UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

March, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras announces conclusion of investigation into Unigel

—

Rio de Janeiro, March 4, 2024 –

Petróleo Brasileiro S.A. – Petrobras clarifies that its Governance and Compliance Department has concluded the investigation

into possible interference by two of its directors in the processing of the procedure that led to the signing of the tolling contract

with Unigel and has concluded that there is no confirmation of irregularities in this regard. This investigation was fully monitored by

KPMG, which carried out additional tests and examined the procedures and controls applicable to the whole process, under the terms of

the rules applicable to the matter.

As is usually the case in Petrobras'

internal investigations in similar cases, the procedure provides that, in addition to document analysis and interviews with those involved

in the process, there will be an examination of digital media, data and information contained in institutional equipment that may be essential

to clarifying the facts, under the terms of the company's rules that guide its internal investigations and in order to offer transparency

and agility in the investigations.

The information that the contract

was not signed in accordance with all the relevant procedures is unfounded. On the contrary, the contract was approved and validated by

all the previous bodies, so that the company's governance system was fully respected. The claim that KPMG has removed directors from the

process of certifying the financial statements is also incorrect.

KPMG has been Petrobras' independent

auditor since 2017 and has been hired by the company to audit the financial statements. It is not true that KPMG was hired by the Statutory

Audit Committee or any of its members to carry out an investigation into the Unigel contract.

The disclosure schedule for Petrobras'

financial statements is maintained.

As already informed to the market,

the service contract with Unigel is of a provisional nature and aims to allow the plants located in Sergipe and Bahia, which belong to

Petrobras, to continue operating for eight months, without extension. The temporary tolling service contract proved to be the best alternative

among those available, considering the current situation of the plants and the risk scenarios.

The tolling operation (gas processing

service with a view to producing urea and ammonia) will still be activated, and so far Petrobras has not made any disbursements.

The intention of the signatory parties

is, during the term of this contract, to work together to discuss and implement a sustainable business model for these two plants in the

long term.

Finally, the company reiterates

that it has been providing all the clarifications requested by the TCU.

Material facts will be disclosed

to the market in due course.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9 th floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 4, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Sergio Caetano Leite

______________________________

Sergio Caetano Leite

Chief Financial Officer and Investor Relations

Officer

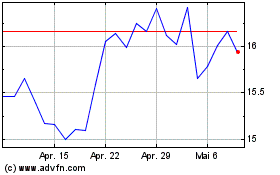

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

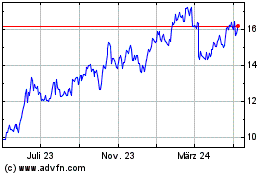

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024