | | |

| 66 | | |

| -27.3 | % |

| Income from continuing operations | |

| 86 | | |

| 92 | | |

| -6.5 | % | |

| 134 | | |

| 220 | | |

| -39.1 | % |

| Income (loss)

from discontinued operations, net of taxes | |

| (2 | ) | |

| 39 | | |

| -105.1 | % | |

| (3 | ) | |

| 540 | | |

| -100.6 | % |

| Net

income attributable to XPO | |

$ | 84 | | |

$ | 131 | | |

| -35.9 | % | |

$ | 131 | | |

$ | 760 | | |

| -82.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable

to common shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | 86 | | |

$ | 92 | | |

| | | |

$ | 134 | | |

$ | 220 | | |

| | |

| Discontinued

operations | |

| (2 | ) | |

| 39 | | |

| | | |

| (3 | ) | |

| 540 | | |

| | |

| Net income

attributable to common shareholders | |

$ | 84 | | |

$ | 131 | | |

| | | |

$ | 131 | | |

$ | 760 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic

earnings (loss) per share attributable to common shareholders (1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | 0.74 | | |

$ | 0.80 | | |

| | | |

$ | 1.16 | | |

$ | 1.92 | | |

| | |

| Discontinued

operations | |

| (0.01 | ) | |

| 0.34 | | |

| | | |

| (0.02 | ) | |

| 4.69 | | |

| | |

| Basic

earnings per share attributable to common shareholders | |

$ | 0.73 | | |

$ | 1.14 | | |

| | | |

$ | 1.14 | | |

$ | 6.61 | | |

| | |

| Diluted

earnings (loss) per share attributable to common shareholders (1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | 0.72 | | |

$ | 0.79 | | |

| | | |

$ | 1.14 | | |

$ | 1.91 | | |

| | |

| Discontinued

operations | |

| (0.01 | ) | |

| 0.34 | | |

| | | |

| (0.02 | ) | |

| 4.66 | | |

| | |

| Diluted

earnings per share attributable to common shareholders | |

$ | 0.71 | | |

$ | 1.13 | | |

| | | |

$ | 1.12 | | |

$ | 6.57 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common

shares outstanding | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic weighted-average common

shares outstanding | |

| 116 | | |

| 115 | | |

| | | |

| 116 | | |

| 115 | | |

| | |

| Diluted weighted-average common

shares outstanding | |

| 119 | | |

| 116 | | |

| | | |

| 118 | | |

| 116 | | |

| | |

| (1) The

sum of quarterly earnings per share may not equal year-to-date amounts due to differences in the weighted-average number of shares

outstanding during the respective periods. |

XPO, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(In millions, except per share data)

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 355 | | |

$ | 460 | |

| Accounts receivable, net of allowances of $45 and $43, respectively | |

| 1,059 | | |

| 954 | |

| Other current assets | |

| 199 | | |

| 199 | |

| Current assets of discontinued operations | |

| - | | |

| 17 | |

| Total current assets | |

| 1,613 | | |

| 1,630 | |

| Long-term assets | |

| | | |

| | |

| Property and equipment, net of $1,767 and $1,679 in accumulated depreciation, respectively | |

| 2,072 | | |

| 1,832 | |

| Operating lease assets | |

| 695 | | |

| 719 | |

| Goodwill | |

| 1,465 | | |

| 1,472 | |

| Identifiable intangible assets, net of $431 and $392 in accumulated amortization, respectively | |

| 366 | | |

| 407 | |

| Other long-term assets | |

| 217 | | |

| 209 | |

| Total long-term assets | |

| 4,815 | | |

| 4,639 | |

| Total assets | |

$ | 6,428 | | |

$ | 6,269 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 473 | | |

$ | 521 | |

| Accrued expenses | |

| 827 | | |

| 774 | |

| Short-term borrowings and current maturities of long-term debt | |

| 66 | | |

| 59 | |

| Short-term operating lease liabilities | |

| 111 | | |

| 107 | |

| Other current liabilities | |

| 45 | | |

| 30 | |

| Current liabilities of discontinued operations | |

| - | | |

| 16 | |

| Total current liabilities | |

| 1,522 | | |

| 1,507 | |

| Long-term liabilities | |

| | | |

| | |

| Long-term debt | |

| 2,447 | | |

| 2,473 | |

| Deferred tax liability | |

| 326 | | |

| 319 | |

| Employee benefit obligations | |

| 90 | | |

| 93 | |

| Long-term operating lease liabilities | |

| 584 | | |

| 606 | |

| Other long-term liabilities | |

| 262 | | |

| 259 | |

| Total long-term liabilities | |

| 3,709 | | |

| 3,750 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock, $0.001 par value; 300 shares authorized;

116 and 115 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 1,284 | | |

| 1,238 | |

| Retained earnings (accumulated deficit) | |

| 127 | | |

| (4 | ) |

| Accumulated other comprehensive loss | |

| (214 | ) | |

| (222 | ) |

| Total equity | |

| 1,197 | | |

| 1,012 | |

| Total liabilities and equity | |

$ | 6,428 | | |

$ | 6,269 | |

XPO, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

(In

millions)

| | |

Nine Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities of continuing operations | |

| | | |

| | |

| Net income | |

$ | 131 | | |

$ | 760 | |

| Income (loss) from discontinued operations, net of taxes | |

| (3 | ) | |

| 540 | |

| Income from continuing operations | |

| 134 | | |

| 220 | |

| Adjustments to reconcile income from continuing operations to net cash from operating activities | |

| | | |

| | |

| Depreciation, amortization and net lease activity | |

| 318 | | |

| 289 | |

| Stock compensation expense | |

| 58 | | |

| 21 | |

| Accretion of debt | |

| 8 | | |

| 12 | |

| Deferred tax expense | |

| 16 | | |

| 30 | |

| Gains on sales of property and equipment | |

| (4 | ) | |

| (3 | ) |

| Other | |

| 46 | | |

| 46 | |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (141 | ) | |

| (199 | ) |

| Other assets | |

| (24 | ) | |

| 72 | |

| Accounts payable | |

| (38 | ) | |

| 13 | |

| Accrued expenses and other liabilities | |

| 70 | | |

| 127 | |

| Net cash provided by operating activities from continuing operations | |

| 443 | | |

| 628 | |

| Cash flows from investing activities of continuing operations | |

| | | |

| | |

| Payment for purchases of property and equipment | |

| (494 | ) | |

| (354 | ) |

| Proceeds from sale of property and equipment | |

| 19 | | |

| 10 | |

| Proceeds from settlement of cross currency swaps | |

| 2 | | |

| 29 | |

| Net cash used in investing activities from continuing operations | |

| (473 | ) | |

| (315 | ) |

| Cash flows from financing activities of continuing operations | |

| | | |

| | |

| Proceeds from issuance of debt | |

| 1,977 | | |

| - | |

| Repurchase of debt | |

| (2,003 | ) | |

| (651 | ) |

| Proceeds from borrowings on ABL facility | |

| - | | |

| 275 | |

| Repayment of borrowings on ABL facility | |

| - | | |

| (275 | ) |

| Repayment of debt and finance leases | |

| (50 | ) | |

| (46 | ) |

| Payment for debt issuance costs | |

| (15 | ) | |

| - | |

| Change in bank overdrafts | |

| 30 | | |

| 5 | |

| Payment for tax withholdings for restricted shares | |

| (12 | ) | |

| (13 | ) |

| Other | |

| 1 | | |

| (1 | ) |

| Net cash used in financing activities from continuing operations | |

| (72 | ) | |

| (706 | ) |

| Cash flows from discontinued operations | |

| | | |

| | |

| Operating activities of discontinued operations | |

| (11 | ) | |

| 31 | |

| Investing activities of discontinued operations | |

| 2 | | |

| 668 | |

| Net cash provided by (used in) discontinued operations | |

| (9 | ) | |

| 699 | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | |

| 2 | | |

| (25 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| (109 | ) | |

| 281 | |

| Cash, cash equivalents and restricted cash, beginning of period | |

| 470 | | |

| 273 | |

| Cash, cash equivalents and restricted cash, end of period | |

| 361 | | |

| 554 | |

| Less: Cash, cash equivalents and restricted cash of discontinued operations, end of period | |

| - | | |

| 187 | |

| Cash, cash equivalents and restricted cash of continuing operations, end of period | |

$ | 361 | | |

$ | 367 | |

North

American Less-Than-Truckload Segment

Summary

Financial Table

(Unaudited)

(In

millions)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

Change

% | | |

2023 | | |

2022 | | |

Change

% | |

| Revenue

(excluding fuel surcharge revenue) | |

$ | 1,005 | | |

$ | 931 | | |

| 7.9 | % | |

$ | 2,848 | | |

$ | 2,780 | | |

| 2.4 | % |

| Fuel

surcharge revenue | |

| 223 | | |

| 274 | | |

| -18.6 | % | |

| 636 | | |

| 772 | | |

| -17.6 | % |

| Revenue | |

| 1,228 | | |

| 1,205 | | |

| 1.9 | % | |

| 3,484 | | |

| 3,552 | | |

| -1.9 | % |

| Salaries,

wages and employee benefits | |

| 616 | | |

| 562 | | |

| 9.6 | % | |

| 1,744 | | |

| 1,630 | | |

| 7.0 | % |

| Purchased

transportation | |

| 97 | | |

| 123 | | |

| -21.1 | % | |

| 283 | | |

| 393 | | |

| -28.0 | % |

| Fuel,

operating expenses and supplies (1) | |

| 244 | | |

| 252 | | |

| -3.2 | % | |

| 718 | | |

| 741 | | |

| -3.1 | % |

| Operating

taxes and licenses | |

| 11 | | |

| 13 | | |

| -15.4 | % | |

| 35 | | |

| 37 | | |

| -5.4 | % |

| Insurance

and claims | |

| 20 | | |

| 31 | | |

| -35.5 | % | |

| 81 | | |

| 98 | | |

| -17.3 | % |

| (Gains)

losses on sales of property and equipment | |

| 4 | | |

| - | | |

| 100.0 | % | |

| 6 | | |

| - | | |

| 100.0 | % |

| Depreciation

and amortization | |

| 75 | | |

| 60 | | |

| 25.0 | % | |

| 214 | | |

| 175 | | |

| 22.3 | % |

| Transaction

and integration costs | |

| - | | |

| - | | |

| 0.0 | % | |

| - | | |

| 2 | | |

| -100.0 | % |

| Restructuring

costs | |

| - | | |

| 2 | | |

| -100.0 | % | |

| 10 | | |

| 5 | | |

| 100.0 | % |

| Operating

income | |

| 161 | | |

| 162 | | |

| -0.6 | % | |

| 393 | | |

| 471 | | |

| -16.6 | % |

| Operating

ratio (2) | |

| 86.8 | % | |

| 86.6 | % | |

| | | |

| 88.7 | % | |

| 86.7 | % | |

| | |

| Other

income | |

| - | | |

| 1 | | |

| | | |

| - | | |

| 1 | | |

| | |

| Amortization

expense | |

| 9 | | |

| 9 | | |

| | | |

| 26 | | |

| 26 | | |

| | |

| Transaction

and integration costs | |

| - | | |

| - | | |

| | | |

| - | | |

| 2 | | |

| | |

| Restructuring

costs | |

| - | | |

| 2 | | |

| | | |

| 10 | | |

| 5 | | |

| | |

| Gains

on real estate transactions | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| | |

| Adjusted

operating income (3) | |

$ | 170 | | |

$ | 174 | | |

| -2.3 | % | |

$ | 429 | | |

$ | 505 | | |

| -15.0 | % |

| Adjusted

operating ratio (3) (4) | |

| 86.2 | % | |

| 85.6 | % | |

| | | |

| 87.7 | % | |

| 85.8 | % | |

| | |

| Depreciation

expense | |

| 66 | | |

| 51 | | |

| | | |

| 188 | | |

| 149 | | |

| | |

| Pension

income | |

| 5 | | |

| 14 | | |

| | | |

| 13 | | |

| 44 | | |

| | |

| Gains

on real estate transactions | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| | |

| Other | |

| - | | |

| 1 | | |

| | | |

| 1 | | |

| 2 | | |

| | |

| Adjusted

EBITDA (5) | |

$ | 241 | | |

$ | 240 | | |

| 0.4 | % | |

$ | 631 | | |

$ | 700 | | |

| -9.9 | % |

| Adjusted

EBITDA margin (6) | |

| 19.6 | % | |

| 19.9 | % | |

| | | |

| 18.1 | % | |

| 19.7 | % | |

| | |

| (1) Fuel,

operating expenses and supplies includes fuel-related taxes. |

| (2) Operating

ratio is calculated as (1 - (Operating income divided by Revenue)). |

| (3) See

the “Non-GAAP Financial Measures” section of the press release. |

| (4) Adjusted

operating ratio is calculated as (1 - (Adjusted operating income divided by Revenue)); adjusted operating margin is the inverse of

adjusted operating ratio. |

| (5) Adjusted

EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280. |

| (6) Adjusted

EBITDA margin is calculated as Adjusted EBITDA divided by Revenue. |

North

American Less-Than-Truckload

Summary

Data Table

(Unaudited)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

Change % | | |

2023 | | |

2022 | | |

Change % | |

| Pounds per day (thousands) | |

| 72,257 | | |

| 70,063 | | |

| 3.1 | % | |

| 70,465 | | |

| 70,854 | | |

| -0.5 | % |

| Shipments per day | |

| 53,637 | | |

| 49,744 | | |

| 7.8 | % | |

| 51,303 | | |

| 49,459 | | |

| 3.7 | % |

| Average weight per shipment (in pounds) | |

| 1,347 | | |

| 1,408 | | |

| -4.3 | % | |

| 1,374 | | |

| 1,433 | | |

| -4.1 | % |

| Revenue per shipment | |

$ | 366.36 | | |

$ | 378.26 | | |

| -3.1 | % | |

$ | 357.20 | | |

$ | 374.61 | | |

| -4.6 | % |

| Gross revenue per hundredweight (including fuel surcharges) (1) | |

$ | 27.74 | | |

$ | 27.52 | | |

| 0.8 | % | |

$ | 26.59 | | |

$ | 26.86 | | |

| -1.0 | % |

| Gross revenue per hundredweight (excluding fuel surcharges) (1) | |

$ | 22.81 | | |

$ | 21.43 | | |

| 6.4 | % | |

$ | 21.84 | | |

$ | 21.18 | | |

| 3.1 | % |

| Average length of haul (in miles) | |

| 850.0 | | |

| 831.0 | | |

| | | |

| 839.4 | | |

| 830.7 | | |

| | |

| Total average load factor (2) | |

| 22,683 | | |

| 23,574 | | |

| -3.8 | % | |

| 22,862 | | |

| 23,914 | | |

| -4.4 | % |

| Average age of tractor fleet (years) | |

| 5.2 | | |

| 6.0 | | |

| | | |

| | | |

| | | |

| | |

| Number of working days | |

| 62.5 | | |

| 64.0 | | |

| | | |

| 190.0 | | |

| 191.5 | | |

| | |

| (1) Gross

revenue per hundredweight excludes the adjustment required for financial statement purposes in accordance with the company's revenue

recognition policy. |

| (2) Total

average load factor equals freight pound miles divided by total linehaul miles. |

| Note:

Table excludes the company's trailer manufacturing operations. |

European

Transportation Segment

Summary

Financial Table

(Unaudited)

(In

millions)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

Change

% | | |

2023 | | |

2022 | | |

Change

% | |

| Revenue | |

$ | 752 | | |

$ | 741 | | |

| 1.5 | % | |

$ | 2,320 | | |

$ | 2,335 | | |

| -0.6 | % |

| Salaries,

wages and employee benefits | |

| 189 | | |

| 167 | | |

| 13.2 | % | |

| 595 | | |

| 537 | | |

| 10.8 | % |

| Purchased

transportation | |

| 340 | | |

| 357 | | |

| -4.8 | % | |

| 1,055 | | |

| 1,122 | | |

| -6.0 | % |

| Fuel,

operating expenses and supplies (1) | |

| 162 | | |

| 159 | | |

| 1.9 | % | |

| 499 | | |

| 499 | | |

| 0.0 | % |

| Operating

taxes and licenses | |

| 4 | | |

| 2 | | |

| 100.0 | % | |

| 10 | | |

| 7 | | |

| 42.9 | % |

| Insurance

and claims | |

| 15 | | |

| 13 | | |

| 15.4 | % | |

| 43 | | |

| 42 | | |

| 2.4 | % |

| Gains

on sales of property and equipment | |

| (3 | ) | |

| (1 | ) | |

| 200.0 | % | |

| (10 | ) | |

| (3 | ) | |

| 233.3 | % |

| Depreciation

and amortization | |

| 35 | | |

| 31 | | |

| 12.9 | % | |

| 100 | | |

| 96 | | |

| 4.2 | % |

| Transaction

and integration costs | |

| 1 | | |

| 2 | | |

| -50.0 | % | |

| 2 | | |

| 5 | | |

| -60.0 | % |

| Restructuring

costs | |

| 1 | | |

| 1 | | |

| 0.0 | % | |

| 9 | | |

| 4 | | |

| 125.0 | % |

| Operating

income | |

$ | 8 | | |

$ | 10 | | |

| -20.0 | % | |

$ | 17 | | |

$ | 26 | | |

| -34.6 | % |

| Other

expense | |

| (1 | ) | |

| (1 | ) | |

| | | |

| (1 | ) | |

| (1 | ) | |

| | |

| Amortization

expense | |

| 6 | | |

| 5 | | |

| | | |

| 16 | | |

| 15 | | |

| | |

| Transaction

and integration costs | |

| 1 | | |

| 2 | | |

| | | |

| 2 | | |

| 5 | | |

| | |

| Restructuring

costs | |

| 1 | | |

| 1 | | |

| | | |

| 9 | | |

| 4 | | |

| | |

| Adjusted

operating income (2) | |

$ | 15 | | |

$ | 17 | | |

| -11.8 | % | |

$ | 43 | | |

$ | 49 | | |

| -12.2 | % |

| Depreciation

expense | |

| 29 | | |

| 26 | | |

| | | |

| 84 | | |

| 81 | | |

| | |

| Adjusted

EBITDA (3) | |

| 44 | | |

| 43 | | |

| 2.3 | % | |

| 127 | | |

| 130 | | |

| -2.3 | % |

| Adjusted

EBITDA margin (4) | |

| 5.8 | % | |

| 5.9 | % | |

| | | |

| 5.5 | % | |

| 5.6 | % | |

| | |

| (1) Fuel,

operating expenses and supplies includes fuel-related taxes. |

| (2) See

the “Non-GAAP Financial Measures” section of the press release. |

| (3) Adjusted

EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280. |

| (4) Adjusted

EBITDA margin is calculated as Adjusted EBITDA divided by Revenue. |

Corporate

Summary

Financial Table

(Unaudited)

(In

millions)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

Change % | | |

2023 | | |

2022 | | |

Change % | |

| Revenue | |

$ | - | | |

$ | - | | |

| 0.0 | % | |

$ | - | | |

$ | - | | |

| 0.0 | % |

| Salaries, wages and employee benefits | |

| 4 | | |

| 10 | | |

| -60.0 | % | |

| 15 | | |

| 49 | | |

| -69.4 | % |

| Fuel, operating expenses and supplies | |

| - | | |

| 14 | | |

| -100.0 | % | |

| 6 | | |

| 37 | | |

| -83.8 | % |

| Operating taxes and licenses | |

| - | | |

| - | | |

| 0.0 | % | |

| - | | |

| - | | |

| 0.0 | % |

| Insurance and claims | |

| 4 | | |

| (3 | ) | |

| -233.3 | % | |

| 5 | | |

| 5 | | |

| 0.0 | % |

| Depreciation and amortization | |

| - | | |

| 8 | | |

| -100.0 | % | |

| 4 | | |

| 18 | | |

| -77.8 | % |

| Transaction and integration costs | |

| 7 | | |

| - | | |

| 100.0 | % | |

| 45 | | |

| 9 | | |

| 400.0 | % |

| Restructuring costs | |

| - | | |

| 4 | | |

| -100.0 | % | |

| 16 | | |

| 6 | | |

| 166.7 | % |

| Operating loss | |

$ | (15 | ) | |

$ | (33 | ) | |

| -54.5 | % | |

$ | (91 | ) | |

$ | (124 | ) | |

| -26.6 | % |

| Other income (expense) (1) | |

| 1 | | |

| - | | |

| | | |

| - | | |

| (4 | ) | |

| | |

| Depreciation and amortization | |

| - | | |

| 8 | | |

| | | |

| 4 | | |

| 18 | | |

| | |

| Transaction and integration costs | |

| 7 | | |

| - | | |

| | | |

| 45 | | |

| 9 | | |

| | |

| Restructuring costs | |

| - | | |

| 4 | | |

| | | |

| 16 | | |

| 6 | | |

| | |

| Adjusted EBITDA (2) | |

$ | (7 | ) | |

$ | (21 | ) | |

| -66.7 | % | |

$ | (26 | ) | |

$ | (95 | ) | |

| -72.6 | % |

| (1) Other

income (expense) consists of foreign currency gain (loss) and other income (expense). |

| (2) See

the “Non-GAAP Financial Measures” section of the press release. |

XPO, Inc.

Reconciliation

of Non-GAAP Measures

(Unaudited)

(In

millions)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

Change % | | |

2023 | | |

2022 | | |

Change % | |

| Reconciliation of Net Income from Continuing Operations to Adjusted EBITDA | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income from continuing operations attributable to common shareholders | |

$ | 86 | | |

$ | 92 | | |

| -6.5 | % | |

$ | 134 | | |

$ | 220 | | |

| -39.1 | % |

| Debt extinguishment loss | |

| - | | |

| - | | |

| | | |

| 23 | | |

| 26 | | |

| | |

| Interest expense | |

| 41 | | |

| 35 | | |

| | | |

| 126 | | |

| 103 | | |

| | |

| Income tax provision | |

| 31 | | |

| 27 | | |

| | | |

| 48 | | |

| 66 | | |

| | |

| Depreciation and amortization expense | |

| 110 | | |

| 99 | | |

| | | |

| 318 | | |

| 289 | | |

| | |

| Transaction and integration costs | |

| 8 | | |

| 2 | | |

| | | |

| 47 | | |

| 16 | | |

| | |

| Restructuring costs | |

| 1 | | |

| 7 | | |

| | | |

| 35 | | |

| 15 | | |

| | |

| Other | |

| 1 | | |

| - | | |

| | | |

| 1 | | |

| - | | |

| | |

| Adjusted EBITDA (1) | |

$ | 278 | | |

$ | 262 | | |

| 6.1 | % | |

$ | 732 | | |

$ | 735 | | |

| -0.4 | % |

| Revenue | |

$ | 1,980 | | |

$ | 1,946 | | |

| 1.7 | % | |

$ | 5,804 | | |

$ | 5,887 | | |

| -1.4 | % |

| Adjusted EBITDA margin (1) (2) | |

| 14.0 | % | |

| 13.5 | % | |

| | | |

| 12.6 | % | |

| 12.5 | % | |

| | |

| (1) See

the “Non-GAAP Financial Measures” section of the press release. |

| (2) Adjusted

EBITDA margin is calculated as Adjusted EBITDA divided by Revenue. |

XPO, Inc.

Reconciliation

of Non-GAAP Measures (cont.)

(Unaudited)

(In

millions, except per share data)

| | |

Three Months

Ended | | |

Nine Months

Ended | |

| | |

September 30 | | |

September 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of Net Income

from Continuing Operations and Diluted Earnings Per Share from Continuing Operations to Adjusted Net Income from Continuing Operations

and Adjusted Earnings Per Share from Continuing Operations | |

| | | |

| | | |

| | | |

| | |

| Net income from

continuing operations attributable to common shareholders | |

$ | 86 | | |

$ | 92 | | |

$ | 134 | | |

$ | 220 | |

| Debt extinguishment loss | |

| - | | |

| - | | |

| 23 | | |

| 26 | |

| Amortization of acquisition-related

intangible assets | |

| 15 | | |

| 13 | | |

| 42 | | |

| 40 | |

| Transaction and integration

costs | |

| 8 | | |

| 2 | | |

| 47 | | |

| 16 | |

| Restructuring costs | |

| 1 | | |

| 7 | | |

| 35 | | |

| 15 | |

| Income

tax associated with the adjustments above (1) | |

| (5 | ) | |

| (4 | ) | |

| (28 | ) | |

| (22 | ) |

| Adjusted

net income from continuing operations attributable to common

shareholders (2) | |

$ | 105 | | |

$ | 110 | | |

$ | 253 | | |

$ | 295 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted

diluted earnings from continuing operations per share (2) | |

$ | 0.88 | | |

$ | 0.95 | | |

$ | 2.15 | | |

$ | 2.55 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common

shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Diluted weighted-average common

shares outstanding | |

| 119 | | |

| 116 | | |

| 118 | | |

| 116 | |

| | |

| | | |

| | | |

| | | |

| | |

| (1) This

line item reflects the aggregate tax benefit of all non-tax related adjustments reflected in the table above. The detail by line

item is as follows: | |

| | | |

| | | |

| | | |

| | |

| Debt extinguishment loss | |

$ | - | | |

$ | - | | |

$ | 5 | | |

$ | 6 | |

| Amortization of acquisition-related

intangible assets | |

| 4 | | |

| 3 | | |

| 10 | | |

| 9 | |

| Transaction and integration

costs | |

| - | | |

| 1 | | |

| 5 | | |

| 4 | |

| Restructuring

costs | |

| 1 | | |

| - | | |

| 8 | | |

| 3 | |

| | |

$ | 5 | | |

$ | 4 | | |

$ | 28 | | |

$ | 22 | |

The

income tax rate applied to reconciling items is based on the GAAP annual effective tax rate, excluding discrete items, non-deductible

compensation, and contribution- and margin-based taxes.

| (2) See

the "Non-GAAP Financial Measures" section of the press release. |

North American Less-Than-Truckload Segment

Summary Financial Table vs Prior Quarter

(Unaudited)

(In millions)

| | |

Three Months Ended | |

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Revenue (excluding fuel surcharge revenue) | |

$ | 1,005 | | |

$ | 940 | |

| Fuel surcharge revenue | |

| 223 | | |

| 196 | |

| Revenue | |

| 1,228 | | |

| 1,136 | |

| Salaries, wages and employee benefits | |

| 616 | | |

| 573 | |

| Purchased transportation | |

| 97 | | |

| 87 | |

| Fuel, operating expenses and supplies (1) | |

| 244 | | |

| 226 | |

| Operating taxes and licenses | |

| 11 | | |

| 12 | |

| Insurance and claims | |

| 20 | | |

| 33 | |

| (Gains) losses on sales of property and equipment | |

| 4 | | |

| 1 | |

| Depreciation and amortization | |

| 75 | | |

| 71 | |

| Transaction and integration costs | |

| - | | |

| - | |

| Restructuring costs | |

| - | | |

| 4 | |

| Operating income | |

| 161 | | |

| 129 | |

| Operating ratio (2) | |

| 86.8 | % | |

| 88.7 | % |

| Amortization expense | |

| 9 | | |

| 9 | |

| Transaction and integration costs | |

| - | | |

| - | |

| Restructuring costs | |

| - | | |

| 4 | |

| Gains on real estate transactions | |

| - | | |

| - | |

| Adjusted operating income (3) | |

$ | 170 | | |

$ | 142 | |

| Adjusted operating ratio (3) (4) | |

| 86.2 | % | |

| 87.6 | % |

| Depreciation expense | |

| 66 | | |

| 62 | |

| Pension income | |

| 5 | | |

| 4 | |

| Gains on real estate transactions | |

| - | | |

| - | |

| Adjusted EBITDA (5) | |

$ | 241 | | |

$ | 208 | |

| (1) Fuel, operating expenses and supplies includes fuel-related taxes. |

| (2) Operating ratio is calculated as (1 - (Operating income divided by Revenue)). |

| (3) See the “Non-GAAP Financial Measures” section of the press release. |

| (4) Adjusted operating ratio is calculated as (1 - (Adjusted operating income divided by Revenue)); adjusted operating margin is the inverse of adjusted operating ratio. |

| (5) Adjusted EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

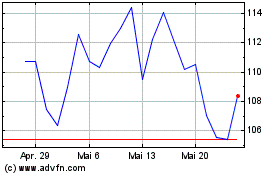

XPO (NYSE:XPO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

XPO (NYSE:XPO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024