0000077543false00000775432023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 9, 2023

Tutor Perini Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Massachusetts | 1-6314 | 04-1717070 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

15901 Olden Street, Sylmar, California 91342-1093

(Address of Principal Executive Offices, and Zip Code)

(818) 362-8391

(Registrant’s Telephone Number, Including Area Code)

None

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | TPC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02. Results of Operations and Financial Condition

On November 9, 2023 Tutor Perini Corporation issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | Description |

| |

| 104 | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | |

| | TUTOR PERINI CORPORATION |

| | |

| Date: | November 9, 2023 | By: | /s/ Gary G. Smalley |

| | Gary G. Smalley |

| | Executive Vice President and Chief Financial Officer |

News Release

Tutor Perini Reports Third Quarter 2023 Results

•Strong operating cash flow of $103.2 million in Q3 2023 was the second-highest result for any third quarter since the merger of Tutor-Saliba Corporation and Perini Corporation in 2008 and up 42% compared to $72.6 million in Q3 2022; year-to-date operating cash flow of $180.8 million was also the second-highest result for the first nine months of any year since the 2008 merger

•Backlog grew to $10.6 billion, up 28% year-over-year compared to $8.4 billion at Q3 2022; anticipating continued strong backlog growth in 2024

LOS ANGELES – (BUSINESS WIRE) – November 9, 2023 – Tutor Perini Corporation (the “Company”) (NYSE: TPC), a leading civil, building and specialty construction company, reported results today for the third quarter of 2023. Revenue was $1.1 billion, level compared to the same quarter last year. Higher revenue in the Civil and Building segments was offset by lower revenue in the Specialty Contractors segment associated with certain projects in the Northeast that are complete or nearing completion. In addition, customer budgetary constraints induced by the COVID-19 pandemic, combined with certain political and other factors, resulted in the Company not being awarded certain Civil segment projects over the last few years totaling more than $10.0 billion despite having been the low or preferred bidder. Not being awarded these projects also impacted revenue for the first nine months of both 2023 and 2022. Most of these projects are currently expected to be re-bid in 2024.

Loss from construction operations for the third quarter of 2023 was $12.6 million compared to $6.9 million for the same period in 2022. The results for both periods were negatively impacted by net unfavorable adjustments on various projects, primarily due to changes in estimates resulting from recent negotiations, settlements and legal judgments on certain disputed claims and unapproved change orders. Net loss attributable to the Company for the third quarter of 2023 was $36.9 million, or a $0.71 diluted loss per common share, compared to a net loss of $32.5 million, or a $0.63 diluted loss per common share, for the third quarter of 2022.

The Company generated $103.2 million of cash from operating activities in the third quarter of 2023, the second-highest result for any third quarter since the 2008 merger between Tutor-Saliba Corporation and Perini Corporation, compared to $72.6 million for the same period of 2022. The strong operating cash flow was driven by solid collection activities, including collections associated with certain recently concluded settlement negotiations. During the first nine months of 2023, the Company generated $180.8 million of cash from operating activities, which was also the second-highest result for the first nine months of any year since the 2008 merger. The Company continues to anticipate strong operating cash generation over the remainder of 2023, as well as in 2024, with operating cash flow for 2023 still expected to exceed the record amount reported for 2022.

Backlog grew to $10.6 billion as of September 30, 2023, up 28% compared to $8.4 billion for the same period last year. The Civil and Building segments were the primary contributors to the new award activity in the third quarter of 2023. The most significant new awards and contract adjustments in the third quarter of 2023 included $115 million of additional funding for a health care project in California; $95 million and $81 million of additional funding for two different mass-transit projects in California; the $47 million New Everglades National Park Visitor Center project in Florida; a $42 million mining project in Virginia; and the Central District Wastewater Treatment Plant electrical project in Florida, valued at more than $40 million.

Outlook and Guidance

Ronald Tutor, Chairman and Chief Executive Officer, commented, “We generated very strong, near-record operating cash in the third quarter and the outlook for continued strong cash generation over the next several quarters is excellent. In addition, our backlog remains healthy and we anticipate that it will increase significantly over the next 12 to 18 months as we bid and expect to capture our share of various large project opportunities amid a robust demand environment bolstered by substantial government funding and limited competition for many of the larger projects." Tutor added, "Importantly, we are focused on our debt maturities and will soon embark upon a plan that we anticipate will result in a timely refinancing of our debt. In the fourth quarter, we began accumulating cash for deleveraging our balance sheet and to date have set aside more than $70 million to be put toward the planned refinancing. Lastly, we expect improved performance in the fourth quarter of 2023 and for next year.”

The Company is still not providing new guidance for 2023, but expects to provide initial EPS guidance for 2024 when it issues its fourth quarter and full year 2023 results.

Third Quarter 2023 Conference Call

The Company will host a conference call at 2:00 PM Pacific Time on Thursday, November 9, 2023, to discuss the third quarter 2023 results. To participate in the conference call, please dial 877-407-8293 five to ten minutes prior to the scheduled time. International callers should dial 1-201-689-8349.

The conference call will be webcast live over the Internet and can be accessed by all interested parties on Tutor Perini's website at www.tutorperini.com. For those unable to participate during the live call, the webcast will be available for replay shortly after the call on the website.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and specialty construction company offering diversified general contracting and design-build services to private customers and public agencies throughout the world. We have provided construction services since 1894 and have established a strong reputation within our markets by executing large, complex projects on time and within budget, while adhering to strict quality control measures. We offer general contracting, pre-construction planning and comprehensive project management services, including planning and scheduling of manpower, equipment, materials and subcontractors required for a project. We also offer self-performed construction services including site work, concrete forming and placement, steel erection, electrical, mechanical, plumbing and heating, ventilation and air conditioning (HVAC). We are known for our major complex building project commitments, as well as our capacity to perform large and complex transportation and heavy civil construction for government agencies and private customers throughout the world.

Forward-Looking Statements

The statements contained in this release, including those set forth in the section “Outlook and Guidance,” that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation, statements regarding the Company’s expectations, hopes, beliefs, intentions or strategies regarding the future and statements regarding future guidance or estimates and non-historical performance. These forward-looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. While the Company’s expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them, there can be no assurance that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the Company) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: unfavorable outcomes of existing or future litigation or dispute resolution proceedings against us or customers (project owners, developers, general contractors, etc.), subcontractors or suppliers, as well as failure to promptly recover significant working capital invested in projects subject to such matters; revisions of

estimates of contract risks, revenue or costs, economic factors such as inflation, the timing of new awards, or the pace of project execution, which has resulted and may continue to result in losses or lower than anticipated profit; increased competition and failure to secure new contracts; contract requirements to perform extra work beyond the initial project scope, which has and in the future could result in disputes or claims and adversely affect our working capital, profits and cash flows; risks and other uncertainties associated with assumptions and estimates used to prepare our financial statements; a significant slowdown or decline in economic conditions, such as those presented during a recession; failure to meet contractual schedule requirements, which could result in higher costs and reduced profits or, in some cases, exposure to financial liability for liquidated damages and/or damages to customers, as well as damage to our reputation; failure to meet our obligations under our debt agreements (especially in a high interest rate environment), including the spring-forward maturity on January 30, 2025 of our Term Loan B and Revolver if any of the 2017 Senior Notes remain outstanding as of such date; inability to attract and retain our key officers, and to adequately plan for their succession, and hire and retain personnel required to execute and perform on our contracts; possible systems and information technology interruptions and breaches in data security and/or privacy; an inability to obtain bonding could have a negative impact on our operations and results; risks related to our international operations, such as uncertainty of U.S. government funding, as well as economic, political, regulatory and other risks, including risks of loss due to acts of war, labor conditions, and other unforeseeable events in countries where we do business, which could adversely affect our revenue and earnings; decreases in the level of government spending for infrastructure and other public projects; downgrades in our credit ratings; failure of our joint venture partners to perform their venture obligations, which could impose additional financial and performance obligations on us, resulting in reduced profits or losses and/or reputational harm; the impact of inclement weather conditions on projects; risks related to government contracts and related procurement regulations; significant fluctuations in the market price of our common stock, which could result in substantial losses for stockholders and potentially subject us to securities litigation; client cancellations of, or reductions in scope under, contracts reported in our backlog; violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws; public health crises, such as COVID-19, have adversely impacted, and could in the future adversely impact, our business, financial condition and results of operations by, among other things, delaying the timing of project bids and/or awards and the timing of dispute resolutions and associated collections; physical and regulatory risks related to climate change; impairment of our goodwill or other indefinite-lived intangible assets; the exertion of influence over the Company by our chairman and chief executive officer due to his position and significant ownership interest; and other risks and uncertainties discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 15, 2023 and in other reports that we file with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact:

Tutor Perini Corporation

Jorge Casado, 818-362-8391

Vice President, Investor Relations & Corporate Communications

www.tutorperini.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Statements of Operations |

| Unaudited |

| | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except per common share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| REVENUE | | $ | 1,060,705 | | | $ | 1,070,926 | | | $ | 2,858,756 | | | $ | 2,884,107 | |

| COST OF OPERATIONS | | (1,009,792) | | | (1,020,586) | | | (2,767,051) | | | (2,817,645) | |

| GROSS PROFIT | | 50,913 | | | 50,340 | | | 91,705 | | | 66,462 | |

| General and administrative expenses | | (63,479) | | | (57,232) | | | (183,828) | | | (173,815) | |

| LOSS FROM CONSTRUCTION OPERATIONS | | (12,566) | | | (6,892) | | | (92,123) | | | (107,353) | |

| Other income, net | | 2,967 | | | 397 | | | 12,442 | | | 5,114 | |

| Interest expense | | (20,313) | | | (17,015) | | | (63,842) | | | (49,711) | |

| LOSS BEFORE INCOME TAXES | | (29,912) | | | (23,510) | | | (143,523) | | | (151,950) | |

| Income tax (expense) benefit | | 4,086 | | | (560) | | | 52,004 | | | 47,047 | |

| NET LOSS | | (25,826) | | | (24,070) | | | (91,519) | | | (104,903) | |

| LESS: NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | 11,070 | | | 8,385 | | | 32,107 | | | 12,189 | |

| NET LOSS ATTRIBUTABLE TO TUTOR PERINI CORPORATION | | $ | (36,896) | | | $ | (32,455) | | | $ | (123,626) | | | $ | (117,092) | |

| BASIC LOSS PER COMMON SHARE | | $ | (0.71) | | | $ | (0.63) | | | $ | (2.39) | | | $ | (2.28) | |

| DILUTED LOSS PER COMMON SHARE | | $ | (0.71) | | | $ | (0.63) | | | $ | (2.39) | | | $ | (2.28) | |

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | | |

| BASIC | | 51,994 | | | 51,404 | | | 51,784 | | | 51,263 | |

| DILUTED | | 51,994 | | | 51,404 | | | 51,784 | | | 51,263 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Segment Information |

| Unaudited |

| | | | | | | | |

| Reportable Segments | | | | |

| (in thousands) | Civil | Building | Specialty

Contractors | Total | | Corporate | | Consolidated

Total |

| Three Months Ended September 30, 2023 | | | | | | | | |

| Total revenue | $ | 543,776 | | $ | 368,244 | | $ | 174,933 | | $ | 1,086,953 | | | $ | — | | | $ | 1,086,953 | |

| Elimination of intersegment revenue | (23,282) | | (2,795) | | (171) | | (26,248) | | | — | | | (26,248) | |

| Revenue from external customers | $ | 520,494 | | $ | 365,449 | | $ | 174,762 | | $ | 1,060,705 | | | $ | — | | | $ | 1,060,705 | |

| Income (loss) from construction operations | $ | 46,889 | | $ | 123 | | $ | (38,429) | | $ | 8,583 | | (a) | $ | (21,149) | | (b) | $ | (12,566) | |

| Capital expenditures | $ | 11,941 | | $ | 241 | | $ | 391 | | $ | 12,573 | | | $ | 2,394 | | | $ | 14,967 | |

Depreciation and amortization(c) | $ | 7,698 | | $ | 743 | | $ | 615 | | $ | 9,056 | | | $ | 2,175 | | | $ | 11,231 | |

| | | | | | | | |

| Three Months Ended September 30, 2022 | | | | | | | | |

| Total revenue | $ | 564,205 | | $ | 341,614 | | $ | 251,974 | | $ | 1,157,793 | | | $ | — | | | $ | 1,157,793 | |

| Elimination of intersegment revenue | (63,300) | | (23,564) | | (3) | | (86,867) | | | — | | | (86,867) | |

| Revenue from external customers | $ | 500,905 | | $ | 318,050 | | $ | 251,971 | | $ | 1,070,926 | | | $ | — | | | $ | 1,070,926 | |

| Income (loss) from construction operations | $ | 22,786 | | $ | 56 | | $ | (11,836) | | $ | 11,006 | | (d) | $ | (17,898) | | (b) | $ | (6,892) | |

| Capital expenditures | $ | 11,872 | | $ | 921 | | $ | 748 | | $ | 13,541 | | | $ | 423 | | | $ | 13,964 | |

Depreciation and amortization(c) | $ | 12,166 | | $ | 470 | | $ | 529 | | $ | 13,165 | | | $ | 2,368 | | | $ | 15,533 | |

___________________________________________________________________________________________________

(a)During the three months ended September 30, 2023, the Company’s income (loss) from construction operations was adversely impacted by $16.9 million ($12.3 million, or $0.24 per diluted share, after tax) of unfavorable non-cash adjustments due to changes in estimates on the Specialty Contractors segment’s electrical and mechanical scope of a transportation project in the Northeast associated with changes in the expected recovery on certain unapproved change orders resulting from ongoing negotiations, $14.0 million ($10.9 million, or $0.21 per diluted share, after tax) of unfavorable adjustments on the same transportation project in the Northeast, split evenly between the Civil and Building segments, primarily due to the settlement of certain change orders, changes in estimates due to recent negotiations and incremental cost incurred during project closeout, and a $9.4 million ($6.8 million, or $0.13 per diluted share, after tax) unfavorable adjustment due to ongoing negotiations and an anticipated settlement on a completed Specialty Contractors segment mass-transit project in California. During the third quarter of 2023, the Company reached a settlement that impacted multiple components of a Civil segment mass-transit project in California, which included the resolution of certain ongoing disputes and increased the expected profit from work to be performed in the future. The settlement resulted in an unfavorable non-cash adjustment of $23.2 million ($16.8 million, or $0.32 per diluted share, after tax) to one component of the project that is nearing completion, partially offset by a favorable adjustment of $8.8 million ($7.0 million, or $0.13 per diluted share, after tax) on the other component of the project that has substantial scope of work remaining. As a result of the settlement, the net unfavorable impact to the period from these two adjustments is expected to be mitigated by the increased profit generated from future work on the project.

(b)Consists primarily of corporate general and administrative expenses.

(c)Depreciation and amortization is included in income (loss) from construction operations.

(d)During the three months ended September 30, 2022, the Company’s income (loss) from construction operations was adversely impacted by a $14.3 million ($10.2 million, or $0.20 per diluted share, after tax) unfavorable adjustment on a completed Civil segment highway project in the Northeast due to the reversal on appeal of a previously favorable lower-court ruling.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Segment Information (continued) |

| Unaudited |

| | | | | | | | |

| Reportable Segments | | | | |

| (in thousands) | Civil | Building | Specialty

Contractors | Total | | Corporate | | Consolidated

Total |

| Nine Months Ended September 30, 2023 | | | | | | | | |

| Total revenue | $ | 1,477,553 | | $ | 919,468 | | $ | 508,004 | | $ | 2,905,025 | | | $ | — | | | $ | 2,905,025 | |

| Elimination of intersegment revenue | (53,066) | | 6,976 | | (179) | | (46,269) | | | — | | | (46,269) | |

| Revenue from external customers | $ | 1,424,487 | | $ | 926,444 | | $ | 507,825 | | $ | 2,858,756 | | | $ | — | | | $ | 2,858,756 | |

| Income (loss) from construction operations | $ | 170,308 | | $ | (83,917) | | $ | (120,709) | | $ | (34,318) | | (a) | $ | (57,805) | | (b) | $ | (92,123) | |

| Capital expenditures | $ | 36,649 | | $ | 3,716 | | $ | 1,091 | | $ | 41,456 | | | $ | 4,134 | | | $ | 45,590 | |

Depreciation and amortization(c) | $ | 21,753 | | $ | 1,655 | | $ | 1,856 | | $ | 25,264 | | | $ | 6,721 | | | $ | 31,985 | |

| | | | | | | | |

| Nine Months Ended September 30, 2022 | | | | | | | | |

| Total revenue | $ | 1,478,162 | | $ | 960,148 | | $ | 673,302 | | $ | 3,111,612 | | | $ | — | | | $ | 3,111,612 | |

| Elimination of intersegment revenue | (182,840) | | (44,509) | | (156) | | (227,505) | | | — | | | (227,505) | |

| Revenue from external customers | $ | 1,295,322 | | $ | 915,639 | | $ | 673,146 | | $ | 2,884,107 | | | $ | — | | | $ | 2,884,107 | |

| Income (loss) from construction operations | $ | 12,052 | | $ | 9,453 | | $ | (82,461) | | $ | (60,956) | | (d) | $ | (46,397) | | (b) | $ | (107,353) | |

| Capital expenditures | $ | 38,703 | | $ | 973 | | $ | 2,202 | | $ | 41,878 | | | $ | 931 | | | $ | 42,809 | |

Depreciation and amortization(c) | $ | 44,191 | | $ | 1,261 | | $ | 1,539 | | $ | 46,991 | | | $ | 7,063 | | | $ | 54,054 | |

____________________________________________________________________________________________________

(a)During the nine months ended September 30, 2023, the Company’s income (loss) from construction operations was impacted by an adverse legal ruling on a completed mixed-use project in New York, which resulted in a non-cash, pre-tax charge of $83.6 million ($60.1 million, or $1.16 per diluted share, after-tax) in the first quarter, of which $72.2 million impacted the Building segment and $11.4 million impacted the Specialty Contractors segment; $57.0 million ($41.4 million, or $0.80 per diluted share, after tax) of unfavorable non-cash adjustments due to changes in estimates on the Specialty Contractors segment’s electrical and mechanical scope of a transportation project in the Northeast associated with changes in the expected recovery on certain unapproved change orders resulting from ongoing negotiations; $27.5 million ($21.4 million, or $0.41 per diluted share, after tax) of unfavorable adjustments on the same transportation project in the Northeast, split evenly between the Civil and Building segments, primarily due to the settlement of certain change orders, changes in estimates due to recent negotiations and incremental cost incurred during project closeout; net favorable adjustments of $25.6 million ($20.3 million, or $0.39 per diluted share, after tax) for a Civil segment mass-transit project in California that resulted from changes in estimates due to improved performance; a non-cash charge of $25.1 million ($18.2 million, or $0.35 per diluted share, after tax) in the second quarter of 2023 that resulted from an adverse legal ruling on a Specialty Contractors segment educational facilities project in New York; and a $9.4 million ($6.8 million, or $0.13 per diluted share, after tax) unfavorable adjustment due to ongoing negotiations and an anticipated settlement on a completed Specialty Contractors segment mass-transit project in California. During the third quarter of 2023, the Company reached a settlement that impacted multiple components of a Civil segment mass-transit project in California, which included the resolution of certain ongoing disputes and increased the expected profit from work to be performed in the future. The settlement resulted in an unfavorable non-cash adjustment of $23.2 million ($16.8 million, or $0.32 per diluted share, after tax) to one component of the project that is nearing completion, partially offset by a favorable adjustment of $8.8 million ($7.0 million, or $0.14 per diluted share, after tax) on the other component of the project that has substantial scope of work remaining. As a result of the settlement, the net unfavorable impact to the period from these two adjustments is expected to be mitigated by the increased profit generated from future work on the project.

(b)Consists primarily of corporate general and administrative expenses.

(c)Depreciation and amortization is included in income (loss) from construction operations.

(d)During the nine months ended September 30, 2022, the Company’s income (loss) from construction operations was adversely impacted by $36.0 million ($26.0 million, or $0.51 per diluted share, after tax) due to unfavorable adjustments related to the unforeseen cost of project close-out issues, remediation work, extended project supervision and associated labor inefficiencies on the electrical component of a transportation project in the Northeast in the Specialty Contractors segment, and $34.6 million ($27.3 million, or $0.53 per diluted share, after tax) for a Civil segment mass-transit project in California, which resulted from the successful negotiation of significant lower margin (and lower risk) change orders that increased the project’s overall estimated profit but reduced the project’s percentage of completion and overall margin percentage. The Company’s income (loss) from construction operations was also impacted by a non-cash charge of $25.5 million ($18.3 million, or $0.36 per diluted share, after tax) due to an adverse legal ruling on a dispute related to a completed Civil segment bridge project in New York; an $18.0 million ($13.9 million, or $0.27 per diluted share, after tax) unfavorable adjustment split evenly between the Civil and Building segments due to changes in estimates on the same transportation project in the Northeast mentioned above; a non-cash charge of $17.8 million ($12.8 million, or $0.25 per diluted share, after tax) that increased cost of operations associated with the partial reversal by an appellate court of previously awarded legal damages related to a completed electrical project in New York in the Specialty Contractors segment; a $16.2 million ($11.6 million, or $0.23 per diluted share, after tax) unfavorable non-cash impact related to the settlement of a long-disputed, completed Civil segment project in Maryland; a $14.3 million ($10.2 million, or $0.20 per diluted share, after tax) unfavorable adjustment on a completed Civil segment highway project in the Northeast due to the reversal on appeal of a previously favorable lower-court ruling; and $13.1 million ($9.4 million, or $0.18 per diluted share, after tax) of unfavorable adjustments on a Civil segment mass-transit project in California.

| | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Balance Sheets |

| Unaudited |

| (in thousands, except share and per share amounts) | | As of September 30,

2023 | | As of December 31,

2022 |

| | | | |

| ASSETS |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents ($148,097 and $168,408 related to variable interest entities (“VIEs”)) | | $ | 290,008 | | | $ | 259,351 | |

| Restricted cash | | 41,915 | | | 14,480 | |

| Restricted investments | | 98,361 | | | 91,556 | |

| Accounts receivable ($85,836 and $54,040 related to VIEs) | | 1,161,020 | | | 1,171,085 | |

| Retention receivable ($155,590 and $187,615 related to VIEs) | | 561,856 | | | 585,556 | |

| Costs and estimated earnings in excess of billings ($61,279 and $83,911 related to VIEs) | | 1,175,795 | | | 1,377,528 | |

| Other current assets ($31,260 and $33,340 related to VIEs) | | 239,736 | | | 179,215 | |

| Total current assets | | 3,568,691 | | | 3,678,771 | |

PROPERTY AND EQUIPMENT ("P&E"), net of accumulated depreciation of $524,774 and $505,512 (net P&E of $36,852 and $22,133 related to VIEs) | | 447,303 | | | 435,088 | |

| GOODWILL | | 205,143 | | | 205,143 | |

| INTANGIBLE ASSETS, NET | | 68,865 | | | 70,542 | |

| DEFERRED INCOME TAXES | | 72,003 | | | 15,910 | |

| OTHER ASSETS | | 123,722 | | | 137,346 | |

| TOTAL ASSETS | | $ | 4,485,727 | | | $ | 4,542,800 | |

| | | | |

| LIABILITIES AND EQUITY |

| CURRENT LIABILITIES: | | | | |

| Current maturities of long-term debt | | $ | 28,040 | | | $ | 70,285 | |

| Accounts payable ($42,864 and $36,484 related to VIEs) | | 558,844 | | | 495,345 | |

| Retention payable ($25,467 and $44,859 related to VIEs) | | 221,488 | | | 246,562 | |

| Billings in excess of costs and estimated earnings ($432,558 and $480,839 related to VIEs) | | 1,028,960 | | | 975,812 | |

| Accrued expenses and other current liabilities ($12,239 and $5,082 related to VIEs) | | 199,238 | | | 179,523 | |

| Total current liabilities | | 2,036,570 | | | 1,967,527 | |

LONG-TERM DEBT, less current maturities, net of unamortized discount and debt issuance costs totaling $11,538 and $13,980 | | 876,794 | | | 888,154 | |

| | | | |

| OTHER LONG-TERM LIABILITIES | | 238,408 | | | 245,135 | |

| TOTAL LIABILITIES | | 3,151,772 | | | 3,100,816 | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| EQUITY | | | | |

| Stockholders' equity: | | | | |

| Preferred stock - authorized 1,000,000 shares ($1 par value), none issued | | — | | | — | |

| Common stock - authorized 112,500,000 shares ($1 par value), issued and outstanding 52,022,169 and 51,521,336 shares | | 52,022 | | | 51,521 | |

| Additional paid-in capital | | 1,144,783 | | | 1,140,933 | |

| Retained earnings | | 180,675 | | | 304,301 | |

| Accumulated other comprehensive loss | | (45,979) | | | (47,037) | |

| Total stockholders' equity | | 1,331,501 | | | 1,449,718 | |

| Noncontrolling interests | | 2,454 | | | (7,734) | |

| TOTAL EQUITY | | 1,333,955 | | | 1,441,984 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 4,485,727 | | | $ | 4,542,800 | |

| | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Statements of Cash Flows |

| Unaudited |

| Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 |

| Cash Flows from Operating Activities: | | | |

| Net loss | $ | (91,519) | | | $ | (104,903) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation | 30,308 | | | 40,088 | |

| Amortization of intangible assets | 1,677 | | | 13,966 | |

| Share-based compensation expense | 9,103 | | | 7,681 | |

| Change in debt discounts and deferred debt issuance costs | 2,992 | | | 2,751 | |

| Deferred income taxes | (61,146) | | | (53,365) | |

| Gain on sale of property and equipment | (5,077) | | | (183) | |

| Changes in other components of working capital | 296,839 | | | 338,527 | |

| Other long-term liabilities | (2,976) | | | 10,862 | |

| Other, net | 610 | | | (4,146) | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 180,811 | | | 251,278 | |

| | | |

| Cash Flows from Investing Activities: | | | |

| Acquisition of property and equipment | (45,590) | | | (42,809) | |

| Proceeds from sale of property and equipment | 9,006 | | | 6,738 | |

| Investments in securities | (17,986) | | | (11,145) | |

| Proceeds from maturities and sales of investments in securities | 11,134 | | | 8,333 | |

| NET CASH USED IN INVESTING ACTIVITIES | (43,436) | | | (38,883) | |

| | | |

| Cash Flows from Financing Activities: | | | |

| Proceeds from debt | 702,427 | | | 498,606 | |

| Repayment of debt | (758,473) | | | (533,452) | |

| Cash payments related to share-based compensation | (737) | | | (1,389) | |

| Distributions paid to noncontrolling interests | (26,500) | | | (46,500) | |

| Contributions from noncontrolling interests | 4,500 | | | 3,961 | |

| Debt issuance, extinguishment and modification costs | (500) | | | — | |

| NET CASH USED IN FINANCING ACTIVITIES | (79,283) | | | (78,774) | |

| | | |

| Net increase in cash, cash equivalents and restricted cash | 58,092 | | | 133,621 | |

| Cash, cash equivalents and restricted cash at beginning of period | 273,831 | | | 211,396 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 331,923 | | | $ | 345,017 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Backlog Information |

| Unaudited |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Backlog at

June 30, 2023 | | New Awards in the Three Months Ended

September 30, 2023(a) | | Revenue Recognized in the Three Months Ended

September 30, 2023 | | Backlog at September 30, 2023 |

| Civil | | $ | 4,581.1 | | | $ | 469.0 | | | $ | (520.5) | | | $ | 4,529.6 | |

| Building | | 4,456.5 | | | 249.0 | | | (365.4) | | | 4,340.1 | |

| Specialty Contractors | | 1,826.5 | | | 128.5 | | | (174.8) | | | 1,780.2 | |

| Total | | $ | 10,864.1 | | | $ | 846.5 | | | $ | (1,060.7) | | | $ | 10,649.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| (in millions) | | Backlog at December 31, 2022 | | New Awards in the Nine Months Ended

September 30, 2023(a) | | Revenue Recognized in the Nine Months Ended

September 30, 2023 | | Backlog at September 30, 2023 |

| Civil | | $ | 4,416.3 | | | $ | 1,537.8 | | | $ | (1,424.5) | | | $ | 4,529.6 | |

| Building | | 2,223.6 | | | 3,042.9 | | | (926.4) | | | 4,340.1 | |

| Specialty Contractors | | 1,289.2 | | | 998.9 | | | (507.9) | | | 1,780.2 | |

| Total | | $ | 7,929.1 | | | $ | 5,579.6 | | | $ | (2,858.8) | | | $ | 10,649.9 | |

____________________________________________________________________________________________________

(a)New awards consist of the original contract price of projects added to our backlog plus or minus subsequent changes to the estimated total contract price of existing contracts.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

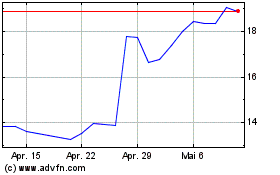

Tutor Perini (NYSE:TPC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Tutor Perini (NYSE:TPC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024