UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 3, 2015

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-33160 | | 20-2436320 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

3801 South Oliver, Wichita, Kansas 67210

(Address of principal executive offices)(zip code)

(316) 526-9000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On February 3, 2015, Spirit AeroSystems Holdings, Inc. issued a press release announcing its financial results for the twelve months ended December 31, 2014 under the heading “Spirit AeroSystems Holdings, Inc. Reports Fourth Quarter and Full-Year 2014 Financial Results; Provides 2015 Guidance.” The press release is furnished as Exhibit 99.

The information in this report, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Furnished

Exhibit 99 — Press Release dated February 3, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| SPIRIT AEROSYSTEMS HOLDINGS, INC. |

| |

Date: February 3, 2015 | /s/ Sanjay Kapoor |

| Sanjay Kapoor |

| Senior Vice President and Chief Financial Officer |

Exhibit 99

Spirit AeroSystems Holdings, Inc.

3801 S. Oliver

Wichita, KS 67210

www.spiritaero.com

Spirit AeroSystems Holdings, Inc. Reports Fourth Quarter and Full-Year 2014 Financial Results; Provides 2015 Guidance

2015 Guidance

| |

• | Full-Year 2015 Guidance: Revenues $6.6 - $6.7 billion, Earnings Per Share of $3.60 - $3.80, Free Cash Flow of $600 - $700 million* |

Fourth Quarter 2014 Consolidated Results

| |

• | Total Revenues of $1.6 billion, up 5% y/y |

| |

• | Reports fully diluted EPS loss of ($0.77), adjusted EPS of $0.87* excluding the impact of the divestiture of the Gulfstream programs and deferred tax valuation allowance |

| |

• | Adjusted Free Cash Flow of $107 million* |

| |

• | Records loss of ($197) million for previously announced divestiture of the Gulfstream programs |

Full-Year 2014 Consolidated Results

| |

• | Total Revenues of $6.8 billion, up 14% y/y |

| |

• | Reports fully diluted EPS of $2.53, adjusted EPS of $3.57* excluding the impact of the divestiture of the Gulfstream programs and deferred tax valuation allowance |

| |

• | Adjusted Free Cash Flow of $302 million* |

| |

• | A record total backlog of ~$47 billion |

Wichita, Kan., Feb. 3, 2015 - Spirit AeroSystems Holdings, Inc. [NYSE: SPR] reported fourth quarter and full-year 2014 financial results driven by strong mature program operating performance. Spirit’s fourth quarter 2014 revenues were $1.6 billion, up from $1.5 billion for the same period of 2013.

|

| | | | | | | | | | | | | | | | | | | | | | |

Table 1. Summary Financial Results (unaudited) | | | | |

| | 4th Quarter | | | | Twelve Months | | |

($ in millions, except per share data) | | 2014 | | 2013 | | Change | | 2014 | | 2013 | | Change |

Revenues | |

| $1,574 |

| |

| $1,494 |

| | 5 | % | |

| $6,799 |

| |

| $5,961 |

| | 14 | % |

Operating (Loss) Income | |

| ($273 | ) | |

| ($321 | ) | | 15 | % | |

| $354 |

| |

| ($364 | ) | | 197 | % |

Operating (Loss) Income as a % of Revenues | | (17.3 | %) | | (21.5 | %) | | 420 BPS |

| | 5.2 | % | | (6.1 | %) | | 1,130 BPS |

|

Net (Loss) Income | |

| ($106 | ) | |

| ($587 | ) | | 82 | % | |

| $359 |

| |

| ($621 | ) | | 158 | % |

Net (Loss) Income as a % of Revenues | | (6.7 | %) | | (39.3 | %) | | 3,260 BPS |

| | 5.3 | % | | (10.4 | %) | | 1,570 BPS |

|

(Loss) Earnings Per Share (Fully Diluted) | |

| ($0.77 | ) | |

| ($4.15 | ) | | 81 | % | |

| $2.53 |

| |

| ($4.40 | ) | | 158 | % |

Fully Diluted Weighted Avg Share Count | | 138.8 |

| | 141.4 |

| | |

| | 141.6 |

| | 141.3 |

| | |

|

* Non-GAAP financial measure, see Appendix for reconciliation

Operating loss for the fourth quarter of 2014 was ($273) million compared to operating loss of ($321) million in the fourth quarter of 2013. Net loss for the quarter was ($106) million, or ($0.77) per share, compared to net loss of ($587) million, or ($4.15) per share, in the same period of 2013. The current quarter includes a pretax charge of ($471) million, or ($1.42) per share*, for the divestiture of Gulfstream programs and ($30) million, or ($0.22) per share, negative impact for deferred tax asset valuation allowance not associated with the Gulfstream programs. This is compared to pretax ($546) million of forward loss charges in the same period of 2013, and a ($381) million negative impact due to the establishment of a valuation allowance against U.S. net deferred tax assets. Revenue for the full-year 2014 increased 14 percent to $6.8 billion. Operating income for the full-year was $354 million compared to operating loss of ($364) million for the prior year. Full-year net income was $359 million, or $2.53 per share, compared to net loss of ($621) million, or ($4.40) per share in 2013. (Table 1)

“This was a record year for sales and deliveries; 2014 was a year of transition for Spirit. We addressed performance challenges in both development and production, we improved productivity and quality, and we mitigated risk as exemplified by the sale of the Gulfstream wing programs,” said President and Chief Executive Officer Larry Lawson.

“We delivered a record 1,545 ship sets last year. We also made positive inroads in defense, with focused program execution on Sikorsky’s CH-53K and Textron’s Bell V-280 Valor and we celebrated with Boeing and the U.S. Air Force the successful first test flight for the KC-46A tanker program,” Lawson added.

“Our objectives for 2015 are well defined. We will continue to focus on increasing productivity, making thoughtful investments in preparation for rate increases, continuing progress on A350, increasing our emphasis on long-term growth, and addressing how we deploy capital,” Lawson concluded.

Spirit’s backlog at the end of the fourth quarter of 2014 increased by approximately 7 percent from the previous quarter to a record $47 billion as orders exceeded deliveries.

Spirit updated its contract profitability estimates during the fourth quarter of 2014 resulting in pretax $63 million, or $0.31 per share#, favorable cumulative catch-up adjustments on mature programs due to improved performance and reduced risks. Additionally, the company recorded reversal of forward loss charges of $27 million on the BR725, 767 and 747-8 programs combined. In comparison, Spirit recorded pretax ($546) million forward losses and pretax $51 million favorable cumulative catch-up adjustments in the fourth quarter of 2013.

Adjusted free cash flow from operations was a $107 million* source of cash for the fourth quarter of 2014, compared to a $6 million* source of cash in the fourth quarter of 2013 due to greater reduction in accounts receivable partially offset by higher cash tax payments. Adjusted full-year free cash flow was a $302 million* source of cash compared to a $57 million* source of cash in 2013. (Table 2)

# The earnings per share amount is presented net of income taxes of 31.0%.

* Non-GAAP financial measure, see Appendix for reconciliation

|

| | | | | | | | |

Table 2. Cash Flow and Liquidity (unaudited) | | | | |

| | 4th Quarter | | Twelve Months |

($ in millions) | | 2014 | | 2013 | | 2014 | | 2013 |

Cash Flow from Operations | | $33 | | $61 | | $362 | | $261 |

Purchases of Property, Plant & Equipment | | ($86) | | ($81) | | ($220) | | ($273) |

Free Cash Flow* | | ($53) | | ($20) | | $142 | | ($12) |

Adjusted Free Cash Flow*# | | $107 | | $6 | | $302 | | $57 |

# Excludes Cash Transferred on Gulfstream Divestiture and Severe Weather Impact | | | | | | | | |

Liquidity | | | | | | December 31,

2014 | | December 31,

2013 |

Cash | | | | | | $378 | | $421 |

Total Debt | | | | | | $1,154 | | $1,167 |

Cash balances at the end of the year were $378 million after a $160 million cash payment to Triumph Group related to the divestiture of the Gulfstream programs and $129 million related to the first share repurchase in Spirit’s history. At the end of 2014, the company’s $650 million revolving credit facility was undrawn. Debt balances at the end of the fourth quarter were $1.2 billion. The company’s credit rating remained unchanged at the end of the fourth quarter 2014.

Financial Outlook and Risk to Future Financial Results

Spirit revenue for the full-year 2015 is expected to be $6.6 - $6.7 billion. Fully diluted earnings per share for 2015 is expected to be $3.60 - $3.80 per share and does not include the impact of potential future adjustments to the deferred tax asset valuation allowance. Free cash flow is expected to be between $600 million and $700 million*, with higher capital expenditures of $325 million to $375 million. The effective tax rate for 2015 is forecasted to be approximately 32.0 - 33.0 percent, including the expected benefit of the U.S. Research Tax Credit for 2015, and excluding any potential adjustment to the valuation allowance against U.S. net deferred tax assets. (Table 3)

Risks to our financial guidance are described more fully in the Cautionary Statement Regarding Forward-Looking Statements in this release and in the “Risk Factors” section of our filings with the Securities and Exchange Commission.

|

| | |

Table 3. Financial Outlook Issued February 3, 2015 | | 2015 Guidance |

Revenues | | $6.6 - $6.7 billion |

Earnings Per Share (Fully Diluted) | | $3.60 - $3.80 |

Effective Tax Rate** | | ~32.0% - 33.0% |

Free Cash Flow* | | $600 - $700 million |

** Effective tax rate guidance, among other factors, assumes the benefit attributable to the extension of the U.S. Research Tax Credit and does not assume an impact for any potential adjustment to the valuation allowance against the U.S. net deferred tax assets.

* Non-GAAP financial measure, see Appendix for reconciliation

Cautionary Statement Regarding Forward-Looking Statements

This press release contains “forward-looking statements” that may involve many risks and uncertainties. Forward-looking statements reflect our current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “should,” “will,” or other similar words, or the negative thereof, unless the context requires otherwise. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. Our actual results may vary materially from those anticipated in forward-looking statements. We caution investors not to place undue reliance on any forward-looking statements. Important factors that could cause actual results to differ materially from those reflected in such forward-looking statements and that should be considered in evaluating our outlook include, but are not limited to, the following: 1) our ability to continue to grow our business and execute our growth strategy, including the timing, execution, and profitability of new and maturing programs; 2) our ability to perform our obligations and manage costs related to our new and maturing commercial, business aircraft and military development programs and the related recurring production; 3) margin pressures and the potential for additional forward losses on new and maturing programs; 4) our ability to accommodate, and the cost of accommodating, announced increases in the build rates of certain aircraft; 5) the effect on business and commercial aircraft demand and build rates of the following factors: changing customer preferences for business aircraft, including the effect of global economic conditions on the business aircraft market and expanding conflicts or political unrest in the Middle East or Asia; 6) customer cancellations or deferrals as a result of global economic uncertainty; 7) the effect of economic conditions in the industries and markets in which we operate in the U.S. and globally and any changes therein, including fluctuations in foreign currency exchange rates; 8) the success and timely execution of key milestones such as receipt of necessary regulatory approvals and customer adherence to their announced schedules; 9) our ability to successfully negotiate future pricing under our supply agreements with Boeing, Airbus and our other customers; 10) our ability to enter into profitable supply arrangements with additional customers; 11) the ability of all parties to satisfy their performance requirements under existing supply contracts with Boeing and Airbus, our two major customers, and other customers and the risk of nonpayment by such customers; 12) any adverse impact on Boeing’s and Airbus’ production of aircraft resulting from cancellations, deferrals or reduced orders by their customers or from labor disputes or acts of terrorism; 13) any adverse impact on the demand for air travel or our operations from the outbreak of diseases or epidemic or pandemic outbreaks; 14) our ability to avoid or recover from cyber-based or other security attacks, information technology failures or other disruptions; 15) returns on pension plan assets and the impact of future discount rate changes on pension obligations; 16) our ability to borrow additional funds or refinance debt; 17) competition from commercial aerospace original equipment manufacturers and other aerostructures suppliers; 18) the effect of governmental laws, such as U.S. export control laws and U.S. and foreign anti-bribery laws such as the Foreign Corrupt Practices Act and the United Kingdom Bribery Act, and environmental laws and agency regulations, both in the U.S. and abroad; 19) any reduction in our credit ratings; 20) the cost and availability of raw materials and purchased components; 21) our ability to recruit and retain highly-skilled employees and our relationships with the unions representing many of our employees; 22) spending by the U.S. and other governments on defense; 23) the possibility that our cash flows and borrowing facilities may not be adequate for our additional capital needs or for payment of interest on and principal of our indebtedness; 24) our exposure under our existing senior secured revolving credit facility to higher interest payments should interest rates increase substantially; 25) the effectiveness of any interest rate hedging programs; 26) the effectiveness of our internal control over financial reporting; 27) the outcome or impact of ongoing or future litigation, claims and regulatory actions; and 28) exposure to potential product liability and warranty claims. These factors are not exhaustive and it is not possible for us to predict all factors that could cause actual results to differ materially from those reflected in our forward-looking statements. These factors speak only as of the date hereof, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. Except to the extent required by law, we undertake no obligation to, and expressly disclaim any obligation to, publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Segment Results

Fuselage Systems

Fuselage Systems segment revenues in the fourth quarter of 2014 were $788 million, up from $701 million for the same period last year. Operating margin for the fourth quarter of 2014 was 17.9 percent as compared to (31.6)(1) (2) percent during the same period of 2013. In the fourth quarter of 2014, the segment recorded pretax $28 million favorable cumulative catch-up adjustments on mature programs, and reversal of forward losses of $11 million on the 747-8 and 767 programs combined. In comparison, the segment realized pretax forward loss charges of ($368) million and pretax $26 million favorable cumulative catch-up adjustments in the fourth quarter of 2013.

Propulsion Systems

Propulsion Systems segment revenues in the fourth quarter of 2014 were $385 million compared to $398 million for the same period last year. Operating margin for the fourth quarter of 2014 was 27.7 percent as compared to 5.8(1) (2) percent in the fourth quarter of 2013. In the fourth quarter of 2014, the segment realized pretax $21 million favorable cumulative catch-up adjustments on mature programs and reversal of forward loss charges of $16 million on the BR725 and 767 programs combined. In comparison, the segment recorded pretax forward loss charges of ($60) million and pretax $15 million favorable cumulative catch-up adjustments in the fourth quarter of 2013.

Wing Systems

Wing Systems segment revenues in the fourth quarter of 2014 were $397 million, up from $393 million for the same period last year. Operating margin for the fourth quarter of 2014 was 15.2 percent as compared to (14.8)(1) (2)percent during the same period of 2013. In the fourth quarter of 2014, the segment recorded pretax $14 million favorable cumulative catch-up adjustments on mature programs. In comparison, the segment recorded pretax forward loss charges of ($118) million and pretax $10 million favorable cumulative catch-up adjustments in the fourth quarter of 2013.

| |

(1) | For the three months ended December 31, 2013, corporate SG&A of $1.3 million, $2.2 million and $2.6 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. |

| |

(2) | For the three months ended December 31, 2013, research and development of $4.2 million, $2.0 million and $1.9 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. |

Appendix

|

| | | | | | | | | | | | | | | | | | | | | | |

Table 4. Segment Reporting

| | (unaudited) 4th Quarter | | (unaudited) Twelve Months |

($ in millions) | | 2014 | | 2013 | | Change | | 2014 | | 2013 | | Change |

Segment Revenues | | |

| | |

| | |

| | |

| | |

| | |

|

Fuselage Systems | |

| $787.6 |

| |

| $700.8 |

| | 12.4 | % | |

| $3,354.9 |

| |

| $2,861.1 |

| | 17.3 | % |

Propulsion Systems | | 384.7 |

| | 398.2 |

| | (3.4 | )% | | 1,737.2 |

| | 1,581.3 |

| | 9.9 | % |

Wing Systems | | 397.2 |

| | 392.8 |

| | 1.1 | % | | 1,695.9 |

| | 1,502.5 |

| | 12.9 | % |

All Other | | 4.9 |

| | 2.6 |

| | |

| | 11.2 |

| | 16.1 |

| | |

Total Segment Revenues | |

| $1,574.4 |

| |

| $1,494.4 |

| | 5.4 | % | |

| $6,799.2 |

| |

| $5,961.0 |

| | 14.1 | % |

Segment Earnings (Loss) from Operations | | |

| | |

| | | | | | |

| | |

Fuselage Systems | |

| $140.7 |

| |

| ($221.6 | ) | | 163.5 | % | |

| $557.3 |

| |

| $89.6 |

| | 522.0 | % |

Propulsion Systems | | 106.7 |

| | 23.1 |

| | 361.9 | % | | 354.9 |

| | 249.5 |

| | 42.2 | % |

Wing Systems | | 60.5 |

| | (58.2 | ) | | 204.0 | % | | 244.6 |

| | (402.1 | ) | | 160.8 | % |

All Other | | 3.4 |

| | 0.3 |

| | | | 3.4 |

| | 4.4 |

| | |

Total Segment Operating Earnings (Loss) (1)(2) | |

| $311.3 |

| |

| ($256.4 | ) | | 221.4 | % | |

| $1,160.2 |

| |

| ($58.6 | ) | | 2,079.9 | % |

Unallocated Expense | | |

| | |

| | | | |

| | |

| | |

Corporate SG&A (1) | |

| ($68.9 | ) | |

| ($49.6 | ) | | 38.9 | % | |

| ($233.8 | ) | |

| ($200.8 | ) | | 16.4 | % |

Impact From Severe Weather Event | | — |

| | (10.7 | ) | | | | — |

| | (30.3 | ) | | |

Research & Development (2) | | (7.5 | ) | | (11.1 | ) | | (32.4 | )% | | (29.3 | ) | | (34.7 | ) | | (15.6 | )% |

Cost of Sales | | (36.7 | ) | | 7.0 |

| | (624.3 | )% | | (72.0 | ) | | (39.9 | ) | | 80.5 | % |

Loss on Divestiture of Programs | | (471.1 | ) | | — |

| | | | (471.1 | ) | | — |

| | |

Total (Loss) Earnings from Operations | |

| ($272.9 | ) | |

| ($320.8 | ) | | 14.9 | % | |

| $354.0 |

| |

| ($364.3 | ) | | 197.2 | % |

Segment Operating Earnings (Loss) as % of Revenues | | |

| | |

| | |

| | |

| | |

| | |

Fuselage Systems | | 17.9 | % | | (31.6 | )% | | 4,950 BPS |

| | 16.6 | % | | 3.1 | % | | 1,350 BPS |

|

Propulsion Systems | | 27.7 | % | | 5.8 | % | | 2,190 BPS |

| | 20.4 | % | | 15.8 | % | | 460 BPS |

|

Wing Systems | | 15.2 | % | | (14.8 | )% | | 3,000 BPS |

| | 14.4 | % | | (26.8 | )% | | 4,120 BPS |

|

All Other | | 69.4 | % | | 11.5 | % | | |

| | 30.4 | % | | 27.3 | % | | |

Total Segment Operating Earnings (Loss) as % of Revenues | | 19.8 | % | | (17.2 | )% | | 3,700 BPS |

| | 17.1 | % | | (1.0 | )% | | 1,810 BPS |

|

Total Operating (Loss) Earnings as % of Revenues | | (17.3 | )% | | (21.5 | )% | | 420 BPS |

| | 5.2 | % | | (6.1 | )% | | 1,130 BPS |

|

| |

(1) | For the three months ended December 31, 2013, corporate SG&A of $1.3 million, $2.2 million and $2.6 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. For the twelve months ended December 31, 2013, corporate SG&A of $6.8 million, $5.6 million and $6.9 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. |

| |

(2) | For the three months ended December 31, 2013, research and development of $4.2 million, $2.0 million and $1.9 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. For the twelve months ended December 31, 2013, research and development of $12.7 million, $8.1 million and $5.0 million was reclassified from segment operating income for Fuselage, Propulsion, and Wing Systems, respectively, to conform to current year presentation. |

Contact information:

Investor Relations: Ghassan Awwad (316) 523-7040

Media: Jarrod Bartlett (316) 523-4070

On the web: http://www.spiritaero.com

Spirit Ship Set Deliveries

(one ship set equals one aircraft)

|

| | | | | | | | | | | | |

| | 4th Quarter | | Twelve Months |

| | 2014** |

| | 2013 |

| | 2014 |

| | 2013 |

|

B737 | | 114 |

| | 107 |

| | 493 |

| | 442 |

|

B747 | | 4 |

| | 3 |

| | 18 |

| | 19 |

|

B767 | | 4 |

| | 1 |

| | 14 |

| | 15 |

|

B777 | | 22 |

| | 24 |

| | 99 |

| | 99 |

|

B787 | | 28 |

| | 19 |

| | 118 |

| | 65 |

|

Total | | 172 |

| | 154 |

| | 742 |

| | 640 |

|

| | | | | | | | |

A320 Family* | | 124 |

| | 130 |

| | 505 |

| | 506 |

|

A330/340 | | 26 |

| | 30 |

| | 113 |

| | 113 |

|

A350 | | 5 |

| | 4 |

| | 16 |

| | 8 |

|

A380 | | 7 |

| | 8 |

| | 29 |

| | 34 |

|

Total | | 162 |

| | 172 |

| | 663 |

| | 661 |

|

| | | | | | | | |

Business/Regional Jet | | 35 |

| | 31 |

| | 140 |

| | 97 |

|

| | | | | | | | |

Total Spirit | | 369 |

| | 357 |

| | 1,545 |

| | 1,398 |

|

| | | | | | | | |

* 2013 A320 deliveries have been updated for the purpose of measuring wing ship set deliveries, from weighted average to total ship set. |

** Includes four fewer workdays as compared to prior year period.

|

Spirit AeroSystems Holdings, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

|

| | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Twelve Months Ended |

| | December 31, 2014 | | December 31, 2013 | | December 31, 2014 | | December 31, 2013 |

| | ($ in millions, except per share data) |

Net revenues | |

| $1,574.4 |

| |

| $1,494.4 |

| |

| $6,799.2 |

| |

| $5,961.0 |

|

Operating costs and expenses: | | | | |

| | | | |

|

Cost of sales | | 1,299.8 |

| | 1,743.8 |

| | 5,711.0 |

| | 6,059.5 |

|

Selling, general and administrative | | 68.9 |

| | 49.6 |

| | 233.8 |

| | 200.8 |

|

Impact from severe weather event | | — |

| | 10.7 |

| | — |

| | 30.3 |

|

Research and development | | 7.5 |

| | 11.1 |

| | 29.3 |

| | 34.7 |

|

Loss on divestiture of programs | | 471.1 |

| | — |

| | 471.1 |

| | — |

|

Total operating costs and expenses | | 1,847.3 |

| | 1,815.2 |

| | 6,445.2 |

| | 6,325.3 |

|

Operating (loss) income | | (272.9 | ) | | (320.8 | ) | | 354.0 |

| | (364.3 | ) |

Interest expense and financing fee amortization | | (15.9 | ) | | (18.1 | ) | | (88.1 | ) | | (70.1 | ) |

Interest income | | 0.2 |

| | 0.1 |

| | 0.6 |

| | 0.3 |

|

Other (expense) income, net | | (2.5 | ) | | 4.5 |

| | (4.1 | ) | | 3.3 |

|

(Loss) income before income taxes and equity in net income of affiliate | | (291.1 | ) | | (334.3 | ) | | 262.4 |

| | (430.8 | ) |

Income tax benefit (provision) | | 184.8 |

| | (253.4 | ) | | 95.9 |

| | (191.1 | ) |

(Loss) income before equity in net income of affiliate | | (106.3 | ) | | (587.7 | ) | | 358.3 |

| | (621.9 | ) |

Equity in net income of affiliate | | 0.1 |

| | 0.8 |

| | 0.5 |

| | 0.5 |

|

Net (loss) income | |

| ($106.2 | ) | |

| ($586.9 | ) | |

| $358.8 |

| |

| ($621.4 | ) |

| | | | | | | | |

(Loss) earnings per share | | | | |

| | | | |

|

Basic | |

| ($0.77 | ) | |

| ($4.15 | ) | |

| $2.55 |

| |

| ($4.40 | ) |

Shares | | 138.8 |

| | 141.4 |

| | 140.0 |

| | 141.3 |

|

| | | | | | | | |

Diluted | |

| ($0.77 | ) | |

| ($4.15 | ) | |

| $2.53 |

| |

| ($4.40 | ) |

Shares | | 138.8 |

| | 141.4 |

| | 141.6 |

| | 141.3 |

|

Spirit AeroSystems Holdings, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

| | | | | | | | |

| | December 31, 2014 | | December 31, 2013 |

| | ($ in millions) |

Current assets | | |

| | |

|

Cash and cash equivalents | |

| $377.9 |

| |

| $420.7 |

|

Accounts receivable, net | | 605.6 |

| | 550.8 |

|

Inventory, net | | 1,753.0 |

| | 1,842.6 |

|

Other current assets | | 315.6 |

| | 130.1 |

|

Total current assets | | 3,052.1 |

| | 2,944.2 |

|

Property, plant and equipment, net | | 1,783.6 |

| | 1,803.3 |

|

Pension assets | | 203.4 |

| | 252.6 |

|

Other assets | | 123.6 |

| | 107.1 |

|

Total assets | |

| $5,162.7 |

| |

| $5,107.2 |

|

Current liabilities | | | | |

|

Accounts payable | |

| $611.2 |

| |

| $753.7 |

|

Accrued expenses | | 329.1 |

| | 220.6 |

|

Current portion of long-term debt | | 9.4 |

| | 16.8 |

|

Advance payments, short-term | | 118.6 |

| | 133.5 |

|

Deferred revenue, short-term | | 23.4 |

| | 19.8 |

|

Other current liabilities | | 167.1 |

| | 191.2 |

|

Total current liabilities | | 1,258.8 |

| | 1,335.6 |

|

Long-term debt | | 1,144.1 |

| | 1,150.5 |

|

Advance payments, long-term | | 680.4 |

| | 728.9 |

|

Deferred revenue and other deferred credits | | 27.5 |

| | 30.9 |

|

Pension/OPEB obligation | | 73.0 |

| | 69.8 |

|

Other liabilities | | 356.9 |

| | 310.5 |

|

Equity | | | | |

|

Preferred stock, par value $0.01, 10,000,000 shares authorized, no shares issued | | — |

| | — |

|

Common stock, Class A par value $0.01, 200,000,000 shares authorized, 141,084,378 and 120,946,429 shares issued, respectively | | 1.4 |

| | 1.2 |

|

Common stock, Class B par value $0.01, 150,000,000 shares authorized, 4,745 and 23,851,694 shares issued, respectively | | — |

| | 0.2 |

|

Additional paid-in capital | | 1,035.6 |

| | 1,025.0 |

|

Accumulated other comprehensive loss | | (153.8 | ) | | (54.6 | ) |

Retained earnings | | 867.5 |

| | 508.7 |

|

Treasury stock, at cost (4,000,000 and zero shares, respectively) | | (129.2 | ) | | — |

|

Total shareholders’ equity | | 1,621.5 |

| | 1,480.5 |

|

Noncontrolling interest | | 0.5 |

| | 0.5 |

|

Total equity | | 1,622.0 |

| | 1,481.0 |

|

Total liabilities and equity | |

| $5,162.7 |

| |

| $5,107.2 |

|

Spirit AeroSystems Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

| | | | | | | | |

| | For the Twelve Months Ended |

| | December 31, 2014 | | December 31, 2013 |

| | ($ in millions) |

Operating activities | | |

| | |

|

Net income (loss) | |

| $358.8 |

| |

| ($621.4 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities | | | | |

|

Depreciation expense | | 170.2 |

| | 158.2 |

|

Amortization expense | | 29.1 |

| | 9.8 |

|

Accretion of customer supply agreement | | 1.1 |

| | 0.6 |

|

Employee stock compensation expense | | 16.4 |

| | 19.6 |

|

Excess tax benefits from share-based payment arrangements | | (2.6 | ) | | (0.6 | ) |

Loss on divestiture of programs | | 471.1 |

| | — |

|

Loss on disposition of assets | | 13.7 |

| | 0.1 |

|

Loss on interest rate swaps | | 0.5 |

| | — |

|

Gain from hedge contracts | | (1.4 | ) | | (2.6 | ) |

Loss (gain) from foreign currency transactions | | 10.5 |

| | (2.6 | ) |

Deferred taxes | | (8.4 | ) | | 202.8 |

|

Long-term tax provision | | (1.2 | ) | | (2.5 | ) |

Pension and other post-retirement benefits, net | | (24.0 | ) | | (32.0 | ) |

Grant income | | (8.6 | ) | | (7.3 | ) |

Equity in net income of affiliate | | (0.5 | ) | | (0.5 | ) |

Changes in assets and liabilities | | | | |

|

Accounts receivable | | (64.7 | ) | | (128.5 | ) |

Inventory, net | | (332.2 | ) | | 666.0 |

|

Accounts payable and accrued liabilities | | 51.7 |

| | 104.2 |

|

Advance payments | | (52.9 | ) | | (41.9 | ) |

Income taxes receivable/payable | | (177.9 | ) | | (82.2 | ) |

Deferred revenue and other deferred credits | | 2.2 |

| | (0.2 | ) |

Cash transferred on divestiture of programs | | (160.0 | ) | | — |

|

Other | | 70.7 |

| | 21.6 |

|

Net cash provided by operating activities | |

| $361.6 |

| |

| $260.6 |

|

Investing activities | | | | |

|

Purchase of property, plant and equipment | | (220.2 | ) | | (234.2 | ) |

Purchase of property, plant and equipment - severe weather related expenses | | — |

| | (38.4 | ) |

Change in restricted cash | | (19.9 | ) | | — |

|

Other | | 0.5 |

| | 4.4 |

|

Net cash used in investing activities | |

| ($239.6 | ) | |

| ($268.2 | ) |

Financing activities | | | | |

|

Proceeds from issuance of bonds | | 300.0 |

| | — |

|

Principal payments of debt | | (16.8 | ) | | (10.4 | ) |

Payment on bonds | | (300.0 | ) | | — |

|

Excess tax benefits from share-based payment arrangements | | 2.6 |

| | 0.6 |

|

Debt issuance and financing costs | | (20.8 | ) | | (4.1 | ) |

Purchase of treasury stock | | (129.2 | ) | | — |

|

Net cash used in financing activities | |

| ($164.2 | ) | |

| ($13.9 | ) |

Effect of exchange rate changes on cash and cash equivalents | | (0.6 | ) | | 1.5 |

|

Net decrease in cash and cash equivalents for the period | |

| ($42.8 | ) | |

| ($20.0 | ) |

Cash and cash equivalents, beginning of the period | | 420.7 |

| | 440.7 |

|

Cash and cash equivalents, end of the period | |

| $377.9 |

| |

| $420.7 |

|

Management believes that the non-GAAP (Generally Accepted Accounting Principles) measures (indicated by *) used in this report provide investors with important perspectives into the company’s ongoing business performance. The company does not intend for the information to be considered in isolation or as a substitute for the related GAAP measure. Other companies may define the measure differently.

|

| | |

Free Cash Flow |

($ in millions) |

| | Guidance |

| | 2015 |

Cash Provided by Operating Activities | | $925 - $1,075 |

Capital Expenditures | | (325 - 375) |

Free Cash Flow | | $600 - $700 |

|

| | | | | | | | | | | | | | | | |

Adjusted Free Cash Flow |

($ in millions) |

| | 4th Quarter | | Twelve Months |

| | 2014 |

| | 2013 |

| | 2014 |

| | 2013 |

|

Cash Provided by Operating Activities | |

| $33.3 |

| |

| $61.3 |

| |

| $361.6 |

| |

| $260.6 |

|

Severe Weather Impact | | — |

| | 10.7 |

| | — |

| | 30.3 |

|

Cash Transferred on Gulfstream Divestiture | | 160.0 |

| | — |

| | 160.0 |

| | — |

|

Adjusted Cash Provided by Operating Activities | |

| $193.3 |

| |

| $72.0 |

| |

| $521.6 |

| |

| $290.9 |

|

| | | | | | | | |

Capital Expenditures | |

| ($86.2 | ) | |

| ($81.1 | ) | |

| ($220.2 | ) | |

| ($272.6 | ) |

Severe Weather Impact | | — |

| | 15.0 |

| | — |

| | 38.4 |

|

Adjusted Capital Expenditures | |

| ($86.2 | ) | |

| ($66.1 | ) | |

| ($220.2 | ) | |

| ($234.2 | ) |

| | | | | | | | |

Adjusted Cash Provided by Operating Activities | |

| $193.3 |

| |

| $72.0 |

| |

| $521.6 |

| |

| $290.9 |

|

Adjusted Capital Expenditures | | (86.2 | ) | | (66.1 | ) | | (220.2 | ) | | (234.2 | ) |

Adjusted Free Cash Flow | |

| $107.1 |

| |

| $5.9 |

| |

| $301.4 |

| |

| $56.7 |

|

|

| | | | | | | | | | | | | | | | | |

Adjusted EPS

|

| | 4th Quarter | | Twelve Months | |

| | 2014 |

| | 2013 |

| | 2014 |

| | 2013 |

| |

GAAP Diluted Earnings Per Share | |

| ($0.77 | ) | |

| ($4.15 | ) | |

| $2.53 |

| |

| ($4.40 | ) | |

Net Loss impact of the Gulfstream divestiture | |

| $1.42 |

| a | — |

| |

| $1.39 |

| a | — |

| |

Impact of deferred tax asset valuation allowance not associated with the Gulfstream divestiture | | 0.22 |

| b | — |

| | (0.35 | ) | c | 2.69 |

| d |

| | | | | | | | | |

Diluted Shares | | 138.8 |

| | 141.4 |

| | 141.6 |

| | 141.3 |

| |

| | | | | | | | | |

Adjusted Diluted Earnings Per Share | |

| $0.87 |

| |

| ($4.15 | ) | |

| $3.57 |

| |

| ($1.71 | ) | |

a Represents the net earnings per share impact of the Gulfstream divestiture of $471.1 million charge less tax benefit of $273.9 million.

b Represents the net earnings per share impact of deferred tax asset valuation allowance not associated with the Gulfstream divestiture of $30.2 million.

c Represents the net earnings per share impact of deferred tax asset valuation allowance not associated with the Gulfstream divestiture of ($49.1) million.

d Represents the net earnings per share impact of deferred tax asset valuation allowance not associated with the Gulfstream divestiture of $381.0 million.

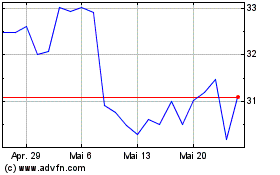

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024