Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

17 September 2024 - 11:09PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-266837

Relating to Preliminary Prospectus Supplement dated September 16, 2024

(to Prospectus dated August 12, 2022)

$500,000,000 4.450% Notes due 2026

$600,000,000 4.600% Notes due 2029

$700,000,000 5.000% Notes due 2034

Final Pricing Term Sheet

September 17, 2024

| Issuer: |

Sonoco Products Company |

| |

|

| Issuer Long-term Debt Ratings (Moody’s/S&P/Fitch) *: |

Baa2 (Negative Watch) / BBB (Negative Watch) / BBB (Stable) |

| |

|

| Type of Offering: |

SEC Registered (no. 333-266837) |

| |

|

| Ranking: |

Senior Unsecured |

| |

|

| Trade Date: |

September 17, 2024 |

| |

|

| Settlement Date: |

September 19, 2024 (T+2) ** |

| |

|

| Use of Proceeds: |

The Issuer intends to use an amount equal to the net proceeds from this offering, together with borrowings under the Acquisition Term Loan Facilities (as defined in the preliminary prospectus supplement dated September 16, 2024 (the “preliminary prospectus supplement”)) and, if needed, cash on hand or additional borrowings under the Revolving Credit Facility (as defined in the preliminary prospectus supplement), to fund the cash consideration payable by the Issuer in connection with the Eviosys Acquisition (as defined in the preliminary prospectus supplement) and to pay related fees and expenses. If a Special Mandatory Redemption Event (as defined in the preliminary prospectus supplement) occurs, the Issuer will be required to redeem all of the 2029 notes and the 2034 notes at the applicable special mandatory redemption price, and the net proceeds from the sale of the 2026 notes will be used for general corporate purposes, which may include refinancing of indebtedness. See “Use of Proceeds” and “Description of the Notes — Special Mandatory Redemption” in the preliminary prospectus supplement. |

|

Notes due 2026 |

| |

| Title of Securities: |

4.450% Notes due 2026 (the “2026 Notes”) |

| |

|

| Aggregate Principal Amount Offered: |

$500,000,000 |

| |

|

| Coupon (Interest Rate): |

4.450% per annum |

| |

|

| Maturity Date: |

September 1, 2026 |

| |

|

| Interest Payment Dates: |

Semi-annually on March 1 and September 1, beginning on March 1, 2025 |

| |

|

| Interest Payment Record Dates: |

February 15 and August 15 |

| |

|

| Make-Whole Call: |

T+15 bps |

| |

|

| Benchmark Treasury: |

3.750% UST due August 31, 2026 |

| |

|

| Benchmark Treasury Price and Yield: |

100-09+; 3.590% |

| |

|

| Spread to Benchmark Treasury: |

+90 basis points |

| |

|

| Yield to Maturity: |

4.490% |

| |

|

| Price to Public (Issue Price): |

99.928% of principal amount |

| |

|

| CUSIP / ISIN: |

835495AQ5 / US835495AQ50 |

|

Notes due 2029 |

| |

| Title of Securities: |

4.600% Notes due 2029 (the “2029 Notes”) |

| |

|

| Aggregate Principal Amount Offered: |

$600,000,000 |

| |

|

| Coupon (Interest Rate): |

4.600% per annum |

| |

|

| Maturity Date: |

September 1, 2029 |

| |

|

| Interest Payment Dates: |

Semi-annually on March 1 and September 1, beginning on March 1, 2025 |

| |

|

| Interest Payment Record Dates: |

February 15 and August 15 |

| |

|

| Special Mandatory Redemption: |

If the Eviosys Acquisition is not consummated on or before December 31, 2025 or if, on or prior to such date, the Purchase Agreement (as defined in the preliminary prospectus supplement) is terminated other than as a result of consummating the Eviosys Acquisition, the Issuer will be required to redeem the notes at a redemption price equal to 101% of the principal amount of the notes, plus accrued and unpaid interest, if any, to, but excluding, the special mandatory redemption date. See “Description of the Notes—Special Mandatory Redemption” in the preliminary prospectus supplement. |

| |

|

| Make-Whole Call: |

Prior to August 1, 2029 (one month prior to the maturity date of the 2029 Notes) at T+20 bps |

| |

|

| Par Call: |

On or after August 1, 2029 |

| |

|

| Benchmark Treasury: |

3.625% UST due August 31, 2029 |

| |

|

| Benchmark Treasury Price and Yield: |

100-27+; 3.434% |

| |

|

| Spread to Benchmark Treasury: |

+118 basis points |

| |

|

| Yield to Maturity: |

4.614% |

| |

|

| Price to Public (Issue Price): |

99.941% of principal amount |

| |

|

| CUSIP / ISIN: |

835495AR3 / US835495AR34 |

|

Notes due 2034 |

| |

| Title of Securities: |

5.000% Notes due 2034 (the “2034 Notes”) |

| |

|

| Aggregate Principal Amount Offered: |

$700,000,000 |

| |

|

| Coupon (Interest Rate): |

5.000% per annum |

| |

|

| Maturity Date: |

September 1, 2034 |

| |

|

| Interest Payment Dates: |

Semi-annually on March 1 and September 1, beginning on March 1, 2025 |

| |

|

| Interest Payment Record Dates: |

February 15 and August 15 |

| |

|

| Special Mandatory Redemption: |

If the Eviosys Acquisition is not consummated on or before December 31, 2025 or, if on or prior to such date, the Purchase Agreement is terminated other than as a result of consummating the Eviosys Acquisition, the Issuer will be required to redeem the notes at a redemption price equal to 101% of the principal amount of the notes, plus accrued and unpaid interest, if any, to, but excluding, the special mandatory redemption date. See “Description of the Notes—Special Mandatory Redemption” in the preliminary prospectus supplement. |

| |

|

| Make-Whole Call: |

Prior to June 1, 2034 (three months prior to the maturity date of the 2034 Notes) at T+25 bps |

| |

|

| Par Call: |

On or after June 1, 2034 |

| |

|

| Benchmark Treasury: |

3.875% UST due August 15, 2034 |

| |

|

| Benchmark Treasury Price and Yield: |

101-30; 3.640% |

| |

|

| Spread to Benchmark Treasury: |

+143 basis points |

| |

|

| Yield to Maturity: |

5.070% |

| |

|

| Price to Public (Issue Price): |

99.461% of principal amount |

| |

|

| CUSIP / ISIN: |

835495AS1 / US835495AS17 |

| |

|

| Joint Book-Running Managers: |

J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC

BofA Securities, Inc.

Wells Fargo Securities, LLC

TD Securities (USA) LLC

U.S. Bancorp Investments, Inc. |

| |

|

| Co-Managers: |

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

MUFG Securities Americas Inc.

RBC Capital Markets, LLC

Truist Securities, Inc.

ING Financial Markets LLC

Regions Securities LLC |

| |

|

| Trustee: |

Regions Bank |

*Note: A securities rating is not a recommendation

to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

**It is expected that delivery of the notes will

be made against payment therefor on or about September 19, 2024, which is the second business day following the date hereof (such settlement

cycle being referred to as “T+2”). Under Rule 15c6-1 under the Exchange Act of 1934, as amended, trades in the secondary

market are generally required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly,

purchasers who wish to trade such notes more than one business day prior to the scheduled settlement date will be required, by virtue

of the fact that the notes initially will settle in T+2, to specify an alternative settlement arrangement at the time of any such trade

to prevent failed settlement. Purchasers of such notes who wish to trade notes prior to the date of delivery should consult their advisors.

The issuer has filed a registration statement

(including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication

relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement dated

September 16, 2024 and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer or any underwriter

participating in this offering can arrange to send you the preliminary prospectus supplement and accompanying prospectus and, when available,

the final prospectus supplement if you request it by calling J.P. Morgan Securities LLC collect at 1-212-834-4533; by calling Morgan Stanley

& Co. LLC toll-free at 1-866-718-1649; by calling BofA Securities, Inc. toll free at 1-800-294-1322; or by calling Wells Fargo Securities,

LLC toll-free at 1-800-645-3751.

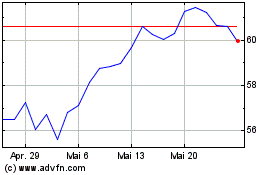

Sonoco Products (NYSE:SON)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Sonoco Products (NYSE:SON)

Historical Stock Chart

Von Dez 2023 bis Dez 2024