UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Public acquisition offer for shares representing up to 28.19% of Telefonica Deutschland | 2 |

The information contained herein is not for publication or distribution, in whole or in part, into, within or from any country where such publication or distribution would be in violation of the relevant legal provisions of such countries.

TELEFÓNICA, S.A. (hereinafter, Telefónica), in compliance with the Securities Market legislation, hereby communicates the following:

INSIDE INFORMATION

Today, the Executive Commission of Telefónica, pursuant to the authorization granted by the Board of Directors, has resolved to make, through Telefónica Local Services GmbH (the "Bidder") (a direct wholly-owned subsidiary of Telefónica), a voluntary public acquisition offer in the form of a partial offer (the "Offer") for shares representing approximately up to 28.19% of the share capital and the voting rights of Telefónica Deutschland Holding AG (“Telefónica Deutschland”). The definitive number of Telefónica Deutschland shares subject to the Offer will be set forth in the offer document.

Telefónica currently holds, directly or indirectly, the remaining 71.81% of the share capital and the voting rights of Telefónica Deutschland, and has advised the Bidder that it has no intention to tender any such shares into the Offer. In addition, Telefónica directly holds instruments that give Telefónica the right to acquire approximately 1.32% of Telefónica Deutschland’s share capital and voting rights.

The Offer will be structured as a share purchase. The consideration offered to Telefónica Deutschland shareholders amounts to EUR 2.35 in cash for each share, representing a premium of approximately (i) 37.6% over Telefónica Deutschland's yesterday closing price; and (ii) 36.3% over Telefónica Deutschland's volume-weighted average price during the three months prior to this announcement. The necessary funds are available to Telefónica to pay the total consideration of the Offer.

By making the Offer, the Bidder and Telefónica intend to increase Telefónica Deutschland’s contribution to the consolidated profit and cash flows attributable to equity holders of Telefónica. In addition, the Offer reinforces Telefónica’s strategy to focus on its core geographies (i.e., Spain, Brazil, Germany and the UK) and its strong commitment to the German market, representing one of the most attractive and stable telecom markets in Europe. The Offer also supports Telefónica’s efforts to simplify the Group’s structure and enhances the Euro denominated cash flows generated in the Group. The Bidder has no intention to implement a domination agreement and/or profit and loss transfer agreement.

In the context of the Offer, Telefónica intends to promote a revision of the current Telefónica Deutschland dividend policy beyond the already-confirmed EUR 0.18 dividend per share for financial year 2023 and expected to be paid in 2024. Telefónica Deutschland’s future dividend policy will be reflective of the needs resulting from the implementation of its current business plan, and accordingly be subject among other things to Telefónica Deutschland’s future spending and investment plans, as well as

to other existing or potential risks and contingencies. The Bidder and Telefónica intend to evaluate Telefónica Deutschland’s dividend policy over time jointly with Telefónica Deutschland’s management team. Consequently, Telefónica believes the Offer provides an attractive opportunity to access liquidity at a significant premium for all shareholders, in particular for those focused on the current dividend policy.

Additional information on the Offer is set out in the announcement published today in the manner prescribed by German law. An informative English translation of the announcement is attached hereto.

The specific characteristics, conditions and terms of the Offer will be set out in the relevant offer document, which will be published after review and approval by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht).

The acceptance period for the Offer will commence upon the publication of the offer document. The Offer will be subject to a customary market MAC (Material Adverse Change) condition and may be subject to regulatory approval, to the extent required. The Offer will not be subject to a minimum acceptance threshold.

In Madrid, on 7 November 2023

Important notice:

This announcement is for information purposes and neither represents an offer to purchase or sell nor a solicitation of an offer to purchase, sell or tender shares of Telefónica Deutschland. The complete terms and conditions of the Offer will be published in the offer document after the approval of the offer document by the German Federal Financial Supervisory Authority.

THE INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, INTO, WITHIN OR FROM ANY COUNTRY WHERE SUCH PUBLICATION OR DISTRIBUTION WOULD BE IN VIOLATION OF THE RELEVANT LEGAL PROVISIONS OF SUCH COUNTRIES.

Publication of the decision to make a voluntary public acquisition offer in the form of a partial offer pursuant to Section 10 para. 1 and para. 3 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – “WpÜG”)

Bidder:

Telefónica Local Services GmbH

Adalperostraße 82-86

85737 Ismaning

Germany

registered with the commercial register of the local court of Munich under HRB 287256

Target:

Telefónica Deutschland Holding AG

Georg-Brauchle-Ring 50

80992 Munich

Germany

registered with the commercial register of the local court of Munich under HRB 201055

ISIN: DE000A1J5RX9 / WKN: A1J5RX

Information by the Bidder:

Today, Telefónica Local Services GmbH (the “Bidder”) has decided to make a voluntary public acquisition offer in the form of a partial offer to the shareholders of Telefónica Deutschland Holding AG, with registered office in Munich, Germany (“Telefónica Deutschland”), to acquire up to 838,452,647 non-par value registered shares in Telefónica Deutschland not already directly held by the Bidder, corresponding to approximately 28.19% of the share capital and the voting rights of Telefónica Deutschland, each share representing a proportionate amount of EUR 1.00 of the share capital of Telefónica Deutschland (ISIN DE000A1J5RX9) (the “Telefónica Deutschland Shares”). The offer provides for payment of a cash consideration of EUR 2.35 per Telefónica Deutschland Share (the “Offer”), representing a premium of approximately (i) 37.6% over Telefónica Deutschland’s yesterday closing price and (ii) 36.3% over Telefónica Deutschland’s volume-weighted average price during the three months prior to this announcement. The definitive number of Telefónica Deutschland Shares subject to the Offer will be set forth in the offer document.

The Bidder is a direct wholly-owned subsidiary of Telefónica, S.A., with registered office in Madrid, Spain. Telefónica, S.A. has and will ensure that the Bidder will have the necessary funds available to pay the total consideration of the Offer at the time the cash consideration will be due. Telefónica, S.A. currently indirectly holds 2,059,117,075 Telefónica Deutschland Shares, corresponding to approximately 69.22% of Telefónica Deutschland’s share capital and voting rights, and directly holds 76,985,271 Telefónica Deutschland Shares, corresponding to approximately 2.59% of Telefónica Deutschland’s share capital and voting rights. In addition, Telefónica, S.A. directly holds instruments that give Telefónica, S.A. the right to acquire approximately 1.32% of Telefónica Deutschland’s share capital and voting rights. Telefónica, S.A. has advised the Bidder that it has no intention to tender any of its directly or indirectly held Telefónica Deutschland Shares into the Offer.

In the context of the Offer, Telefónica, S.A. intends to promote a revision of the current Telefónica Deutschland dividend policy beyond the already-confirmed EUR 0.18 dividend per share for financial year 2023 and expected to be paid in 2024. Telefónica Deutschland’s future dividend policy will be reflective of the needs resulting from the implementation of its current business plan and, accordingly be subject among other things to Telefónica Deutschland’s future spending and investment plans, as well as to other existing or potential risks and contingencies. The Bidder and Telefónica, S.A. intend to evaluate Telefónica Deutschland’s dividend policy over time jointly with Telefónica Deutschland’s management team. Consequently, Telefónica, S.A. believes the Offer provides an attractive opportunity to access liquidity at a significant premium for all shareholders, in particular for those focused on the current dividend policy.

The Bidder has no intention to implement a domination agreement and/or profit and loss transfer agreement.

The Offer will be made in accordance with the terms and conditions set forth in the offer document to be approved by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin). The offer document and other information relating to the Offer will be available at https://www.td-offer.com.

The acceptance period for the Offer will commence upon the publication of the offer document. The Offer will be subject to a customary market MAC (Material Adverse Change) condition and may be subject to regulatory approval, to the extent required. The Offer will not be subject to a minimum acceptance threshold.

Important Notice:

This announcement is for information purposes and neither represents an offer to purchase or sell nor a solicitation of an offer to purchase, sell or tender shares of Telefónica Deutschland. The complete

terms and conditions of the Offer will be published in the offer document after the approval of the offer document by the German Federal Financial Supervisory Authority. The Bidder reserves the right, to the extent legally permissible, to change the terms referred to herein in the final terms and conditions of the Offer.

Investors and shareholders of Telefónica Deutschland are strongly advised to read the offer document and any relevant documents in connection with the Offer as soon as such documents are published as they will contain important information. Where appropriate, it is furthermore recommended that investors and shareholders seek independent advice in order to receive individual assessment regarding the Offer.

The Offer will be conducted exclusively under the laws of the Federal Republic of Germany and certain applicable provisions of the U.S. securities laws. Any contract concluded on the basis of the Offer will be exclusively governed by the laws of the Federal Republic of Germany and is to be interpreted in accordance with such laws.

The Bidder and/or persons acting jointly with the Bidder within the meaning of section 2 para. 5 sentences 1 and 3 WpÜG may acquire, or make arrangements to acquire, Telefónica Deutschland Shares other than in the course of the Offer on or off the stock exchange prior to publication of the offer document and/or during the period in which the Offer remains open for acceptance, provided that such acquisitions or arrangements to acquire comply with the applicable German statutory provisions, in particular the WpÜG, and the applicable provisions under the U.S. Securities Exchange Act of 1934. If any such acquisitions are made prior to the publication of the offer document, the number of Telefónica Deutschland Shares subject to the Offer may be less than 838,452,647 Telefónica Deutschland Shares and the definitive number of Telefónica Deutschland Shares subject to the Offer will be set forth in the offer document. Information about such acquisitions or arrangements to acquire will be disclosed (i) if consummated prior to the publication of the offer document, in the offer document and (ii) if consummated during the period in which the Offer remains open for acceptance, in the form prescribed by section 23 para. 2 WpÜG, with a non-binding English translation being made available on the Bidder’s website at https:///www.td-offer.com. Any information about such acquisitions or arrangements that is made public in Germany will be made publicly available in the United States.

7 November 2023

Telefónica Local Services GmbH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | November 7, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

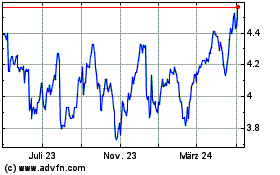

Telefonica (NYSE:TEF)

Historical Stock Chart

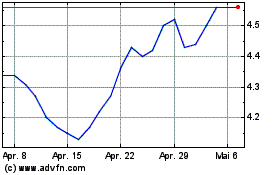

Von Mär 2024 bis Apr 2024

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024