Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Dezember 2023 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2023

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras to analyze Mubadala Capital proposal

for refining and biorefining partnership in Bahia

—

Rio de Janeiro, December 22, 2023

– Petróleo Brasileiro S.A. – Petrobras informs that it has received a communication from Mubadala Capital proposing

the formalization of recent discussions on the formation of a potential strategic partnership for the development of downstream in Brazil,

in continuity with the memorandum of understanding released on September 4, 2023. The initiative has as its scope businesses focused on

traditional refining, as well as the development of a biorefinery, both in the state of Bahia.

The aim of the future partnership

is to strengthen the business environment in the sector and increase the supply of renewable fuels in our country. The business model

to be analyzed will take into account future investments and the development of new technologies in conjunction with Mubadala Capital.

Mubadala Capital, which through

Acelen controls the Mataripe Refinery ("RefMat") and Acelen Energia Renovável S.A. ("Biorrefinaria"), indicates

in its correspondence the main terms and conditions of the possible partnership. Petrobras will evaluate the acquisition of a stake in

these assets.

The proposal will still be subject

to internal evaluation by Petrobras. The company also clarifies that any investment decisions must, within the governance established

at Petrobras, go through the planning and approval processes provided for in the applicable systems, with their technical and economic

viability demonstrated and in line with its Strategic Plan 2024-2028+.

Material facts will be disclosed

to the market in due course.

About RefMat

The Mataripe Refinery, located in

São Francisco do Conde in the state of Bahia, has a processing capacity of 333,000 barrels/day, and its assets include four storage

terminals and a set of pipelines that connect the refinery and the terminals, totaling 669 km in length.

About the Biorefinery

The integrated biorefining project

includes plants to produce renewable diesel and sustainable aviation kerosene from vegetable oil from native crops, operating in the states

of Bahia and Minas Gerais.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9 th floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

December 22, 2023

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Sergio Caetano Leite

______________________________

Sergio Caetano Leite

Chief Financial Officer and Investor Relations

Officer

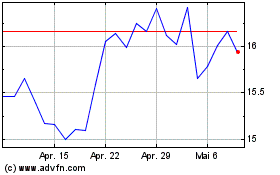

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

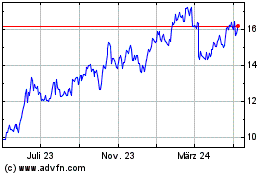

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024