- Third quarter 2009 Revenues grew 3 percent to $1.054 billion -

Operating Income grew 18 percent as Operating Margins expanded to

12.4 percent - Fully Diluted Earnings Per Share increased 17

percent to $0.62 per share - Cash and Cash Equivalents were $207

million - Total backlog of approximately $28.2 billion WICHITA,

Kan., Nov. 5 /PRNewswire-FirstCall/ -- Spirit AeroSystems Holdings,

Inc. (NYSE:SPR) reported third quarter 2009 financial results

reflecting revenue and earnings growth as ship set deliveries for

large commercial aircraft increased from the same period of 2008.

Spirit's third quarter 2009 revenues increased to $1.054 billion,

up 3 percent from the same period last year. Operating income

increased 18 percent to $131 million, up from $111 million in the

same period a year ago, as revenues increased, operating

efficiencies improved, and period expense declined. Net income was

$87 million, or $0.62 per fully diluted share, up 18 percent from

$74 million, or $0.53 per fully diluted share, in the same period

of 2008. (Table 1) Table 1. Summary Financial Results (Unaudited)

($ in Millions, 3rd Quarter Nine Months except per share

----------- ----------- data) 2009 2008 Change 2009 2008 Change

----------------- ---- ---- ------ ---- ---- ------ Revenues $1,054

$1,027 3% $3,001 $3,126 (4%) Operating Income $131 $111 18% $218

$378 (42%) Operating Income as a % of Revenues 12.4% 10.8% 160 BPS

7.3% 12.1% (480) BPS Net Income $87 $74 18% $142 $246 (42%) Net

Income as a % of Revenues 8.3% 7.2% 110 BPS 4.7% 7.9% (320) BPS

Earnings per Share (Fully Diluted) $0.62 $0.53 17% $1.01 $1.76

(43%) Fully Diluted Weighted Avg Share Count (Millions) 140.2 139.1

140.0 139.2 "We executed well across the company as we delivered

solid operating performance in the third quarter," said President

and Chief Executive Officer Jeff Turner. "Our results reflect

improving performance as revenues and profitability increased and

we recovered from the disrupted operations in the previous three

quarters caused by the Machinists' strike at Boeing and the new ERP

system implementation in the first half of 2009," Turner stated.

"We continue to support the 787 program and are preparing for

production restart and ramp-up. In addition, we continue to make

good progress on other development programs as we work to grow and

diversify our company," Turner added. "While we have seen some

stabilization in the global economic outlook, we remain cautious

regarding the outlook of the commercial aerospace market. Our

backlog remains strong and our strategy is on track to achieve

long-term value creation for our customers, shareholders, and

employees," Turner concluded. Spirit's backlog at the end of the

third quarter of 2009 was $28.2 billion, flat from the end of the

second quarter of 2009, as Airbus and Boeing third quarter backlog

reductions were offset by a follow-on contract at Spirit Europe for

777 wing components. Spirit calculates its backlog based on

contractual prices for products and volumes from the published firm

order backlogs of Airbus and Boeing, along with firm orders from

other customers. Spirit updated its contract profitability

estimates during the third quarter of 2009, resulting in a $2

million favorable cumulative catch-up adjustment, compared to a $13

million unfavorable cumulative catch-up adjustment for the third

quarter of 2008, which was largely the result of the Machinists'

strike at Boeing. Cash flow from operations was $5 million for the

third quarter of 2009, compared to $68 million for the third

quarter of 2008, primarily due to a decrease in cash advance

receipts from customers of $48 million compared to the same period

of 2008. (Table 2) Table 2. Cash Flow and Liquidity 3rd Quarter

Nine Months ----------- ----------- ($ in Millions) 2009 2008 2009

2008 --------------- ---- ---- ---- ---- Cash Flow from Operations

$5 $68 ($211) $147 Purchases of Property, Plant & Equipment

($51) ($56) ($158) ($175) October 1, December 31, Liquidity 2009

2008 ---- ---- Cash $207 $217 Total Debt $884 $588 During the third

quarter, Spirit issued $300 million in senior unsecured notes with

a coupon rate of 7.5% and a maturity in 2017. A portion of the

proceeds were used to pay down the outstanding revolver balance of

$200 million prior to the close of the third quarter. Cash balances

at the end of the third quarter of 2009 were $207 million and debt

balances were $884 million. During the third quarter of 2009, the

company utilized its credit-line as it continued to invest in

development programs. All credit-line borrowings were paid down

using a portion of the funds from the issuance of the senior

unsecured notes. At the end of the third quarter of 2009, the

company's $729 million revolving credit facility was undrawn.

Approximately $17 million of the credit facility is reserved for

financial letters of credit. The company's credit ratings remained

unchanged at the end of the third quarter of 2009 with a BB rating

at Standard & Poor's and a Ba3 rating at Moody's. 2009 Outlook

Spirit revenue guidance for the full-year 2009 has been updated to

reflect movement of certain forecasted non-recurring contract

settlements out of 2009. Revenues are now expected to be between

$4.1 and $4.2 billion based on Boeing's 2009 delivery guidance of

480-485 aircraft; anticipated B787 deliveries consistent with our

expectations following Boeing's announcement of the revised B787

schedule on August 27, 2009; 2009 expected Airbus deliveries of

approximately 483 aircraft; internal Spirit forecasts for non-OEM

production activity and non-Boeing and Airbus customers; and

foreign exchange rates consistent with fourth quarter 2008 levels.

Fully diluted earnings per share for 2009 remains unchanged and is

expected to be between $1.45 and $1.55 per share after the increase

in interest expense and fees associated with the recently issued

senior unsecured notes. Cash flow from operations less capital

expenditures, net of customer reimbursements, is now expected to be

no more than a ($150) million use of cash in the aggregate, with

capital expenditures of approximately $225 million. The effective

tax rate is now forecasted to be approximately 30 percent for 2009.

The guidance assumes the settlement and receipt of certain

outstanding non-recurring contract payments associated with our

development programs. To the extent these forecasted payments are

not received during the fourth quarter of 2009, they will represent

a shift in revenues, earnings and cash flows from 2009 to 2010.

(Table 3) Table 3. Financial Outlook 2008 Actual 2009 Guidance

Change ----------------- ----------- ------------- ------ Revenues

$3.8 billion $4.1 - $4.2 billion 8% - 11% Earnings Per Share (Fully

Diluted) $1.91 $1.45 - $1.55 (24%) - (19%) Effective Tax Rate (%

Pre-Tax Earnings) 30.9% ~30% Cash Flow From Operations $211

million* Capital Expenditures $236 million* Customer Reimbursement

$116 million* *($150M) with ~$225 million of Capital Expenditures

Cautionary Statement Regarding Forward-Looking Statements This

press release contains "forward-looking statements."

Forward-looking statements reflect our current expectations or

forecasts of future events. Forward-looking statements generally

can be identified by the use of forward-looking terminology such as

"may," "will," "expect," "anticipate," "intend," "estimate,"

"believe," "project," "continue," "plan," "forecast," or other

similar words. These statements reflect management's current views

with respect to future events and are subject to risks and

uncertainties, both known and unknown. Our actual results may vary

materially from those anticipated in forward-looking statements. We

caution investors not to place undue reliance on any

forward-looking statements. Important factors that could cause

actual results to differ materially from forward-looking statements

include, but are not limited to: our ability to continue to grow

our business and execute our growth strategy, including the timing

and execution of new programs; our ability to perform our

obligations and manage cost related to our new commercial and

business aircraft development programs; reduction in the build

rates of certain Boeing aircraft including, but not limited to, the

B737 program, the B747 program, the B767 program and the B777

program, and build rates of the Airbus A320 and A380 programs,

which could be affected by the impact of a deep recession on

business and consumer confidence and the impact of continuing

turmoil in the global financial and credit markets; declining

business jet manufacturing rates and customer cancellations or

deferrals as a result of the weakened global economy; the success

and timely execution of key milestones such as first flight and

delivery of Boeing's new B787 and Airbus' new A350 aircraft

programs, including receipt of necessary regulatory approvals and

customer adherence to their announced schedules; our ability to

enter into supply arrangements with additional customers and the

ability of all parties to satisfy their performance requirements

under existing supply contracts with Boeing, Airbus, and other

customers and the risk of nonpayment by such customers; any adverse

impact on Boeing's and Airbus' production of aircraft resulting

from cancellations, deferrals or reduced orders by their customers

or labor disputes; any adverse impact on the demand for air travel

or our operations from the outbreak of diseases such as the

influenza outbreak caused by the H1N1 virus, avian influenza,

severe acute respiratory syndrome or other epidemic or pandemic

outbreaks; returns on pension plan assets and impact of future

discount rate changes on pension obligations; our ability to borrow

additional funds, or refinance debt; competition from original

equipment manufacturers and other aerostructures suppliers; the

effect of governmental laws, such as U.S. export control laws, the

Foreign Corrupt Practices Act, environmental laws and agency

regulations, both in the U.S. and abroad; the cost and availability

of raw materials and purchased components; our ability to

successfully extend or renegotiate our primary collective

bargaining contracts with our labor unions; our ability to recruit

and retain highly skilled employees and our relationships with the

unions representing many of our employees; spending by the U.S. and

other governments on defense; the possibility that our cash flows

and borrowing facilities may not be adequate for our additional

capital needs or for payment of interest on and principal of our

indebtedness; our exposure under our revolving credit facility to

higher interest payments should interest rates increase

substantially; the outcome or impact of ongoing or future

litigation and regulatory actions; and our exposure to potential

product liability claims. These factors are not exhaustive, and new

factors may emerge or changes to the foregoing factors may occur

that could impact our business. Except to the extent required by

law, we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. Appendix Segment Results Fuselage

Systems Fuselage Systems segment revenues for the third quarter of

2009 were $526 million, up 9 percent over the same period last

year, as deliveries in the prior year quarter were impacted by the

Machinists' strike at Boeing. Operating margin for the third

quarter of 2009 was 18.1 percent, up from 15.2 percent in the third

quarter of 2008, as a favorable cumulative catch-up of $4 million

was realized during the quarter. During the third quarter of 2008,

the segment realized an unfavorable $11 million cumulative catch-up

adjustment. Propulsion Systems Propulsion Systems segment revenues

for the third quarter of 2009 were $266 million, down 9 percent

over the same period last year due to fewer 747 deliveries and

lower aftermarket sales. Operating margin for the third quarter of

2009 was 13.3 percent, down from 16.2 percent in the third quarter

of 2008, primarily due to lower spares volumes. During the quarter,

an unfavorable cumulative catch-up of $1 million was realized. Wing

Systems Wing Systems segment revenues for the third quarter of 2009

were $257 million, up 4 percent over the same period last year as

increased deliveries to Airbus and Boeing more than offset fewer

Hawker 850XP deliveries. Operating margin for the third quarter of

2009 was 10.3 percent, down from 10.9 percent in the third quarter

of 2008, as an unfavorable cumulative catch-up of $1 million was

realized during the quarter. During the third quarter of 2008, the

segment realized an unfavorable $2 million cumulative catch-up

adjustment. Table 4. Segment Reporting (Unaudited) (Unaudited) ($

in Millions, 3rd Quarter Nine Months except margin -----------

----------- percent) 2009 2008 Change 2009 2008 Change

-------------- ---- ---- ------ ---- ---- ------ Segment Revenues

Fuselage Systems $525.9 $484.8 8.5% $1,497.6 $1,470.2 1.9%

Propulsion Systems $266.2 $291.5 (8.7%) $772.1 $863.1 (10.5%) Wing

Systems $257.3 $246.8 4.3% $712.9 $773.5 (7.8%) All Other $4.4 $4.1

7.3% $18.2 $18.9 (3.7%) ---- ---- --- ----- ----- ---- Total

Segment Revenues $1,053.8 $1,027.2 2.6% $3,000.8 $3,125.7 (4.0%)

Segment Earnings from Operations Fuselage Systems $95.2 $73.5 29.5%

$229.4 $255.0 (10.0%) Propulsion Systems $35.3 $47.1 (25.1%) $97.2

$140.9 (31.0%) Wing Systems $26.6 $26.9 (1.1%) ($12.7) $92.3

(113.8%) All Other $1.0 $0.0 NA ($1.0) $0.1 (1,100.0%) ---- ----

--- ----- ---- -------- Total Segment Operating Earnings $158.1

$147.5 7.2% $312.9 $488.3 (35.9%) Unallocated Corporate SG&A

Expense ($26.7) ($35.6) (25.0%) ($92.9) ($109.7) (15.3%)

Unallocated Research & Development Expense ($0.4) ($0.7)

(42.9%) ($1.6) ($1.1) 45.5% ----- ----- ----- ----- ----- ----

Total Earnings from Operations $131.0 $111.2 17.8% $218.4 $377.5

(42.1%) Segment Operating Earnings as % of Revenues Fuselage

Systems 18.1% 15.2% 290 BPS 15.3% 17.3% (200)BPS Propulsion Systems

13.3% 16.2% (290)BPS 12.6% 16.3% (370)BPS Wing Systems 10.3% 10.9%

(60)BPS (1.8%) 11.9% (1,370)BPS All Other 22.7% 0.0% 2,270 BPS

(5.5%) 0.5% (600)BPS ---- --- --------- ---- --- -------- Total

Segment Operating Earnings as % of Revenues 15.0% 14.4% 60 BPS

10.4% 15.6% (520)BPS Total Operating Earnings as % of Revenues

12.4% 10.8% 160 BPS 7.3% 12.1% (480)BPS Spirit Ship Set Deliveries

(One Ship Set equals One Aircraft) 2008 Spirit AeroSystems

Deliveries 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Total 2008 -------

------- ------- ------- ---------- B737 93 95 87 42 317 B747 4 7 4

1 16 B767 3 3 3 1 10 B777 20 22 18 8 68 B787 1 1 1 0 3 --- --- ---

--- --- Total 121 128 113 52 414 A320 Family 95 95 90 87 367

A330/340 24 21 23 22 90 A380 4 2 4 6 16 --- --- --- --- --- Total

123 118 117 115 473 Hawker 850XP 15 24 24 28 91 --- --- --- --- ---

Total Spirit 259 270 254 195 978 === === === === === 2009 Spirit

AeroSystems Deliveries 1st Qtr 2nd Qtr 3rd Qtr YTD 2009 -------

------- ------- -------- B737 74 96 93 263 B747 3 1 3 7 B767 3 3 3

9 B777 21 21 21 63 B787 2 2 2 6 --- --- --- --- Total 103 123 122

348 A320 Family 105 101 94 300 A330/340 26 23 28 77 A380 0 2 5 7

--- --- --- --- Total 131 126 127 384 Hawker 850XP 18 13 6 37 ---

--- --- --- Total Spirit 252 262 255 769 === === === === Spirit

AeroSystems Holdings, Inc. Condensed Consolidated Statements of

Operations (unaudited) For the For the For the For the Three Months

Three Months Nine Months Nine Months Ended Ended Ended Ended

October 1, September 25, October 1, September 25, 2009 2008 2009

2008 ---------- ----------- ---------- ----------- ($ in millions,

except per share data) Net Revenues $1,053.8 $1,027.2 $3,000.8

$3,125.7 Operating costs and expenses: Cost of sales 878.3 864.3

2,637.2 2,596.1 Selling, general and administrative 30.5 39.0 103.6

119.0 Research and development 14.0 12.7 41.6 33.1 ---- ---- ----

---- Total Operating Costs and Expenses 922.8 916.0 2,782.4 2,748.2

Operating Income 131.0 111.2 218.4 377.5 Interest expense and

financing fee amortization (10.2) (9.9) (29.1) (29.5) Interest

income 1.6 4.4 6.2 15.1 Other income, net (0.5) (0.7) 5.2 0.9 ----

---- --- --- Income Before Income Taxes 121.9 105.0 200.7 364.0

Income tax provision (34.4) (31.0) (58.8) (118.4) ----- ----- -----

------ Income Before Equity in Net Loss of Affiliate 87.5 74.0

141.9 245.6 Equity in net loss of affiliate (0.2) - (0.2) - ----

--- ---- --- Net Income $87.3 $74.0 $141.7 $245.6 ===== =====

====== ====== Earnings per share Basic $0.63 $0.54 $1.03 $1.79

Shares 138.6 137.0 138.2 136.9 Diluted $0.62 $0.53 $1.01 $1.76

Shares 140.2 139.1 140.0 139.2 Spirit AeroSystems Holdings, Inc.

Condensed Consolidated Balance Sheets (unaudited) October 1,

December 31, 2009 2008 ---------- ----------- ($ in millions)

Current assets Cash and cash equivalents $206.7 $216.5 Accounts

receivable, net 235.8 149.3 Current portion of long-term receivable

28.2 108.9 Inventory, net 2,204.6 1,882.0 Other current assets 85.8

76.6 ---- ---- Total current assets 2,761.1 2,433.3 Property, plant

and equipment, net 1,224.0 1,068.3 Pension assets 60.0 60.1 Other

assets 238.6 198.6 ----- ----- Total assets $4,283.7 $3,760.3

======== ======== Current liabilities Accounts payable $421.2

$316.9 Accrued expenses 164.1 161.8 Current portion of long-term

debt 6.7 7.1 Advance payments, short-term 194.3 138.9 Deferred

revenue, short-term 59.3 110.5 Other current liabilities 25.8 8.1

---- --- Total current liabilities 871.4 743.3 Long-term debt 583.5

580.9 Bonds payable, long-term 293.4 - Advance payments, long-term

806.5 923.5 Deferred revenue and other deferred credits 54.3 58.6

Pension/OPEB obligation 49.1 47.3 Other liabilities 169.6 109.2

Shareholders' equity Preferred stock, par value $0.01, 10,000,000

shares authorized, no shares issued and outstanding - - Common

stock, Class A par value $0.01, 200,000,000 shares authorized,

104,819,957 and 103,209,466 issued and outstanding, respectively

1.0 1.0 Common stock, Class B par value $0.01, 150,000,000 shares

authorized, 36,216,211 and 36,679,760 shares issued and

outstanding, respectively 0.4 0.4 Additional paid-in capital 946.3

939.7 Minority interest 0.5 0.5 Accumulated other comprehensive

loss (124.1) (134.2) Retained earnings 631.8 490.1 ----- -----

Total shareholders' equity 1,455.9 1,297.5 ------- ------- Total

liabilities and shareholders' equity $4,283.7 $3,760.3 ========

======== Spirit AeroSystems Holdings, Inc. Condensed Consolidated

Statements of Cash Flows (unaudited) For the For the Nine Months

Nine Months Ended Ended October 1, September 25, 2009 2008

---------- ------------- ($ in millions) Operating activities Net

Income $141.7 $245.6 Adjustments to reconcile net income to net

cash provided by (used in) operating activities Depreciation

expense 91.9 90.8 Amortization expense 7.7 7.1 Accretion of

long-term receivable (5.8) (13.0) Employee stock compensation

expense 6.7 11.6 Loss from the ineffectiveness of hedge contracts -

0.4 (Gain) loss from foreign currency transactions (3.9) 0.3 Gain

on disposition of assets - (0.2) Deferred taxes (20.5) 0.9 Pension

and other post-retirement benefits, net 1.6 (21.5) Grant income

(1.4) - Equity in net income of affiliate 0.2 - Changes in assets

and liabilities Accounts receivable (84.6) (28.4) Inventory, net

(319.5) (432.9) Accounts payable and accrued liabilities 104.9 30.5

Advance payments (61.6) 230.4 Deferred revenue and other deferred

credits (54.9) 16.9 Other (13.8) 8.1 ----- --- Net cash provided by

(used in) operating activities (211.3) 146.6 ------ ----- Investing

Activities Purchase of property, plant and equipment (158.0)

(175.2) Long-term receivable 86.5 87.1 Other 0.2 (0.7) --- ---- Net

cash (used in) investing activities (71.3) (88.8) ----- -----

Financing Activities Proceeds from revolving credit facility 300.0

75.0 Payments on revolving credit facility (300.0) (75.0) Proceeds

from issuance of debt - 8.8 Proceeds from issuance of bonds 293.4 -

Proceeds from government grants 0.7 1.6 Principal payments of debt

(5.8) (11.9) Debt issuance and financing costs (17.2) (6.8) -----

---- Net cash provided by (used in) financing activities 271.1

(8.3) ----- ---- Effect of exchange rate changes on cash and cash

equivalents 1.7 (5.2) --- ---- Net increase (decrease) in cash and

cash equivalents for the period (9.8) 44.3 Cash and cash

equivalents, beginning of the period 216.5 133.4 ----- ----- Cash

and cash equivalents, end of the period $206.7 $177.7 ====== ======

DATASOURCE: Spirit AeroSystems CONTACT: Investor Relations, Alan

Hermanson, +1-316-523-7040, or Media, Debbie Gann, +1-316-526-3910,

both of Spirit AeroSystems Web Site: http://www.spiritaero.com/

Copyright

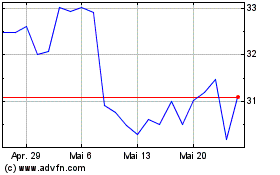

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024