0000084748false00000847482024-12-042024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 4, 2024

ROGERS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Massachusetts | | 1-4347 | | 06-0513860 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2225 W. Chandler Blvd., Chandler, Arizona 85224

(Address of principal executive offices) (Zip Code)

(480) 917-6000

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, | par value $1.00 per share | ROG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Annual Incentive Compensation Plan

On December 4, 2024, the Compensation and Organization Committee (“Committee”) of the board of directors (the “Board”) of Rogers Corporation (the “Company”) adopted the Rogers Corporation Annual Incentive Compensation Plan (the “AICP”), effective January 1, 2025. The AICP provides opportunities for eligible employees of the Company, including eligible executive officers, to earn annual cash incentives, subject to the achievement of performance metrics. The Committee administers the AICP but is permitted to delegate administrative authority to officers of the Company with respect to non-executive officer awards. Awards are generally paid under the AICP by March 15 of the year following the performance year. Unless otherwise provided by the AICP administrator or a Company severance plan, employees must generally be employed on the payment date in order to receive an award for that year. However, the AICP generally provides for payment of certain amounts in the event of an employee’s termination due to death or disability prior to a payment date.

The foregoing summary of the AICP is not intended to be complete and is qualified in its entirety by reference to the plan document, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Cessation of Future Elections Under the 2009 Stock Acquisition Program

The Company previously maintained the Rogers Corporation 2009 Stock Acquisition Program (the “Program”) to allow executive officers, and non-management directors to acquire shares of the Company’s Capital Stock, par value $1.00 per share (“common stock”), in lieu of cash compensation. On December 4, 2024, the Board approved the cessation of further elections under the Program. The 120,833 shares of common stock that remain available for issuance under the Program as of that date will be returned to the Company’s authorized but unissued share reserve.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit No. | Description |

| 10.1* | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| *Management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | ROGERS CORPORATION | |

| | | (Registrant) | |

| | | | | |

| Date: December 4, 2024 | | | | By: | | /s/ Laura Russell | |

| | | | | | Laura Russell | |

| | | | | | Vice President, Interim Chief Financial Officer and Treasurer | |

____________________________________________________________________

ROGERS CORPORATION

ANNUAL INCENTIVE COMPENSATION PLAN

___________________

Effective January 1, 2025

____________________________________________________________________

ARTICLE 1 - INTRODUCTION

Section 1.1 Purpose.

The purpose of the Rogers Corporation Annual Incentive Compensation Plan (the “Plan”) is to assist Rogers Corporation in attracting, retaining, and motivating highly qualified employees by making a portion of their cash compensation dependent on the achievement of performance goals.

Section 1.2 Effective Date.

The Plan will be in effect beginning January 1, 2025 (the “Effective Date”).

ARTICLE 2 - DEFINITIONS AND CONSTRUCTION

Section 2.1 Definitions.

When used in capitalized form in the Plan, the following words and phrases have the following meanings:

“Administrator” means the Committee and any delegates thereof, pursuant to Section 6.7.

“Award” means a cash incentive payable in accordance with the terms and conditions of the Plan.

“Base Salary” means the base pay rate in effect for a Participant.

“Board” means the Board of Directors of the Company.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Committee” means the Compensation and Organization Committee of the Board.

“Company” means Rogers Corporation and its affiliates (but only during the period of such affiliation).

“Disability” means that the Participant is (i) unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, or (ii) by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, receiving income replacement benefits for a period of not less than three (3) months under a Company or affiliate employee accident and health plan, each of clauses (i) and (ii) as reasonably determined by the Administrator. In addition, the Administrator may determine that the Participant has incurred a Disability if the Participant is considered “totally disabled” by the Social Security Administration or if a comparable determination is made by a non-U.S. entity.

“Effective Date” has the meaning provided in Section 1.2.

“Employee” means an employee of the Company.

“Eligible Employee” means, with respect to a Performance Year, an Employee who satisfies the requirements of Section 3.2.

“Executive Officer” means an “officer” as defined in Rule 16a-1(f) promulgated under the Securities Exchange Act of 1934, as amended.

“Participant” means an Eligible Employee designated by the Administrator to participate in the Plan for a Performance Year, as described in Section 3.1.

“Payment Date” means the date on which an Award is processed through payroll and released to a Participant.

“Performance Objective” means the performance goal or goals established by the Administrator for a Performance Year. Such goals may include corporate, business unit and/or individual performance goals.

“Performance Year” means the fiscal year beginning January 1 and ending December 31.

“Plan” has the meaning provided in Section 1.1.

“Section 409A” means Section 409A of the Code and the regulations promulgated thereunder.

“Target Award” means the target award payable under the Plan to a Participant for a particular Performance Year, as determined based on the Target Bonus Percentage.

“Target Bonus Percentage” means, the percentage of Base Salary that a Participant may earn pursuant to an Award under the Plan, assuming achievement of the Performance Objectives for such Performance Year at the target performance level of 100%.

Section 2.2 Section 409A.

With respect to U.S. taxpayers, all Awards and related payments under the Plan are intended to be exempt from, or comply with, the requirements of Section 409A and the Plan shall be interpreted accordingly. Nonetheless, the Company does not guaranty any particular tax treatment for any Award. Notwithstanding anything to the contrary in the Plan, if at the time of a Participant’s separation from service, such Participant is a “specified employee” (within the meaning of Section 409A), then any amounts payable under the Plan on account of such separation from service that would (but for this provision) be payable within six (6) months following the date of the separation from service shall instead be paid on the next business day following the expiration of such six (6) month period or, if earlier, upon the Participant’s death, but only to the extent compliance with the requirements of Treas. Reg. § 1.409A‑3(i)(2) (or any successor provision) is necessary to avoid the application of an additional tax under Section 409A to such amounts. Notwithstanding the foregoing, neither the Company nor the Administrator shall have any obligation to take any action to prevent the assessment of any excise tax or penalty on any Participant under Section 409A and neither the Company nor the Administrator will have any liability to any Participant for such tax or penalty.

ARTICLE 3 - ELIGIBILITY

Section 3.1 General.

Subject to Section 3.2 and Section 3.3 below, the Administrator, in its sole and absolute discretion, may designate Participants in the Plan. An individual who is designated as a Participant for a given Performance Year is not guaranteed or assured of being selected for participation in any subsequent Performance Year. Each year, the Administrator will communicate, whether orally or in writing, the applicable Performance Objectives to Participants.

Section 3.2 Eligible Employees.

Subject to Section 3.3 below, and unless otherwise determined by the Administrator, all active, regular Employees (whether full-time or part-time) shall be considered Eligible Employees with respect to a Performance Year and, at the Administrator’s discretion, may be designated as Participants in the Plan in accordance with Section 3.1. The Administrator will determine in its sole discretion, subject to applicable local laws and regulations, whether or not Eligible Employees on approved leaves of absence during a Performance Year will be eligible to participate in the Plan.

Section 3.3 Employees Excluded from Eligibility.

Notwithstanding anything in the Plan to the contrary, unless otherwise determined by the Administrator, the following Employees shall not be considered Eligible Employees under the Plan with respect to a Performance Year:

(a) Employees participating in another Company-sponsored variable incentive program (Production Bonus Plan, Sales (MBO/SIP), CLA 90, etc.);

(b) Employees covered by a collective bargaining agreement unless such agreement expressly provides for participation in the Plan;

(c) Employees hired on and after October 1st of the applicable Performance Year;

(d) Temporary Employees (regardless of whether such Employee is working on a full-time or part-time basis); and

(e) Employees classified as “contingent workers” by the Company.

ARTICLE 4 - AWARDS

Section 4.1 Target Awards.

Unless otherwise determined by the Administrator, the Target Award for each Participant for a Performance Year shall be calculated based on such Participant’s Target Bonus Percentage and Base Salary as in effect on the last day of the Performance Year. Notwithstanding the foregoing, unless otherwise determined by the Administrator, if an Executive Officer changes roles during a Performance Year, or a non-executive employee becomes an Executive Officer during a Performance Year, such Executive Officer’s Target Award for the year will be calculated based on (a) the Target Bonus Percentage and Base Salary (properly pro-rated) as in effect for the portion of the Performance Year preceding the role change, and (b) the Target Bonus Percentage and Base Salary (properly pro-rated) as in effect for the portion of the Performance Year on and after the role change. The Performance Objectives for each portion of the Performance Year need not be the same, and will be determined in the Administrator’s discretion.

Each Participant shall be eligible to earn between 0% and 200% of the Participant’s Target Award, as described further in Section 4.2 below.

Section 4.2 Determining Award Amounts.

(a) Award Amount. Following the end of the Performance Year, the Administrator shall determine the percentage of the Target Award earned for each Participant, based upon the level at which the Performance Objectives have been achieved during the applicable Performance Year. In so doing, the Administrator may adjust or modify the calculation of a Performance Objective in its discretion based on: (i) unusual or nonrecurring events affecting the Company or any business unit of the Company, or the financial statements of the Company or results thereof, (ii) the effects of changes to applicable law (including tax, disclosure, and other laws), regulations and/or accounting principles, (iii) acquisitions or divestitures and/or (iv) any other circumstances deemed relevant by the Administrator.

(b) Proration for Partial Year Participation. Award payments shall be prorated based on full-time equivalent hours worked and, to the extent a Participant is hired and commenced employment after the first date of the applicable Performance Year, such Participant’s Award payment shall be prorated based on days actually worked by the Participant during the Performance Year.

(c) Treatment on Termination for Death or Disability. If a Participant experiences a termination of employment as a result of such Participant’s death or Disability, such Participant (or the Participant’s estate, if applicable) will receive, (i) payment of any earned but unpaid Award (if any) with respect to the immediately preceding completed Performance Year based on the achievement of applicable Performance Objectives, at the time provided under Section 4.4, and (ii) a lump sum cash payment equal to a prorated portion of the Participant’s Target Award for the Performance Year in which the termination date occurs based on the days actually worked by the Participant during the Performance Year, paid as soon as practicable but in no event more than forty-five (45) days following the termination date.

Section 4.3 Additional Conditions for Payment of an Award.

Notwithstanding anything in the Plan to the contrary, unless otherwise provided under the terms of a Company severance plan, or as determined by the Administrator, the Participant will not receive payment of an Award for an applicable Performance Year if the Participant:

(a) is subject to a Performance Incentive Plan (PIP) or a corrective action plan of any kind as of the Payment Date, including but not limited to formal verbal counseling (documented);

(b) is not in good standing with the Company (as determined by the Administrator in its sole discretion) as of the Payment Date;

(c) has submitted a verbal or written resignation of employment with the Company prior to the Payment Date; or

(d) has terminated employment with the Company, either voluntarily or involuntarily, prior to the Payment Date, other than in the case of a termination of employment due to death or Disability, as provided for in Section 4.2(c).

Section 4.4 Timing of Payment.

The Company will pay a Participant the amount of the Award determined in accordance with Section 4.2 in cash as soon as practicable following the end of an applicable Performance Year (and for U.S. taxpayers only, in no event later than the deadline for short-term deferrals under Treas. Reg. § 1.409A-1(b)(4)); provided, however, that if the Company has adopted a deferred compensation plan and the Participant has made a valid deferral election under such plan, the Award will be paid under the terms of such deferred compensation plan.

Section 4.5 Change in Control.

The Administrator will have the authority to determine the treatment of Awards under the Plan with respect to a Performance Year in which a “Change in Control” (within the meaning of the equity compensation plan most recently approved by the Company’s shareholders) occurs. Such treatment may include, without limitation, and subject to Section 409A, (i) continuing the Awards, and modifying, if applicable, the Performance Objectives, (ii) paying out Target Awards, (iii) paying out Target Awards on a prorated basis, based on the number of days that have elapsed in the Performance Year prior to the Change in Control, or (iv) calculating the achievement of Performance Objectives for the Performance Year as of the date of the Change in Control.

ARTICLE 5 - NATURE OF INTEREST IN THE PLAN

Section 5.1 No Right to Assets.

Amounts payable with respect to Awards under the Plan shall be paid from the Company’s general assets. Participation in the Plan does not create, in favor of any Employee, any right or lien in or against any asset of the Company. Nothing contained in the Plan, and no action taken under its provisions, will create or be construed to create a trust of any kind, or a fiduciary relationship, between the Company and an Employee or any other person. The Company’s promise to pay benefits under the Plan will always remain unfunded as to each Employee, whose rights under the Plan are limited to those of a general and unsecured creditor of the Company.

Section 5.2 No Right to Transfer Interest.

Awards are not transferable by a Participant except upon the Participant’s death by will or the laws of descent and distribution. Awards will not be subject in any manner to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, or charge, and any such attempted action will be void.

Section 5.3 No Employment Rights.

No provisions of the Plan and no action taken by the Company, the Board, the Committee or the Administrator will give any person any right to be retained in the employ of the Company, and the Company specifically reserves the right and power to dismiss or discharge any Employee for any reason or no reason and at any time.

Section 5.4 Clawback.

All Awards shall be subject to the Rogers Corporation Compensation Recovery Policy and all other Company clawback policies as may be in effect from time to time.

Section 5.5 Withholding and Tax Liabilities.

The Company shall have the right to withhold from any Award, any federal, state, local and foreign taxes required by law to be withheld and to take such other action as the Administrator may deem advisable to enable the Company and Participants to satisfy obligations for the payment of withholding taxes and other tax obligations relating to an Award.

ARTICLE 6 - ADMINISTRATION, ARBITRATION, AND MODIFICATION OF PLAN

Section 6.1 Plan Administrator.

The Plan shall be administered by the Administrator; provided that, notwithstanding anything to the contrary herein, in its sole discretion, the Board may at any time and from time to time exercise any and all rights and duties of the Administrator under the Plan, except with respect to matters which under applicable law are required to be determined in the sole discretion of the Administrator.

Section 6.2 Powers of the Administrator.

The Administrator will have full authority to approve Awards under the Plan and determine the terms of such Awards. Such authority includes, but is not limited to, the right to:

(a) make all relevant determinations with respect to the granting of Awards;

(b) waive any conditions or restrictions associated with an Award;

(c) adopt, alter and repeal any rules, guidelines and/or practices governing the Plan as it, from time to time, deems advisable;

(d) decide all questions relating to the interpretation of the terms and provisions of the Plan;

(e) modify or amend the terms of any Award, subject to the Participant’s consent if such modification or amendment would materially impair such Participant’s rights;

(f) correct any defect, supply any omission and/or reconcile any inconsistency in the Plan or in any Award Notice in the manner and to the extent it deems necessary to carry out the intent of the Plan; and

(g) resolve all other questions arising under the Plan (including, without limitation, the power to remedy possible ambiguities, inconsistencies, or omissions by a general rule or decision).

Section 6.3 Foreign Law.

To facilitate compliance with the laws in countries other than the U.S. in which the Company operates or has Employees, or to otherwise ensure the viability of the benefits from Awards to Employees performing services in such countries and to meet the objectives of the Plan, the Administrator in its discretion, will have the power and authority to: (a) modify the terms and conditions of the Plan as they apply to Awards made to Employees based outside the U.S.; (b) adopt rules or procedures applicable to particular affiliates or Participants in a particular location, and (c) take any action, before or after an Award is made, that it deems advisable to facilitate compliance with local law.

Section 6.4 Finality of Administrator Determinations.

Determinations by the Administrator and any interpretation, rule, or decision adopted by the Administrator under the Plan, or in carrying out or administering the Plan, will be final and binding for all purposes and upon all interested persons, their heirs, and their personal representatives.

Section 6.5 Arbitration; Waiver of Jury Trial.

Any dispute, controversy, suit, action or proceeding (“Proceeding”) arising out of or relating to the Plan, other than the injunctive relief described below in this paragraph, will be settled exclusively by arbitration, conducted before a single arbitrator in Maricopa County, Arizona in accordance with, and pursuant to, the Employment Arbitration Rules and Procedures of JAMS (“JAMS”). The decision of the arbitrator will be final and binding upon the parties thereto. Any arbitral award may be entered as a judgment or order in any court of competent jurisdiction. Either party may commence litigation in court to obtain injunctive relief in aid of arbitration, to compel arbitration, or to confirm or vacate an award, to the extent authorized by the U.S. Federal Arbitration Act or applicable state law. The Company and the Participant will share the JAMS administrative fees, the arbitrator’s fee and expenses. Each party shall be responsible for such party’s attorneys’ fees.

IF THE ABOVE PROVISION COMPELLING ARBITRATION IS HELD INVALID OR UNENFORCEABLE THEN, TO THE EXTENT NOT PROHIBITED BY APPLICABLE LAW THAT CANNOT BE WAIVED, THE PARTICIPANT AND THE COMPANY WAIVE AND COVENANT THAT THE PARTICIPANT AND THE COMPANY WILL NOT ASSERT (WHETHER AS PLAINTIFF, DEFENDANT OR OTHERWISE) ANY RIGHT TO TRIAL BY JURY IN ANY ACTION ARISING IN WHOLE OR IN PART UNDER OR IN CONNECTION WITH THE PLAN OR ANY MATTERS CONTEMPLATED THEREBY, WHETHER NOW OR HEREAFTER ARISING, AND WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AND AGREE THAT ANY OF THE COMPANY OR ANY OF ITS AFFILIATES OR THE PARTICIPANT MAY FILE A COPY OF THIS PARAGRAPH WITH ANY COURT AS WRITTEN EVIDENCE OF THE KNOWING, VOLUNTARY AND BARGAINED-FOR AGREEMENT AMONG THE COMPANY AND ITS AFFILIATES, ON THE ONE HAND, AND THE PARTICIPANT, ON THE OTHER HAND, IRREVOCABLY TO WAIVE THE RIGHT TO TRIAL BY JURY IN ANY PROCEEDING WHATSOEVER BETWEEN SUCH PARTIES ARISING OUT OF OR RELATING TO THE PLAN AND THAT ANY PROCEEDING PROPERLY HEARD BY A COURT UNDER THE PLAN WILL INSTEAD BE TRIED IN A COURT OF COMPETENT JURISDICTION BY A JUDGE SITTING WITHOUT A JURY.

Section 6.6 Amendment, Suspension and Termination.

The Committee and/or the Board have the right to amend, suspend, or terminate the Plan at any time.

Section 6.7 Power to Delegate Authority.

The Committee, in its sole discretion, may delegate all or part of its authority and powers under the Plan to one or more officers of the Company, provided, however, that the Committee may only delegate its authority and powers with respect to Awards to Employees that are not Executive Officers of the Company. To the extent that the Committee so delegates authority, applicable references in the Plan to the “Administrator” shall be deemed to include the delegate. Notwithstanding the foregoing, the Committee will retain broad authority to administer the Plan, including the authority to make determinations with respect to Awards approved by a delegate. The Committee may revoke any delegation it previously effectuated hereunder at any time, for any reason, with or without prior notice.

Section 6.8 Headings.

The headings used in this document are for convenience of reference only and may not be given any weight in interpreting any provision of the Plan.

Section 6.9 Severability.

If an arbitrator or court of competent jurisdiction determines that any term, provision, or portion of this Plan is void, illegal, or unenforceable, the other terms, provisions, and portions of this Plan will remain in full force and effect, and the terms, provisions, and portions that are determined to be void, illegal, or unenforceable will either be limited so that they will remain in effect to the extent permissible by law, or such arbitrator or court will substitute, to the extent enforceable, provisions similar thereto or other provisions, so as to provide to the Company, to the fullest extent permitted by applicable law, the benefits intended by this Plan.

Section 6.10 Governing Law.

The provisions of the Plan and all Awards made hereunder shall be governed by and interpreted in accordance with the laws of the state of Arizona, regardless of the laws that might otherwise govern under any state’s applicable principles of conflicts of laws.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

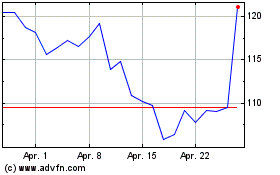

Rogers (NYSE:ROG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

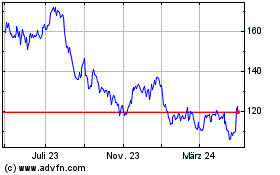

Rogers (NYSE:ROG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024