UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

_______________________

Date of Report

(Date of earliest event reported): November 3, 2014

Regal-Beloit Corporation

(Exact name of registrant as specified in its charter)

|

| | |

Wisconsin | 1-7283 | 39-0875718 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

200 State Street, Beloit, Wisconsin 53511-6254

(Address of principal executive offices, including Zip code)

(608) 364-8800

(Registrant's telephone number)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On November 3, 2014, Regal Beloit Corporation (the “Company”) issued a news release reporting the financial results of the Company for the financial period ended September 27, 2014. A copy of the Company's news release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On November 4, 2014, the Company held a conference call to discuss its financial results for the financial period ended September 27, 2014 and provided a presentation in connection therewith. A copy of the Company's conference call presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

| |

(d) | Exhibits. The following exhibits are being furnished herewith: |

| |

99.1 | News Release of Regal Beloit Corporation, dated November 3, 2014. |

| |

99.2 | Regal Beloit Corporation Presentation of November 4, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

REGAL BELOIT CORPORATION

Date: November 4, 2014 By: /s/ Peter C. Underwood

Peter C. Underwood

Vice President, General Counsel and Secretary

REGAL BELOIT CORPORATION

Exhibit Index to Report on Form 8-K

Dated November 3, 2014

|

| | |

Exhibit Number | | Exhibit Description |

99.1 | | News Release of Regal Beloit Corporation, dated November 3, 2014. |

99.2 | | Regal Beloit Corporation Presentation of November 4, 2014. |

FOR RELEASE ON OR AFTER: November 3, 2014

CONTACT: John Perino, VP Investor Relations

608-361-7501

john.perino@regalbeloit.com

Regal Beloit Corporation Announces Third Quarter 2014 Financial Results

| |

• | Diluted Earnings per Share in Line with Guidance |

| |

• | Repurchased 500,000 Shares |

BELOIT, WI - Regal Beloit Corporation (NYSE: RBC) today reported financial results for the third quarter 2014. Net sales for the third quarter 2014 were $829.8 million compared to $768.2 million for the third quarter 2013. Net income for the third quarter 2014 was $47.5 million compared to $52.6 million for the third quarter 2013. Diluted earnings per share for the third quarter 2014 were $1.05 compared to $1.16 for the third quarter 2013. Adjusted diluted earnings per share were $1.15 for the third quarter 2014 compared to $1.18 for the third quarter 2013.

“Overall we performed as expected in the third quarter with strong growth in our residential HVAC and mechanical businesses,” said Regal Chairman and CEO Mark Gliebe. “During the quarter, we continued to execute on our simplification initiative and we also divested an underperforming joint venture in China. We remain focused on actions to improve our operating profit margins across the company.”

"We generated free cash flow of 135% of net income,” continued Mark Gliebe. “Additionally, we repurchased 500,000 shares in the quarter. Our strong financial position enables us to both return value to shareholders through share repurchases and pursue strategic acquisitions that add long term value to the company.”

|

| | | | | | | | | | | | | | | | |

ADJUSTED DILUTED EARNINGS PER SHARE* | | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

GAAP Diluted Earnings Per Share | | $ | 1.05 |

| | $ | 1.16 |

| | $ | 3.25 |

| | $ | 3.38 |

|

Restructuring Costs | | 0.04 |

| | 0.02 |

| | 0.15 |

| | 0.05 |

|

Purchase Accounting And Transaction Costs | | 0.02 |

| | — |

| | 0.05 |

| | — |

|

Tax Benefit Recorded Attributable to Prior Year | | — |

| | — |

| | — |

| | (0.04 | ) |

Gain on Disposal of Real Estate | | — |

| | — |

| | (0.03 | ) | | — |

|

Loss on Sale of Joint Venture | | 0.04 |

| | — |

| | 0.04 |

| | — |

|

Adjusted Diluted Earnings Per Share | | $ | 1.15 |

| | $ | 1.18 |

| | $ | 3.46 |

| | $ | 3.39 |

|

*This earnings release includes non-GAAP financial measures. Schedules that reconcile these non-GAAP financial measures to the most comparable GAAP figures are included with this earnings release.

|

| | | | | | | | | | | | | | | | | | | | | |

NET SALES | (Dollars In Millions) |

| Three Months Ended | | Nine Months Ended |

| Sep 27,

2014 | | Sep 28,

2013 | | % Change | | Sep 27,

2014 | | Sep 28,

2013 | | % Change |

Net Sales | $ | 829.8 |

| | $ | 768.2 |

| | 8.0 | % | | $ | 2,481.4 |

| | $ | 2,368.4 |

| | 4.8 | % |

| | | | | | | | | | | |

Net Sales by Segment | | | | | | | | | | | |

Electrical segment | 760.6 |

| | 707.5 |

| | 7.5 | % | | 2,278.3 |

| | 2,171.8 |

| | 4.9 | % |

Mechanical segment | 69.2 |

| | 60.7 |

| | 14.0 | % | | 203.1 |

| | 196.6 |

| | 3.3 | % |

| | | | | | | | | | | |

Electrical segment net sales in the third quarter 2014 included $42.6 million from businesses acquired within the last year ("recently acquired businesses"). North American residential HVAC net sales increased 8.4% for the third quarter 2014 compared to the third quarter 2013 driven primarily by improving market conditions and an HVAC OEM pre-build of SEER 13 product. North American commercial and industrial motor net sales decreased 1.3% for the third quarter 2014 compared to the third quarter 2013.

Mechanical segment net sales in North America increased 18.0% for the third quarter 2014 compared to the third quarter 2013, primarily driven by growth in the power transmission distribution channel and the energy end market.

Excluding the impact of the recently acquired businesses, foreign currency exchange rates positively impacted total net sales by 0.1% for the third quarter 2014 compared to the third quarter 2013.

Excluding the impact of the recently acquired businesses, net sales to regions outside the United States for the third quarter 2014 increased 8.2% compared to the third quarter 2013, and represented 35.0% of net sales. In the third quarter 2014, sales of high efficiency products increased 7.0% compared to the third quarter 2013 and represented 21.5% of total net sales.

|

| | | | | | | | | | | | | | | | |

GROSS PROFIT | | (Dollars in Millions) |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Gross Profit | | $ | 203.8 |

| | $ | 196.5 |

| | $ | 609.2 |

| | $ | 605.2 |

|

As a percentage of net sales | | 24.6 | % | | 25.6 | % | | 24.6 | % | | 25.6 | % |

| | | | | | | | |

Gross Profit by Segment | | | | | | | | |

Electrical segment | | $ | 185.5 |

| | $ | 180.1 |

| | $ | 557.1 |

| | $ | 552.9 |

|

As a percentage of net sales | | 24.4 | % | | 25.5 | % | | 24.5 | % | | 25.5 | % |

Mechanical segment | | $ | 18.3 |

| | $ | 16.4 |

| | $ | 52.1 |

| | $ | 52.3 |

|

As a percentage of net sales | | 26.4 | % | | 27.0 | % | | 25.7 | % | | 26.6 | % |

Electrical segment gross profit for the third quarter 2014 included $3.0 million of restructuring expenses and $1.2 million of purchase accounting adjustments related to the recently acquired businesses. Third quarter 2013 Electrical segment gross profit included $1.2 million of restructuring expenses.

|

| | | | | | | | | | | | | | | | |

OPERATING EXPENSES | | (Dollars in Millions) |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Operating Expenses | | $ | 129.1 |

| | $ | 117.7 |

| | $ | 376.1 |

| | $ | 369.4 |

|

As a percentage of net sales | | 15.6 | % | | 15.3 | % | | 15.2 | % | | 15.6 | % |

| | | | | | | | |

Operating Expenses by Segment | | | | | | | | |

Electrical segment | | $ | 119.5 |

| | $ | 109.0 |

| | $ | 347.8 |

| | $ | 341.8 |

|

As a percentage of net sales | | 15.7 | % | | 15.4 | % | | 15.3 | % | | 15.7 | % |

Mechanical segment | | $ | 9.6 |

| | $ | 8.7 |

| | $ | 28.3 |

| | $ | 27.6 |

|

As a percentage of net sales | | 13.9 | % | | 14.3 | % | | 13.9 | % | | 14.0 | % |

For the third quarter 2014, Electrical segment operating expenses included an incremental $8.3 million from the recently acquired businesses and a $1.9 million loss from the sale of a joint venture in China.

|

| | | | | | | | | | | | | | | | |

INCOME FROM OPERATIONS | | (Dollars in Millions) |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Income from Operations | | $ | 74.7 |

| | $ | 78.8 |

| | $ | 232.1 |

| | $ | 235.8 |

|

As a percentage of net sales | | 9.0 | % | | 10.3 | % | | 9.4 | % | | 10.0 | % |

| | | | | | | | |

Income from Operations by Segment | | | | | | | | |

Electrical segment | | $ | 66.0 |

| | $ | 71.1 |

| | $ | 208.3 |

| | $ | 211.1 |

|

As a percentage of net sales | | 8.7 | % | | 10.0 | % | | 9.1 | % | | 9.7 | % |

Mechanical segment | | $ | 8.7 |

| | $ | 7.7 |

| | $ | 23.8 |

| | $ | 24.7 |

|

As a percentage of net sales | | 12.6 | % | | 12.7 | % | | 11.7 | % | | 12.6 | % |

The effective tax rate for the third quarter 2014 was 27.1% compared to 21.6% for the third quarter 2013. The increase was primarily driven by favorable adjustments recorded in 2013 related to the finalization of the 2012 U.S. Federal income tax return and the increase in the Mexican tax rate in 2014.

For the third quarter 2014, net cash provided by operating activities was $81.8 million. For the third quarter 2014, free cash flow* represented 135.2% of net income attributable to Regal Beloit. During the third quarter 2014, the Company repurchased 500,000 shares of its common stock for a total cost of $35.0 million.

"In the fourth quarter, we expect continued growth in both our HVAC and mechanical businesses and relatively flat performance in our commercial and industrial motor business,” continued Mr. Gliebe. "In the fourth quarter, we expect diluted earnings per share to be $0.83 to $0.91. Adding back $0.06 of estimated restructuring expenses and $0.01 of purchase accounting adjustments, adjusted diluted earnings per share is expected to be $0.90 to $0.98. Finally, we anticipate 2014 will be the fourth consecutive year that free cash flow exceeds 100% of net income."

Regal management will hold a conference call to discuss the earnings release at 9:00 AM CST (10:00 AM EST) on Tuesday, November 4, 2014. Individuals who would like to participate by phone should dial 888-317-6003 and enter 2542656 when prompted. International callers should dial 412-317-6061 and enter 2542656 when prompted. To view the presentation during the call, please follow this link to Regal’s Investors page: http://investors.regalbeloit.com/phoenix.zhtml?c=116222&p=irol-presentations.

To listen to the live audio and view the presentation via the internet, please go to: http://www.videonewswire.com/event.asp?id=100638.

A telephone replay of the call will be available through January 5, 2015, at 877-344-7529, conference ID 10053674. International callers should call 412-317-0088 using the same conference ID. A webcast replay will be available until January 5, 2015, and can be accessed at http://investors.regalbeloit.com/phoenix.zhtml?c=116222&p=irol-calendarPast or at

http://www.videonewswire.com/event.asp?id=100638.

Regal Beloit Corporation is a leading manufacturer of electric motors, mechanical and electrical motion controls and power generation products serving markets throughout the world. Regal Beloit is headquartered in Beloit, Wisconsin, and has manufacturing, sales and service facilities throughout the United States, Canada, Mexico, Europe and Asia. Regal Beloit’s common stock is a component of the S&P Mid Cap 400 Index and the Russell 2000 Index.

CAUTIONARY STATEMENT

The following is a cautionary statement made under the Private Securities Litigation Reform Act of 1995: With the exception of historical facts, the statements contained in this press release may be forward looking statements. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward-looking statements by terminology such as “may,” “will,” “plan,” “expect,” “anticipate,” “estimate,” “believe,” or “continue” or the negative of these terms or other similar words. Actual results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors, including: uncertainties regarding our ability to execute our restructuring plans within expected costs and timing; actions taken by our competitors and our ability to effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers; issues and costs arising from the integration of acquired companies and businesses, including the timing and impact of purchase accounting adjustments; challenges in our Venezuelan operations, including potential currency devaluations, non-payment of receivables, governmental restrictions such as price and margin controls, as well as other difficult operating conditions; unanticipated costs or expenses we may incur related to product warranty issues; our dependence on key suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; increases in our overall debt levels as a result of acquisitions or otherwise and our ability to repay principal and interest on our outstanding debt; product liability and other litigation, or the failure of our products to perform as anticipated, particularly in high volume applications; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired businesses; cyclical downturns affecting the global market for capital goods; difficulties associated with managing foreign operations; and other risks and uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company’s Annual Report on Form 10-K filed on February 26, 2014 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this presentation are made only as of their respective dates, and we undertake no obligation to update these statements to reflect subsequent events or circumstances.

|

| | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS | | | | | | |

Unaudited | | | | | | | |

(Dollars in Millions, Except per Share Data) | | | | | | |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Net Sales | $ | 829.8 |

| | $ | 768.2 |

| | $ | 2,481.4 |

| | $ | 2,368.4 |

|

Cost of Sales | 626.0 |

| | 571.7 |

| | 1,872.2 |

| | 1,763.2 |

|

Gross Profit | 203.8 |

| | 196.5 |

| | 609.2 |

| | 605.2 |

|

Operating Expenses | 129.1 |

| | 117.7 |

| | 376.1 |

| | 369.4 |

|

Goodwill Impairment | — |

| | — |

| | 1.0 |

| | — |

|

Total Operating Expenses | 129.1 |

| | 117.7 |

| | 377.1 |

| | 369.4 |

|

Income From Operations | 74.7 |

| | 78.8 |

| | 232.1 |

| | 235.8 |

|

Interest Expense | 9.8 |

| | 10.6 |

| | 30.5 |

| | 31.9 |

|

Interest Income | 2.0 |

| | 1.3 |

| | 5.4 |

| | 3.1 |

|

Income Before Taxes | 66.9 |

| | 69.5 |

| | 207.0 |

| | 207.0 |

|

Provision For Income Taxes | 18.1 |

| | 15.0 |

| | 55.1 |

| | 48.2 |

|

Net Income | 48.8 |

| | 54.5 |

| | 151.9 |

| | 158.8 |

|

Less: Net Income Attributable to Noncontrolling

Interests | 1.3 |

| | 1.9 |

| | 4.4 |

| | 5.6 |

|

Net Income Attributable to Regal Beloit Corporation | $ | 47.5 |

| | $ | 52.6 |

| | $ | 147.5 |

| | $ | 153.2 |

|

Earnings Per Share Attributable to Regal Beloit Corporation: | | | | | | | |

Basic | $ | 1.06 |

| | $ | 1.17 |

| | $ | 3.27 |

| | $ | 3.40 |

|

Assuming Dilution | $ | 1.05 |

| | $ | 1.16 |

| | $ | 3.25 |

| | $ | 3.38 |

|

Cash Dividends Declared | $ | 0.22 |

| | $ | 0.20 |

| | $ | 0.64 |

| | $ | 0.59 |

|

Weighted Average Number of Shares Outstanding: | | | | | | | |

Basic | 44.9 |

| | 45.1 |

| | 45.1 |

| | 45.0 |

|

Assuming Dilution | 45.2 |

| | 45.4 |

| | 45.4 |

| | 45.3 |

|

|

| | | | | | | | | | | | | | | | |

SEGMENT INFORMATION | | | | | | |

Unaudited | | | | | | | | |

(Dollars In Millions) | | | | | | | | |

| | Three Months Ended |

| | Electrical Segment | | Mechanical Segment |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Net Sales | | $ | 760.6 |

| | $ | 707.5 |

| | $ | 69.2 |

| | $ | 60.7 |

|

Income from Operations | | 66.0 |

| | 71.1 |

| | 8.7 |

| | 7.7 |

|

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended |

| | Electrical Segment | | Mechanical Segment |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

Net Sales | | $ | 2,278.3 |

| | $ | 2,171.8 |

| | $ | 203.1 |

| | $ | 196.6 |

|

Income from Operations | | 208.3 |

| | 211.1 |

| | 23.8 |

| | 24.7 |

|

|

| | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS |

Unaudited | | | | |

(Dollars in Millions) | | | | |

| | Sep 27,

2014 | | Dec 28,

2013 |

ASSETS | | | | |

Current Assets: | | | | |

Cash and Cash Equivalents | | $ | 327.3 |

| | $ | 466.0 |

|

Trade Receivables, less Allowances

of $12.8 million in 2014 and $11.5 million in 2013 | | 545.7 |

| | 463.8 |

|

Inventories | | 681.7 |

| | 618.7 |

|

Prepaid Expenses and Other Current Assets | | 116.5 |

| | 130.6 |

|

Deferred Income Tax Benefits | | 47.5 |

| | 46.8 |

|

Total Current Assets | | 1,718.7 |

| | 1,725.9 |

|

| | | | |

Net Property, Plant, Equipment and Noncurrent Assets | | 1,952.7 |

| | 1,917.6 |

|

Total Assets | | $ | 3,671.4 |

| | $ | 3,643.5 |

|

| | | | |

LIABILITIES AND EQUITY | | | | |

Current Liabilities: | | | | |

Accounts Payable | | $ | 347.9 |

| | $ | 304.6 |

|

Other Accrued Expenses | | 236.4 |

| | 237.9 |

|

Current Maturities of Debt | | 8.3 |

| | 158.4 |

|

Total Current Liabilities | | 592.6 |

| | 700.9 |

|

| | | | |

Long-Term Debt | | 668.6 |

| | 609.0 |

|

Other Noncurrent Liabilities | | 233.5 |

| | 231.2 |

|

Equity: | | | | |

Total Regal Beloit Corporation Shareholders' Equity | | 2,131.1 |

| | 2,056.2 |

|

Noncontrolling Interests | | 45.6 |

| | 46.2 |

|

Total Equity | | 2,176.7 |

| | 2,102.4 |

|

Total Liabilities and Equity | | $ | 3,671.4 |

| | $ | 3,643.5 |

|

|

| | | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW | | | | |

Unaudited | | | | | | | | |

(Dollars in Millions) | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 | | Sep 28,

2013 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

Net income | | $ | 48.8 |

| | $ | 54.5 |

| | $ | 151.9 |

| | $ | 158.8 |

|

Adjustments to reconcile net income and changes in assets and liabilities (net of acquisitions) to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | 35.6 |

| | 31.7 |

| | 103.6 |

| | 95.1 |

|

Excess tax benefits from share-based compensation | | — |

| | — |

| | (1.2 | ) | | (0.7 | ) |

Goodwill impairment | | — |

| | — |

| | 1.0 |

| | — |

|

Loss (Gain) on disposition of property, net | | 0.2 |

| | (0.2 | ) | | 0.4 |

| | 0.1 |

|

Share-based compensation expense | | 2.2 |

| | 2.9 |

| | 8.5 |

| | 8.3 |

|

Loss on sale of consolidated joint venture | | 1.9 |

| | — |

| | 1.9 |

| | — |

|

Change in operating assets and liabilities | | (6.9 | ) | | (7.7 | ) | | (39.0 | ) | | (23.1 | ) |

Net cash provided by operating activities | | 81.8 |

| | 81.2 |

| | 227.1 |

| | 238.5 |

|

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Additions to property, plant, and equipment | | (17.6 | ) | | (18.2 | ) | | (60.5 | ) | | (65.4 | ) |

Net (purchases) sales of investment securities | | 3.6 |

| | (0.1 | ) | | (9.9 | ) | | (0.3 | ) |

Business acquisitions, net of cash acquired | | (50.6 | ) | | (0.4 | ) | | (128.2 | ) | | (6.1 | ) |

Additions of equipment on operating leases | | (1.3 | ) | | (3.6 | ) | | (4.5 | ) | | (3.6 | ) |

Grants received for capital expenditures | | — |

| | 1.6 |

| | — |

| | 1.6 |

|

Proceeds from sale of consolidated joint venture | | 0.7 |

| | — |

| | 0.7 |

| | — |

|

Proceeds from sale of assets | | — |

| | 1.7 |

| | 0.1 |

| | 1.7 |

|

Net cash used in investing activities | | (65.2 | ) | | (19.0 | ) | | (202.3 | ) | | (72.1 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Net proceeds (repayments) under revolving credit facility | | 60.0 |

| | (3.0 | ) | | 60.0 |

| | — |

|

Net (repayments) proceeds of short-term borrowings | | — |

| | (1.3 | ) | | (0.3 | ) | | 1.0 |

|

Repayments of long-term debt | | (150.0 | ) | | (0.6 | ) | | (150.1 | ) | | (55.8 | ) |

Dividends paid to shareholders | | (9.9 | ) | | (9.1 | ) | | (28.0 | ) | | (26.1 | ) |

Payments of contingent consideration | | — |

| | — |

| | (8.6 | ) | | (0.3 | ) |

Proceeds from the exercise of stock options | | — |

| | 0.1 |

| | 0.8 |

| | 2.3 |

|

Excess tax benefits from share-based compensation | | — |

| | — |

| | 1.2 |

| | 0.7 |

|

Repurchase of common stock | | (35.0 | ) | | — |

| | (35.0 | ) | | — |

|

Distributions to noncontrolling interests | | (0.3 | ) | | — |

| | (0.3 | ) | | — |

|

Purchase of subsidiary shares from noncontrolling interest | | — |

| | (1.7 | ) | | — |

| | (1.7 | ) |

Net cash used in financing activities | | (135.2 | ) | | (15.6 | ) | | (160.3 | ) | | (79.9 | ) |

EFFECT OF EXCHANGE RATES ON CASH AND CASH EQUIVALENTS | | 0.6 |

| | 1.7 |

| | (3.2 | ) | | 0.9 |

|

| | | | | | | | |

Net (decrease) increase in cash and cash equivalents | | (118.0 | ) | | 48.3 |

| | (138.7 | ) | | 87.4 |

|

Cash and cash equivalents at beginning of period | | 445.3 |

| | 414.4 |

| | 466.0 |

| | 375.3 |

|

Cash and cash equivalents at end of period | | $ | 327.3 |

| | $ | 462.7 |

| | $ | 327.3 |

| | $ | 462.7 |

|

NON-GAAP MEASURES

Unaudited

(Dollars in Millions)

We prepare financial statements in accordance with accounting principles generally accepted in the United States (GAAP). We also disclose adjusted diluted earnings per share (EPS), adjusted gross profit, adjusted gross profit as a percentage of net sales, adjusted income from operations, free cash flow and free cash flow as a percentage of net income attributable to Regal Beloit Corporation (collectively, “non-GAAP financial measures”). We use these measures in our internal performance reporting and for reports to the Board of Directors. We also periodically disclose certain of these measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events. We believe that these non-GAAP financial measures are useful measures for providing investors with additional insight into our operating performance. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. Free cash flow is defined as net cash provided by operating activities less additions to property, plant and equipment adjusted for grants received for capital expenditures.

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 |

| | Sep 28,

2013 |

|

GAAP Gross Profit | | $ | 203.8 |

| | $ | 196.5 |

| | $ | 609.2 |

| | $ | 605.2 |

|

Purchase Accounting Costs | | 1.2 |

| | — |

| | 2.5 |

| | — |

|

Restructuring Costs | | 3.0 |

| | 1.2 |

| | 10.5 |

| | 2.7 |

|

Adjusted Gross Profit | | $ | 208.0 |

| | $ | 197.7 |

| | $ | 622.2 |

| | $ | 607.9 |

|

Adjusted Gross Profit as a Percentage of Net Sales | | 25.1 | % | | 25.7 | % | | 25.1 | % | | 25.7 | % |

| | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 |

| | Sep 28,

2013 |

|

GAAP Income from Operations | | $ | 74.7 |

| | $ | 78.8 |

| | $ | 232.1 |

| | $ | 235.8 |

|

Purchase Accounting and Transaction Costs | | 1.2 |

| | — |

| | 3.3 |

| | — |

|

Restructuring Costs | | 3.0 |

| | 1.2 |

| | 10.8 |

| | 3.5 |

|

Gain on Disposal of Real Estate | | — |

| | — |

| | (2.0 | ) | | — |

|

Loss on Sale of Joint Venture | | 1.9 |

| | — |

| | 1.9 |

| | — |

|

Adjusted Income from Operations | | $ | 80.8 |

| | $ | 80.0 |

| | $ | 246.1 |

| | $ | 239.3 |

|

| | | | | | | | |

| | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | Sep 27,

2014 | | Sep 28,

2013 | | Sep 27,

2014 |

| | Sep 28,

2013 |

|

GAAP Net Cash Provided by Operating Activities | | $ | 81.8 |

| | $ | 81.2 |

| | $ | 227.1 |

| | $ | 238.5 |

|

Additions to Property Plant and Equipment | | (17.6 | ) | | (18.2 | ) | | (60.5 | ) | | (65.4 | ) |

Grants Received for Capital Expenditures | | — |

| | 1.6 |

| | — |

| | 1.6 |

|

Free Cash Flow | | $ | 64.2 |

| | $ | 64.6 |

| | $ | 166.6 |

| | $ | 174.7 |

|

Free Cash Flow as a Percentage of Net Income Attributable to Regal Beloit | | 135.2 | % | | 122.8 | % | | 112.9 | % | | 114.0 | % |

Regal Beloit Corporation Third Quarter 2014 Earnings Conference Call November 4, 2014 Mark Gliebe Chairman and Chief Executive Officer Jon Schlemmer Chief Operating Officer Chuck Hinrichs Vice President Chief Financial Officer John Perino Vice President Investor Relations

Safe Harbor Statement This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward-looking statements by terminology such as “may,” “will,” “plan,” “expect,” “anticipate,” “estimate,” “believe,” or “continue” or the negative of these terms or other similar words. Actual results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors, including: uncertainties regarding our ability to execute our restructuring plans within expected costs and timing; actions taken by our competitors and our ability to effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers; issues and costs arising from the integration of acquired companies and businesses, including the timing and impact of purchase accounting adjustments; challenges in our Venezuelan operations, including potential currency devaluations, non-payment of receivables, governmental restrictions such as price and margin controls, as well as other difficult operating conditions; unanticipated costs or expenses we may incur related to product warranty issues; our dependence on key suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; increases in our overall debt levels as a result of acquisitions or otherwise and our ability to repay principal and interest on our outstanding debt; product liability and other litigation, or the failure of our products to perform as anticipated, particularly in high volume applications; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired businesses; cyclical downturns affecting the global market for capital goods; difficulties associated with managing foreign operations; and other risks and uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company’s Annual Report on Form 10-K filed on February 26, 2014 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this presentation are made only as of their respective dates, and we undertake no obligation to update these statements to reflect subsequent events or circumstances. p 2

Non-GAAP Financial Measures p 3 We prepare financial statements in accordance with accounting principles generally accepted in the United States (GAAP). We also disclose adjusted diluted earnings per share (EPS), adjusted gross profit, adjusted gross profit as a percentage of net sales, adjusted income from operations, and free cash flow and free cash flow as a percentage of adjusted net income attributable to Regal Beloit Corporation, organic growth, (collectively, “non-GAAP financial measures”). We use these measures in our internal performance reporting and for reports to the Board of Directors. We also periodically disclose certain of these measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events. We believe that these non-GAAP financial measures are useful measures for providing investors with additional insight into our operating performance. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. Free cash flow is defined as net cash provided by operating activities less additions to property, plant and equipment adjusted for grants received for capital expenditures.

Agenda p 4 Opening Comments Mark Gliebe Financial Update Chuck Hinrichs Operations Update Jon Schlemmer Summary Mark Gliebe Q&A All

> Solid 3rd Quarter Results in Sales and Free Cash Flow > Adjusted EPS* in Line with Guidance > Revenues Up 8% Over Prior Year − N.A. Residential HVAC − N.A. Mechanical − N.A. C&I Motors − China − India − Venezuela − Acquisitions p 5 * Non-GAAP Financial Measurement, See Appendix for Reconciliation Opening Comments – 3rd Quarter Results

> Operating Profit Margin as Expected > Simplification Projects Progressing Acuna Consolidation Completed Springfield Transition to be Completed in February 2015 Progress on Two Kentucky Plant Closures Sale of China JV > Strong Free Cash Flow* Performance > Repurchased 500,000 Shares p 6 Opening Comments – 3rd Quarter Results * Non-GAAP Financial Measurement, See Appendix for Reconciliation

> Continued Growth in North America Residential HVAC > Strong Growth in Mechanical > Flat in North America C&I Motors > Venezuela Market Instability > Adjusted Operating Margins Up in the Quarter p 7 Opening Comments – 4th Quarter Outlook

> Restructuring Charges in 3Q 2014 of $3.0 Million > Loss on Sale of Underperforming Joint Venture of $1.9 Million > Adjusted EPS* in Line with Guidance of $1.12 to $1.20 p 8 3rd Quarter Financial Results ADJUSTED DILUTED EARNINGS PER SHARE* Sep 27, 2014 Sep 28, 2013 Sep 27, 2014 Sep 28, 2013 GAAP Diluted Earnings Per Share 1.05$ 1.16$ 3.25$ 3.38$ Purchase Accounting Costs 0.02 — 0.05 — Restructuring Costs 0.04 0.02 0.15 0.05 Tax Benefit Recorded Attributable to Prior Year — — — (0.04) Gain on Disposal of Real Estate — — (0.03) — Loss on Sale of Joint Venture 0.04 — 0.04 — Adjusted Diluted Earnings Per Share 1.15$ 1.18$ 3.46$ 3.39$ Three Months Ended Nine Months Ended * Non-GAAP Financial Measurement, See Appendix for Reconciliation

> Sales of $830 Million, Up 8.0% from Prior Year – Foreign Currency Translation Increased Total Net Sales by 0.1% – Sales from Acquired Businesses $42.7 Million – Organic Sales* up 2.6% from Prior Year > Adjusted Gross Margin* of 25.1% – Adjusted for Restructuring and Purchase Accounting Adjustments – Headwind of lower sales into Venezuela > Operating Expenses of $129.1 Million – $8.3 Million SG&A of Acquired Companies – $1.9 Million Loss on Sale of Joint Venture > Repurchased 500,000 Shares at Average Cost of $69.94 per Share p 9 3rd Quarter Financial Results * Non-GAAP Financial Measurement, See Appendix for Reconciliation

Capital Expenditures > $17.6 Million in 3Q 2014 > $80 Million Est. for FY 2014 Effective Tax Rate (ETR) > 27.1% ETR in 3Q 2014 > 25% ETR Est. for 4Q 2014 Balance Sheet at Sep 27, 2014 > Total Debt of $677 Million > Net Debt of $350 Million > Debt to Adj. LTM EBITDA* 1.6 x > Net Debt to Adj. EBITDA* 0.8 x p 10 Key Financial Metrics 3Q 2014 Free Cash Flow* > $64 Million > 135% of Net Income > 113% of Net Income YTD * Non-GAAP Financial Measurement, See Appendix for Reconciliation

4th Quarter 2014 Guidance > GAAP EPS Guidance of $0.83 to $0.91 > Adjusted EPS Guidance of $0.90 to $0.98 – $0.06 of Restructuring Charges – $0.01 of Purchase Accounting Adjustments > Continued Headwinds from Venezuelan Operations > Guidance Excludes Potential Devaluation of the Venezuelan Bolivar –SICAD I Exposure ~$4 - 7 Million –SICAD II Exposure ~$8 - 13 Million p 11

NA HVAC > Overall Market Strength > SEER 13 OEM Pre-Build NA C&I Motors > Refrigeration and Irrigation Down > Commercial HVAC Up NA Mechanical > Strength in Power Transmission Distribution Channel > Strength in Energy Other > Venezuela Down > Europe Flat, Orders Declining > Slowing in China > Solid Growth in LA, India, ME ~8% ~(1%) ~18% ~(1%) End Market Update p 12 * Excludes Acquisitions

Design Platform Simplification Platform Description 48 Frame Fractional HVAC Motors 3.3” Fractional HVACR Motors and Blowers Worm Gear Mechanical IEC (IE3) Industrial Motors for Asia and Europe 48/56 Frame Fractional C&I Motors p 13

> Acuna Now Completed > Largest Phase of the Australia Restructuring to be Completed by Year End > Expect to be Substantially Completed with Springfield Production by End of February > Kentucky Transitions Progressing as Planned > Announced Plans to Consolidate Mechanical Operations in Europe $2.7 $4.2 $3.6 $3.0 $4.3 $7 4Q13 A 1Q14 A 2Q14 A 3Q14 A 4Q14E 1H15E Footprint Simplification Total Simplification Restructuring Expense ($M) p 14

Energy Efficiency Retrofits High Efficiency Right Angle (HERA) Variable Speed Pool Motors & Controls Commercial HVAC ECM Motors Commercial Refrigeration ECM Fan Systems p 15

> 3Q 2014 Results in Line with Guidance > Strong Free Cash Flow Performance > Expect 4Q 2014 Operating Margin Improvement > Focus on Simplification Initiatives > Successful Integration of Acquisitions > Strong Acquisition Pipeline > Balance Sheet Provides Flexibility p 16 Closing Comments

Questions and Answers p 17

ADJUSTED GROSS PROFIT* Sep 27, 2014 Sep 28, 2013 Sep 27, 2014 Sep 28, 2013 GAAP Gross Profit 203.8$ 196.5$ 609.2$ 605.2$ Purchase Accounting Costs 1.2 - 2.5 - Restructuring Costs 3.0 1.2 10.5 2.7 Adjusted Gross Profit 208.0$ 197.7$ 622.2$ 607.9$ Adjusted Gross Profit as a Percentage of Net Sales 25.1 % 25.7 % 25.1 % 25.7 % Three Months Ended Nine Months Ended Appendix Non-GAAP Reconciliations Dollars in Millions ADJUSTED DILUTED EARNINGS PER SHARE* Sep 27, 2014 Sep 28, 2013 Sep 27, 2014 Sep 28, 2013 GAAP Diluted Earnings Per Share 1.05$ 1.16$ 3.25$ 3.38$ Purchase Accounting Costs 0.02 — 0.05 — Restructuring Costs 0.04 0.02 0.15 0.05 Tax Benefit Recorded Attributable to Prior Year — — — (0.04) Gain on Disposal of Real Estate — — (0.03) — Loss on Sale of Joint Venture 0.04 — 0.04 — Adjusted Diluted Earnings Per Share 1.15 1.18 3.46 3.39 Three Months Ended Nine Months Ended

Appendix Non-GAAP Reconciliations Dollars in Millions Dollars in Millions FREE CASH FLOW* Sep 27, 2014 Sep 28, 2013 Sep 27, 2014 Sep 28, 2013 GAAP Net Cash Provided by Operating Activities 81.8$ 81.2$ 227.1$ 238.5$ Additions to Property Plant and Equipment (17.6) (18.2) (60.5) (65.4) Grants Received for Capital Expenditures - 1.6 - 1.6 Free Cash Flow 64.2$ 64.6$ 166.6$ 174.7$ Free Cash Flow as a Percentage of Net Income Attributable to Regal Beloit 135.2 % 122.8 % 112.9 % 114.0 % Three Months Ended Nine Months Ended ADJUSTED INCOME FROM OPERATIONS* Sep 27, 2014 Sep 28, 2013 Sep 27, 2014 Sep 28, 2013 GAAP Income from Operations 74.7$ 78.8$ 232.1$ 235.8$ Purchase Accounting and Transaction Costs 1.2 - 3.3 - Restructuring Costs 3.0 1.2 10.8 3.5 Gain on Disposal of Real Estate - - (2.0) - Loss on Sale of Joint Venture 1.9 - 1.9 - Adjusted Income from Operations 80.8$ 80.0$ 246.1$ 239.3$ Three Months Ended Nine Months Ended

Appendix Non-GAAP Reconciliations EBITDA Reconciliation Dollars in Millions 4Q 2013 1Q 2014 2Q 2014 3Q 2014 LTM Net Income ($33.2) $43.8 $56.2 $47.5 $114.3 Asset Impairment and Other, Net 81.0 - 1.0 - 82.0 Plus: Minority Interest 0.4 1.2 1.9 1.3 4.8 Plus: Taxes -3.7 16.0 21.0 18.1 51.4 Plus: Interest Expense 10.5 10.4 10.3 9.8 41.0 Less: Interest Income -1.8 -1.7 -1.7 -2.0 -7.2 Plus: Depreciation 22.3 21.5 23.0 23.8 90.6 Plus: Amortization 11.1 11.3 12.2 11.8 46.4 Adjusted EBITDA $86.6 $102.5 $123.9 $110.3 $423.3

Appendix Non-GAAP Reconciliations Organic Growth Reconciliation Net Sales Quarter Ended Sept. 27, 2014 $829.8 Net Sales from Businesses Acquired Within Last Twelve Months (42.7) Impact of Foreign Currency Exchange Rates (0.6) Incremental Sales from Sold Joint Venture 1.5 Adjusted Net Sales Quarter Ended Sept. 27, 2014 $788.0 Net Sales Quarter Ended Sept. 28, 2013 $768.2

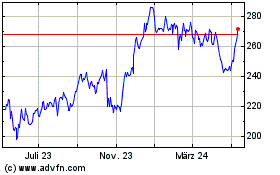

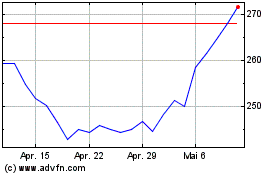

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024