As filed with the Securities and Exchange Commission on July 21, 2023

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

PRIORITY INCOME FUND, INC.

(Name of Subject Company (Issuer) AND Filing Person (Offeror))

Common Stock, Par Value $0.01 per share

(Title of Class of Securities)

74272V107 – Class R Common Stock

74272V206 – Class RIA Common Stock

74272V305 – Class I Common Stock

(CUSIP Number of Class of Securities)

(Underlying Common Stock)

M. Grier Eliasek

Chief Executive Officer

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Steven B. Boehm, Esq.

Cynthia R. Beyea, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW

Washington, DC 20001

Tel: (202) 383-0100

Fax: (202) 637-3593

| | | | | | | | |

o Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| Check the appropriate boxes below to designate any transactions to which the statement relates: |

| o | Third-party tender offer subject to Rule 14d-1. |

| x | Issuer tender offer subject to Rule 13e-4. |

| o | Going-private transaction subject to Rule 13e-3. |

| o | Amendment to Schedule 13D under Rule 13d-2. |

| | | | | | | | |

x Check the box if the filing is a final amendment reporting the results of the tender offer. |

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon: | | | | | | | | |

| o | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| o | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

AMENDMENT NO. 2

SCHEDULE TO

This Amendment No. 2 amends and supplements the Tender Offer Statement on Schedule TO originally filed with the U.S. Securities and Exchange Commission (the “Commission”) on March 24, 2023, as amended by Amendment No. 1 ("Amendment No. 1") thereto, filed with the Commission on May 12, 2023 (the “Schedule TO”) by Priority Income Fund, Inc., an externally managed, non-diversified, closed-end management investment company incorporated in the State of Maryland (the “Company”), relating to the offer by the Company to purchase up to 1,099,918 shares of its issued and outstanding common stock, par value $0.01 per share (the “Shares”) (which amount represents 2.5% of the number of shares outstanding at the close of business on the last day of the prior fiscal year ended June 30, 2022). The offer was made upon the terms and subject to the conditions set forth in the Offer to Purchase and the related Letter of Transmittal (which, together with any amendments or supplements hereto or thereto, collectively constituted the “Offer”), and expired at 4:00 p.m., Eastern Time, on May 12, 2023.

In Amendment No. 1, the Company reported a total of 1,337,603 Shares were validly tendered and not withdrawn pursuant to the Offer, and the Company purchased all 1,337,603 Shares validly tendered and not withdrawn at a price equal to $11.64 per Share, for an aggregate purchase price of approximately $15,569,702.

However, due to an administrative error in connection with processing the shares tendered for repurchase, 4,279 shares (the “Additional Shares”) that were validly tendered were not reported to the Company for repurchase. The Company and its transfer agent subsequently arranged for the repurchase of the Additional Shares in accordance with the terms of the Offer.

Consequently, the Company now files this Amendment No. 2 to report that as of the date hereof and in accordance with the terms of the Offer, the Company has repurchased a total of 1,341,882 Shares in connection with the Offer, including 4,279 of the Additional Shares, that were validly tendered and not withdrawn, at a price equal to $11.64 per Share (the Company’s net asset value per Share as of April 30, 2023), for an aggregate purchase price of approximately $15,619,512.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 21, 2023

| | |

|

|

| |

| Priority Income Fund, Inc. |

| |

By: /s/ M. Grier Eliasek |

| Name: M. Grier Eliasek |

| Title: Chairman, Chief Executive Officer and President |

EXHIBIT INDEX

| | | | | | | | |

EXHIBIT

NUMBER | | DESCRIPTION |

| | Offer to Purchase, dated March 24, 2023. |

| | Letter of Transmittal (including Instructions to Letter of Transmittal). |

| | Notice of Tender Cancellation. |

| | Letter to Stockholders, dated March 24, 2023. |

| | Calculation of Filing Fees Table** |

*Previously filed with the Schedule TO on March 24, 2023.

**Filed herewith.

Calculation of Filing Fee Table

Form Schedule TO

(Form Type)

Priority Income Fund, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Transaction Value

| | | | | | | | | | | |

| Transaction Valuation | Fee Rate | Amount of Filing Fee |

| Fees to be paid | $15,619,511.90(1) | $0.00011020 | $1,721.27(2) |

| Fees Previously Paid | $15,569,701.80 | | $1,715.78(3) |

| Total Transaction Valuation | $15,619,511.90 | | |

| Total Fees Due for Filing | | | $1,721.27 |

| Total Fees Previously Paid | | | $1,715.78 |

| Total Fee Offsets | | | — |

| Net Fee Due | | | $5.49 |

(1) The Registrant previously offered to purchase up to 1,337,603 shares worth of its issued and outstanding common stock, par value $0.01 per share (“Shares”). The Registrant subsequently increased its offer to purchase to 1,341,882 Shares at a price equal to the net asset value per Share as of April 30, 2023 of $11.64.

(2) Calculated as 100% of the Transaction Valuation.

(3) Paid in connection with the Registrant’s filing of a Schedule TO on March 24, 2023 and Amendment No. 1 thereto on May 12, 2023.

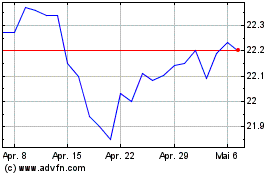

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

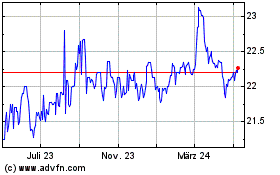

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Mai 2023 bis Mai 2024