Schneider National, Inc. (NYSE: SNDR), a premier multimodal

provider of transportation, intermodal and logistics services,

announced today the company, through certain wholly owned

subsidiaries, has entered into a definitive agreement to acquire

Cowan Systems, LLC and affiliated entities (collectively, “Cowan

Systems”), for a cash purchase price of approximately $390 million,

subject to certain adjustments. The sale includes separate

agreements to purchase certain real estate assets relating to Cowan

Systems’ business for approximately $31 million in cash.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241122242439/en/

(Photo: Business Wire)

Based in Baltimore, Md., Cowan Systems is primarily a dedicated

contract carrier with a portfolio of complementary services

including brokerage, drayage and warehousing. Cowan Systems’

Dedicated customers include leading producers of retail and

consumer goods, food and beverage products, industrials, and

building materials. The company operates approximately 1,800 trucks

and 7,500 trailers across more than forty locations throughout the

Eastern and Mid-Atlantic regions of the United States. Cowan

Systems’ lightweight equipment enables customers to move more

freight per shipment, saving transportation expenses and reducing

emissions.

The acquisition will further complement Schneider’s Dedicated

organic growth success. Including Cowan Systems, Schneider will

operate over 8,400 Dedicated tractors – approximately 70% of

Schneider’s Truckload fleet – cementing its place as one of the

largest dedicated providers in the transportation industry.

“This acquisition aligns with Schneider’s long-term vision to

have customer-centric Dedicated solutions as the cornerstone of its

Truckload segment. By complementing our organic Dedicated growth

success with transactions like this, we are broadening our presence

to provide greater value to our customers and stakeholders,” said

Schneider President and CEO Mark Rourke. “We look forward to

collaborating with the talented team at Cowan Systems to drive our

now shared mission forward.”

Cowan Systems, founded in 1924, has a history of consistent

growth. Upon closing, Cowan Systems will operate as a wholly owned

subsidiary of Schneider, continuing a successful trajectory with

its associates and trusted brand.

“My father started Cowan Systems more than 100 years ago, and

with the expertise, passion and dedication of so many amazing

employees along the way, it has grown in more ways than he could

have ever imagined,” explained Chairman Joe Cowan. “When it was

time for me to move to a new chapter in my life, I wanted to be

sure the organization was in good hands, at a company with a

similar culture and values, and that it would continue to grow.

With Schneider I know our legacy will not just be preserved, but it

will continue to thrive.”

The acquisition is expected to be accretive to Schneider’s

earnings per share within the first year, before consideration of

anticipated synergies. The transaction is expected to close in

fourth quarter 2024, subject to the satisfaction of certain

customary closing conditions, and it will be financed through

existing cash on hand as well as borrowings under Schneider’s new

$400 million delayed draw term credit facility. Upon closing, Cowan

Systems’ financial results will be reported in their corresponding

Schneider Truckload and Logistics business segments. This

transaction follows earlier acquisitions of Dedicated contract

carriers Midwest Logistics Systems and M&M Transport Services,

LLC, which are also wholly owned subsidiaries of Schneider.

Scopelitis, Garvin, Light, Hanson & Feary served as

Schneider’s legal advisor. Stifel Financial Corp. served as

exclusive financial advisor to Cowan Systems, and Scudder Law Firm

served as their legal advisor on the transaction. To learn more

about the acquisition, go to investors.schneider.com. To learn more

about Schneider, go to schneider.com.

Forward-Looking Statements

The information contained in this press release contains

forward-looking statements within the meaning of the United States

Private Securities Litigation Reform Act of 1995, which are

intended to come within the safe harbor protection provided by such

Act. These forward-looking statements reflect our current

expectations, beliefs, plans, or forecasts with respect to, among

other things, future events and financial performance and trends in

the business and industry. Forward-looking statements are often

characterized by words or phrases such as “may,” “will,” “could,”

“should,” “would,” “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “target,” “prospects,” “potential,”

“forecast,” and other words, terms, and phrases of similar meaning

and include statements regarding: (1) the timing of completion of

the acquisition and the consummation of the acquisition, (2) the

anticipated financing of the acquisition, (3) how Cowan Systems

will be integrated into Schneider’s group structure and how Cowan

Systems’ financial results will be reported in Schneider’s

consolidated financial statements, (4) whether Cowan Systems will

continue to operate as a wholly owned subsidiary of Schneider, (5)

the expected trajectory, operations and results of the combined

company (6) the expectation that the acquisition of Cowan Systems

will be accretive to Schneider’s earnings per share within the

first year and (7) the potential realization of synergies in

connection with the acquisition. Forward-looking statements involve

estimates, expectations, projections, goals, forecasts,

assumptions, risks, and uncertainties. Such forward-looking

statements are based on information presently available to the

Company’s management and are current only as of the date made.

Actual results could also differ materially from those anticipated

as a result of a number of factors, including, but not limited to,

(1) the risks that the transaction may not be completed in a timely

manner or at all, (2) the risk that using debt to finance, in part,

the acquisition will increase Schneider's indebtedness, (3) the

risk that the operations of Schneider and Cowan Systems will not be

integrated successfully, (4) the risk that the combined business

will not achieve the anticipated revenue and synergies or other

expected benefits and (5) those discussed in Part I, Item 1A, “Risk

Factors,” of our Annual Report on Form 10-K filed on February 23,

2024, as such may be amended or supplemented in Part II, Item 1A,

“Risk Factors,” of subsequently filed Quarterly Reports on Form

10-Q, as well as those discussed in the consolidated financial

statements, related notes, and other information appearing

elsewhere in the aforementioned reports and other filings with the

SEC. We do not intend, and undertake no obligation, to update any

of our forward-looking statements after the date of this press

release to reflect actual results or future events or

circumstances. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking

statements.

About Schneider

Schneider is a premier provider of transportation, intermodal

and logistics services. Offering one of the broadest portfolios in

the industry, Schneider’s solutions include Regional and Long-Haul

Truckload, Expedited, Dedicated, Bulk, Intermodal, Brokerage,

Warehousing, Supply Chain Management, Port Logistics and Logistics

Consulting.

Schneider has been safely delivering superior customer

experiences and investing in innovation for almost 90 years. The

company’s digital marketplace, Schneider FreightPower®, is

revolutionizing the industry giving shippers access to an expanded,

highly flexible capacity network and provides carriers with

unmatched access to quality drop-and-hook freight – Always

Delivering, Always Ahead.

For more information about Schneider, visit Schneider.com or

follow the company socially on Facebook, LinkedIn and X:

@WeAreSchneider.

Source: Schneider SNDR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122242439/en/

For additional or story assistance, please contact Kara

Leiterman, Media Relations Manager M 920-370-7188

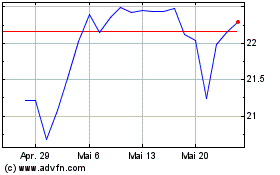

Schneider National (NYSE:SNDR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Schneider National (NYSE:SNDR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024