Reports Mailed to Shareholders (registered Investment Company) (n-30b-2)

27 April 2022 - 8:23PM

Edgar (US Regulatory)

ADAMS

NATURAL

RESOURCES FUND

GET THE LATEST NEWS AND INFORMATION

Dear Fellow Shareholders,

A lot of things have impacted financial markets since the beginning of 2022. Investors entered the year worried about inflationary pressures not experienced since the 1980s. Inflation has only run hotter since. All eyes were on the U.S. Federal Reserve (Fed) and how it would use interest rate increases to tackle inflation. Those began in March, offering some amount of clarity. Still, investors are struggling to discern the pace of policy tightening and its impact on economic growth. The beginning of the year also brought new fears of an omicron variant of COVID-19. The pandemic is still here, if somewhat in the background, but its ultimate path remains unclear. Adding to all the uncertainty, Russia invaded Ukraine, beginning Europe’s largest military conflict since World War II.

“Energy was the best performing sector in the S&P 500 during the first quarter, rising 39.0%...”

The war exacerbated inflation. Both Russia and Ukraine are important providers of oil and gas, metals, wheat, and other commodities. Crude prices rose sharply during the quarter, briefly surpassing 2008’s peak and helping to lift the price of gasoline to all-time highs. Led by energy and food, the U.S. consumer price index rose to an 8.5% annual rate in March, its fastest climb in 40 years.

On March 16, the Fed raised its key rate by 25 basis points and signaled additional hikes for all six remaining policy meetings in 2022, plus more in 2023. Fed Chair Jerome Powell and other policymakers indicated that more aggressive interest rate increases, including some in 50 basis point increments, are on the table. The Fed also said it would end its pandemic-inspired bond purchase program and start to shrink its balance sheet as soon as the second quarter.

Energy was the best performing sector in the S&P 500 during the first quarter, rising 39.0% and outperforming the index by 43.6%. The sector benefited from sharply rising oil prices, with West Texas Intermediate (WTI) crude prices rising by 33% during the quarter, amid strong demand, low inventory, and supply shocks from the war. WTI reached a 13-year high in early March, before declining late in the quarter as the U.S. and other members of the International Energy Agency (IEA) announced plans to release emergency reserves. The fall in oil prices in late March also reflected some concern about the pace of global economic growth in the face of multiple uncertainties. However, the IEA’s forecast—average WTI prices of $112 per barrel in the second quarter and over $100 for 2022—remains very supportive for energy companies.

Letter to Shareholders (continued)

The global commodities complex posted its biggest quarterly gain in three decades as the Refinitiv/CoreCommodity CRB Index gained 27.0% for the three-month period, lifting its one-year price return to 59.6%. Beyond energy commodities, the war and sanctions drove up prices of industrial metals and agricultural products, especially those with supply chains tied to Russia and Ukraine. This led to a wide range of outcomes in the Materials sector. On the one hand, stocks such as steel manufacturers and fertilizer producers benefited from the rise in prices for their products. Conversely, companies that use these products as inputs, such as paint manufacturers, had a more difficult time as their profitability was crimped by the higher prices. Overall, materials stocks declined slightly in the first quarter.

All Energy industry groups advanced by double digits in the quarter, led by a 48.7% gain for the Equipment and Services group. This was in contrast to 2021 when the group trailed the performance of the sector. We have favored exploration and production (E&P) companies over service providers because they benefit more directly from a higher oil price. While this has benefited the Fund over the last two years, it was a drag on relative performance in the first quarter. We remain comfortable being overweight E&P stocks versus services but will continue to evaluate the relative merits of each.

In the Integrated Oil and Gas industry group, we moved to an overweight position in Occidental Petroleum during the first quarter. After acquiring Anadarko Petroleum in 2019, the company struggled with the large amount of debt it assumed to complete the acquisition. High oil prices have enabled them to strengthen their balance sheet by paying down much of the debt, leaving them in a better position going forward. The stock rose 30% after we added to the position in February, outperforming the sector by more than 20%.

The Refining and Marketing group was the strongest relative performer in the first quarter, as our investments in the group advanced 32.0% compared to a 30.8% return for the benchmark. Our overweight in Marathon Petroleum was a key driver. In addition to benefiting from rising demand for gasoline and other refined products, Marathon is in a very strong financial position after completing the sale of its retail gasoline business.

The Fund’s Materials holdings also outperformed, with a return of -1.9% that beat the benchmark’s -2.4% result. Our underweight in the Specialty Chemicals group was a notable contributor, as these stocks tend to be more negatively exposed to inflationary pressures and have struggled in the current environment. Stock selection in the sector also aided relative performance. Specifically, our position in Steel Dynamics was up 34.6% in the first quarter. The company continues to benefit from elevated steel prices, and we expect it to generate significant free cash flow going forward as their capital spending moderates.

For the three months ended March 31, 2022, the total return on the Fund’s net asset value (“NAV”) per share (with dividends and capital gains reinvested) was

Letter to Shareholders (continued)

27.7%. This compares to a total return of 28.3% for the Fund’s benchmark, comprised of the S&P 500 Energy Sector (74% weight) and the S&P 500 Materials Sector (26% weight), over the same time period. The total return on the market price of the Fund’s shares for the period was 27.3%.

For the twelve months ended March 31, 2022, the Fund’s total return on NAV was 52.1%. Comparable return for the Fund’s benchmark was 51.1%. The Fund’s total return on market price was 50.1%.

During the quarter, the Fund paid distributions to shareholders of $2.4 million, or $.10 per share, consisting of $.02 net investment income, $.03 short-term capital gain, and $.01 long-term capital gain realized in 2021, and $.04 net investment income realized in 2022.

There’s no shortage of uncertainty as we look ahead, starting with the question of how long the war in Ukraine will last. Potential outcomes of the conflict vary widely. Whatever path it takes, the war and ensuing sanctions cloud the picture around oil and gas prices, supply chain disruptions, and even Western government and monetary policies. The Fed’s path forward will require a delicate balance between managing inflation and avoiding a hard economic landing. We are mindful of the suffering of the people of Ukraine and elsewhere who feel the impact of the war. We hope for a return to peace, and that we have moved past the worst of the pandemic. When it comes to managing our Fund, we will keep our eyes on the long term, manage risk, make adjustments, and seek opportunities. We continue to focus on companies that are reasonably priced and capable of executing and delivering through whatever comes next.

We appreciate your trust and will continue to work hard to keep it.

By order of the Board of Directors,

Mark E. Stoeckle

Chief Executive Officer

April 21, 2022

Summary Financial Information

| |

|

|

2022

|

|

|

2021

|

|

| At March 31: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value per share |

|

|

|

$ |

24.42 |

|

|

|

|

$ |

16.94 |

|

|

| Market price per share |

|

|

|

$ |

20.93 |

|

|

|

|

$ |

14.71 |

|

|

| Shares outstanding |

|

|

|

|

24,484,655 |

|

|

|

|

|

24,084,802 |

|

|

| Total net assets |

|

|

|

$ |

597,963,876 |

|

|

|

|

$ |

408,043,138 |

|

|

| Average net assets |

|

|

|

$ |

536,828,174 |

|

|

|

|

$ |

367,697,599 |

|

|

| Unrealized appreciation on investments |

|

|

|

$ |

128,800,842 |

|

|

|

|

$ |

(29,682,127) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended March 31: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

|

$ |

3,892,803 |

|

|

|

|

$ |

2,588,622 |

|

|

| Net realized gain (loss) |

|

|

|

$ |

21,682,426 |

|

|

|

|

$ |

2,518,140 |

|

|

| Total return (based on market price) |

|

|

|

|

27.3% |

|

|

|

|

|

30.3% |

|

|

| Total return (based on net asset value) |

|

|

|

|

27.7% |

|

|

|

|

|

24.0% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses to average net assets* |

|

|

|

|

0.71% |

|

|

|

|

|

1.39% |

|

|

| Net investment income to average net assets* |

|

|

|

|

2.96% |

|

|

|

|

|

2.86% |

|

|

| Portfolio turnover* |

|

|

|

|

36.9% |

|

|

|

|

|

35.9% |

|

|

| Net cash & short-term investments to net assets |

|

|

|

|

0.8% |

|

|

|

|

|

0.5% |

|

|

*

Annualized

Ten Largest Equity Portfolio Holdings

March 31, 2022

(unaudited)

| |

|

|

Market Value

|

|

|

Percent

of Net Assets

|

|

| Exxon Mobil Corporation |

|

|

|

$ |

104,123,691 |

|

|

|

|

|

17.4% |

|

|

| Chevron Corporation |

|

|

|

|

89,408,488 |

|

|

|

|

|

15.0 |

|

|

| ConocoPhillips |

|

|

|

|

48,922,600 |

|

|

|

|

|

8.2 |

|

|

| Pioneer Natural Resources Company |

|

|

|

|

24,352,922 |

|

|

|

|

|

4.1 |

|

|

| Linde plc |

|

|

|

|

21,657,354 |

|

|

|

|

|

3.6 |

|

|

| Marathon Petroleum Corporation |

|

|

|

|

21,202,717 |

|

|

|

|

|

3.5 |

|

|

| EOG Resources, Inc. |

|

|

|

|

21,175,248 |

|

|

|

|

|

3.5 |

|

|

| Occidental Petroleum Corporation |

|

|

|

|

18,097,280 |

|

|

|

|

|

3.0 |

|

|

| Schlumberger N.V. |

|

|

|

|

17,507,178 |

|

|

|

|

|

2.9 |

|

|

| Diamondback Energy, Inc. |

|

|

|

|

13,584,628 |

|

|

|

|

|

2.3 |

|

|

| |

|

|

|

$ |

380,032,106 |

|

|

|

|

|

63.5% |

|

|

March 31, 2022

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Common Stocks — 99.2% |

|

|

Energy — 79.4%

|

|

|

Equipment & Services — 6.2%

|

|

|

Baker Hughes Company

|

|

|

|

|

171,900 |

|

|

|

|

$ |

6,258,879 |

|

|

|

Halliburton Company

|

|

|

|

|

349,970 |

|

|

|

|

|

13,253,364 |

|

|

|

Schlumberger N.V.

|

|

|

|

|

423,800 |

|

|

|

|

|

17,507,178 |

|

|

| |

|

|

|

|

37,019,421 |

|

|

|

Exploration & Production — 27.1%

|

|

|

APA Corporation

|

|

|

|

|

222,200 |

|

|

|

|

|

9,183,526 |

|

|

|

Canadian Natural Resources Limited

|

|

|

|

|

47,800 |

|

|

|

|

|

2,962,644 |

|

|

|

Cheniere Energy, Inc.

|

|

|

|

|

26,000 |

|

|

|

|

|

3,604,900 |

|

|

|

ConocoPhillips

|

|

|

|

|

489,226 |

|

|

|

|

|

48,922,600 |

|

|

|

Coterra Energy Inc.

|

|

|

|

|

153,600 |

|

|

|

|

|

4,142,592 |

|

|

|

Devon Energy Corporation

|

|

|

|

|

119,600 |

|

|

|

|

|

7,071,948 |

|

|

|

Diamondback Energy, Inc.

|

|

|

|

|

99,100 |

|

|

|

|

|

13,584,628 |

|

|

|

EOG Resources, Inc.

|

|

|

|

|

177,600 |

|

|

|

|

|

21,175,248 |

|

|

|

Hess Corporation

|

|

|

|

|

53,700 |

|

|

|

|

|

5,748,048 |

|

|

|

Marathon Oil Corporation

|

|

|

|

|

118,400 |

|

|

|

|

|

2,973,024 |

|

|

|

Occidental Petroleum Corporation

|

|

|

|

|

318,951 |

|

|

|

|

|

18,097,280 |

|

|

|

Pioneer Natural Resources Company

|

|

|

|

|

97,400 |

|

|

|

|

|

24,352,922 |

|

|

|

Whiting Petroleum Corporation

|

|

|

|

|

452 |

|

|

|

|

|

36,842 |

|

|

|

Whiting Petroleum Corporation warrants,

strike price $73.44, expires 9/1/24 (b)

|

|

|

|

|

2,654 |

|

|

|

|

|

54,407 |

|

|

|

Whiting Petroleum Corporation warrants,

strike price $83.45, expires 9/1/25 (b)

|

|

|

|

|

1,327 |

|

|

|

|

|

19,786 |

|

|

| |

|

|

|

|

161,930,395 |

|

|

|

Integrated Oil & Gas — 33.9%

|

|

|

BP plc Sponsored ADR

|

|

|

|

|

51,300 |

|

|

|

|

|

1,508,220 |

|

|

|

Cenovus Energy Inc.

|

|

|

|

|

176,700 |

|

|

|

|

|

2,947,356 |

|

|

|

Chevron Corporation

|

|

|

|

|

549,091 |

|

|

|

|

|

89,408,488 |

|

|

|

Exxon Mobil Corporation

|

|

|

|

|

1,260,730 |

|

|

|

|

|

104,123,691 |

|

|

|

Shell plc Sponsored ADR

|

|

|

|

|

28,600 |

|

|

|

|

|

1,570,998 |

|

|

|

Suncor Energy Inc.

|

|

|

|

|

46,400 |

|

|

|

|

|

1,512,176 |

|

|

|

TotalEnergies SE Sponsored ADR

|

|

|

|

|

28,500 |

|

|

|

|

|

1,440,390 |

|

|

|

|

|

|

|

202,511,319 |

|

|

|

Refining & Marketing — 7.2%

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

247,985 |

|

|

|

|

|

21,202,717 |

|

|

|

Phillips 66

|

|

|

|

|

100,575 |

|

|

|

|

|

8,688,674 |

|

|

|

Valero Energy Corporation

|

|

|

|

|

131,600 |

|

|

|

|

|

13,362,664 |

|

|

|

|

|

|

|

43,254,055 |

|

|

Schedule of Investments (continued)

March 31, 2022

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Storage & Transportation — 5.0%

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

464,400 |

|

|

|

|

$ |

8,781,804 |

|

|

|

ONEOK, Inc.

|

|

|

|

|

143,500 |

|

|

|

|

|

10,135,405 |

|

|

|

Williams Companies, Inc.

|

|

|

|

|

328,700 |

|

|

|

|

|

10,981,867 |

|

|

| |

|

|

|

|

29,899,076 |

|

|

|

Materials — 19.8%

|

|

|

Chemicals — 11.5%

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

|

23,500 |

|

|

|

|

|

5,872,885 |

|

|

|

Albemarle Corporation

|

|

|

|

|

9,000 |

|

|

|

|

|

1,990,350 |

|

|

|

Celanese Corporation

|

|

|

|

|

6,000 |

|

|

|

|

|

857,220 |

|

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

47,900 |

|

|

|

|

|

4,936,574 |

|

|

|

Corteva Inc.

|

|

|

|

|

66,245 |

|

|

|

|

|

3,807,763 |

|

|

|

Dow, Inc.

|

|

|

|

|

65,745 |

|

|

|

|

|

4,189,271 |

|

|

|

DuPont de Nemours, Inc.

|

|

|

|

|

73,987 |

|

|

|

|

|

5,443,963 |

|

|

|

Eastman Chemical Company

|

|

|

|

|

8,900 |

|

|

|

|

|

997,334 |

|

|

|

Ecolab Inc.

|

|

|

|

|

25,600 |

|

|

|

|

|

4,519,936 |

|

|

|

FMC Corporation

|

|

|

|

|

10,500 |

|

|

|

|

|

1,381,485 |

|

|

|

International Flavors & Fragrances Inc.

|

|

|

|

|

21,006 |

|

|

|

|

|

2,758,718 |

|

|

|

Linde plc

|

|

|

|

|

67,800 |

|

|

|

|

|

21,657,354 |

|

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

61,400 |

|

|

|

|

|

6,313,148 |

|

|

|

Mosaic Company

|

|

|

|

|

21,001 |

|

|

|

|

|

1,396,567 |

|

|

|

PPG Industries, Inc.

|

|

|

|

|

19,700 |

|

|

|

|

|

2,582,079 |

|

|

| |

|

|

|

|

68,704,647 |

|

|

|

Construction Materials — 2.2%

|

|

|

Martin Marietta Materials, Inc.

|

|

|

|

|

4,500 |

|

|

|

|

|

1,732,005 |

|

|

|

Sherwin-Williams Company

|

|

|

|

|

38,700 |

|

|

|

|

|

9,660,294 |

|

|

|

Vulcan Materials Company

|

|

|

|

|

9,800 |

|

|

|

|

|

1,800,260 |

|

|

| |

|

|

|

|

13,192,559 |

|

|

|

Containers & Packaging — 2.0%

|

|

|

Amcor plc

|

|

|

|

|

125,100 |

|

|

|

|

|

1,417,383 |

|

|

|

Avery Dennison Corporation

|

|

|

|

|

5,500 |

|

|

|

|

|

956,835 |

|

|

|

Ball Corporation

|

|

|

|

|

29,100 |

|

|

|

|

|

2,619,000 |

|

|

|

International Paper Company

|

|

|

|

|

28,200 |

|

|

|

|

|

1,301,430 |

|

|

|

Packaging Corporation of America

|

|

|

|

|

7,600 |

|

|

|

|

|

1,186,436 |

|

|

|

Sealed Air Corporation

|

|

|

|

|

55,500 |

|

|

|

|

|

3,716,280 |

|

|

|

WestRock Company

|

|

|

|

|

22,200 |

|

|

|

|

|

1,044,066 |

|

|

| |

|

|

|

|

12,241,430 |

|

|

|

Metals & Mining — 4.1%

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

233,200 |

|

|

|

|

|

11,599,368 |

|

|

|

Newmont Corporation

|

|

|

|

|

86,800 |

|

|

|

|

|

6,896,260 |

|

|

|

Nucor Corporation

|

|

|

|

|

21,100 |

|

|

|

|

|

3,136,515 |

|

|

|

Steel Dynamics, Inc.

|

|

|

|

|

32,500 |

|

|

|

|

|

2,711,475 |

|

|

| |

|

|

|

|

24,343,618 |

|

|

| |

Schedule of Investments (continued)

March 31, 2022

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Total Common Stocks |

|

|

(Cost $464,296,078)

|

|

|

|

|

|

|

|

|

|

$ |

593,096,520 |

|

|

| Short-Term Investments — 0.8% |

|

|

Money Market Funds — 0.8%

|

|

|

Morgan Stanley Institutional Liquidity Funds Prime Portfolio, 0.36% (c)

|

|

|

|

|

4,001,200 |

|

|

|

|

|

4,000,400 |

|

|

|

Northern Institutional Treasury Portfolio, 0.17% (c)

|

|

|

|

|

678,340 |

|

|

|

|

|

678,340 |

|

|

| Total Short-Term Investments |

|

|

(Cost $4,678,340)

|

|

|

|

|

|

|

|

|

|

|

4,678,740 |

|

|

| Total — 100.0% of Net Assets |

|

|

(Cost $468,974,418)

|

|

|

|

|

|

|

|

|

|

|

597,775,260 |

|

|

| Other Assets Less Liabilities — 0.0% |

|

|

|

|

|

|

|

|

|

|

188,616 |

|

|

|

Net Assets — 100.0%

|

|

|

|

|

|

|

|

|

|

$ |

597,963,876 |

|

|

| |

(a)

Common stocks and warrants are listed on the New York Stock Exchange or NASDAQ and are valued at the last reported sale price on the day of valuation.

(b)

Presently non-dividend paying.

(c)

Rate presented is as of period-end and represents the annualized yield earned over the previous seven days.

Information regarding transactions in equity securities during the quarter can be found on our website at: www.adamsfunds.com.

Disclaimers

This report contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements. Several factors that could materially affect the Fund’s actual results are the performance of the portfolio of stocks held by the Fund, the conditions in the U.S. and international financial markets, the price at which shares of the Fund will trade in the public markets, and other factors discussed in the Fund’s periodic filings with the Securities and Exchange Commission.

This report is transmitted to the shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if sold, may be worth more or less than their original cost. Past performance is no guarantee of future investment results.

[This Page Intentionally Left Blank]

Adams Natural Resources Fund, Inc.

Board of Directors

| |

Enrique R. Arzac (2)(4) |

|

|

Roger W. Gale (2) (3) |

|

|

Kathleen T. McGahran(1)(5)

|

|

| |

Kenneth J. Dale(1)(2) (3)

|

|

|

Mary Chris Jammet (2) (4)

|

|

|

Jane Musser Nelson (2)

|

|

| |

Frederic A. Escherich (1) (3) (4)

|

|

|

Lauriann C. Kloppenburg(1)(3) (4)

|

|

|

Mark E. Stoeckle (1)

|

|

(1)

Member of Executive Committee

(2)

Member of Audit Committee

(3)

Member of Compensation Committee

(4)

Member of Nominating and Governance Committee

(5)

Chair of the Board

Officers

| |

Mark E. Stoeckle |

|

|

Chief Executive Officer

|

|

| |

James P. Haynie, CFA |

|

|

President

|

|

| |

Brian S. Hook, CFA, CPA |

|

|

Vice President, Chief Financial Officer and Treasurer

|

|

| |

Janis F. Kerns

|

|

|

Vice President, General Counsel, Secretary and Chief Compliance Officer

|

|

| |

Gregory W. Buckley |

|

|

Vice President—Research

|

|

| |

Michael A. Kijesky, CFA |

|

|

Vice President—Research

|

|

| |

Michael E. Rega, CFA |

|

|

Vice President—Research

|

|

| |

Jeffrey R. Schollaert, CFA |

|

|

Vice President—Research

|

|

| |

Christine M. Sloan, CPA |

|

|

Assistant Treasurer and Director of Human Resources

|

|

500 East Pratt Street, Suite 1300, Baltimore, MD 21202

410.752.5900 800.638.2479

Website: www.adamsfunds.com

Email: investorrelations@adamsfunds.com

Tickers: PEO (NYSE), XPEOX (NASDAQ)

Independent Registered Public Accounting Firm: PricewaterhouseCoopers LLP

Custodian of Securities: The Northern Trust Company

Transfer Agent & Registrar: American Stock Transfer & Trust Company, LLC

Stockholder Relations Department

6201 15th Avenue

Brooklyn, NY 11219

(866) 723-8330

Website: www.astfinancial.com

Email: info@astfinancial.com

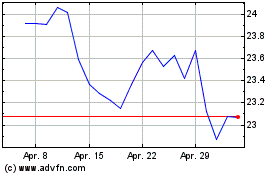

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024