000155462506/30falseN-CSRS00015546252023-07-012023-12-310001554625pris:MarketRiskMember2023-07-012023-12-310001554625us-gaap:CreditRiskMember2023-07-012023-12-310001554625pris:CreditSpreadRiskMember2023-07-012023-12-310001554625pris:LiquidityRiskMember2023-07-012023-12-310001554625us-gaap:InterestRateRiskMember2023-07-012023-12-310001554625us-gaap:PrepaymentRiskMember2023-07-012023-12-310001554625pris:DowngradeRiskMember2023-07-012023-12-310001554625pris:DefaultRiskMember2023-07-012023-12-310001554625pris:StructuredCreditRelatedRiskMember2023-07-012023-12-310001554625pris:MarketDisruptionAndGeopoliticalRiskMember2023-07-012023-12-310001554625pris:EconomicRecessionsRiskMember2023-07-012023-12-310001554625us-gaap:CommonStockMember2023-07-012023-12-310001554625pris:TermPreferredStockMember2023-07-012023-12-310001554625pris:CreditFacilityMember2023-07-012023-12-31iso4217:USD0001554625pris:A2035NotesMember2023-07-012023-12-310001554625pris:CreditFacilityMember2023-12-31iso4217:USDxbrli:shares0001554625pris:A2035NotesMember2023-12-310001554625pris:SeriesDTermPreferredMember2023-12-310001554625pris:SeriesDTermPreferredMember2023-07-012023-12-310001554625pris:SeriesFTermPreferredMember2023-12-310001554625pris:SeriesFTermPreferredMember2023-07-012023-12-310001554625pris:SeriesGTermPreferredMember2023-12-310001554625pris:SeriesGTermPreferredMember2023-07-012023-12-310001554625pris:SeriesHTermPreferredMember2023-12-310001554625pris:SeriesHTermPreferredMember2023-07-012023-12-310001554625pris:SeriesITermPreferredMember2023-12-310001554625pris:SeriesITermPreferredMember2023-07-012023-12-310001554625pris:SeriesJTermPreferredMember2023-12-310001554625pris:SeriesJTermPreferredMember2023-07-012023-12-310001554625pris:SeriesLTermPreferredMember2023-12-310001554625pris:SeriesLTermPreferredMember2023-07-012023-12-310001554625pris:SeriesKCumulativePreferredStockMember2023-12-310001554625pris:SeriesKCumulativePreferredStockMember2023-07-012023-12-310001554625pris:CreditFacilityMember2023-06-300001554625pris:A2035NotesMember2023-06-300001554625pris:SeriesDTermPreferredMember2023-06-300001554625pris:SeriesDTermPreferredMember2022-07-012023-06-300001554625pris:SeriesFTermPreferredMember2023-06-300001554625pris:SeriesFTermPreferredMember2022-07-012023-06-300001554625pris:SeriesGTermPreferredMember2023-06-300001554625pris:SeriesGTermPreferredMember2022-07-012023-06-300001554625pris:SeriesHTermPreferredMember2023-06-300001554625pris:SeriesHTermPreferredMember2022-07-012023-06-300001554625pris:SeriesITermPreferredMember2023-06-300001554625pris:SeriesITermPreferredMember2022-07-012023-06-300001554625pris:SeriesJTermPreferredMember2023-06-300001554625pris:SeriesJTermPreferredMember2022-07-012023-06-300001554625pris:SeriesLTermPreferredMember2023-06-300001554625pris:SeriesLTermPreferredMember2022-07-012023-06-300001554625pris:SeriesKCumulativePreferredStockMember2023-06-300001554625pris:SeriesKCumulativePreferredStockMember2022-07-012023-06-300001554625pris:CreditFacilityMember2022-06-300001554625pris:A2035NotesMember2022-06-300001554625pris:SeriesDTermPreferredMember2022-06-300001554625pris:SeriesDTermPreferredMember2022-07-012022-12-310001554625pris:SeriesFTermPreferredMember2022-06-300001554625pris:SeriesFTermPreferredMember2022-07-012022-12-310001554625pris:SeriesGTermPreferredMember2022-06-300001554625pris:SeriesGTermPreferredMember2022-07-012022-12-310001554625pris:SeriesHTermPreferredMember2022-06-300001554625pris:SeriesHTermPreferredMember2022-07-012022-12-310001554625pris:SeriesITermPreferredMember2022-06-300001554625pris:SeriesITermPreferredMember2022-07-012022-12-310001554625pris:SeriesJTermPreferredMember2022-06-300001554625pris:SeriesJTermPreferredMember2022-07-012022-12-310001554625pris:SeriesLTermPreferredMember2022-06-300001554625pris:SeriesLTermPreferredMember2022-07-012022-12-310001554625pris:SeriesKCumulativePreferredStockMember2022-06-300001554625pris:SeriesKCumulativePreferredStockMember2022-07-012022-12-310001554625pris:CreditFacilityMember2021-06-300001554625pris:A2035NotesMember2021-06-300001554625pris:SeriesATermPreferredMember2021-06-300001554625pris:SeriesATermPreferredMember2021-07-012021-12-310001554625pris:SeriesDTermPreferredMember2021-06-300001554625pris:SeriesDTermPreferredMember2021-07-012021-12-310001554625pris:SeriesETermPreferredMember2021-06-300001554625pris:SeriesETermPreferredMember2021-07-012021-12-310001554625pris:SeriesFTermPreferredMember2021-06-300001554625pris:SeriesFTermPreferredMember2021-07-012021-12-310001554625pris:SeriesGTermPreferredMember2021-06-300001554625pris:SeriesGTermPreferredMember2021-07-012021-12-310001554625pris:SeriesHTermPreferredMember2021-06-300001554625pris:SeriesHTermPreferredMember2021-07-012021-12-310001554625pris:SeriesITermPreferredMember2021-06-300001554625pris:SeriesITermPreferredMember2021-07-012021-12-310001554625pris:A2035NotesMember2020-06-300001554625pris:SeriesATermPreferredMember2020-06-300001554625pris:SeriesATermPreferredMember2020-07-012020-12-310001554625pris:SeriesBTermPreferredMember2020-06-300001554625pris:SeriesBTermPreferredMember2020-07-012020-12-310001554625pris:SeriesCTermPreferredMember2020-06-300001554625pris:SeriesCTermPreferredMember2020-07-012020-12-310001554625pris:SeriesDTermPreferredMember2020-06-300001554625pris:SeriesDTermPreferredMember2020-07-012020-12-310001554625pris:SeriesETermPreferredMember2020-06-300001554625pris:SeriesETermPreferredMember2020-07-012020-12-310001554625pris:SeriesFTermPreferredMember2020-06-300001554625pris:SeriesFTermPreferredMember2020-07-012020-12-310001554625pris:SeriesATermPreferredMember2019-06-300001554625pris:SeriesATermPreferredMember2019-07-012019-12-310001554625pris:SeriesBTermPreferredMember2019-06-300001554625pris:SeriesBTermPreferredMember2019-07-012019-12-310001554625pris:SeriesCTermPreferredMember2019-06-300001554625pris:SeriesCTermPreferredMember2019-07-012019-12-310001554625pris:SeriesDTermPreferredMember2019-06-300001554625pris:SeriesDTermPreferredMember2019-07-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22725

Priority Income Fund, Inc.

(Exact name of registrant as specified in charter)

10 East 40th Street, 42nd Floor

New York, NY 10016

(Address of principal executive offices)

M. Grier Eliasek

Chief Executive Officer

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 448-0702

Date of fiscal year end: June 30

Date of reporting period: December 31, 2023

Item 1(a). Reports to Stockholders.

The semi-annual report to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, for the six months ended December 31, 2023 is filed herewith.

Semi-Annual Report

December 31, 2023

priorityincomefund.com

Priority Income Fund, Inc. (the “Company”) is an externally managed, diversified, closed-end investment management company registered under the Investment Company Act of 1940, as amended. The Company has elected to be treated for tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended.

INVESTMENT OBJECTIVE

The Company’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation. We expect to seek to achieve our investment objective by investing, under normal circumstances, at least 80% of our total assets in senior secured loans made to companies whose debt is rated below investment grade or, in limited circumstances, unrated, which we collectively refer to as “Senior Secured Loans,” with an emphasis on current income. Our investments may take the form of the purchase of Senior Secured Loans (either in the primary or secondary markets) or through investments in the equity and junior debt tranches of collateralized loan obligation (“CLO”) vehicles that in turn own pools of Senior Secured Loans. The Company intends to invest in both the primary and secondary markets.

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| Index to Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 4

Letter to Shareholders

Dear Shareholders,

We are pleased to present this semi-annual report of Priority Income Fund, Inc. (“we,” “us,” “our,” the “Company”, the “Fund” or “Priority”) for the period ended December 31, 2023. Priority has provided its shareholders with cash distributions each month for 10 years, and recently paid its now monthly bonus distributions to shareholders for the 14th time since August 2020.

Priority recently paid shareholders an annualized dividend yield of 11.50%, based on the December 31, 2023 “Class R Shares” offering price of $12.05, 12.24% based on the December 31, 2023 “Class RIA Shares” offering price of $11.32, and 12.32% based on the December, 2023 “Class I Shares” offering price of $11.24.

Priority Update

Priority Income Fund’s increased distributions continued to deliver value to shareholders in calendar year 2023, and Priority Income Fund ended the year with a positive total return of 11.71% based on final Net Asset Value (“NAV”) per share of $11.24, assuming reinvestment of all shareholder distributions.

Annualized dividend yields increased by 5.33% year-over-year based on the December 31, 2023 “Class R Shares” offering price of $12.05, 5.37% year-over-year based on the December 31, 2023 “Class RIA Shares” offering price of $11.32, and 5.29% year-over-year based on the December 31, 2023 “Class I Shares” offering price of $11.24.

Since our annual shareholder letter for the fiscal year ended June 2023, we have continued to implement Priority’s strategy of targeting investments in CLO debt and equity, with a continued recent emphasis on the former, that further our primary objective of providing our shareholders with current income.

Priority is pleased to report the following accomplishments for the six-months ended December 31, 2023:

–Priority purchased 28 CLO debt investments totaling $72.1 million in cost basis. Priority sold three CLO debt investments totaling $6.7 million in cost basis. The Fund continues to focus on identifying attractive investments consistent with the Fund’s strategy and accretive to solid risk-adjusted historical performance.

–The Fund successfully raised $101 million during the 2023 calendar year and $148 million in the 2023 fiscal year.

–Since inception in January 2014 through December 29, 2023, Priority’s Class I Shares’ return of 9.68% has outperformed the Bloomberg US Aggregate Bond Index’s 1.81% return1 and the Credit Suisse Leveraged Loan Index's 4.43% return2.

Furthermore, Priority has benefited from certain strategic portfolio management decisions accretive to the Fund’s historical strategy and performance:

–Opportunistic purchasing of CLO debt tranches rated at inception as ‘BB’ investments by rating agencies that include S&P, Moody’s, and Fitch, with a weighted average discount from par of over 13% and weighted average underwritten internal rates of return of approximately 13-15% in line with the Fund’s target returns.

–Market volatility in 2023 allowed Priority to acquire CLO debt tranches at discounted prices, which led to equity-like returns and increased cushion-related resistance to defaults, while also creating an opportunity to build NAV given our purchases were made significantly below par. We anticipate continuing to grow our CLO debt book, which is currently 24% of our investment portfolio, should the discounted opportunity persist in the current fiscal year.

1 Bloomberg US Aggregate Bond Index, Bloomberg Historical Price Data through 12/29/2023.

2 Credit Suisse Leveraged Loan Index, Bloomberg Historical Price Data through 12/29/2023.

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 5

CLO Market Commentary

The Russia/Ukraine war, inflationary pressures, and the corresponding Fed response introduced volatility which began in 2022 and persisted throughout 2023. Despite slowing from its 2021 peak of $187.0 billion3, market CLO issuance remained robust by historical standards at $115.8 billion3 for 2023. Furthermore, CLOs represented 69%4 of the buyer base in the institutional Senior Secured Loan market for 2023, highlighting the importance of the CLO market.

CLO research analysts are projecting calendar year 2024 CLO issuance totaling:

–Bank of America: $110 billion5

–Citigroup: $110 billion6

–JP Morgan: $110-120 billion7

–Morgan Stanley: $115 billion8

–Nomura: $105 billion9

Secondary CLO trading exhibited volatility during fiscal year 2023, with CLO BB debt trading in a 9-point range, from a trough index price of 84.17 on March 20, 2023, to a high index price of 93.08 on December 29, 202310. Other parts of CLO capital structures exhibited heightened price and spread volatility as well10.

We believe the widening of CLO liabilities contributed to a decline in CLO refinance and reset activity in 2023. A CLO refinancing is an occurrence where all or part of the CLO liabilities are refinanced at a lower spread without a change in CLO maturity. A CLO reset is an occurrence where all of the CLO liabilities are refinanced and the CLO reinvestment period is extended, typically, by two to five years.

Looking ahead to 2024, we expect the macroeconomic picture to remain uncertain, with defaults likely to continue increasing from historically low levels. While such default increases that may put some pressure on pricing in the loan and CLO markets, we also anticipate such factors to present enhanced opportunities for Priority to invest in various CLO tranches at discounted prices.

In addition, we believe that long-term fundamentals for the investments held by Priority remain attractive. Priority continued to expand portfolio diversity by increasing its number of investments to 238 investments as of December 31, 2023 (the highest count achieved to date), while the portfolio’s trailing twelve-month (“TTM”) default rate of 1.14% as of December 31, 2023 remained below the historical market average of 1.16%. We also continue to believe that CLO managers will be able to capitalize on loan price volatility to increase portfolio spreads and purchase loans at discounted prices.

Dividend Policy

To qualify for U.S federal income tax treatment as a regulated investment company, the Company is required to pay out distributions as determined in accordance with federal income tax regulations. In certain periods, we expect the income distributable pursuant to these regulations, which we refer to as distributable income, to be higher or lower than our reportable accounting income. In addition to net investment income, our dividend policy considers in part our estimate of our distributable income, which includes: (1) interest income from our underlying collateralized loan obligation (“CLO”) debt and equity investments, (2) recognition of certain mark-to-market gains or losses to the extent that the fair market value of our CLO investments is determined to deviate from its adjusted tax basis, and (3) acceleration of unamortized fees and expenses following the refinancing or reset of a CLO’s liabilities. As a result, distributable income may differ from accounting income, as expressed by net investment income. Our distributions may exceed our earnings, and portions of the distributions that we make may therefore be a return of the money that you originally invested and represent a return of capital to you for tax purposes.

3 Pitchbook | LCD, “LCD’s Quarterly Leveraged Lending Review: 2Q 2023”

4 Barclays Credit Research, “Supply update: Issuance to remain steady, but refis/resets to increase in 2H23”, June 2023

5 Bank of America, “CLO Outlook: A Tale of two CCCs”, November 2023

6 Citi Research, “Global CLO Markets Midyear Outlook”, June 2023

7 LCD News, “JP Morgan reduces year-end US CLO issuance forecast”, June 2023

8 Morgan Stanley, “2023 Global Securitized Products Mid-Year Outlook: Shake it Off”, June 2023

9 Nomura Global Markets Research, “2023 CLO Special Topics”, July 2023

10Palmer Square BB Price Index

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 6

We would like to express our gratitude to both our new and long-term shareholders for their continued support of Priority Income Fund’s investment thesis and hope to continue to realize our goal to create further value for the Fund’s shareholders.

M. Grier Eliasek

Chairman and Chief Executive Officer

Disclosures

The Senior Secured Loans in which we invest are made primarily to U.S. companies whose debt is rated below investment grade or, in some circumstances, unrated. These investments, which are often referred to as “junk” or “high yield,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and illiquid.

This letter may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future performance of Priority Income Fund, Inc. Words such as “believes,” “expects,” and “future” or similar expressions are intended to identify forward-looking statements. Any such statements, other than statements of historical fact, are highly likely to be affected by the current global financial market situation, as well as various social and political circumstances in the U.S. and around the world (including wars and other forms of conflict, terrorist acts, security operations and catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes and global health epidemics and pandemics that are or are not under the control of Priority Income Fund, Inc., and that Priority Income Fund, Inc. may or may not have considered. Accordingly, such statements cannot be guarantees or assurances of any aspect of future performance and involve a number of risks and uncertainties, and related changes in base interest rates and significant market volatility on our business, our industry, and the global economy. Actual developments and results may vary materially from any forward-looking statements. Such statements speak only as of the time when made. Priority Income Fund, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any performance information quoted above represents past performance. We caution investors that the past performance described above is not indicative of and does not guarantee future returns. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. Current performance information may be different than the performance data presented above. Index and asset class performance quoted above does not reflect the fees, expenses or taxes that a stockholder may incur. The results described above may not be representative of our portfolio.

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 7

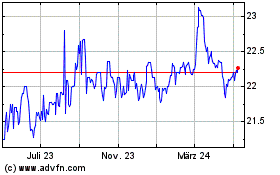

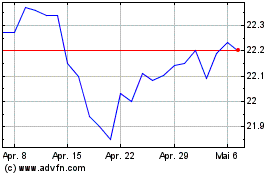

Comparison of change in value of a $10,000 investment in Priority Income Fund with a hypothetical investment of $10,000 in the Bloomberg US Aggregate Bond Index, Credit Suisse Leveraged Loan Index, and S&P 500® Index.

Past performance is not predictive of future performance. Current and future results may be lower or higher than those shown. The results shown are before taxes on fund distributions and sale of fund shares.

The above graph compares a hypothetical $10,000 investment made in Priority Income Fund on 1/3/14 (inception date) to a hypothetical investment of $10,000 made in the Bloomberg US Aggregate Bond Index, Credit Suisse Leverage Loan Index, and S&P 500® Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class R shares. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). The Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The S&P 500 Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index. These factors can contribute to the indices potentially outperforming the Fund. Further information relating to fund performance is contained in the Financial Highlights section of the Fund’s prospectus and elsewhere in this report.

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of December 31, 2023 | |

| | Inception Date | | 1 Year | | 5 Year | | From Inception | |

| Priority Income Fund, Inc. | | | | | | | | | |

| with maximum sales charge | | 1/3/2014 | | 4.90 | % | | 5.52 | % | | 8.77 | % | |

without sales charge(1) | | 1/3/2014 | | 12.50 | % | | 7.29 | % | | 9.68 | % | |

| | | | | | | | | |

| Bloomberg US Aggregate Bond Index | | 1/3/2014 | | 5.54 | % | | 1.10 | % | | 1.81 | % | * |

| Credit Suisse Leveraged Loan Index | | 1/3/2014 | | 13.08 | % | | 5.57 | % | | 4.43 | % | * |

| S&P 500 Index | | 1/3/2014 | | 26.37 | % | | 15.70 | % | | 12.15 | % | * |

| | | | | | | | | |

*Index date is based on the inception date of the fund.

(1)Calculated based off of the net offering price.

The performance data quoted represents past performance, which is no guarantee of future results. Share prices and investment returns fluctuate and an investor’s shares may be worth more or less than original cost upon sale or repurchase. Current performance may be lower or higher than the performance quoted. Go to www.priorityincomefund.com for the Fund’s most recent return information. The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. In addition to the performance of Class R shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses.

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 9

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio Composition - At a Glance |

| | | | | | | | |

Top Ten Holdings | | | | | | | | |

| As of December 31, 2023 | | | | | | | | |

| | | | | | | | |

| Portfolio Investment | | Investment | | Legal Maturity | | Fair Value | | % of Net Assets |

| Cedar Funding IV CLO, Ltd. | | Subordinated Notes | | 7/23/2034 | | $ | 20,702,162 | | | 3.3 | % |

| Voya CLO 2022-1, Ltd. | | Subordinated Notes | | 4/20/2035 | | 16,097,180 | | | 2.6 | % |

| Columbia Cent CLO 29 Limited | | Subordinated Notes | | 10/20/2034 | | 14,182,783 | | | 2.2 | % |

| Cedar Funding XI CLO, Ltd. | | Subordinated Notes | | 6/1/2032 | | 14,026,048 | | | 2.2 | % |

| Madison Park Funding XIV, Ltd. | | Subordinated Notes | | 10/22/2030 | | 14,005,017 | | | 2.2 | % |

| CIFC Funding 2017-IV, Ltd. | | Subordinated Notes | | 10/24/2030 | | 13,824,934 | | | 2.2 | % |

| Neuberger Berman CLO XVI-S, Ltd. | | Subordinated Notes | | 4/17/2034 | | 13,766,091 | | | 2.2 | % |

| Voya CLO 2018-1, Ltd. | | Subordinated Notes | | 4/21/2031 | | 13,036,784 | | | 2.0 | % |

| Venture 28A CLO, Ltd. | | Subordinated Notes | | 10/20/2034 | | 12,443,182 | | | 1.9 | % |

| Venture 42 CLO, Ltd. | | Subordinated Notes | | 4/17/2034 | | 12,224,782 | | | 1.9 | % |

Portfolio Composition

| | | | | |

| Number of Loans Underlying the Company’s CLO Investments | 2,071 | |

| Dollar Amount of Loans Underlying the Company’s CLO Investments | $93.4 billion |

| Percentage of Collateral Underlying the Company’s CLO Investments that are in Default | 1.16 | % |

| Last Twelve Months Default Rate of Collateral Underlying the Company’s CLO Investments | 1.53 | % |

Legal Maturity of Portfolio Securities

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 10

Collateral Summary

| | | | | |

| Number of loans underlying the Company’s CLO investments | 2,071 |

| Largest exposure to any individual borrower | 0.86 | % |

| Average individual borrower exposure | 0.06 | % |

| Aggregate exposure to 10 largest borrowers | 5.71 | % |

| Aggregate exposure to senior secured loans | 100 | % |

| Weighted average stated spread | 3.68 | % |

| Weighted average LIBOR floor | 0.63 | % |

| Weighted average percentage of floating rate loans with LIBOR floors | 54.32 | % |

| Weighted average credit rating of underlying collateral based on average Moody’s rating | B1/B2 |

| Weighted average maturity of underlying collateral | 4.0 years |

| U.S. dollar currency exposure | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Underlying Secured Loan Rating Distribution (Moody’s / S&P)(1) |

| Quarter-End | Aaa/AAA | Aa/AA | A/A | Baa/BBB | Ba/BB | B/B | Caa/CCC and Lower | Unrated |

| December 31, 2023 | 0.01% / 0.00% | 0.00% / 0.00% | 0.13% / 0.07% | 2.06% / 1.96% | 23.41% / 20.98% | 64.59% / 64.63% | 6.45% / 7.98% | 0.60% / 1.63% |

(1)Excludes structured product assets and newly issued transactions for which collateral data is not yet available. |

|

Cash is included within the denominator of the above calculations, but is not rated by Moody’s/S&P. |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 11

| | | | | | | | | | | | | | | | | | | | |

Statement of Assets and Liabilities (unaudited) |

| As of December 31, 2023 |

| | | | | | |

| Assets | |

| Investments, at fair value (amortized cost $1,123,432,990) | $ | 940,170,338 | |

| Cash | 20,006,851 | |

| Restricted cash | 250,000 | |

| Interest receivable | 6,632,695 | |

| Deferred common stock offering costs (Note 5) | 736,189 | |

| Deferred financing costs on Revolving Credit Facility (Note 11) | 451,985 | |

| Due from affiliate (Note 5) | 239,242 | |

| Prepaid expenses | 152,514 | |

| | | | Total assets | 968,639,814 | |

| | | | | | |

| Liabilities | |

Mandatorily redeemable Term Preferred Stock; ($0.01 par value; 50,000,000 shares authorized; 1,094,065 Series D Term Preferred Stock outstanding with net offering costs of $394,631 and unamortized discount of $543,231; 1,233,428 Series F Term Preferred Stock outstanding with net offering costs of $110,213 and unamortized discount of $528,405; 1,472,000 Series G Term Preferred Stock outstanding with net offering costs of $165,827 and unamortized discount of $608,690; 1,196,000 Series H Term Preferred Stock outstanding with net offering costs of $186,757 and unamortized discount of $544,007; 1,600,000 Series I Term Preferred Stock outstanding with net offering costs of $193,235 and unamortized discount of $878,974; 1,580,000 Series J Term Preferred Stock outstanding with net offering costs of $218,175 and unamortized discount of $910,575; 1,100,000 Series L Term Preferred Stock outstanding with net offering costs of $258,557 and unamortized discount of $684,418) (Note 7) | 225,661,630 | |

Notes payable (less unamortized discount and debt issuance costs of $1,077,065) (Note 12) | 28,922,935 | |

| Revolving Credit Facility (Note 11) | 21,500,000 | |

| Due to Adviser (Note 5) | 10,385,475 | |

| Due to Administrator (Note 5) | 3,440,851 | |

| Accrued expenses | 1,211,914 | |

| Due to affiliate (Note 5) | 392,706 | |

| Tax payable | 177,492 | |

| Interest payable | 24,125 | |

| | | | Total liabilities | 291,717,128 | |

Cumulative Preferred Stock, par value $0.01 per share (50,000,000 shares authorized; 1,600,000 Series K Cumulative Preferred Stock outstanding as of December 31, 2023) (Note 7) | 38,414,986 | |

| Commitments and contingencies (Note 10) | |

| Net Assets Applicable to Common Shares | $ | 638,507,700 | |

| |

| Components of net assets: | |

Common stock, $0.01 par value; 150,000,000 shares authorized; 56,814,979 shares issued and | |

| outstanding (Note 4) | $ | 568,150 | |

| Paid-in capital in excess of par (Note 4) | 651,008,085 | |

| Total distributable earnings (Note 8) | (13,068,535) | |

| Net Assets Applicable to Common Shares | $ | 638,507,700 | |

| | | | | | |

| Net asset value per Common Share | $ | 11.24 | |

| See accompanying notes to financial statements. |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 12

| | | | | | | | | | | | | | | | | | | | |

Statement of Operations (unaudited) |

| For the six months ended December 31, 2023 |

| |

| Investment income | |

| Interest income from investments | $ | 82,923,922 | |

| | | | Total investment income | 82,923,922 | |

| Expenses | |

| Incentive fee (Note 5) | 11,295,842 | |

| Base management fee (Note 5) | 9,507,762 | |

| Total investment advisory fees | 20,803,604 | |

| |

| Preferred dividend expense | 7,975,003 | |

| Administrator costs (Note 5) | 2,524,119 | |

| Interest expense and credit facility expense | 1,393,269 | |

| Transfer agent fees and expenses | 1,068,434 | |

| Valuation services | 876,500 | |

| Amortization of common stock offering costs (Note 5) | 821,538 | |

| Adviser shared service expense (Note 5) | 800,234 | |

| Report and notice to shareholders | 250,839 | |

| General and administrative | 198,059 | |

| Audit and tax expense | 169,373 | |

| Insurance expense | 128,158 | |

| Director fees | 112,500 | |

| Legal expense | 40,465 | |

| Total expenses | 37,162,095 | |

| Net investment income before income taxes | 45,761,827 | |

| Excise tax expense (Note 8) | 66,571 | |

| Net investment income | 45,695,256 | |

| Net realized and net change in unrealized gain (loss) on investments | |

| Net realized gain on investments | 224,422 | |

| Net change in unrealized loss on investments | (9,862,927) | |

| Net realized and net change in unrealized gain (loss) on investments | (9,638,505) | |

| Net increase in net assets resulting from operations | 36,056,751 | |

| Dividends declared on Cumulative Preferred Stock | (1,400,000) | |

| Net Increase in Net Assets Resulting from Operations applicable to Common Stockholders | $ | 34,656,751 | |

| | | | | | |

| See accompanying notes to financial statements. |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 13

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Statements of Changes in Net Assets and Temporary Equity |

| | | | | | | | |

| | | | | | Six Months Ended | | |

| | | | | | December 31, 2023 | Year Ended | |

| | | | | | (unaudited) | June 30, 2023 | |

| Net increase (decrease) in net assets resulting from operations applicable to Common Stockholders: | | | |

| Net investment income | $ | 45,695,256 | | $ | 107,817,201 | | |

| Net realized gain on investments | 224,422 | | 217,233 | | |

| Net change in unrealized loss on investments | (9,862,927) | | (71,740,677) | | |

| Net realized loss on extinguishment of debt | — | | (324,184) | | |

| | | | Net increase in net assets resulting from operations | 36,056,751 | | 35,969,573 | | |

| Distributions to common stockholders: | | | |

| Dividends from earnings (Notes 6 and 8) | (38,306,397) | | (68,287,135) | | |

| | | | Total distributions to common stockholders | (38,306,397) | | (68,287,135) | | |

| Distributions to Series K Cumulative Preferred stockholders: | | | |

| Dividends from earnings (Note 7) | (1,400,000) | | (2,800,000) | | |

| | | | Total distributions to Series K Cumulative Preferred stockholders | (1,400,000) | | (2,800,000) | | |

| Capital transactions: | | | |

| Gross proceeds from shares sold (Note 4) | 42,297,692 | | 147,937,976 | | |

| Commissions and fees on shares sold (Note 5) | (2,109,656) | | (6,724,498) | | |

| Repurchase of common shares (Note 4) | (24,909,560) | | (48,347,692) | | |

| Reinvestment of distributions (Note 4) | 17,491,626 | | 21,809,485 | | |

| | | | Net increase in net assets from capital transactions | 32,770,102 | | 114,675,271 | | |

| | | | Total increase in net assets | 29,120,456 | | 79,557,709 | | |

| Net assets: | | | |

| Beginning of period | 609,387,244 | | 529,829,535 | | |

| End of period | $ | 638,507,700 | | $ | 609,387,244 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Six Months Ended | |

| | | | | | December 31, 2023 | Year Ended |

| | | | | | (unaudited) | June 30, 2023 |

| Preferred Stock Classified as Temporary Equity: | | |

| Proceeds from the issuance of Cumulative Preferred Stock (Note 7) | $ | — | | $ | — | |

| Cumulative Preferred Stock issuance costs, paid and deferred | — | | (19,588) | |

| Net decrease in Temporary Equity from Cumulative Preferred Stock transactions | — | | (19,588) | |

| Temporary Equity: | | |

| Beginning of period | 38,414,986 | | 38,434,574 | |

| End of period | $ | 38,414,986 | | $ | 38,414,986 | |

| | | | | | | |

| See accompanying notes to financial statements. |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 14

| | | | | | | | | | | | | | | | | | | | |

Statement of Cash Flows (unaudited) |

| For the six months ended December 31, 2023 |

| |

| Cash flows used in operating activities: | |

| Net increase in net assets resulting from operations | $ | 36,056,751 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

| Amortization of common stock offering costs (Note 5) | 821,538 | |

| Net Reductions to Subordinated Structured Notes and related investment cost | 5,520,796 | |

| Amortization of term preferred stock deferred offering costs | 151,219 | |

| Amortization of term preferred stock discount | 511,476 | |

| Amortization of notes payable debt issuance costs | 7,152 | |

| Amortization of notes payable discount | 24,116 | |

| Amortization of deferred financing costs on Revolving Credit Facility (Note 11) | 71,571 | |

| Purchases of investments | (72,101,439) | |

| Proceeds from sales of investments | 6,748,883 | |

| Repayments from investments | 9,718,481 | |

| Payment-in-kind interest | (485,771) | |

| Net realized gain on investments | (224,422) | |

| Net change in unrealized loss on investments | 9,862,927 | |

| (Increase) Decrease in operating assets: | |

| Deferred common stock offering costs (Note 5) | (572,013) | |

| Interest receivable | (2,003,651) | |

| Due from affiliate (Note 5) | 72,006 | |

| Prepaid expenses | 87,208 | |

| Increase (Decrease) in operating liabilities: | |

| Due to adviser (Note 5) | (902,956) | |

| Accrued expenses | 51,918 | |

| Due to Administrator (Note 5) | 2,524,119 | |

| Tax payable | 66,571 | |

| Due to affiliate (Note 5) | 9,455 | |

| Interest payable | 13,322 | |

| Net cash used in operating activities | (3,970,743) | |

| Cash flows provided by financing activities: | |

| Gross proceeds from shares sold (Note 4) | 46,412,086 | |

| Commissions and fees on shares sold (Note 5) | (2,266,999) | |

| Distributions paid to common stockholders | (30,172,404) | |

| Repurchase of common shares (Note 4) | (25,092,015) | |

| Distributions paid to Cumulative Preferred Stockholders | (1,400,000) | |

| Borrowings under Revolving Credit Facility (Note 11) | 43,800,000 | |

| Repayments of Revolving Credit Facility (Note 11) | (32,300,000) | |

| Net cash provided by financing activities | (1,019,332) | |

| Net increase in cash and restricted cash | (4,990,075) | |

| Cash and restricted cash at beginning of period | 25,246,926 | |

| Cash and restricted cash at end of period | $ | 20,256,851 | |

| |

| Non-cash financing activity: | |

| Value of shares issued through reinvestment of distributions | $ | 17,491,626 | |

| Supplemental disclosure: | |

| Cash paid for interest | $ | 1,277,107 | |

| Cash paid for Term Preferred Stock and Cumulative Preferred Stock | $ | 8,712,308 | |

| | | | | | |

| Beginning of the period | |

| Cash | $ | 24,996,926 | |

| Restricted cash | 250,000 | |

| Cash and restricted cash at beginning of period | $ | 25,246,926 | |

| | | | | | |

| End of the period | |

| Cash | $ | 20,006,851 | |

| Restricted cash | 250,000 | |

| Cash and restricted cash at end of period | $ | 20,256,851 | |

| See accompanying notes to financial statements. |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Schedule of Investments (unaudited) |

| As of December 31, 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

Adams Mill CLO Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/15/2026 | | 7/3/2014 | | $ | 500,000 | | | $ | — | | | $ | — | | | — | % |

| AIMCO CLO 11, Ltd. | | Subordinated Notes | | 19.20 | % | | 10/17/2034 | | 4/4/2022 | | 5,000,000 | | | 5,365,920 | | | 4,841,964 | | | 0.8 | % |

| Apidos CLO XVIII-R | | Subordinated Notes | | 10.72 | % | | 10/22/2030 | | 9/26/2018 | | 410,000 | | | 533,549 | | | 415,465 | | | 0.1 | % |

| Apidos CLO XX | | Subordinated Notes | | 24.25 | % | | 7/16/2031 | | 3/4/2020 | | 12,500,000 | | | 7,776,461 | | | 7,602,494 | | | 1.2 | % |

Apidos CLO XXI(6)(7) | | Subordinated Notes | | — | % | | 7/19/2027 | | 5/13/2015 | | 5,000,000 | | | 1,468,543 | | | — | | | — | % |

| Apidos CLO XXII | | Subordinated Notes | | 12.30 | % | | 4/21/2031 | | 9/17/2015 | | 9,894,611 | | | 7,087,040 | | | 6,555,345 | | | 1.0 | % |

| Apidos CLO XXIV | | Subordinated Notes | | 26.38 | % | | 10/21/2030 | | 5/17/2019 | | 12,214,397 | | | 7,481,599 | | | 7,667,556 | | | 1.2 | % |

| Apidos CLO XXVI | | Subordinated Notes | | 2.06 | % | | 7/18/2029 | | 7/25/2019 | | 6,000,000 | | | 4,335,920 | | | 3,416,471 | | | 0.5 | % |

Babson CLO Ltd. 2015-I(6) | | Subordinated Notes | | — | % | | 1/20/2031 | | 4/1/2015 | | 3,400,000 | | | 1,775,332 | | | 1,115,690 | | | 0.2 | % |

Barings CLO Ltd. 2018-III(6) | | Subordinated Notes | | — | % | | 7/20/2029 | | 10/10/2014 | | 396,214 | | | 145,632 | | | 46,341 | | | 0.0 | % |

BlueMountain CLO 2013-2 Ltd.(6) | | Subordinated Notes | | — | % | | 10/22/2030 | | 10/1/2015 | | 1,900,000 | | | 1,273,874 | | | 636,646 | | | 0.1 | % |

| BlueMountain CLO XXVI Ltd. | | Subordinated Notes | | 19.55 | % | | 10/20/2034 | | 11/18/2021 | | 8,906,000 | | | 8,198,843 | | | 7,336,927 | | | 1.1 | % |

| BlueMountain CLO XXVIII Ltd. | | Subordinated Notes | | 21.06 | % | | 4/17/2034 | | 4/1/2022 | | 3,300,000 | | | 3,081,054 | | | 2,881,636 | | | 0.5 | % |

| BlueMountain CLO XXIX Ltd. | | Subordinated Notes | | 20.22 | % | | 7/25/2034 | | 12/15/2021 | | 6,000,000 | | | 6,018,077 | | | 5,331,368 | | | 0.8 | % |

| BlueMountain CLO XXXI Ltd. | | Subordinated Notes | | 21.26 | % | | 4/19/2034 | | 4/28/2022 | | 5,000,000 | | | 4,511,960 | | | 4,195,402 | | | 0.7 | % |

| BlueMountain CLO XXXII Ltd. | | Subordinated Notes | | 21.57 | % | | 10/16/2034 | | 2/18/2022 | | 12,000,000 | | | 10,653,416 | | | 9,846,220 | | | 1.5 | % |

| BlueMountain CLO XXXIV Ltd. | | Subordinated Notes | | 21.97 | % | | 4/20/2035 | | 3/23/2022 | | 5,700,000 | | | 5,755,000 | | | 5,309,995 | | | 0.8 | % |

| BlueMountain Fuji US CLO II Ltd. | | Subordinated Notes | | 0.54 | % | | 10/21/2030 | | 8/22/2017 | | 2,500,000 | | | 1,893,720 | | | 1,519,088 | | | 0.2 | % |

| California Street CLO IX, Ltd. | | Preference Shares | | 19.62 | % | | 7/16/2032 | | 12/13/2019 | | 4,670,000 | | | 2,488,004 | | | 2,185,212 | | | 0.3 | % |

Carlyle Global Market Strategies CLO 2013-1, Ltd.(6) | | Subordinated Notes | | — | % | | 8/14/2030 | | 6/23/2016 | | 17,550,000 | | | 9,397,950 | | | 5,500,569 | | | 0.9 | % |

| Carlyle Global Market Strategies CLO 2013-4, Ltd. | | Income Notes | | 1.97 | % | | 1/15/2031 | | 12/22/2016 | | 11,839,488 | | | 6,302,256 | | | 4,396,092 | | | 0.7 | % |

| Carlyle Global Market Strategies CLO 2014-1, Ltd. | | Income Notes | | 6.83 | % | | 4/17/2031 | | 2/25/2016 | | 12,870,000 | | | 7,792,157 | | | 6,525,642 | | | 1.0 | % |

| Carlyle Global Market Strategies CLO 2014-3-R, Ltd. | | Subordinated Notes | | 2.35 | % | | 7/28/2031 | | 5/23/2018 | | 15,000,000 | | | 11,729,573 | | | 9,457,544 | | | 1.5 | % |

| Carlyle Global Market Strategies CLO 2016-1, Ltd. | | Subordinated Notes | | 9.58 | % | | 4/20/2034 | | 3/16/2016 | | 6,844,556 | | | 6,191,709 | | | 5,065,297 | | | 0.8 | % |

| Carlyle Global Market Strategies CLO 2016-3, Ltd. | | Subordinated Notes | | 9.58 | % | | 7/20/2034 | | 8/8/2016 | | 3,245,614 | | | 2,927,376 | | | 2,456,413 | | | 0.4 | % |

| Carlyle Global Market Strategies CLO 2017-2, Ltd. | | Subordinated Notes | | 15.28 | % | | 7/21/2031 | | 1/4/2022 | | 4,450,000 | | | 2,915,862 | | | 2,491,272 | | | 0.4 | % |

| Carlyle Global Market Strategies CLO 2017-4, Ltd. | | Income Notes | | 11.48 | % | | 1/15/2030 | | 10/14/2021 | | 9,107,000 | | | 5,605,644 | | | 4,567,512 | | | 0.7 | % |

Carlyle Global Market Strategies CLO 2017-5, Ltd.(6) | | Subordinated Notes | | — | % | | 1/22/2030 | | 12/18/2017 | | 10,000,000 | | | 7,960,369 | | | 5,983,727 | | | 0.9 | % |

| Cedar Funding II CLO, Ltd. | | Subordinated Notes | | 14.84 | % | | 4/20/2034 | | 9/27/2017 | | 2,500,000 | | | 2,363,421 | | | 1,994,265 | | | 0.3 | % |

| Cedar Funding IV CLO, Ltd. | | Subordinated Notes | | 14.05 | % | | 7/23/2034 | | 6/19/2017 | | 26,698,229 | | | 22,533,052 | | | 20,702,162 | | | 3.3 | % |

| Cedar Funding V CLO, Ltd. | | Subordinated Notes | | 18.76 | % | | 7/17/2031 | | 10/15/2018 | | 7,358,000 | | | 7,640,085 | | | 7,231,229 | | | 1.1 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Cedar Funding VI CLO, Ltd. | | Subordinated Notes | | 16.75 | % | | 4/20/2034 | | 8/7/2017 | | $ | 6,722,117 | | | $ | 6,887,359 | | | $ | 5,921,166 | | | 0.9 | % |

| Cedar Funding X CLO, Ltd. | | Subordinated Notes | | 22.84 | % | | 10/20/2032 | | 1/12/2022 | | 10,775,000 | | | 10,203,244 | | | 9,654,136 | | | 1.5 | % |

| Cedar Funding XI CLO, Ltd. | | Subordinated Notes | | 21.91 | % | | 6/1/2032 | | 7/12/2021 | | 17,500,000 | | | 15,128,006 | | | 14,026,048 | | | 2.2 | % |

| Cedar Funding XII, Ltd. | | Subordinated Notes | | 20.61 | % | | 10/25/2034 | | 3/28/2022 | | 3,300,000 | | | 3,136,667 | | | 2,906,511 | | | 0.5 | % |

| Cedar Funding XIV, Ltd. | | Subordinated Notes | | 21.48 | % | | 7/15/2033 | | 4/7/2022 | | 10,000,000 | | | 8,516,733 | | | 8,043,715 | | | 1.3 | % |

| Cedar Funding XV, Ltd. | | Subordinated Notes | | 23.48 | % | | 4/20/2035 | | 7/25/2022 | | 5,000,000 | | | 4,110,596 | | | 4,119,014 | | | 0.6 | % |

Cent CLO 21 Limited(6) | | Subordinated Notes | | — | % | | 7/26/2030 | | 5/15/2014 | | 510,555 | | | 325,655 | | | 62,179 | | | 0.0 | % |

| CIFC Falcon 2019, Ltd. | | Subordinated Notes | | 17.40 | % | | 1/20/2033 | | 5/14/2021 | | 8,500,000 | | | 8,259,347 | | | 7,835,070 | | | 1.2 | % |

| CIFC Funding 2013-I, Ltd. | | Subordinated Notes | | 0.85 | % | | 7/16/2030 | | 6/1/2018 | | 3,000,000 | | | 1,685,330 | | | 1,245,378 | | | 0.2 | % |

CIFC Funding 2013-II, Ltd.(6) | | Income Notes | | — | % | | 10/18/2030 | | 2/6/2014 | | 305,000 | | | 151,612 | | | 101,106 | | | 0.0 | % |

| CIFC Funding 2013-III-R, Ltd. | | Subordinated Notes | | 12.60 | % | | 4/24/2031 | | 1/19/2021 | | 4,900,000 | | | 2,396,267 | | | 2,185,139 | | | 0.3 | % |

| CIFC Funding 2013-IV, Ltd. | | Subordinated Notes | | 9.36 | % | | 4/28/2031 | | 3/15/2019 | | 8,000,000 | | | 5,189,255 | | | 4,715,145 | | | 0.7 | % |

| CIFC Funding 2014, Ltd. | | Income Notes | | 4.00 | % | | 1/21/2031 | | 2/6/2014 | | 2,758,900 | | | 1,599,941 | | | 1,214,108 | | | 0.2 | % |

| CIFC Funding 2014-III, Ltd. | | Income Notes | | 8.24 | % | | 10/22/2031 | | 11/14/2016 | | 11,700,000 | | | 7,597,976 | | | 6,145,154 | | | 1.0 | % |

| CIFC Funding 2014-IV-R, Ltd. | | Income Notes | | 11.90 | % | | 1/17/2035 | | 8/5/2014 | | 4,833,031 | | | 3,374,486 | | | 2,632,529 | | | 0.4 | % |

CIFC Funding 2015-I, Ltd.(6) | | Subordinated Notes | | — | % | | 1/22/2031 | | 11/24/2015 | | 7,500,000 | | | 4,702,703 | | | 3,318,657 | | | 0.5 | % |

CIFC Funding 2015-III, Ltd.(6) | | Subordinated Notes | | — | % | | 4/19/2029 | | 5/29/2018 | | 10,000,000 | | | 4,415,769 | | | 2,845,997 | | | 0.4 | % |

| CIFC Funding 2015-IV, Ltd. | | Subordinated Notes | | 14.12 | % | | 4/20/2034 | | 4/27/2016 | | 22,930,000 | | | 14,251,157 | | | 11,455,281 | | | 1.8 | % |

| CIFC Funding 2016-I, Ltd. | | Subordinated Notes | | 22.71 | % | | 10/21/2031 | | 12/9/2016 | | 6,500,000 | | | 5,188,209 | | | 5,580,799 | | | 0.9 | % |

CIFC Funding 2017-I, Ltd.(6) | | Subordinated Notes | | — | % | | 4/20/2029 | | 2/3/2017 | | 8,000,000 | | | 5,960,891 | | | 4,334,670 | | | 0.7 | % |

| CIFC Funding 2017-IV, Ltd. | | Subordinated Notes | | 3.20 | % | | 10/24/2030 | | 8/14/2017 | | 18,000,000 | | | 16,473,818 | | | 13,824,934 | | | 2.2 | % |

| CIFC Funding 2018-II, Ltd. | | Subordinated Notes | | 26.84 | % | | 4/20/2031 | | 8/11/2022 | | 10,000,000 | | | 6,820,087 | | | 6,212,112 | | | 1.0 | % |

| CIFC Funding 2018-IV, Ltd. | | Subordinated Notes | | 19.28 | % | | 10/17/2031 | | 6/19/2020 | | 6,000,000 | | | 5,163,997 | | | 5,123,545 | | | 0.8 | % |

| CIFC Funding 2020-II, Ltd. | | Income Notes | | 24.72 | % | | 10/20/2034 | | 7/20/2020 | | 2,000,000 | | | 1,800,215 | | | 1,872,480 | | | 0.3 | % |

| CIFC Funding 2020-III, Ltd. | | Subordinated Notes | | 20.70 | % | | 10/20/2034 | | 9/11/2020 | | 7,350,000 | | | 7,267,289 | | | 7,056,762 | | | 1.1 | % |

| Columbia Cent CLO 29 Limited | | Subordinated Notes | | 23.27 | % | | 10/20/2034 | | 7/10/2020 | | 16,000,000 | | | 13,305,962 | | | 14,182,783 | | | 2.2 | % |

| Columbia Cent CLO 31 Limited | | Subordinated Notes | | 19.91 | % | | 4/20/2034 | | 2/1/2021 | | 12,100,000 | | | 11,052,602 | | | 10,486,185 | | | 1.6 | % |

| Dryden 86 CLO, Ltd. | | Subordinated Notes | | 20.52 | % | | 7/17/2034 | | 3/10/2022 | | 10,250,000 | | | 8,199,766 | | | 7,148,481 | | | 1.1 | % |

| Dryden 87 CLO, Ltd. | | Subordinated Notes | | 21.49 | % | | 5/22/2034 | | 3/10/2022 | | 4,000,000 | | | 3,802,786 | | | 3,505,437 | | | 0.5 | % |

| Dryden 95 CLO, Ltd. | | Subordinated Notes | | 20.56 | % | | 8/21/2034 | | 4/27/2022 | | 10,500,000 | | | 9,406,134 | | | 8,546,995 | | | 1.3 | % |

Galaxy XIX CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 7/24/2030 | | 12/5/2016 | | 2,750,000 | | | 1,791,024 | | | 1,262,886 | | | 0.2 | % |

| Galaxy XX CLO, Ltd. | | Subordinated Notes | | 10.72 | % | | 4/21/2031 | | 5/28/2021 | | 2,000,000 | | | 1,587,267 | | | 1,358,151 | | | 0.2 | % |

| Galaxy XXI CLO, Ltd. | | Subordinated Notes | | 12.84 | % | | 4/21/2031 | | 5/28/2021 | | 4,775,000 | | | 3,193,270 | | | 2,808,395 | | | 0.4 | % |

| Galaxy XXVII CLO, Ltd. | | Subordinated Notes | | 18.62 | % | | 5/16/2031 | | 7/23/2021 | | 2,212,500 | | | 1,079,525 | | | 1,096,471 | | | 0.2 | % |

| Galaxy XXVIII CLO, Ltd. | | Subordinated Notes | | 19.85 | % | | 7/15/2031 | | 5/30/2014 | | 5,295,000 | | | 2,787,135 | | | 2,640,333 | | | 0.4 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

GoldenTree Loan Opportunities IX, Ltd.(6) | | Subordinated Notes | | — | % | | 10/29/2029 | | 7/19/2017 | | $ | 3,250,000 | | | $ | 2,024,912 | | | $ | 1,158,882 | | | 0.2 | % |

Halcyon Loan Advisors Funding 2014-2 Ltd.(6)(7) | | Subordinated Notes | | — | % | | 4/28/2025 | | 4/14/2014 | | 400,000 | | | 210,313 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2014-3 Ltd.(6)(7) | | Subordinated Notes | | — | % | | 10/22/2025 | | 9/12/2014 | | 500,000 | | | 298,545 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-1 Ltd.(6) | | Subordinated Notes | | — | % | | 4/20/2027 | | 3/16/2015 | | 3,000,000 | | | 1,849,511 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-2 Ltd.(6) | | Subordinated Notes | | — | % | | 7/26/2027 | | 6/3/2015 | | 3,000,000 | | | 1,927,789 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-3 Ltd.(6) | | Subordinated Notes | | — | % | | 10/18/2027 | | 7/27/2015 | | 7,000,000 | | | 5,329,399 | | | 14,299 | | | 0.0 | % |

HarbourView CLO VII-R, Ltd.(6) | | Subordinated Notes | | — | % | | 7/18/2031 | | 6/5/2015 | | 275,000 | | | 195,731 | | | 102,353 | | | 0.0 | % |

Jefferson Mill CLO Ltd.(6) | | Subordinated Notes | | — | % | | 10/20/2031 | | 6/30/2015 | | 6,049,689 | | | 4,391,326 | | | 3,395,170 | | | 0.5 | % |

LCM XV Limited Partnership(6) | | Income Notes | | — | % | | 7/19/2030 | | 1/28/2014 | | 250,000 | | | 133,020 | | | 62,141 | | | 0.0 | % |

LCM XVI Limited Partnership(6) | | Income Notes | | — | % | | 10/15/2031 | | 5/12/2014 | | 6,814,685 | | | 4,243,203 | | | 3,133,462 | | | 0.5 | % |

LCM XVII Limited Partnership(6) | | Income Notes | | — | % | | 10/15/2031 | | 9/17/2014 | | 1,000,000 | | | 667,372 | | | 507,070 | | | 0.1 | % |

| LCM XVIII Limited Partnership | | Income Notes | | 10.49 | % | | 7/21/2031 | | 10/29/2021 | | 12,195,000 | | | 5,414,130 | | | 4,205,174 | | | 0.7 | % |

| LCM XXVIII Limited Partnership | | Subordinated Notes | | 19.80 | % | | 10/21/2030 | | 10/29/2021 | | 2,000,000 | | | 1,369,678 | | | 1,210,215 | | | 0.2 | % |

| LCM XXXII Limited Partnership | | Income Notes | | 21.52 | % | | 7/20/2034 | | 3/2/2022 | | 10,390,000 | | | 8,932,408 | | | 7,898,661 | | | 1.2 | % |

| LCM XXXIV Limited Partnership | | Subordinated Notes | | 26.95 | % | | 10/20/2034 | | 8/4/2022 | | 2,395,000 | | | 1,822,848 | | | 1,705,136 | | | 0.3 | % |

| Madison Park Funding XIII, Ltd. | | Subordinated Notes | | 0.22 | % | | 4/19/2030 | | 2/3/2014 | | 13,000,000 | | | 6,334,276 | | | 4,794,053 | | | 0.8 | % |

| Madison Park Funding XIV, Ltd. | | Subordinated Notes | | 12.20 | % | | 10/22/2030 | | 7/3/2014 | | 23,750,000 | | | 16,558,999 | | | 14,005,017 | | | 2.2 | % |

| Madison Park Funding XL, Ltd. | | Subordinated Notes | | 13.45 | % | | 5/28/2030 | | 10/8/2020 | | 7,000,000 | | | 3,405,938 | | | 2,963,794 | | | 0.5 | % |

Mountain View CLO 2014-1 Ltd.(6)(7) | | Income Notes | | — | % | | 10/15/2026 | | 8/29/2014 | | 1,000,000 | | | 497,106 | | | — | | | — | % |

Mountain View CLO IX Ltd.(6) | | Subordinated Notes | | — | % | | 7/15/2031 | | 5/13/2015 | | 8,815,500 | | | 3,800,216 | | | 2,890,690 | | | 0.5 | % |

| Neuberger Berman CLO XVI-S, Ltd. | | Subordinated Notes | | 18.91 | % | | 4/17/2034 | | 2/9/2022 | | 16,000,000 | | | 16,841,880 | | | 13,766,091 | | | 2.2 | % |

| Neuberger Berman CLO XXI, Ltd. | | Subordinated Notes | | 20.19 | % | | 4/20/2034 | | 2/16/2022 | | 8,501,407 | | | 7,646,148 | | | 6,216,588 | | | 1.0 | % |

Octagon Investment Partners XIV, Ltd.(6) | | Income Notes | | — | % | | 7/16/2029 | | 12/1/2017 | | 6,150,000 | | | 2,821,529 | | | 849,440 | | | 0.1 | % |

| Octagon Investment Partners XV, Ltd. | | Income Notes | | 1.18 | % | | 7/19/2030 | | 5/23/2019 | | 8,937,544 | | | 4,620,677 | | | 3,642,597 | | | 0.6 | % |

Octagon Investment Partners XVII, Ltd.(6) | | Subordinated Notes | | — | % | | 1/27/2031 | | 6/28/2018 | | 16,153,000 | | | 7,030,606 | | | 4,479,408 | | | 0.7 | % |

Octagon Investment Partners 18-R, Ltd.(6) | | Subordinated Notes | | — | % | | 4/16/2031 | | 7/30/2015 | | 4,568,944 | | | 1,873,741 | | | 1,379,662 | | | 0.2 | % |

| Octagon Investment Partners 20-R, Ltd. | | Subordinated Notes | | 13.72 | % | | 5/12/2031 | | 4/25/2019 | | 3,500,000 | | | 2,988,647 | | | 2,360,676 | | | 0.4 | % |

| Octagon Investment Partners XXI, Ltd. | | Subordinated Notes | | 11.64 | % | | 2/14/2031 | | 1/6/2016 | | 13,822,188 | | | 8,260,500 | | | 6,331,903 | | | 1.0 | % |

Octagon Investment Partners XXII, Ltd.(6) | | Subordinated Notes | | — | % | | 1/22/2030 | | 11/12/2014 | | 6,625,000 | | | 4,281,220 | | | 2,786,904 | | | 0.4 | % |

| Octagon Investment Partners 27, Ltd. | | Subordinated Notes | | 2.86 | % | | 7/15/2030 | | 10/31/2018 | | 5,000,000 | | | 3,091,920 | | | 2,372,635 | | | 0.4 | % |

Octagon Investment Partners 30, Ltd.(6) | | Subordinated Notes | | — | % | | 3/18/2030 | | 11/16/2017 | | 9,525,000 | | | 6,512,638 | | | 5,021,084 | | | 0.8 | % |

| Octagon Investment Partners 31, Ltd. | | Subordinated Notes | | 3.39 | % | | 7/19/2030 | | 12/20/2019 | | 3,067,500 | | | 1,687,930 | | | 1,397,983 | | | 0.2 | % |

Octagon Investment Partners 33, Ltd.(6) | | Subordinated Notes | | — | % | | 1/20/2031 | | 7/9/2018 | | 2,850,000 | | | 2,094,577 | | | 1,465,201 | | | 0.2 | % |

| Octagon Investment Partners 36, Ltd. | | Subordinated Notes | | 6.49 | % | | 4/15/2031 | | 12/20/2019 | | 10,400,960 | | | 7,593,650 | | | 6,199,508 | | | 1.0 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Octagon Investment Partners 37, Ltd. | | Subordinated Notes | | 8.58 | % | | 7/25/2030 | | 3/17/2021 | | $ | 14,500,000 | | | $ | 10,891,672 | | | $ | 9,353,724 | | | 1.5 | % |

| Octagon Investment Partners 39, Ltd. | | Subordinated Notes | | 11.66 | % | | 10/21/2030 | | 1/9/2020 | | 10,250,000 | | | 8,404,824 | | | 7,872,274 | | | 1.2 | % |

| Octagon Loan Funding, Ltd. | | Subordinated Notes | | 9.80 | % | | 11/18/2031 | | 8/25/2014 | | 5,014,526 | | | 3,035,803 | | | 2,557,606 | | | 0.4 | % |

OZLM VI, Ltd.(6) | | Subordinated Notes | | — | % | | 4/17/2031 | | 10/31/2016 | | 15,688,991 | | | 9,393,182 | | | 5,798,345 | | | 0.9 | % |

OZLM VII, Ltd.(6) | | Subordinated Notes | | — | % | | 7/17/2029 | | 11/3/2015 | | 2,654,467 | | | 1,302,082 | | | 264,107 | | | 0.0 | % |

OZLM VIII, Ltd.(6) | | Subordinated Notes | | — | % | | 10/17/2029 | | 8/7/2014 | | 950,000 | | | 512,793 | | | 172,124 | | | 0.0 | % |

| OZLM IX, Ltd. | | Subordinated Notes | | 2.62 | % | | 10/20/2031 | | 2/22/2017 | | 15,000,000 | | | 10,592,944 | | | 7,805,234 | | | 1.2 | % |

OZLM XII, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 4/30/2027 | | 1/17/2017 | | 12,122,952 | | | 6,534,353 | | | — | | | — | % |

OZLM XXII, Ltd.(6) | | Subordinated Notes | | — | % | | 1/17/2031 | | 5/11/2017 | | 27,343,000 | | | 12,423,997 | | | 8,167,068 | | | 1.3 | % |

| Redding Ridge 3 CLO, Ltd. | | Preference Shares | | 4.96 | % | | 1/15/2030 | | 3/26/2021 | | 12,293,000 | | | 6,464,803 | | | 4,942,944 | | | 0.8 | % |

| Redding Ridge 4 CLO, Ltd. | | Subordinated Notes | | 7.13 | % | | 4/15/2030 | | 1/29/2021 | | 14,000,000 | | | 12,285,387 | | | 10,557,966 | | | 1.7 | % |

| Redding Ridge 5 CLO, Ltd. | | Subordinated Notes | | 11.84 | % | | 10/15/2031 | | 5/27/2021 | | 5,500,000 | | | 5,267,880 | | | 4,811,595 | | | 0.8 | % |

| Rockford Tower CLO 2021-3, Ltd. | | Subordinated Notes | | 18.36 | % | | 10/20/2034 | | 2/11/2022 | | 8,000,000 | | | 7,325,121 | | | 7,119,497 | | | 1.1 | % |

Romark WM-R Ltd.(6) | | Subordinated Notes | | — | % | | 4/21/2031 | | 4/11/2014 | | 490,713 | | | 325,190 | | | 246,749 | | | 0.0 | % |

Sound Point CLO II, Ltd.(6) | | Subordinated Notes | | — | % | | 1/26/2031 | | 5/16/2019 | | 21,053,778 | | | 9,200,285 | | | 4,577,577 | | | 0.7 | % |

| Sound Point CLO VII-R, Ltd. | | Subordinated Notes | | 3.85 | % | | 10/23/2031 | | 7/31/2019 | | 9,002,745 | | | 3,760,089 | | | 2,813,523 | | | 0.4 | % |

Sound Point CLO XVII, Ltd.(6) | | Subordinated Notes | | — | % | | 10/20/2030 | | 7/11/2018 | | 20,000,000 | | | 13,143,516 | | | 9,045,340 | | | 1.4 | % |

Sound Point CLO XVIII, Ltd.(6) | | Subordinated Notes | | — | % | | 1/20/2031 | | 10/29/2018 | | 15,563,500 | | | 9,986,019 | | | 7,281,495 | | | 1.1 | % |

| Sound Point CLO XIX, Ltd. | | Subordinated Notes | | 4.54 | % | | 4/15/2031 | | 9/23/2021 | | 7,500,000 | | | 4,118,367 | | | 3,319,115 | | | 0.5 | % |

| Sound Point CLO XX, Ltd. | | Subordinated Notes | | 6.17 | % | | 7/28/2031 | | 11/5/2021 | | 8,000,000 | | | 5,288,356 | | | 4,145,291 | | | 0.6 | % |

| Sound Point CLO XXIII, Ltd. | | Subordinated Notes | | 13.47 | % | | 7/17/2034 | | 8/27/2021 | | 5,915,000 | | | 4,833,605 | | | 4,451,141 | | | 0.7 | % |

Symphony CLO XIV, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/14/2026 | | 5/6/2014 | | 750,000 | | | 340,041 | | | — | | | — | % |

| Symphony CLO XVI, Ltd. | | Subordinated Notes | | 1.17 | % | | 10/15/2031 | | 7/1/2015 | | 5,000,000 | | | 3,836,682 | | | 2,956,648 | | | 0.5 | % |

| Symphony CLO XIX, Ltd. | | Subordinated Notes | | 9.97 | % | | 4/16/2031 | | 5/6/2021 | | 2,000,000 | | | 1,261,412 | | | 1,067,193 | | | 0.2 | % |

| TCI-Symphony CLO 2017-1, Ltd. | | Income Notes | | 9.78 | % | | 7/15/2030 | | 9/15/2020 | | 3,000,000 | | | 1,763,118 | | | 1,465,736 | | | 0.2 | % |

| TCW CLO 2021-2, Ltd. | | Subordinated Notes | | 23.47 | % | | 7/25/2034 | | 8/17/2022 | | 5,000,000 | | | 4,032,508 | | | 3,854,306 | | | 0.6 | % |

THL Credit Wind River 2013-1 CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 7/19/2030 | | 11/1/2017 | | 10,395,000 | | | 6,382,090 | | | 2,878,662 | | | 0.5 | % |

THL Credit Wind River 2013-2 CLO, Ltd.(6) | | Income Notes | | — | % | | 10/18/2030 | | 12/27/2017 | | 3,250,000 | | | 1,692,150 | | | 1,056,312 | | | 0.2 | % |

THL Credit Wind River 2014-1 CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 7/18/2031 | | 7/11/2018 | | 11,800,000 | | | 6,455,013 | | | 3,923,450 | | | 0.6 | % |

THL Credit Wind River 2014-2 CLO, Ltd.(6) | | Income Notes | | — | % | | 1/15/2031 | | 1/22/2021 | | 7,550,000 | | | 2,518,505 | | | 1,751,045 | | | 0.3 | % |

| THL Credit Wind River 2017-4 CLO, Ltd. | | Subordinated Notes | | 10.77 | % | | 11/20/2030 | | 6/25/2020 | | 3,765,400 | | | 2,752,106 | | | 2,286,010 | | | 0.4 | % |

| THL Credit Wind River 2018-2 CLO, Ltd. | | Subordinated Notes | | 8.59 | % | | 7/15/2030 | | 3/11/2019 | | 8,884,000 | | | 7,830,471 | | | 6,671,603 | | | 1.0 | % |

| THL Credit Wind River 2018-3 CLO, Ltd. | | Subordinated Notes | | 15.44 | % | | 1/20/2031 | | 6/28/2019 | | 13,000,000 | | | 12,498,644 | | | 11,047,239 | | | 1.7 | % |

Venture XVIII CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 10/15/2029 | | 7/16/2018 | | 4,750,000 | | | 2,561,567 | | | 348,122 | | | 0.1 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Venture 28A CLO, Ltd. | | Subordinated Notes | | 14.12 | % | | 10/20/2034 | | 7/16/2018 | | $ | 17,715,000 | | | $ | 14,345,683 | | | $ | 12,443,182 | | | 1.9 | % |

Venture XXX CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 1/15/2031 | | 7/16/2018 | | 5,100,000 | | | 3,565,022 | | | 2,791,897 | | | 0.4 | % |

Venture XXXII CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 7/18/2031 | | 10/9/2018 | | 7,929,328 | | | 6,517,310 | | | 5,037,451 | | | 0.8 | % |

| Venture XXXIV CLO, Ltd. | | Subordinated Notes | | 12.32 | % | | 10/15/2031 | | 7/30/2019 | | 13,903,000 | | | 11,351,747 | | | 9,931,244 | | | 1.6 | % |

| Venture 41 CLO, Ltd. | | Subordinated Notes | | 21.59 | % | | 1/20/2034 | | 1/26/2021 | | 8,249,375 | | | 7,834,354 | | | 7,325,721 | | | 1.1 | % |

| Venture 42 CLO, Ltd. | | Subordinated Notes | | 20.39 | % | | 4/17/2034 | | 11/5/2021 | | 15,000,000 | | | 13,786,380 | | | 12,224,782 | | | 1.9 | % |

| Venture 43 CLO, Ltd. | | Subordinated Notes | | 19.46 | % | | 4/17/2034 | | 9/1/2021 | | 12,000,000 | | | 10,335,819 | | | 9,643,664 | | | 1.5 | % |

Voya IM CLO 2013-1, Ltd.(6) | | Income Notes | | — | % | | 10/15/2030 | | 6/9/2016 | | 4,174,688 | | | 2,257,951 | | | 1,550,586 | | | 0.2 | % |

Voya IM CLO 2013-3, Ltd.(6) | | Subordinated Notes | | — | % | | 10/18/2031 | | 2/13/2015 | | 4,000,000 | | | 1,803,195 | | | 1,119,543 | | | 0.2 | % |

Voya IM CLO 2014-1, Ltd.(6) | | Subordinated Notes | | — | % | | 4/18/2031 | | 2/5/2014 | | 314,774 | | | 172,461 | | | 100,637 | | | 0.0 | % |

Voya CLO 2014-3, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/24/2026 | | 4/10/2015 | | 7,000,000 | | | 2,672,262 | | | — | | | — | % |

Voya CLO 2014-4, Ltd.(6) | | Subordinated Notes | | — | % | | 7/14/2031 | | 11/10/2014 | | 1,000,000 | | | 610,872 | | | 392,219 | | | 0.1 | % |

Voya CLO 2015-2, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/23/2027 | | 6/24/2015 | | 13,712,000 | | | 2,777,172 | | | — | | | — | % |

Voya CLO 2016-1, Ltd.(6) | | Subordinated Notes | | — | % | | 1/21/2031 | | 1/22/2016 | | 7,750,000 | | | 5,506,207 | | | 4,268,815 | | | 0.7 | % |

| Voya CLO 2016-3, Ltd. | | Subordinated Notes | | 1.56 | % | | 10/20/2031 | | 9/30/2016 | | 10,225,000 | | | 8,178,073 | | | 6,294,700 | | | 1.0 | % |

| Voya CLO 2017-3, Ltd. | | Subordinated Notes | | 7.73 | % | | 4/20/2034 | | 6/15/2017 | | 5,750,000 | | | 6,564,211 | | | 5,157,939 | | | 0.8 | % |

| Voya CLO 2017-4, Ltd. | | Subordinated Notes | | 7.85 | % | | 10/15/2030 | | 3/25/2021 | | 2,500,000 | | | 1,586,706 | | | 1,290,296 | | | 0.2 | % |

| Voya CLO 2018-1, Ltd. | | Subordinated Notes | | 5.31 | % | | 4/21/2031 | | 2/23/2018 | | 20,000,000 | | | 15,533,262 | | | 13,036,784 | | | 2.0 | % |

| Voya CLO 2018-2, Ltd. | | Subordinated Notes | | 11.26 | % | | 7/15/2031 | | 4/27/2021 | | 6,778,666 | | | 4,580,600 | | | 3,921,847 | | | 0.6 | % |

| Voya CLO 2018-4, Ltd. | | Subordinated Notes | | 23.52 | % | | 1/15/2032 | | 8/9/2021 | | 3,192,000 | | | 2,502,770 | | | 2,386,547 | | | 0.4 | % |

| Voya CLO 2019-1, Ltd. | | Subordinated Notes | | 9.13 | % | | 4/15/2031 | | 1/27/2020 | | 15,500,000 | | | 13,760,828 | | | 11,347,899 | | | 1.8 | % |

| Voya CLO 2020-1, Ltd. | | Subordinated Notes | | 17.28 | % | | 7/17/2034 | | 3/3/2022 | | 6,500,000 | | | 5,811,810 | | | 5,011,952 | | | 0.8 | % |

| Voya CLO 2022-1, Ltd. | | Subordinated Notes | | 20.82 | % | | 4/20/2035 | | 3/18/2022 | | 17,600,000 | | | 16,507,655 | | | 16,097,180 | | | 2.6 | % |

West CLO 2014-1 Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/17/2026 | | 6/24/2014 | | 13,375,000 | | | 2,520,027 | | | — | | | — | % |

| Total Collateralized Loan Obligation - Equity Class | | $ | 886,864,813 | | | $ | 715,043,019 | | | 111.9 | % |

| | | | | | | | | | | | | | | | |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| AGL CLO 5, Ltd. | | Class E-R Notes | | 12.13% (SOFR + 6.45%) | | 7/20/2034 | | 6/13/2023 | | $ | 4,500,000 | | | $ | 4,007,280 | | | $ | 4,155,235 | | | 0.7 | % |

| Apidos CLO XII | | Class E-R Notes | | 11.06% (SOFR + 5.40%) | | 4/15/2031 | | 4/11/2023 | | 6,775,000 | | | 5,687,735 | | | 6,020,397 | | | 1.0 | % |

| Apidos CLO XXIV | | Class E-R Notes | | 13.53% (SOFR + 7.86%) | | 10/21/2030 | | 3/10/2020 | | 2,000,000 | | | 1,604,568 | | | 1,663,166 | | | 0.3 | % |

| Bain Capital Credit CLO 2017-2, Ltd. | | Class E-R2 Notes | | 12.50% (SOFR + 6.86%) | | 7/25/2034 | | 9/28/2023 | | 1,750,000 | | | 1,594,143 | | | 1,643,601 | | | 0.3 | % |

| Bain Capital Credit CLO 2019-4, Ltd. | | Class E-R Notes | | 13.40% (SOFR + 7.99%) | | 4/23/2035 | | 11/8/2023 | | 1,000,000 | | | 921,887 | | | 988,153 | | | 0.2 | % |

| Bain Capital Credit CLO 2021-2, Ltd. | | Class E Notes | | 12.39% (SOFR + 6.73%) | | 7/16/2034 | | 6/14/2023 | | 2,500,000 | | | 2,160,263 | | | 2,268,797 | | | 0.4 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| BlueMountain CLO 2015-3 Ltd. | | Class E-R Notes | | 13.76% (SOFR + 8.08%) | | 4/21/2031 | | 8/5/2022 | | $ | 2,500,000 | | | $ | 1,827,194 | | | $ | 1,642,214 | | | 0.3 | % |

| BlueMountain CLO XXV Ltd. | | Class E-R Notes | | 12.91% (SOFR + 7.25%) | | 7/15/2036 | | 4/24/2023 | | 4,275,000 | | | 3,722,255 | | | 4,086,158 | | | 0.6 | % |

| BlueMountain CLO XXXIII Ltd. | | Class E Notes | | 12.46% (SOFR + 6.83%) | | 11/20/2034 | | 7/19/2023 | | 5,000,000 | | | 4,526,689 | | | 4,616,246 | | | 0.7 | % |

| BlueMountain Fuji US CLO III Ltd. | | Class E Notes | | 10.86% (SOFR + 5.20%) | | 1/15/2030 | | 9/9/2022 | | 2,000,000 | | | 1,691,691 | | | 1,804,900 | | | 0.3 | % |

| California Street CLO IX, Ltd. | | Class F-R2 Notes | | 14.18% (SOFR + 8.52%) | | 7/16/2032 | | 9/2/2020 | | 2,000,000 | | | 1,648,090 | | | 1,699,038 | | | 0.3 | % |

| Carlyle CLO 17, Ltd. | | Class E-R Notes | | 14.00% (SOFR + 8.35%) | | 4/30/2031 | | 3/5/2019 | | 3,000,000 | | | 2,848,664 | | | 2,176,252 | | | 0.3 | % |

| Carlyle Global Market Strategies 2014-2-R, Ltd. | | Class E Notes | | 13.64% (SOFR + 8.00%) | | 5/15/2031 | | 3/6/2019 | | 7,500,000 | | | 7,010,772 | | | 4,483,550 | | | 0.7 | % |

| Carlyle Global Market Strategies CLO 2013-3, Ltd. | | Class D-R Notes | | 11.16% (SOFR + 5.50%) | | 10/15/2030 | | 11/13/2023 | | 2,400,000 | | | 2,027,065 | | | 2,072,952 | | | 0.3 | % |

| Carlyle Global Market Strategies CLO 2015-1, Ltd. | | Class E-R Notes | | 12.62% (SOFR + 6.94%) | | 7/21/2031 | | 12/14/2023 | | 1,000,000 | | | 879,977 | | | 942,663 | | | 0.1 | % |

| Carlyle Global Market Strategies CLO 2016-1, Ltd. | | Class D-R2 Notes | | 12.28% (SOFR + 6.60%) | | 4/20/2034 | | 10/20/2023 | | 1,000,000 | | | 888,086 | | | 916,862 | | | 0.1 | % |

| Carlyle Global Market Strategies CLO 2019-1, Ltd. | | Class D Notes | | 12.38% (SOFR + 6.70%) | | 4/21/2031 | | 7/14/2023 | | 4,605,000 | | | 4,144,831 | | | 4,331,257 | | | 0.7 | % |

| Cent CLO 21 Limited | | Class D-R2 Notes | | 11.95% (SOFR + 6.30%) | | 7/26/2030 | | 7/29/2022 | | 7,000,000 | | | 5,875,953 | | | 6,175,576 | | | 1.1 | % |

Cent CLO 21 Limited(8) | | Class E-R2 Notes | | 14.30% (SOFR + 8.65%) | | 7/26/2030 | | 7/12/2018 | | 121,028 | | | 117,501 | | | 80,467 | | | 0.0 | % |

| CIFC Funding 2013-III-R, Ltd. | | Class D Notes | | 11.56% (SOFR + 5.90%) | | 4/24/2031 | | 9/9/2022 | | 1,675,000 | | | 1,442,700 | | | 1,539,022 | | | 0.2 | % |

| CIFC Funding 2013-III-R, Ltd. | | Class E Notes | | 13.44% (SOFR + 7.78%) | | 4/24/2031 | | 10/2/2020 | | 3,000,000 | | | 2,406,457 | | | 2,172,532 | | | 0.3 | % |

| CIFC Funding 2014-III, Ltd. | | Class E-R2 Notes | | 11.77% (SOFR + 6.10%) | | 10/22/2031 | | 9/16/2022 | | 1,125,000 | | | 963,682 | | | 1,094,141 | | | 0.2 | % |

| CIFC Funding 2014-III, Ltd. | | Class F-R2 Notes | | 13.92% (SOFR + 8.25%) | | 10/22/2031 | | 11/5/2021 | | 1,500,000 | | | 1,395,529 | | | 1,202,898 | | | 0.2 | % |

| CIFC Funding 2014-IV-R, Ltd. | | Class E-R Notes | | 14.84% (SOFR + 9.18%) | | 1/17/2035 | | 12/20/2021 | | 778,684 | | | 748,788 | | | 753,711 | | | 0.1 | % |

| CIFC Funding 2014-V, Ltd. | | Class F-R2 Notes | | 14.16% (SOFR + 8.50%) | | 10/17/2031 | | 9/17/2018 | | 750,000 | | | 739,602 | | | 662,898 | | | 0.1 | % |

| CIFC Funding 2015-I, Ltd. | | Class E-RR Notes | | 11.67% (SOFR + 6.00%) | | 1/22/2031 | | 9/9/2022 | | 2,562,500 | | | 2,208,649 | | | 2,464,404 | | | 0.4 | % |

| CIFC Funding 2015-I, Ltd. | | Class F-RR Notes | | 13.52% (SOFR + 7.85%) | | 1/22/2031 | | 10/31/2019 | | 5,000,000 | | | 4,273,231 | | | 3,998,400 | | | 0.6 | % |

| CIFC Funding 2016-I, Ltd. | | Class F-R Notes | | 15.82% (SOFR + 10.15%) | | 10/21/2031 | | 9/16/2019 | | 3,750,000 | | | 3,644,691 | | | 3,835,526 | | | 0.6 | % |

| CIFC Funding 2017-IV, Ltd. | | Class D Notes | | 11.76% (SOFR + 6.10%) | | 10/24/2030 | | 4/21/2023 | | 4,500,000 | | | 3,972,377 | | | 4,208,308 | | | 0.7 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| Dryden 28 CLO, Ltd. | | Class B2LR Notes | | 12.09% (SOFR + 6.45%) | | 8/15/2030 | | 5/1/2023 | | $ | 3,090,000 | | | $ | 2,735,803 | | | $ | 2,702,183 | | | 0.4 | % |

| Dryden 41 CLO, Ltd. | | Class E-R Notes | | 10.96% (SOFR + 5.30%) | | 4/15/2031 | | 8/25/2023 | | 3,015,000 | | | 2,462,661 | | | 2,699,400 | | | 0.4 | % |

| Dryden 49 CLO, Ltd. | | Class E Notes | | 11.96% (SOFR + 6.30%) | | 7/18/2030 | | 8/15/2023 | | 5,850,000 | | | 5,007,851 | | | 5,462,360 | | | 0.9 | % |

| Dryden 57 CLO, Ltd. | | Class E Notes | | 10.84% (SOFR + 5.20%) | | 5/15/2031 | | 4/11/2023 | | 4,000,000 | | | 3,295,503 | | | 3,197,756 | | | 0.5 | % |

| Dryden 65 CLO, Ltd. | | Class E Notes | | 11.41% (SOFR + 5.75%) | | 7/18/2030 | | 10/11/2023 | | 1,750,000 | | | 1,560,568 | | | 1,592,830 | | | 0.2 | % |

| Dryden 92 CLO, Ltd. | | Class E Notes | | 12.13% (SOFR + 6.50%) | | 11/20/2034 | | 7/10/2023 | | 2,230,129 | | | 1,957,152 | | | 1,944,334 | | | 0.3 | % |

| Galaxy XXI CLO, Ltd. | | Class F-R Notes | | 12.93% (SOFR + 7.25%) | | 4/21/2031 | | 3/8/2019 | | 6,000,000 | | | 5,232,590 | | | 5,251,037 | | | 0.8 | % |

| Galaxy XXII CLO, Ltd. | | Class F-RR Notes | | 14.46% (SOFR + 8.80%) | | 4/17/2034 | | 8/8/2022 | | 1,500,000 | | | 1,210,407 | | | 1,336,824 | | | 0.2 | % |

| Galaxy XXVII CLO, Ltd. | | Class F Junior Notes | | 13.71% (SOFR + 8.06%) | | 5/16/2031 | | 3/5/2019 | | 1,500,000 | | | 1,386,996 | | | 1,097,777 | | | 0.2 | % |

| Galaxy XXVIII CLO, Ltd. | | Class F Junior Notes | | 14.14% (SOFR + 8.48%) | | 7/15/2031 | | 6/29/2018 | | 41,713 | | | 39,959 | | | 38,271 | | | 0.0 | % |

HarbourView CLO VII-R, Ltd.(8) | | Class F Notes | | 13.93% (SOFR + 8.27%) | | 7/18/2031 | | 10/29/2018 | | 7,114,624 | | | 7,014,085 | | | 3,972,097 | | | 0.6 | % |

| LCM 26 Ltd. | | Class E Notes | | 10.98% (SOFR + 5.30%) | | 1/20/2031 | | 8/23/2023 | | 4,000,000 | | | 2,912,588 | | | 3,100,192 | | | 0.5 | % |

| LCM 30 Ltd. | | Class E-R Notes | | 12.18% (SOFR + 6.50%) | | 4/21/2031 | | 7/13/2023 | | 5,000,000 | | | 4,296,261 | | | 4,548,135 | | | 0.7 | % |

| LCM 32 Ltd. | | Class E Notes | | 12.07% (SOFR + 6.39%) | | 7/20/2034 | | 10/13/2023 | | 4,750,000 | | | 4,039,115 | | | 4,152,570 | | | 0.7 | % |

| LCM 34 Ltd. | | Class E Notes | | 12.22% (SOFR + 6.54%) | | 10/20/2034 | | 9/6/2023 | | 5,250,000 | | | 4,518,603 | | | 4,747,458 | | | 0.7 | % |

| LCM 37 Ltd. | | Class E Notes | | 13.02% (SOFR + 7.63%) | | 4/17/2034 | | 8/30/2023 | | 3,000,000 | | | 2,657,520 | | | 2,866,777 | | | 0.4 | % |

| LCM XXIII Ltd. | | Class D Notes | | 12.73% (SOFR + 7.05%) | | 10/19/2029 | | 8/19/2022 | | 6,000,000 | | | 5,208,071 | | | 5,090,566 | | | 0.8 | % |

| Madison Park Funding XIII, Ltd. | | Class F-R Notes | | 13.61% (SOFR + 7.95%) | | 4/19/2030 | | 10/25/2019 | | 2,000,000 | | | 1,802,400 | | | 1,715,823 | | | 0.3 | % |

| Madison Park Funding XIV, Ltd. | | Class E-R Notes | | 11.47% (SOFR + 5.80%) | | 10/22/2030 | | 6/2/2023 | | 2,375,000 | | | 2,033,124 | | | 2,310,274 | | | 0.4 | % |

| Madison Park Funding XIV, Ltd. | | Class F-R Notes | | 13.44% (SOFR + 7.77%) | | 10/22/2030 | | 3/13/2020 | | 4,500,000 | | | 3,394,335 | | | 3,956,186 | | | 0.6 | % |

| Madison Park Funding XL, Ltd. | | Class E-R Notes | | 12.10% (SOFR + 6.45%) | | 5/28/2030 | | 9/9/2022 | | 3,460,000 | | | 3,074,221 | | | 3,274,054 | | | 0.5 | % |

| Madison Park Funding XXIV, Ltd. | | Class E-R Notes | | 12.88% (SOFR + 7.20%) | | 10/19/2029 | | 8/19/2022 | | 5,000,000 | | | 4,699,061 | | | 4,944,801 | | | 0.8 | % |

| Mountain View CLO IX Ltd. | | Class E Notes | | 13.68% (SOFR + 8.02%) | | 7/15/2031 | | 10/29/2018 | | 3,625,000 | | | 3,551,048 | | | 2,034,819 | | | 0.3 | % |

2024 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| Neuberger Berman CLO XV, Ltd. | | Class E-R Notes | | 12.41% (SOFR + 6.75%) | | 10/15/2029 | | 9/14/2022 | | $ | 1,375,000 | | | $ | 1,255,850 | | | $ | 1,351,783 | | | 0.2 | % |

| Newark BSL CLO 2, Ltd. | | Class D Notes | | 11.94% (SOFR + 6.30%) | | 7/25/2030 | | 7/27/2022 | | 3,000,000 | | | 2,696,435 | | | 2,889,263 | | | 0.5 | % |

| Octagon Investment Partners 18-R, Ltd. | | Class E Notes | | 13.91% (SOFR + 8.25%) | | 4/16/2031 | | 10/15/2019 | | 6,080,742 | | | 5,213,259 | | | 5,376,856 | | | 0.8 | % |

| Octagon Investment Partners 29, Ltd. | | Class E-R Notes | | 12.91% (SOFR + 7.25%) | | 1/24/2033 | | 12/18/2023 | | 1,500,000 | | | 1,413,181 | | | 1,449,395 | | | 0.2 | % |

| Octagon Investment Partners 36, Ltd. | | Class E Notes | | 11.09% (SOFR + 5.43%) | | 4/15/2031 | | 11/15/2023 | | 3,000,000 | | | 2,558,873 | | | 2,683,176 | | | 0.4 | % |

| Octagon Investment Partners 45, Ltd. | | Class E-R Notes | | 12.21% (SOFR + 6.82%) | | 4/16/2035 | | 12/13/2023 | | 2,500,000 | | | 2,211,291 | | | 2,371,065 | | | 0.4 | % |

| Octagon Investment Partners 59, Ltd. | | Class E Notes | | 12.98% (SOFR + 7.60%) | | 5/15/2035 | | 4/19/2023 | | 2,500,000 | | | 2,245,435 | | | 2,188,174 | | | 0.3 | % |

| Octagon Investment Partners XVII, Ltd. | | Class F-R2 Notes | | 12.84% (SOFR + 7.20%) | | 1/27/2031 | | 10/15/2019 | | 5,362,500 | | | 4,489,005 | | | 3,877,832 | | | 0.6 | % |

| Octagon Investment Partners XXI, Ltd. | | Class D-RR Notes | | 12.64% (SOFR + 7.00%) | | 2/14/2031 | | 8/30/2023 | | 2,750,000 | | | 2,493,632 | | | 2,619,316 | | | 0.4 | % |

| Octagon Investment Partners XXII, Ltd. | | Class E-RR Notes | | 11.12% (SOFR + 5.45%) | | 1/22/2030 | | 8/24/2023 | | 1,500,000 | | | 1,285,227 | | | 1,358,344 | | | 0.2 | % |

| Octagon Investment Partners XXII, Ltd. | | Class F-RR Notes | | 13.42% (SOFR + 7.75%) | | 1/22/2030 | | 11/25/2019 | | 5,500,000 | | | 4,595,605 | | | 4,438,546 | | | 0.7 | % |

| OZLM VIII, Ltd. | | Class E-RR Notes | | 13.83% (SOFR + 8.17%) | | 10/17/2029 | | 11/6/2018 | | 8,400,000 | | | 8,272,244 | | | 6,863,222 | | | 1.2 | % |

| Rockford Tower CLO 2021-3, Ltd. | | Class E Notes | | 12.40% (SOFR + 6.72%) | | 10/20/2034 | | 9/15/2023 | | 4,535,000 | | | 4,104,906 | | | 4,149,779 | | | 0.6 | % |

| Sound Point CLO IV-R, Ltd. | | Class F Notes | | 13.76% (SOFR + 8.10%) | | 4/18/2031 | | 3/18/2019 | | 3,500,000 | | | 3,283,945 | | | 1,802,047 | | | 0.3 | % |

| Sound Point CLO XIV, Ltd. | | Class E Notes | | 12.32% (SOFR + 6.65%) | | 1/23/2029 | | 7/27/2022 | | 1,000,000 | | | 931,894 | | | 961,218 | | | 0.2 | % |