Form S-8 - Securities to be offered to employees in employee benefit plans

28 Dezember 2023 - 10:34PM

Edgar (US Regulatory)

As filed with the United States Securities and Exchange Commission on December 28, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

TANGER Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| North Carolina | | 56-1815473 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

3200 Northline Avenue

Suite 360

Greensboro, North Carolina 27408-7612

(Address of Principal Executive Offices) (Zip Code)

____________________

Incentive Award Plan of Tanger Factory Outlet Centers, Inc. and Tanger Properties Limited Partnership (Amended and Restated as of May 19, 2023)

(Full title of the plan)

____________________

Michael J. Bilerman

Executive Vice President, Chief Financial Officer and Chief Investment Officer

Tanger Inc.

3200 Northline Avenue, Suite 360

Greensboro, North Carolina 27408-7612

(336) 292-3010

(Name and address of agent for service) (Telephone number, including area code, of agent for service)

____________________

Copies to:

Dennis Craythorn, Esq. and Austin Ozawa, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, New York 10020

(212) 906-1200

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer o

Non-accelerated filer o Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

EXPLANATORY NOTE

On May 19, 2023, at the 2023 Annual Meeting of Shareholders of Tanger Inc. (the “Company”), the Company’s shareholders approved the amendment and restatement of the Amended and Restated Incentive Award Plan (as amended, the “Plan”) which increased the aggregate number of the Company’s common shares, par value $0.01 per share (the “Common Shares”), that may be issued under the Plan from 18,700,000 to 21,300,000 (resulting in an increase of 2,600,000 Common Shares available for issuance under the Plan). This Registration Statement is being filed in order to register the additional Common Shares that may be offered or sold to participants under the Plan following the amendment and restatement of the Plan approved on May 19, 2023.

STATEMENT OF INCORPORATION BY REFERENCE

This Registration Statement on Form S-8 hereby incorporates by reference the contents of the Registration Statements on Form S-8 filed by the Registrant with the Securities and Exchange Commission on January 10, 2020 (File No. 333-235881) and July 29, 2014 (File No. 333-197713).

Index to Exhibits

| | | | | | | | | | | |

| Exhibit Number | Description of Exhibit |

| 4.1 | |

| 4.1A | |

| 4.1B | |

| 4.1C | |

| 4.1D | |

| 4.1E | |

| 4.1F | |

| 4.1G | |

| 4.1H | |

| | | | | | | | | | | |

| Exhibit Number | Description of Exhibit |

| 4.1I | |

| 4.2 | |

| 4.3 | |

| 5.1* | |

| 23.1* | |

| 23.2** | Consent of Womble Bond Dickinson (US) LLP (included in Exhibit 5.1). |

| 24.1* | Powers of Attorney (included on the signature page of the Registration Statement). |

| 99.1 | |

| 107.1* | |

* Filed herewith.

** Included with the legal opinion provided pursuant to Exhibit 5.1.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Greensboro, State of North Carolina, on December 28, 2023.

Tanger Inc.

By: /s/ Michael J. Bilerman

Michael J. Bilerman

Executive Vice President, Chief Financial Officer

and Chief Investment Officer

POWER OF ATTORNEY

Each of the undersigned officers and directors of the Registrant hereby severally constitutes and appoints Michael J. Bilerman, Steven B. Tanger and Stephen J. Yalof as the undersigned’s true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for the undersigned and in the undersigned’s name, place and stead, in any and all capacities (unless revoked in writing) to sign this Registration Statement on Form S-8, and any and all amendments thereto, including any post-effective amendments as well as any related registration statement (or amendment thereto) filed in reliance upon Rule 462(b) under the Securities Act, as amended, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting to such attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite or necessary to be done in connection therewith, as fully to all intents and purposes as the undersigned might and could do in person hereby ratifying and confirming all that said attorney-in-fact and agent or his or her substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

| /s/ Steven B. Tanger |

Executive Chair of the Board | December 28, 2023 |

| Steven B. Tanger | | |

| /s/ Stephen J. Yalof |

Director, President and Chief Executive Officer | December 28, 2023 |

| Stephen J. Yalof | (principal executive officer) | |

| /s/ Michael J. Bilerman |

Executive Vice President, Chief Financial Officer and Chief Investment Officer | December 28, 2023 |

| Michael J. Bilerman | (principal financial officer) | |

| /s/ Thomas J. Guerrieri Jr. |

Senior Vice President, Chief Accounting Officer | December 28, 2023 |

| Thomas J. Guerrieri Jr. | (principal accounting officer) | |

| /s/ Bridget M. Ryan-Berman | Lead Director | December 28, 2023 |

Bridget M. Ryan-Berman

| | |

| /s/ Jeffrey B. Citrin | Director | December 28, 2023 |

| Jeffrey B. Citrin | | |

| /s/ David B. Henry | Director | December 28, 2023 |

| David B. Henry | | |

| /s/ Sandeep L. Mathrani | Director | December 28, 2023 |

| Sandeep L. Mathrani | | |

| /s/ Thomas J. Reddin | Director | December 28, 2023 |

| Thomas J. Reddin | | |

| /s/ Susan E. Skerritt | Director | December 28, 2023 |

| Susan E. Skerritt | | |

| /s/ Luis A. Ubiñas | Director | December 28, 2023 |

| Luis A. Ubiñas | | |

| | |

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Tanger Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1—Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount

to be

Registered (1) | Proposed

Maximum

Offering Price

Per Unit | Maximum

Aggregate

Offering Price | Fee Rate | Amount of

Registration Fee |

| Equity | Common Shares, $0.01 par value per share | Rule 457(c) and Rule 457(h) | 2,600,000 | $28.19 (3) | $ | 73,294,000.00 | | $147.60 per $1,000,000 | $10,818.19 |

| Total Offering Amounts | | $ | 73,294,000.00 | | | $10,818.19 |

| Total Fee Offsets (4) | | | | $ - |

| Net Fee Due | | | | $10,818.19 |

| | |

| (1) In accordance with Rule 416 under the Securities Act of 1933, as amended, this Registration Statement shall be deemed to cover any additional securities that may from time to time be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (2) Consists of an additional 2,600,000 common shares, par value $0.01 per share (“Common Shares”), of Tanger Inc. (the “Company”) available for issuance under the Incentive Award Plan of Tanger Factory Outlet Centers, Inc. and Tanger Properties Limited Partnership (Amended and Restated as of May 19, 2023) (the “Plan”). |

| (3) Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act, and based upon the average of the high and low prices of the Registrant’s Common Shares as reported on the New York Stock Exchange on December 26, 2023 |

| (4) The Registrant does not have any fee offsets. |

December 28, 2023 Tanger Inc. 3200 Northline Avenue, Suite 360 Greensboro, North Carolina 27408 RE: Registration Statement on Form S-8 Relating to the Incentive Award Plan of Tanger Factory Outlet Centers, Inc. and Tanger Properties Limited Partnership (Amended and Restated as of May 19, 2023) Ladies and Gentlemen: We have acted as counsel to Tanger Inc., a North Carolina corporation (the “Company”), and Tanger Properties Limited Partnership, a North Carolina limited partnership (the “Operating Partnership”), in connection with the preparation of the Company’s above-referenced registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “1933 Act”), filed by the Company with the U.S. Securities and Exchange Commission (the “Commission”) on the date hereof. The Registration Statement relates to 2,600,000 shares of the Company’s common shares, $0.01 par value (the “Shares”), which are proposed to be offered and sold pursuant to the Incentive Award Plan of Tanger Factory Outlet Centers, Inc. and Tanger Properties Limited Partnership (Amended and Restated as of May 19, 2023; the “Plan”). This opinion is provided pursuant to the requirements of Item 8(a) of Form S- 8 and Item 601(b)(5) of Regulation S-K. As the Company’s counsel, we have examined originals or copies, certified or otherwise identified to our satisfaction, of the Company’s articles of incorporation and bylaws, each as amended to date, the Amended and Restated Agreement of Limited Partnership of the Operating Partnership, and minutes and records of the corporate proceedings of the Company relating to the filing of the Registration Statement and the issuance of the Shares, as provided to us by the Company, certificates of public officials and of representatives of the Company, and statutes and other instruments and documents, as a basis for the opinions hereinafter expressed. In rendering this opinion, we have relied upon certificates of public officials and representatives of the Company with respect to the accuracy of the factual matters contained in such certificates. In connection with such examination, we have assumed (a) the genuineness of all signatures and the legal capacity of all signatories; (b) the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as certified or photostatic copies; and (c) the proper issuance and accuracy of certificates of public Exhibit 5.1

Tanger Inc. December 28, 2023 Page 2 officials and representatives of the Company. In rendering opinions as to future events, we have assumed the facts and law existing on the date hereof. Based on and subject to the foregoing, and having regard for such legal considerations as we deem relevant, it is our opinion that the Shares have been duly authorized by all necessary corporate action on the part of the Company, and, upon issuance, delivery and payment therefor in the manner contemplated by the Plan and the Registration Statement (including exchange in accordance with the Amended and Restated Agreement of Limited Partnership of the Operating Partnership), the Shares will be validly issued, fully paid and non-assessable. This opinion is limited to the laws of the State of North Carolina, and we are expressing no opinion as to the effect of the laws of any other jurisdiction. This opinion is rendered as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law or any other matters that may come to our attention after the date hereof. We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to any reference to the name of our firm in the Registration Statement. In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the 1933 Act or the rules and regulations of the Commission thereunder. Very truly yours, /s/Womble Bond Dickinson (US) LLP Womble Bond Dickinson (US) LLP Exhibit 5.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 27, 2023, relating to the financial statements of Tanger Factory Outlet Centers, Inc. and the effectiveness of Tanger Factory Outlet Centers, Inc. internal control over financial reporting, appearing in the Annual Report on Form 10-K of Tanger Factory Outlet Centers, Inc. for the year ended December 31, 2022.

/s/ Deloitte & Touche LLP

Charlotte, North Carolina

December 28, 2023

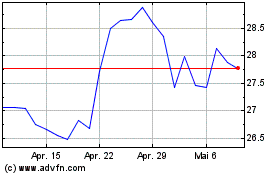

Tanger (NYSE:SKT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

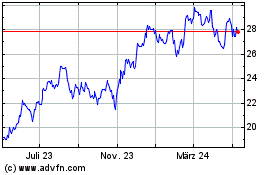

Tanger (NYSE:SKT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024