Current Report Filing (8-k)

14 Dezember 2022 - 11:25PM

Edgar (US Regulatory)

FALSE0001361658Travel & Leisure Co.00013616582022-12-142022-12-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 14, 2022

Travel + Leisure Co.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-32876 | 20-0052541 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification Number) |

| | | | | | | | |

6277 Sea Harbor Drive

| |

Orlando | Florida | 32821

|

(Address of Principal Executive Offices)

| (Zip Code)

|

| (407) | 626-5200 |

(Registrant’s telephone number, including area code) |

None

(Former name or former address, if changed since last report) |

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | TNL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 14, 2022, Travel + Leisure Co. (the “Borrower”) entered into the Third Amendment (the “Third Amendment”) to the Credit Agreement, dated as of May 31, 2018, with Bank of America, N.A., as administrative agent, the several lenders from time to time party thereto, and the other parties thereto (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”). The Third Amendment, among other things, provides for an incremental term loan of $300 million (the “Incremental Term Loan”), which was issued with an original issue discount of 97.5%. The Company expects to use the net proceeds from the Incremental Term Loan, together with cash on hand and revolving credit facility borrowings under the Credit Agreement, to redeem, repurchase or repay all of its 3.90% secured notes due March 2023 (the “2023 Notes”) and to pay the related fees and expenses.

The Incremental Term Loan has substantially the same terms as the outstanding loans under the Credit Agreement, except, among other things, the Incremental Term Loan:

•bears interest at the Borrower’s option at a rate of (a) Base Rate (which is the highest of Bank of America’s prime rate, the federal funds rate plus 0.50%, and the Term SOFR (as defined in the Credit Agreement) one month rate, inclusive of the SOFR Adjustment (defined as 0.10% per annum in the Credit Agreement), plus 1.00% (subject in each case to a floor of 0.50%), plus an applicable rate of 3.00%, or (b) the Term SOFR rate, inclusive of the SOFR Adjustment, plus an applicable rate of 4.00% (subject to a floor of 0.50%);

•will mature on December 14, 2029;

•may be prepaid at any time, without prepayment premium or penalty, but is subject to a prepayment premium of 1.00% if a prepayment of the Incremental Term Loan is made in connection with certain “repricing events” at any time during the first six months after the closing date;

•amortizes in equal quarterly installments of 0.25% of the initial principal amount of the Incremental Term Loan, starting with the first full fiscal quarter after the closing date; and

•is subject to certain mandatory prepayments, subject to certain exceptions, which are set forth in the Credit Agreement.

The description of the Third Amendment in this Current Report on Form 8-K (this “Current Report”) is a summary and is qualified in its entirety by reference to the complete terms of the Third Amendment included therein. The Third Amendment is filed hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 2.03. Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report is incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On December 14, 2022, the Company issued a press release to announce the closing of the Incremental Term Loan. A copy of the press release is attached hereto as Exhibit 99.1.

The information set forth under Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | |

| | TRAVEL + LEISURE CO. |

| | |

| | By: /s/ Thomas M. Duncan | |

| | Name: Thomas M. Duncan | |

| | Title: Chief Accounting Officer | |

Date: December 14, 2022

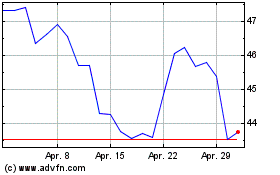

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

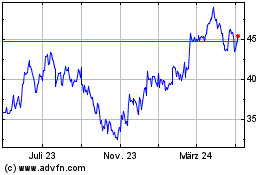

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024