UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38353

PagSeguro Digital Ltd.

(Name of Registrant)

Conyers Trust Company (Cayman) Limited,

Cricket Square, Hutchins Drive, P.O. Box 2681,

Grand Cayman, KY1-1111, Cayman Islands

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

PAGS Reports Third Quarter 2023 Results

Net Income (Non-GAAP) of R$ 440 million, +7% y/y

Net Income (GAAP) of R$ 411 million, +8% y/y

São Paulo, November 16, 2023 – PagSeguro Digital Ltd. (“PAGS,” “PagBank” or “we”) announced today its third quarter results for the period ended September 30, 2023. The consolidated financial statements are presented in Reais (R$) and prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

3Q23 Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Finance Volume (TFV) | | | | Total Payment Volume (TPV) | | | | Total Banking Volume (TBV) | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 244 Billion | | | | R$ 99.8 Billion | | | | R$ 143.9 Billion | |

| | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenue and Income | | | | Payments | Gross Profit | | | | Financial Services | Gross Profit | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 4.03 Billion | | | | R$ 1.4 Billion | | | | R$ 101 Million | |

| | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | Non-GAAP | | | | Payments | Adj. EBITDA | | | | Financial Services | Adj. EBITDA | |

| | | | | | | | | | |

| | | | | | | | | | |

| R$ 440 Million | | | | R$ 892 Million | | | | R$ 2 Million | |

| | | | | | | | | | |

| | | | |

To our shareholders

We are happy to announce our earnings results for the third quarter and first nine months of 2023 and to continue to share our recent developments and milestones.

In September 2023, we reached 30.2 million clients, amounting to R$ 669 billion in transactions occurring over the first nine months of the year. These numbers comprise of R$ 389 billion in Total Banking Volume (formerly known as PagBank TPV) and R$ 281 billion in Total Payment Volume (formerly known as PagSeguro TPV).

In the third quarter, TPV grew faster than the industry’s growth, driven by growth in all merchant segments: micro-merchants, SMBs and large accounts. Also, as of November 2023, PIX has been operational for 3 years in the Brazilian market, and we are very well positioned to take advantage of its capabilities. PagBank Cash-in, which comprise of all PIX P2P transactions and wire transfers sent from different financial institution to us, amounted to R$ 56 billion.

Improved trends in our TPV and PagBank Cash-in resulted in our deposits reaching a record level of almost R$ 22 billion. We have now concluded an important 12-month cycle through which we managed the impact of high interest rates for an extended period through a repricing process, while at the same time diversified our funding structure backed by deposits. As a result, we have executed a valuable strategy to keep increasing our gross profit by disassociating the reliance on take rate trajectory, driven by merchants’ mix change, lowering our average cost of funding. For example, this quarter our financial expenses decreased in comparison to the same period in 2022, a trend we have not observed since early 2021 when interest rate hikes began in Brazil.

Consequently, our net income reached an all-time high, posting R$ 440 million on a non-GAAP basis, representing +7% year-over-year, and pushing our net cash balance to R$ 10.6 billion, which is our cornerstone against economic turmoil and a buffer for new investments without causing shareholder dilution. Also, we totaled over R$ 1 billion in share buybacks since 2021, executing more than 80% of our current program.

We see compelling opportunities to further expand our footprint in different geographies in Brazil through our HUBs and by boosting our online payments penetration, providing a seamless omnichannel solution. As we are expecting to address the mismatch between capital expenditures and depreciation/amortization levels in the second half of 2024, we have started to increase our salesforce to reach our goals and foster the natural cross-selling of our financial services, making the financial lives of our clients easier and empowering them through a one-stop-shop financial ecosystem.

We continue to pursue technological disruptions. In October, we executed our first transaction using DREX, the Brazilian digital currency through the blockchain platform, embracing the digital assets revolution. In November, we announced a facial authentication feature for our clients aiming to use our payment link option, reinforcing our security features while improving user experience and confidence.

Our management principles remain the same:

•Superior execution in balancing growth with profitability;

•Robust financials with high liquidity, sustainable results, and low funding costs; and

•Solid and ethical corporate governance.

I am looking forward to the next milestones of our journey.

Alexandre Magnani, Chief Executive Officer

Selected Capsule of Income Statement Data1

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Revenues and Income | 4,026 | 4,035 | -0.2% | 3,826 | 5.2% | 11,602 | 11,373 | 2.0% |

| (-) Other Financial Income | (66) | (46) | 42.2% | (65) | 1.0% | (195) | (132) | 47.2% |

| (-) Transactions Costs | (1,508) | (1,424) | 5.9% | (1,414) | 6.7% | (4,311) | (4,141) | 4.1% |

| Net Take Rate | 2,452 | 2,565 | -6.3% | 2,347 | 4.5% | 7,095 | 7,099 | -0.8% |

| (-) Financial Expenses | (820) | (921) | -10.9% | (796) | 3.1% | (2,429) | (2,297) | 5.7% |

| (-) Total Losses² | (165) | (273) | -39.4% | (122) | 35.8% | (413) | (793) | -47.9% |

| (+) FX Expenses | 10 | 12 | -20.7% | 9 | 15.7% | 36 | 34 | 4.0% |

| Gross Profit | 1,477 | 1,384 | 6.7% | 1,438 | 2.7% | 4,289 | 4,044 | 6.1% |

Payments | 1,376 | 1,272 | 8.2% | 1,327 | 3.7% | 3,899 | 3,813 | 2.3% |

Financial Services | 101 | 113 | -10.5% | 111 | -9.1% | 390 | 231 | 68.9% |

| (-) Operating Expenses | (583) | (615) | -5.1% | (589) | -1.0% | (1,759) | (1,778) | -1.1% |

| Adj. EBITDA³ | 894 | 770 | 16.1% | 849 | 5.3% | 2,530 | 2,265 | 11.7% |

Payments | 892 | 832 | 7.2% | 850 | 4.9% | 2,460 | 2,471 | -0.4% |

Financial Services | 2 | (62) | n.a. | (1) | n.a. | 70 | (205) | n.a. |

| (-) POS Write-off | (64) | (41) | 54.9% | (65) | -1.5% | (191) | (134) | 42.0% |

| (-) D&A | (329) | (290) | 13.5% | (310) | 6.3% | (941) | (810) | 16.1% |

| (+/-) Other Income (Expense), Net | 56 | 34 | 65.5% | 56 | -1.2% | 159 | 98 | 62.4% |

| EBT | 557 | 472 | 17.9% | 531 | 4.8% | 1,557 | 1,419 | 9.8% |

| (-) Income Tax and Social Contribution | (117) | (61) | 91.0% | (116) | 0.7% | (310) | (233) | 32.9% |

| Net Income | Non-GAAP | 440 | 411 | 7.0% | 415 | 6.0% | 1,248 | 1,186 | 5.2% |

EPS | Non-GAAP4 | R$ 1.36 | R$ 1.25 | 8.7% | R$ 1.28 | 6.6% | R$ 3.83 | R$ 3.60 | 6.5% |

| (-) Non-GAAP Effects | (29) | (31) | -5.0% | (30) | -2.4% | (82) | (89) | -7.8% |

| Net Income | GAAP | 411 | 380 | 8.0% | 385 | 6.7% | 1,166 | 1,097 | 6.3% |

EPS | GAAP4 | R$ 1.27 | R$ 1.16 | 9.7% | R$ 1.18 | 7.2% | R$ 3.58 | R$ 3.33 | 7.6% |

| Cash Earnings | Adj. EBITDA (-) CapEx | 365 | 267 | 36.6% | 319 | 14.4% | 1,063 | 507 | 109.6% |

| Capital Expenditures (CapEx) | 529 | 502 | 5.2% | 530 | 29.3% | 1,467 | 1,758 | -16.6% |

1. This selected capsule income statement data is presented only to facilitate a general overview of highlights of our financial performance for the periods indicated for informational purposes. For our complete Income Statement information, see our consolidated financial statements prepared in accordance with IFRS as issued by the IASB, in our Form 6-K related to the Financial Statements, published on the date hereof;

2. Total Losses: Chargebacks and Expected Credit Losses;

3. Adj. EBITDA: EBITDA net of Financial Expenses;

4. Considering the Weighted Average Number of Diluted Common Shares:

3Q23: 323,773,637 shares;

2Q23: 325,480,431 shares;

3Q22: 328,898,070 shares;

9M23: 325,596,375 shares;

9M22: 329,612,792 shares.

Key Performance Indicators

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| KPIs | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| ARPAC¹ | | | | | | | | |

| Payments | R$ 2,080 | R$ 1,764 | 17.9% | R$ 2,022 | 2.9% | R$ 2,080 | R$ 1,764 | 17.9% |

| Financial Services | R$ 73 | R$ 96 | -23.9% | R$ 82 | -10.6% | R$ 73 | R$ 96 | -23.9% |

| Efficiency Ratio² | 16.4% | 20.5% | (4.1) p.p. | 16.2% | 0.2 p.p. | 16.0% | 20.1% | (3.7) p.p. |

| Credit Portfolio | R$ Billion | 2.5 | 2.7 | -7% | 2.6 | -6% | 2.5 | 2.7 | -7% |

| Total Deposits | R$ Billion | 21.6 | 19.4 | 11% | 18.3 | 18% | 21.6 | 19.4 | 11% |

1. ARPAC: Sum of LTM revenues / Average of active clients over the last 5 quarters;

2. Efficiency Ratio: Selling, Administrative and Other Expenses required for each amount of Total Revenue and Income generated.

Selected Capsule of Balance Sheet Data¹

| | | | | | | | | | | | | | | | | |

| Balance Sheet | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Total Assets | 47,327 | 43,276 | 9.4% | 42,836 | 10.5% |

| Current Assets | 41,147 | 37,709 | 9.1% | 36,898 | 11.5% |

Cash and Financial Investments2 | 3,053 | 2,478 | 23.2% | 2,846 | 7.3% |

| Accounts Receivable | 37,521 | 34,570 | 8.5% | 33,440 | 12.2% |

Others3 | 573 | 661 | -13.4% | 611 | -6.3% |

| Non-current Assets | 6,180 | 5,567 | 11.0% | 5,939 | 4.1% |

| Accounts Receivable | 1,000 | 731 | 36.7% | 918 | 8.9% |

PP&E and Intangible Assets4 | 4,962 | 4,671 | 6.2% | 4,833 | 2.7% |

Others5 | 218 | 164 | 32.8% | 188 | 16.2% |

| Total Liabilities and Equity | 47,327 | 43,276 | 9.4% | 42,836 | 10.5% |

| Current Liabilities | 28,665 | 28,287 | 1.3% | 25,890 | 10.7% |

Accounts Payable6 | 9,052 | 8,214 | 10.2% | 8,374 | 8.1% |

| PagBank | Checking Accounts | 9,655 | 6,734 | 43.4% | 8,258 | 16.9% |

| PagBank | Savings Accounts and CDs | 8,577 | 10,795 | -20.5% | 7,813 | 9.8% |

| Borrowings | 193 | 987 | -80.5% | 292 | -34.0% |

Others7 | 1,189 | 1,558 | -23.7% | 1,153 | 3.1% |

| Non-current Liabilities | 5,793 | 3,477 | 66.6% | 4,421 | 31.0% |

Accounts Payable6 | 159 | 0 | n.a. | 127 | 25.1% |

| PagBank | Savings Accounts and CDs | 3,337 | 1,843 | 81.0% | 2,219 | 50.4% |

Others8 | 2,297 | 1,634 | 40.6% | 2,074 | 10.7% |

| Equity | 12,868 | 11,512 | 11.8% | 12,526 | 2.7% |

| Retained Net Income | 7,403 | 5,830 | 27.0% | 6,992 | 5.9% |

| Capital | 5,465 | 5,682 | -3.8% | 5,533 | -1.2% |

Net Cash Balance9 | 10,573 | 9,050 | 16.8% | 10,089 | 4.8% |

1. This selected capsule balance sheet data is presented only to facilitate a general overview of the highlights of our financial performance for the periods indicated for informational purposes. For our complete Balance Sheet information, see our consolidated financial statements prepared in accordance with IFRS as issued by the IASB, in our Form 6-K related to the Financial Statements, published on the date hereof.

Balance Sheet Reconciliation:

2. Cash & Financial Investments: Cash and Cash Equivalents + Financial Investments;

3. Others: Inventories + Taxes Recoverable + Other Receivables + Receivables from Related Parties;

4. PP&E & Intangible Assets: Property and Equipment + Intangible Assets;

5. Others: Judicial Deposits + Prepaid Expenses + Deferred Income Tax and Social Contribution + Investments + Receivables from Related Parties;

6. Accounts Payable: Payables to third parties (including (i) transactions of sales and services to settle with merchants, net of PagSeguro’s revenue, (ii) the balance of client bank accounts that are invested by the client in Certificate of Deposits, and (iii) the balance of merchant payment accounts through which PagSeguro acquires treasury bonds to comply with certain requirements);

7. Others: Trade Payables + Payables to Related Parties + Derivative Financial Instruments + Salaries and Social Charges + Taxes and Contributions + Provision for Contingencies + Deferred Revenue + Other Liabilities;

8. Others: Deferred Income Tax and Social Contribution + Provision for Contingencies + Deferred Revenue + Other Liabilities;

9. Net Cash Balance: Cash and Cash Equivalents + Financial Investments + Current & Non-Current Account Receivables – Current & Non-Current Payables to Third Parties – Borrowings – Derivative Financial Investments – Current & Non-Current Deposits.

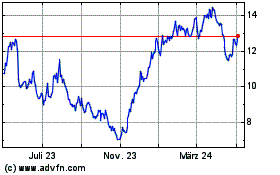

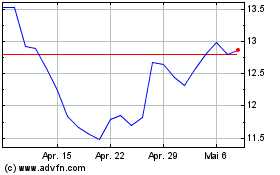

Capital Markets¹

| | | | | | | | | | | | | | | | | |

| Capital Markets | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Market Cap | | | | | |

| In BRL billion | R$ 13.79 | R$ 23.33 | -40.9% | R$ 14.65 | -5.9% |

| In USD billion | $ 2.75 | $ 4.32 | -36.2% | $ 3.04 | -9.5% |

| Stock Price | | | | | |

| In BRL | R$ 43.12 | R$ 71.53 | -39.7% | R$ 45.49 | -5.2% |

| In USD | $ 8.61 | $ 13.23 | -34.9% | $ 9.44 | -8.8% |

| Book Value per Share | | | | | |

| In BRL | R$ 40.25 | R$ 35.29 | 14.0% | R$ 38.89 | 3.5% |

| In USD | $ 8.04 | $ 6.53 | 23.1% | $ 8.07 | -0.4% |

1. As of September 30, 2023;

Brazilian Central Bank Currency Exchange Rate (PTAX) BRL/USD:

3Q23: R$ 5.0076;

3Q22: R$ 5.4066;

2Q23: R$ 4.8192.

Operational Performance

Total Finance Volume

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Finance Volume | 243,691 | 195,485 | 24.7% | 221,050 | 10.2% | 669,477 | 522,415 | 28.2% |

Total Payment Volume1 | 99,836 | 90,261 | 10.6% | 92,676 | 7.7% | 280,609 | 259,576 | 8.1% |

Total Banking Volume2 | 143,855 | 105,224 | 36.7% | 128,374 | 12.1% | 388,868 | 262,839 | 47.9% |

1. Total Payment Volume: includes debit cards, credit cards, prepaid cards, vouchers, boletos and PIX P2M (fee-based product);

2. Total Banking Volume: includes prepaid card top-ups, PagBank card issuing TPV (debit, credit, prepaid), mobile top-ups, wire transfers to third-parties, cash-in through boletos, bill payments, tax collections, P2P transactions, PIX P2P (no fee-based), credit underwriting, super app top-ups and GMV.

Total Finance Volume (TFV), formerly known as PAGS TPV, totaled R$ 243.7 billion, representing an increase of +24.7% vs. 3Q22 due to the growth in both Total Payment Volume and Total Banking Volume.

Total Payment Volume (TPV), formerly known as PagSeguro TPV, totaled R$ 99.8 billion, representing an increase of +10.6% vs. 3Q22 mainly due to:

(i)larger share of wallet mainly driven by the cash conversion into electronic payments;

(ii)maturation of existing cohorts due to increasing productivity of our sales channels; and

(iii)better performance of all merchants’ segments, consisting of micro-merchants, SMBs and large accounts.

Total Banking Volume (TBV), formerly known as PagBank TPV, totaled R$ 143.9 billion, representing an increase of +36.7% vs. 3Q22. This growth is mainly related to our clients’ higher engagement with digital bank features (such as PIX, bill payments, mobile top-up), cards’ spending and credit underwriting.

PagBank Clients

| | | | | | | | | | | | | | | | | |

| # Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

Total Clients1 | 30.2 | 25.9 | 16.4% | 29.5 | 2.5% |

Active Clients2 | 16.7 | 15.8 | 6.3% | 16.4 | 1.8% |

| Consumers | 10.6 | 9.1 | 16.4% | 10.2 | 3.5% |

| Merchants | 6.1 | 6.6 | -7.6% | 6.2 | -1.0% |

1. Total Clients: Number of bank accounts registered at Brazilian Central Bank;

2. Active Clients: Active merchants using one additional digital account feature/service beyond acquiring and consumers with a balance in their digital account on the last day of the month.

PagBank ended the quarter with 30.2 million clients, representing an increase of +16.4% vs. 3Q22, and Active Clients of 16.7 million, an increase of +6.3% vs. 3Q22. This increase is mainly related to higher penetration in the consumers segment which represents 63% of PagBank clients vs. 58% in 3Q22.

Active Merchants

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| # Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

Active Merchants1 | 6.7 | 7.3 | -9.1% | 6.8 | -1.7% | 6.7 | 7.3 | -9.1% |

| Net Addittions | (0.1) | (0.2) | -39.8% | (0.1) | -22.3% | (0.4) | (0.4) | 13.3% |

TPV per Merchant2 | R$ thousand | 14.9 | 12.2 | 22.2% | 12.9 | 15.7% | 40.9 | 36.1 | 13.3% |

1. Active Merchants: At least one transaction in the last twelve months;

2. TPV per Merchant: Amount of TPV divided by the average of active merchants during the period.

Active Merchants ended the quarter with 6.7 million, representing a decrease of -9.1% vs. 3Q22. Since early 2022, the company has been adopting a more selective go-to-market strategy focusing on clients with better unit economics, higher activation ratio, and higher engagement in PagBank financial services. Additionally, we have been improving our onboarding and risk assessment processes since early 2023 to reduce chargebacks and losses.

Credit Portfolio

| | | | | | | | | | | | | | | | | |

| R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Credit Portfolio | 2,462 | 2,653 | -7.2% | 2,609 | -5.6% |

| Working Capital | 471 | 813 | -42.0% | 625 | -24.6% |

| Credit Card | 816 | 1,014 | -19.6% | 886 | -7.9% |

Payroll Loan + Others1 | 1,175 | 826 | 42.3% | 1,099 | 7.0% |

| Provision for Losses | (651) | (903) | -27.9% | (816) | -20.2% |

| Working Capital | (387) | (494) | -21.7% | (513) | -24.6% |

| Credit Card | (236) | (400) | -40.9% | (288) | -18.1% |

Payroll Loan + Others1 | (28) | (9) | 210.2% | (14) | 95.6% |

| Credit Portfolio, net | 1,811 | 1,751 | 3.5% | 1,794 | 1.0% |

1. Payroll Loan + Others: Refers to loan portfolios, including advance Brazil's Severance Indemnity Fund (FGTS) withdrawals and payroll loans to public sector employees and retirees.

| | | | | | | | | | | | | | | | | |

| R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Credit Portfolio | 2,462 | 2,653 | -7.2% | 2,609 | -5.6% |

| Secured Products | 1,469 | 926 | 58.6% | 1,347 | 9.1% |

| % Credit Portfolio | 60% | 35% | 24.8 p.p. | 52% | 8.1 p.p. |

| Unsecured Products | 993 | 1,727 | -42.5% | 1,263 | -21.4% |

| % Credit Portfolio | 40% | 65% | (24.8) p.p. | 48% | (8.1) p.p. |

Credit Portfolio reached R$ 2.5 billion in 3Q23, representing a decrease of -7.2% vs. 3Q22, mainly driven by our strategy to grow in secured products, which represented 60% of the portfolio, combined with the run-off of working capital loans and the write-offs of the working capital loans and payroll loans in 3Q23 and credit cards in 2Q23, according to the credit models update based on IFRS 9 and our tax planning.

Total Deposits

| | | | | | | | | | | | | | | | | |

| R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Total Deposits | 21.569 | 19,402 | 11.2% | 18,290 | 17.9% |

Average Percentage Yield (APY)1 | 93.5% | 99.0% | (5.5) p.p. | 94.3% | (0.8) p.p. |

| Checking Accounts | 9.655 | 6,734 | 43.4% | 8,258 | 16.9% |

Average Percentage Yield (APY)1 | 72.0% | 66.0% | 6.0 p.p. | 73.0% | (1.0) p.p. |

| Merchant's Payment Accounts | 1,736 | 832 | 108.5% | 762 | 127.9% |

| Banking Accounts | 7,919 | 5,901 | 34.2% | 7,496 | 5.6% |

| Savings Accounts | 11,914 | 12,668 | -5.9% | 10,033 | 18.8% |

Average Percentage Yield (APY)1 | 110.9% | 116.5% | (5.6) p.p. | 111.8% | (1.0) p.p. |

| Certificate of Deposits | 9,583 | 10,215 | -0.4% | 8,273 | 23.0% |

| Interbank Deposits | 2,331 | 2,248 | -22.8% | 1,759 | -1.3% |

| Corporate Securities | 0 | 205 | n.a. | 0 | n.a. |

1. As % of CDI (Brazilian Interbank Rate).

Total Deposits reached R$ 21.6 billion, representing an increase of +11.2% vs. 3Q22. This increase was driven by the +43.4% y/y growth in Checking Accounts Balance (following better trends observed in TPV and PagBank cash-in), which allowed us to further reduce annual percentage yields, resulting in lower costs of funding.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brazilian Interest Rates | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| SELIC | 12.75% | 13.75% | (1.0) p.p. | 13.75% | (1.0) p.p. | 11.75% | 13.75% | (1.0) p.p. |

| SELIC | Average | 13.38% | 13.58% | (0.2) p.p. | 13.75% | (0.4) p.p. | 13.62% | 12.14% | 1.2 p.p. |

| CDI | 12.65% | 13.65% | (1.0) p.p. | 13.65% | (1.0) p.p. | 10.75% | 12.75% | (0.1) p.p. |

| CDI | Average | 13.28% | 13.47% | (0.2) p.p. | 13.65% | (0.4) p.p. | 13.52% | 12.04% | 1.2 p.p. |

Financial Performance

Total Revenue and Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

Total Revenue and Income1 | 4,026 | 4,035 | -0.2% | 3,826 | 5.2% | 11,602 | 11,373 | 2.0% |

| Payments | 3,771 | 3,712 | 1.6% | 3,575 | 5.5% | 10,796 | 10,443 | 3.4% |

Financial Services2 | 260 | 376 | -30.8% | 243 | 7.0% | 834 | 1,052 | -20.8% |

| Other Financial Income | 66 | 46 | 42.2% | 65 | 1.0% | 195 | 132 | 47.2% |

1. Including Other Financial Income;

2. Including Float, intercompany revenue from Payments’ business unit.

Total Revenue and Income reached R$ 4,026 million in 3Q23, representing a slight decrease from R$ 4,035 million reported in 3Q22, but represented an increase of +5.2% quarter-over-quarter. The breakdown of Payments, Financial Services and Other Financial Income differs from Total Revenue and Income amount due to the Float from Financial Services unit, which is an intercompany revenue from Merchant Acquiring funding, not accounted for Total Revenue and Income. Before 1Q23, Float from Checking Accounts Balance was partially booked in Payments. Going forward, 100% of Float will be fully booked in Financial Services, similar to other financial institutions. The main differences will be:

(i)Total Revenue and Income: The mismatch between Total Revenue and Income and the managerial Total Revenue and Income’s breakdown in Payments, Financial Services and Other Financial Income increase given the intercompany Float will no longer offset a portion of the Financial Expenses. In 3Q23, intercompany Float amounted to R$ 71 million vs. R$ 99 million in 3Q22 and R$ 57 million in 2Q23.

(ii)Payments: No change in revenue except for an increase in Financial Expenses, since the share of such expenses offset by the Float usually booked in Payments will no longer occur. Consequently, Gross Profit and Adj. EBITDA will decrease.

(iii)Financial Services: An increase in Revenue since the Float will lead to a higher interest income. Consequently, Gross Profit and Adj. EBITDA will increase.

For more details about Float accounting reconciliation between Financial Services and Payments, please refer to page 16.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Revenue and Income | 4,026 | 4,035 | -0.2% | 3,826 | 5.2% | 11,602 | 11,373 | 2.0% |

| Transaction Activities and Other Services | 2,269 | 2,292 | -1.0% | 2,166 | 4.8% | 6,586 | 6,602 | -0.2% |

| Financial Income | 1,691 | 1,697 | -0.4% | 1,595 | 6.0% | 4,820 | 4,638 | 3.9% |

| Other Financial Income | 66 | 46 | 42.2% | 65 | 1.0% | 195 | 132 | 47.2% |

Total Revenue and Income performance is explained below:

(i)Transaction Activities and Other Services in 3Q23 amounted to R$ 2,269 million, representing a slight decrease of -1.0% vs. 3Q22, but represented an increase of +4.8% quarter-over-quarter. This performance is mainly due to the focus on revenues with higher margins, increasing share of larger merchants in Payments, the impact of the regulatory change on prepaid/debit cards that came into force on April 1, 2023 and the mix change in credit portfolio towards secured products with lower yields and longer duration in Financial Services.

(ii)Financial Income, which represents the discount fees we withhold from credit card transactions in installments for the early payment of Accounts Payable to Third Parties (merchants), reached R$ 1,691 million, representing a slight decrease of -0.4% vs R$ 1,697 million in 3Q22, mainly due to the increasing share of larger merchants with lower take rates and shorter duration of TPV of Credit Card installments.

(iii)Other Financial Income reached R$ 66 million in 3Q23, an increase of +42.2% vs. 3Q22, mainly due to the increase in interest accrued on Cash and Cash Equivalents and higher position.

Total Cost and Expenses explained by function

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Costs and Expenses | (3,469) | (3,563) | -2.6% | (3,295) | 5.3% | (10,044) | (9,954) | -0.9% |

| Cost of Sales and Services | (2,028) | (1,911) | 6.1% | (1,923) | 5.4% | (5,875) | (5,545) | -5.6% |

| Selling Expenses | (378) | (531) | -28.9% | (320) | 18.0% | (1,014) | (1,510) | 49.0% |

| Administrative Expenses | (165) | (141) | 16.7% | (162) | 1.9% | (472) | (429) | -9.0% |

| Financial Expenses | (820) | (921) | -10.9% | (796) | 3.1% | (2,429) | (2,297) | -5.4% |

| Other Expenses, Net | (79) | (59) | 33.3% | (94) | -16.1% | (255) | (173) | -32.3% |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Costs and Expenses | (3,514) | (3,610) | -2.7% | (3,341) | 5.2% | (10,168) | (10,088) | -0.8% |

| Cost of Sales and Services | (2,033) | (1,862) | 9.2% | (1,926) | 5.6% | (5,889) | (5,502) | -6.6% |

| Selling Expenses | (379) | (531) | -28.6% | (321) | 18.0% | (1,019) | (1,511) | 48.3% |

| Administrative Expenses | (205) | (185) | 10.8% | (203) | 1.0% | (580) | (555) | -4.4% |

| Financial Expenses | (820) | (921) | -10.9% | (796) | 3.1% | (2,429) | (2,297) | -5.4% |

| Other Expenses, Net | (76) | (111) | -31.4% | (94) | -19.0% | (253) | (225) | -11.1% |

Total Costs and Expenses, on a non-GAAP basis, amounted to R$ 3,469 million in the 3Q23, representing a decrease of -2.6% from R$ 3,563 million in the 3Q22.

The decrease is mainly related to:

Cost of Sales and Services reached R$ 2,028 million in the 3Q23, representing an increase of +6.1% year-over-year, mainly due to the TPV growth, leading to higher interchange and card scheme fees, and higher POS depreciation and amortization of intangible assets.

When excluding non-GAAP figures related to LTIP (long-term incentive plan), Cost of Sales and Services, on a GAAP basis, reached R$ 2,033 million, representing an increase of +9.2%, from R$ 1,862 million reported in 3Q22.

Selling Expenses totaled R$ 377 million, representing a decrease of -29.0% from R$ 531 million reported in the same period of 2022, mainly driven by lower losses and optimizations in Marketing expenses.

When excluding non-GAAP figures related to LTIP (long-term incentive plan), Selling Expenses reached R$ 378 million, representing a decrease of -28.7%, from R$ 531 million reported in 3Q22.

Administrative Expenses reached R$ 166 million, representing an increase of +17.4% from R$ 141 million presented in 3Q22, mainly driven by higher expenses in software licenses and cloud services.

When excluding non-GAAP figures related to LTIP Costs and M&A, Administrative Expenses reached R$ 206 million, representing an increase of +11.3%, from R$ 185 million reported in 3Q22.

Financial Expenses totaled R$ 820 million in 3Q23, representing a decrease of -10.9% vs. 3Q22, mainly due to a lower average cost of funding led by deposits growth, which posted a strong figure quarter-over-quarter, increasing its relevance in our funding strategy, and lower expenses related to the Brazilian Basic Interest Rate (SELIC) decrease, partially offset by TPV growth in the period.

Other Expenses, net reached R$ 79 million in 3Q23, representing an increase of +33.3% from expenses of R$ 59 million reported in 3Q22. This increase is mainly driven by POS write-off during the period.

When excluding non-GAAP figures related to the capital gains from the revaluation of assets of 10% of NETPOS in the amount of R$ 3 million, Other Expenses, net, on a GAAP basis, reached R$ 76 million, representing an increase of +33.3% from expenses of R$ 59 million reported in 3Q22.

On a GAAP basis, including LTIP, M&A and Other Expenses of R$ 45 million, Total Costs and Expenses amounted to R$ 3,514 million, representing a decrease of -2.7% in comparison to the amount of R$ 3,610 million presented in 3Q22.

Total Cost and Expenses explained by nature

Transaction Costs

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Transactions Costs | (1,508) | (1,424) | 5.9% | (1,414) | 6.7% | (4,311) | (4,141) | 4.1% |

| % Total Revenue and Income | 37.5% | 35.3% | 2.2 p.p. | 37.0% | 0.5 p.p. | 37.2% | 36.4% | 1.1 p.p. |

| Interchange and Card Scheme Fee | (1,450) | (1,380) | 5.1% | (1,357) | 6.8% | (4,145) | (3,975) | 4.3% |

| Others | (59) | (45) | 31.3% | (57) | 2.3% | (166) | (166) | 0.0% |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Transactions Costs | (1,508) | (1,372) | 10.0% | (1,414) | 6.7% | (4,311) | (4,089) | 5.4% |

| % Total Revenue and Income | 37.5% | 34.0% | 3.5 p.p. | 37.0% | 0.5 p.p. | 37.2% | 36.0% | 1.5 p.p. |

| Interchange and Card Scheme Fee | (1,450) | (1,380) | 5.1% | (1,357) | 6.8% | (4,145) | (3,975) | 4.3% |

| Others | (58) | 8 | n.a. | (57) | 2.2% | (166) | (114) | 46.1% |

Transaction Costs, on a non-GAAP basis, totaled R$ 1,508 million, representing an increase of +5.9% from R$ 1,424 million in 3Q22. As a percentage of the Total Revenue and Income, Transaction Costs increased to 37.5% in 3Q23 vs. 35.3% in 3Q22.

Transaction Costs, on a GAAP basis, totaled R$ 1,508 million, representing an increase of +10.0% from R$ 1,372 million in 3Q22. As a percentage of Total Revenue and Income, Transaction Costs represented 37.5% vs. 34.0% in 3Q22, mainly driven by:

Interchange and Card Scheme Fees totaled R$ 1,450 million in 3Q23, representing an increase of +5.1% y/y, mainly driven by TPV growth partially offset by the impact of the regulatory changes on prepaid/debit cards that came into force on April 1, 2023; and

Other Costs increased by +31% vs. 3Q22 mainly due to better trends in merchants’ additions leading to higher logistics and maintenance costs. The non-GAAP effect of R$ 53 million is related to the termination of the provision related to the PagPhone supply agreement, which was recorded in 2021 and finalized in 2022 (booked in 3Q22).

Net Take Rate

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Payment Volume | 99,836 | 90,261 | 10.6% | 92,676 | 7.7% | 280,609 | 259,576 | 8.1% |

| Gross Take Rate | 3,961 | 3,989 | -0.7% | 3,761 | 5.3% | 11,407 | 11,240 | 1.5% |

| % Total Payment Volume | 3.97% | 4.42% | (0.45) p.p. | 4.06% | (0.09) p.p. | 4.07% | 4.33% | (0.36) p.p. |

| Transaction Activities and Other Services | 2,269 | 2,292 | -1.0% | 2,166 | 0.0 | 6,586 | 6,602 | -0.24% |

| Financial Income | 1,691 | 1,697 | -0.4% | 1,595 | 0.1 | 4,820 | 4,638 | 3.93% |

| Net Take Rate | 2,452 | 2,618 | -6.3% | 2,347 | 4.5% | 7,095 | 7,152 | -0.8% |

| % Total Payment Volume | 2.46% | 2.90% | (0.44) p.p. | 2.53% | (0.08) p.p. | 2.53% | 2.76% | (0.30) p.p. |

| Transactions Costs | (1,508) | (1,372) | 10.0% | (1,414) | 6.7% | (4,311) | (4,089) | 5.4% |

Net Take Rate totaled R$ 2,452 million in 3Q23, representing a decrease of -6.3% vs. 3Q22, mainly due to:

(i)Payments: higher share of larger merchants with lower take rates and shorter duration of TPV from Credit Card installments; and

(ii)Financial Services: the impact of the regulatory change on prepaid/debit cards that came into force on April 1, 2023, and the mix change in credit products towards secured products with lower yields and longer duration.

Financial Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Financial Expenses | (820) | (921) | -10.9% | (796) | 3.1% | (2,429) | (2,297) | 5.7% |

| % Total Revenue and Income | 20.4% | 22.8% | (2.4) p.p. | 20.8% | (0.4) p.p. | 20.9% | 20.2% | 0.7 p.p. |

| Securitization of Receivables | (249) | (307) | -19.0% | (245) | 1.4% | (708) | (1,017) | -30.4% |

Accrued Interest on Deposits and Others | (571) | (614) | -6.9% | (550) | 3.8% | (1,721) | (1,280) | 34.5% |

Financial Expenses totaled R$ 820 million in 3Q23, representing a decrease of -10.9% vs. 3Q22. As a percentage of Total Revenue and Income, Financial Expenses decreased to 20.4% in 3Q23 vs. 22.8% in 3Q22, mainly due to:

(i)Lower average cost of funding led by deposits growth, which posted a strong figure quarter-over-quarter, increasing its relevance in our funding strategy; and

(ii)Lower expenses related to the Brazilian Basic Interest Rate (SELIC) decrease.

Total Losses

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Total Losses¹ | (165) | (273) | -39.4% | (122) | 35.8% | (413) | (793) | -47.9% |

| % Total Revenue and Income | 4.1% | 6.8% | (2.7) p.p. | 3.2% | 0.9 p.p. | 3.6% | 7.0% | (3.4) p.p. |

| Chargebacks | (131) | (123) | 6,9% | (115) | 13,9% | (333) | (323) | 2,9% |

| Expected Credit Losses (ECL) | (34) | (150) | -77,3% | (6) | 356,8% | (81) | (469) | -82,8% |

1. Review of accounting allocations that resulted in a negligible change between the chargeback and ECL lines in 2Q23 amounting R$ 5 million.

Total Losses reached R$ 165 million in 3Q23, representing a decrease of -39.4% vs. 3Q22. As a percentage of Total Revenues and Income, Total Losses decreased to 4.1% in 3Q23 vs. 6.8% in 3Q22. This decrease was mainly driven by the improved asset quality of our credit portfolio with increased exposure to secured products with negligible NPLs, demanding lower expected credit losses provisions. Quarter-over-quarter, Total Losses increased by +35.8% mainly as a result of our credit model update on our outstanding balance of provisions in working capital loan and payroll loan portfolio, aligned to IFRS 9.

Gross Profit

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Gross Profit | 1,477 | 1,384 | 6.7% | 1,438 | 2.7% | 4,289 | 4,044 | 6.1% |

| % Total Revenue and Income | 36.7% | 34.3% | 2.4 p.p. | 37.6% | (0.9) p.p. | 37.0% | 35.6% | 1.4 p.p. |

| Payments | 1,376 | 1,272 | 8.2% | 1,327 | 3.7% | 3,899 | 3,813 | 2.3% |

| Financial Services | 101 | 113 | -10.5% | 111 | -9.1% | 390 | 231 | 68.9% |

Gross Profit totaled R$ 1,477 million in 3Q23, representing an increase of +6.7% vs. 3Q22. This increase is mainly related to lower financial expenses and lower losses.

Operating Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Operating Expenses | (583) | (615) | -5.1% | (589) | -1.0% | (1,759) | (1,778) | -1.1% |

| % Total Revenue and Income | 14.5% | 15.2% | (0.7) p.p. | 15.4% | (0.9) p.p. | 15.2% | 15.6% | (0.5) p.p. |

| Personnel Expenses | (245) | (235) | 4.2% | (246) | -0.6% | (744) | (704) | 5.7% |

| Marketing and Advertising | (140) | (200) | -30.1% | (129) | 8.1% | (387) | (540) | -28.3% |

| Other Expenses (Income), Net | (199) | (180) | 10.4% | (214) | -7.1% | (629) | (535) | 17.5% |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Operating Expenses | (610) | (710) | -14.0% | (619) | -1.4% | (2,026) | (2,086) | -2.9% |

| % Total Revenue and Income | 15.2% | 17.6% | (2.4) p.p. | 16.2% | (1.0) p.p. | 17.5% | 18.3% | (0.9) p.p. |

| Personnel Expenses | (274) | (278) | -1.3% | (276) | -0.5% | (822) | (825) | -0.4% |

| Marketing and Advertising | (140) | (200) | -30.1% | (129) | 8.1% | (387) | (540) | -28.3% |

| Other Expenses (Income), Net | (196) | (232) | -15.4% | (214) | -8.2% | (817) | (721) | 13.2% |

Operating Expenses, on a GAAP basis, totaled R$ 610 million, representing a decrease of -14.0% from R$ 710 million in 3Q22. As a percentage of Total Revenue and Income, Non-GAAP Operating Expenses represented 15.2% vs. 17.6% in 3Q22.

Operating Expenses, on a Non-GAAP basis, which include Personnel Expenses, Marketing and Advertising and Other Expenses, totaled R$ 583 million, representing a decrease of -5.1% from R$ 615 million in 3Q22. As a percentage of Total Revenue and Income, Non-GAAP Operating Expenses represented 14.5% vs. 17.3% in 3Q22. These trends are mainly due to the following:

Personnel Expenses reached R$ 245 million, representing an increase of +4.2% vs. 3Q22, driven by the impact of our collective bargaining agreement and an increase in our salesforce. When including non-GAAP Expenses of R$ 27 million, Personnel Expenses, on a GAAP basis, totaled R$ 274 million, representing a decrease of -1.3% vs. 3Q22 due to the lower relevance of the long-term incentive plan given the current shares price level.

Marketing and Advertising totaled R$ 140 million in 3Q23, representing a decrease of -30.1% vs. 3Q22, led by the optimizations on marketing deployment, focusing on being more selective in attracting new clients with better unit economics; and

Other Expenses reached R$ 199 million in 3Q23, representing an increase of +10.4% from R$ 180 million reported in 3Q22, mainly driven by software licenses and consulting services. When excluding non-GAAP Expenses of R$ 3 million in 3Q23 and including R$ 52 million in 3Q22, Other Expenses, on a GAAP basis, totaled R$ 196 million, representing a decrease of -15.4% vs. 3Q22. For more information, refer to note 23 on our Form 6-K containing our 3Q23 Financial Statements furnished on the date hereof.

Adj. EBITDA, Capital Expenditures and Cash Earnings

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Adj. EBITDA¹ | 894 | 770 | 16.1% | 849 | 5.3% | 2,530 | 2,266 | 11.7% |

| % Total Revenue and Income | 22.2% | 19.1% | 3.1 p.p. | 22.2% | 0.0 p.p. | 21.8% | 19.9% | 1.9 p.p. |

| Payments | 892 | 832 | 7.2% | 850 | 4.9% | 2,460 | 2,471 | -0.4% |

| Financial Services | 2 | (62) | n.a. | (1) | n.a. | 70 | (205) | n.a. |

| Capital Expenditures (CapEx) | 529 | 502 | 5.3% | 530 | 29.5% | 1,467 | 1,758 | -16.6% |

| % Total Revenue and Income | 13.1% | 12.4% | 0.7 p.p. | 10.7% | 2.5 p.p. | 12.6% | 15.5% | (2.3) p.p. |

| Cash Earnings | Adj. EBITDA (-) CapEx | 365 | 267 | 36.4% | 319 | 14.4% | 1,063 | 507 | 109.5% |

1. Adj. EBITDA: GAAP Net Income + Income Tax and Social Contribution – Other Financial Income + POS Write-off + Depreciation and Amortization + FX Expenses + M&A Expenses + LTIP Expenses. Please see the Supplemental Information for a reconciliation of this adjusted financial measure

Adjusted EBITDA amounted to R$ 894 million in 3Q23, representing an increase of +16.1% vs. 3Q22, led by our gross profit evolution combined with the efficiencies observed in our operating expenses, resulting in higher margins.

Capital Expenditures amounted to R$ 529 million in 3Q23, representing an increase of +5.3% vs. 3Q22, mainly driven by better trends in gross adds (restoring POS inventories) and investments in PagBank new products development.

Cash Earnings amounted to R$ 365 million, representing an increase of +36.4% year-over-year, driven by better operating performance combined with a stable trend on capital expenditure deployments in comparison with the previous year.

Depreciation and Amortization

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Depreciation and Amortization | (346) | (294) | 17.7% | (326) | 6.4% | (989) | (824) | 20.1% |

| % Total Revenue and Income | 8.6% | 7.3% | 1.3 p.p. | 8.5% | 0.1 p.p. | 8.5% | 7.2% | 1.3 p.p. |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Depreciation and Amortization | (329) | (290) | 13.5% | (310) | 6.3% | (941) | (810) | 16.1% |

| % Total Revenue and Income | 8.2% | 7.2% | 1.0 p.p. | 8.1% | 0.1 p.p. | 8.1% | 7.1% | 1.0 p.p. |

Depreciation and Amortization reached R$ 346 million, representing an increase of +17.7%, from R$ 294 million in 3Q22, mainly explained by:

(i)the depreciation of POS devices; and

(ii)the amortization of R&D investments, mainly related to product development and data security. These investments allow us to defer our tax liability through “Lei do Bem” (Technological Innovation Law).

When including non-GAAP Expenses of R$ 17 million, D&A, on a GAAP basis, totaled R$ 329 million, representing an increase of +13.5% vs. 3Q22 due to M&A expenses related to the fair value assets amortization and expenses for external consulting services.

POS Write-off

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| POS Write-off | (64) | (41) | 54.9% | (65) | -1.5% | (191) | (134) | 42.0% |

| % Total Revenue and Income | 1.6 | % | 7.3 | % | 0.6 p.p. | 1.7 | % | (0.1) p.p. | 1.6 | % | 1.2 | % | 0.5 p.p. |

In 3Q23, this value amounted to R$ 64 million, representing an increase of +54.9% year-over-year. In September 2019, we changed our business model from selling POS devices to a subscription model to follow the industry’s best standards and to improve the merchant’s user experience in terms of:

(i)POS delivery for new merchants; and

(ii)POS maintenance and replacement for existing merchants.

At that time, we strategically prepared for the launch of our HUBs strategy to have the best SLAs in the market, providing a superior value proposition to focus not only on pricing (POS, MDR and prepayment) fee itself.

Between 2020 and 2021, the COVID-19 pandemic changed merchants’ transaction profile into the PAGS ecosystem, adding more complexity to understanding merchants’ engagement and activity levels. Now we have a better understanding of merchants’ activity, and we started to write-off POS devices beginning in the 2Q22.

Earnings Before Tax (EBT)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Earnings before Taxes (EBT) | 557 | 472 | 17.9% | 531 | 4.8% | 1,557 | 1,419 | 9.8% |

| % Total Revenue and Income | 13.8% | 11.7% | 2.1 p.p. | 13.9% | (0.1) p.p. | 13.4% | 12.5% | 0.9 p.p. |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Earnings before Taxes (EBT) | 512 | 425 | 20.4% | 485 | 5.5% | 1,433 | 1,284 | 11.6% |

| % Total Revenue and Income | 12.7% | 10.5% | 2.2 p.p. | 12.7% | 0.0 p.p. | 12.4% | 11.3% | 1.1 p.p. |

Earnings before Tax amounted to R$ 557 million in 3Q23, representing an increase of +17.9% vs. 3Q22, reflecting the business growth in Payments and Financial Services, lower financial expenses, lower losses, and operational efficiencies partially offset by higher Depreciation and Amortization levels.

When including non-GAAP Expenses of R$ 45 million, Earnings before Tax, on a GAAP basis, totaled R$ 512 million, representing an increase of +20.4% vs. 3Q22.

Income Tax and Social Contribution Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Earnings before Taxes (EBT) | 512 | 425 | 20.4% | 485 | 5.5% | 1,433 | 1,284 | 11.6% |

| Statutory Rate | 34.0% | 34.0% | 0.0 p.p. | 34.0% | 0.0 p.p. | 34.0% | 34.0% | (0.0) p.p. |

| Expected Income Tax Expenses | (174) | (145) | 20.4% | (165) | 5.5% | (487) | (437) | 11.6% |

| Income Tax effect on: | | | | | | | | |

R&D and Tech Innovation Benefit1 | 48 | 63 | -22.9% | 49 | -1.7% | 149 | 175 | -14.7% |

Taxation of Income abroad2 | 24 | 35 | -30.9% | 24 | -0.4% | 79 | 89 | -11.3% |

| Other | 0 | 2 | -81.0% | (8) | n.a. | (8) | (14) | -41.9% |

| Income Tax Expenses | (101) | (45) | 125.1% | (100) | 1.2% | (268) | (187) | 42.9% |

| Effective Tax Rate | 19.8% | 10.6% | 9.2 p.p. | 20.6% | (0.9) p.p. | 18.7% | 14.6% | 4.1 p.p. |

| Current | (17) | 2 | n.a. | (42) | -60.2% | (77) | (27) | 190.8% |

| Deferred | (85) | (47) | 81.3% | (58) | 45.9% | (191) | (161) | 18.5% |

1. Refers to the benefit granted by the Technological Innovation Law (“Lei do Bem”), which reduces the income tax charges, based on the amount invested by the PagSeguro Digital Ltd. On specific intangible assets. Please, see Note 12 in our Form 6-K related to the Financial Statements, published on the date hereof;

2. Some entities and investment funds adopt different taxation regimes according to the applicable rules in their jurisdictions.

Income Tax and Social Contribution amounted to an expense of R$ 101 million in 3Q23, representing an increase of +125.1% versus 3Q22. Effective Tax Rate (ETR) increased by +920 bps to 19.8% in 3Q23 from 10.6% in 3Q22, mainly driven by lower results in FIDC and lower Capital Expenditure deployments in 2023 vs. 2022 in regards to “Lei do Bem” eligibility. In both periods, the difference between the Effective Income Tax and Social Contribution Rate and the Rate computed by applying the Brazilian federal statutory rate was mainly related to:

(i)Technological Innovation Law (“Lei do Bem”), which reduces income tax charges based on investments made in innovation and technology, such as those made by PagSeguro Brazil, our Brazilian operating subsidiary; and

(ii)Taxation of Income abroad. Certain entities or investment funds adopt different taxation regimes in accordance with the applicable rules in their respective jurisdictions.

Net Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Net Income | 440 | 411 | 7.0% | 415 | 6.0% | 1,248 | 1,186 | 5.2% |

| % Total Revenue and Income | 10.9% | 10.2% | 0.7 p.p. | 10.9% | 0.1 p.p. | 10.8% | 10.4% | 0.3 p.p. |

| | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Net Income | 411 | 380 | 8.0% | 385 | 6.6% | 1,166 | 1,097 | 6.2% |

| % Total Revenue and Income | 10.2% | 9.4% | 0.8 p.p. | 10.1% | 0.1 p.p. | 10.0% | 9.6% | 0.4 p.p. |

Net Income for the quarter amounted to R$ 440 million, representing an increase of +7.0%, from R$ 411 million reported in 3Q22.

Including Non-GAAP expenses of R$ 29 million, Net Income on GAAP basis totaled R$ 411 million, up +8.0% when compared to R$ 385 million reported in 3Q22.

Adj. EBITDA and Net Income (Non-GAAP) Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

| Net Income | GAAP | 350 | 367 | 380 | 408 | 370 | 385 | 411 |

| (+) Income Tax and Social Contribution | 67 | 76 | 45 | 67 | 66 | 100 | 101 |

(+) LTIP Expenses2 | 28 | 51 | 43 | (42) | 19 | 30 | 30 |

| (+) POS Write-off | 0 | 93 | 41 | 66 | 62 | 65 | 64 |

| (+) Depreciation and Amortization | 249 | 281 | 294 | 307 | 317 | 326 | 346 |

| (-) Other Financial Income | (42) | (45) | (46) | (43) | (65) | (65) | (66) |

(+) M&A Expenses3 | 0 | 0 | 0 | 0 | 0 | 0 | 3 |

| (+) FX Expenses | 13 | 9 | 12 | 15 | 17 | 9 | 10 |

(+) PagPhone realizable value reversal1 | 0 | 0 | (53) | 0 | 0 | 0 | (53) |

(-) Software's disposals2 | 0 | 0 | 29 | 11 | 0 | 0 | 29 |

(-) Boleto Flex impairment2 | 0 | 0 | 13 | 0 | 0 | 0 | 13 |

(-) Agreement with POS supplier2 | 0 | 0 | 10 | 0 | 0 | 0 | 0 |

| Adj. EBITDA | 665 | 831 | 770 | 788 | 787 | 849 | 883 |

| | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

| Net Income | GAAP | 350 | 367 | 380 | 408 | 370 | 385 | 411 |

(+) LTIP Expenses2 | 28 | 51 | 43 | (42) | 19 | 30 | 30 |

(+) M&A Expenses3 | 5 | 5 | 5 | 5 | 5 | 5 | 3 |

| (+) Income Tax and Social Contribution | (11) | (19) | (16) | (2) | (11) | (16) | (15) |

(+) PagPhone realizable value reversal1 | 0 | 0 | (35) | 0 | 0 | 0 | 0 |

(-) Software's disposals2 | 0 | 0 | 19 | 11 | 0 | 0 | 0 |

(-) Boleto Flex impairment2 | 0 | 0 | 8 | 0 | 0 | 0 | 0 |

(-) Agreement with POS supplier2 | 0 | 0 | 7 | 0 | 0 | 0 | 0 |

| (+) Capitalized Expenses of platforms development | 0 | 0 | 0 | 32 | 10 | 11 | 12 |

| Net Income | Non-GAAP | 371 | 403 | 411 | 411 | 392 | 415 | 440 |

Total Costs and Expenses (Non-GAAP) are booked in:

1. Transaction Costs;

2. Operating Expenses;

3. Depreciation and Amortization.

Managerial Float Reconciliation1

| | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

| Total Revenue and Income | 3,427 | | 3,911 | | 4,035 | | 3,962 | | 3,750 | | 3,826 | | 4,026 | |

| As previously reported | | | | | | | |

| Payments | 3,125 | | 3,606 | | 3,712 | | 3,654 | | 3,449 | | 3,339 | | 3,771 | |

| Financial Services | 305 | | 314 | | 339 | | 329 | | 298 | | 447 | | 219 | |

| Other Financial Income | 42 | | 45 | | 46 | | 43 | | 65 | | 65 | | 66 | |

| Float | (44) | | (54) | | (62) | | (64) | | (62) | | (26) | | (29) | |

| Current classification | | | | | | | |

| Payments | 3,125 | | 3,606 | | 3,712 | | 3,654 | | 3,449 | | 3,575 | | 3,771 | |

| Financial Services | 333 | | 344 | | 376 | | 362 | | 331 | | 243 | | 260 | |

| Other Financial Income | 42 | | 45 | | 46 | | 43 | | 65 | | 65 | | 66 | |

| Float | (72) | | (84) | | (99) | | (97) | | (95) | | (57) | | (71) | |

| Gross Profit | 1,225 | | 1,434 | | 1,384 | | 1,409 | | 1,374 | | 1,438 | | 1,477 | |

| As previously reported | | | | | | | |

| Payments | 1,205 | | 1,393 | | 1,308 | | 1,278 | | 1,228 | | 1,225 | | 1,417 | |

| Financial Services | 20 | | 41 | | 76 | | 131 | | 147 | | 213 | | 59 | |

| Current classification | | | | | | | |

| Payments | 1,177 | | 1,364 | | 1,272 | | 1,245 | | 1,196 | | 1,327 | | 1,376 | |

| Financial Services | 48 | | 70 | | 113 | | 164 | | 179 | | 111 | | 101 | |

| Adj. EBITDA | 665 | | 831 | | 770 | | 777 | | 787 | | 849 | | 894 | |

| As previously reported | | | | | | | |

| Payments | 769 | | 927 | | 868 | | 809 | | 751 | | 857 | | 933 | |

| Financial Services | (104) | | (96) | | (99) | | (21) | | 36 | | (9) | | (39) | |

| Current classification | | | | | | | |

| Payments | 741 | | 898 | | 832 | | 765 | | 719 | | 850 | | 892 | |

| Financial Services | (76) | | (67) | | (62) | | 12 | | 68 | | (1) | | 2 | |

1. The observed increase in Financial Services revenues and decrease in Gross Profit/EBITDA in Payments is attributed to the revised float allocation: R$ 33M in 1Q23, R$ 33M in 4Q22 and R$ 28M in 1Q22.

Cash Flow Analysis

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Earnings before Taxes (EBT) | 512 | | 425 | | 20.4 | % | 485 | | 5.5 | % | 1,433 | | 1,284 | | 11.6 | % |

| Expenses (Revenues) not affecting Cash | 826 | | 1,238 | | -33.3 | % | 602 | | 37.3 | % | 2,133 | | 3,026 | | -29.5 | % |

| Net Cash from Operating Activities | 972 | | 1,071 | | -9.2 | % | 464 | | 109.8 | % | 1,835 | | 1,589 | | 15.4 | % |

| Net Cash from Investing Activities | (503) | | (498) | | 1.1 | % | (553) | | -8.9 | % | (1,618) | | (1,758) | | -8.0 | % |

| Net Cash from Financing Activities | (218) | | (361) | | -39.4 | % | (3) | | 7146.8 | % | (71) | | (221) | | -67.9 | % |

| Increase (Decrease) in Cash Position | 251 | | 213 | | 17.9 | % | (92) | | n.a. | 146 | | (390) | | n.a. |

| Cash Position at the beginning of the Period | 1,724 | | 1,192 | | 44.6 | % | 1,816 | | -5.1 | % | 1,829 | | 1,794 | | 1.9 | % |

| Cash Position at the end of the Period | 1,975 | | 1,405 | | 40.6 | % | 1,724 | | 14.5 | % | 1,975 | | 1,405 | | 40.6 | % |

Cash and Cash Equivalents at the end of 3Q23 amounted to R$ 1,975 million, representing an increase of R$ 570 million, up +40.6% year-over-year.

Expenses (Revenues) not affecting Cash amounted of R$ 826 million, representing a decrease of -33.3% year-over-year mainly driven by:

•Lower Losses, mainly related to better fraud prevention actions related to Total Payment Volume and more detailed credit analysis for credit operations;

•Depreciation and Amortization growth due to the deployed capital expenditures in prior years;

•Decrease in the Interest accrued from Financial Assets and Liabilities given the lower average cost of funding driven by the deposits growth;

•Increase in Disposal of Property, Equipment, and Intangible Assets, mainly explained by the write-offs of POS devices.

Net Cash provided by (used in) Operating Activities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Net Cash from Operating Activities | 972 | | 1,071 | | -9.2 | % | 464 | | 109.8 | % | 1,835 | | 1,589 | | 15.4 | % |

| Earnings before Income Taxes | 512 | | 425 | | 20.4 | % | 485 | | 5.5 | % | 1,433 | | 1,284 | | 11.6 | % |

| Expenses (Revenues) not affecting Cash | 826 | | 1,238 | | -33.3 | % | 602 | | 37.3 | % | 2,133 | | 3,026 | | -29.5 | % |

| Changes in Operating Assets and Liabilities | (1,037) | | (1,548) | | -33.0 | % | (1,088) | | -4.7 | % | (3,404) | | (5,160) | | -34.0 | % |

| Income Tax and Social Contribution paid | (19) | | (7) | | 183.1 | % | (47) | | -58.4 | % | (79) | | (87) | | -9.3 | % |

| Interest Income received | 690 | | 963 | | -28.3 | % | 511 | | 35.0 | % | 1,751 | | 2,526 | | -30.7 | % |

Net Cash provided in Operating Activities in 3Q23 totaled R$ 972 million, representing a decrease of -9.2% vs. 3Q22.

The adjustments for changes in Operating Assets and Liabilities amounted to negative cash flow of R$ 1,037 million in 3Q23, mainly due to:

•Accounts receivable, mainly related to receivables derived from transactions where we act as the financial intermediary in operations with the issuing banks, which is presented net of Transaction Costs and Financial Expenses we incur when we elect to receive early payment of the accounts receivable owed to us by card issuers, consists of the difference between the opening and closing balances of the Accounts Receivable item of Current Assets and Non-current Assets on our Balance Sheet;

•Payables to third parties, which is presented net of Revenue from Transaction Activities and Financial Income we receive when merchants elect to receive early payments, consists of the difference between the opening and closing balances of the Payables to Third Parties item of Current Liabilities on our Balance Sheet;

•Receivables from (Payables to) related Parties, consists of the difference between the opening and closing balances of the Payables to related Parties excluding Interest Paid, which are presented separately in the statement of Cash Flows;

•Salaries and Social Charges consist of the amounts that were recorded on our Statement of Income, but which remained unpaid at the end of the period.

•Trade Payables item consists of the difference between the opening and closing balances of trade payables, negatively impacting the result.

•Taxes and contributions item consists of sales taxes (ISS. ICMS. PIS and COFINS), negatively impacting the result.

•Financial Investments (mandatory guarantee) item consists of the minimum amount that we need to maintain as required by the Brazilian Central Bank. This item impacted positively the third quarter ended September 30, 2023.

•Taxes Recoverable item consists of withholding taxes and recoverable taxes on transaction activities and other services and purchase of POS devices. This item impacted positively the cash flow in the third quarter.

•Deposits consists of issued certificates of deposit excluding interest income paid to, which are presented separately in the statement of cash flows. This item impacted positively the cash flow in the third quarter.

•We paid Income tax and social contribution in cash totaling R$ 19 million.

•Interest Income received, net consisted of interest recorded under Accounts Receivable (monthly), which related to fees charged from merchants, considering the Brazilian monthly Interest Rate over PAGS Accounts Receivable and interest paid related to our deposits. Interest Income amounted to R$ 690 million.

Net Cash provided by (used in) Investing Activities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Net Cash from Investing Activities | (503) | | (498) | | 1.1 | % | (553) | | -8.9 | % | (1,618) | | (1,758) | | -8.0 | % |

Amount paid on Acquisitions1 | (31) | | — | | n.a. | — | | n.a. | (31) | | — | | n.a. |

| Property and Equipment | (266) | | (247) | | 8.1 | % | (277) | | -3.9 | % | (692) | | (1,027) | | -32.6 | % |

| Intangible Assets | (262) | | (256) | | 2.4 | % | (253) | | 3.5 | % | (775) | | (731) | | 5.9 | % |

Redemption (Acquisition) of Financial Investments | 56 | | 4 | | 1247.8 | % | (22) | | n.a. | (120) | | — | | n.a. |

1. Net of Cash acquired.

Net Cash used in Investing Activities in 3Q23, totaled R$ 503 million, up +1.1% vs. 3Q22, mainly due to:

•Acquisitions, net of cash acquired, resulted in a negative impact of R$ 31 million, related to acquisition of the remaining shares of NetPOS.

•Purchases of Property and Equipment of R$ 266 million, representing an increase of +8.1% y/y.

•Purchases and Development of Intangible Assets of R$ 262 million, representing an increase of +2.4% y/y, in connection with purchases of third-party software and salaries and other amounts that we invested to develop software and technology internally, which we capitalize as intangible assets.

•Acquisition (redemption) of Financial Investments, which positively impacted net cash used by investing activities.

Net Cash provided by (used in) Financing Activities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

Net Cash from Financing Activities | (218) | | (361) | | -39.4 | % | (3) | | 7146.8 | % | (71) | | (221) | | -67.9 | % |

| Proceeds from Borrowings | 0 | | 0 | | n.a. | 100 | | n.a. | 300 | | 250 | | 20.0 | % |

| Payment of borrowings | (100) | | (243) | | -58.8 | % | 0 | | n.a. | (100) | | (250) | | -60.0 | % |

| Payment of borrowings interests | (10) | | (15) | | -37.3 | % | 0 | | n.a. | (10) | | (15) | | -37.3 | % |

| Capital inc. by non-controlling shareholders | 0 | | 0 | | n.a. | 0 | | n.a. | 0 | | 0 | | n.a. |

| Payment of Leases | (4) | | (4) | | -11.7 | % | (5) | | -20.9 | % | (13) | | (14) | | -9.8 | % |

| Acquisition of Treasury Shares | (105) | | (98) | | 7.1 | % | (98) | | 6.9 | % | (249) | | (192) | | 29.7 | % |

Net Cash used in Financing Activities in 3Q23, totaled a disbursement of R$ 218 million, representing a decrease of -39.4% year-over-year, mainly related to the Payment of borrowings and interests in the amount of R$ 110 million and acquisitions of treasury shares in the amount of R$ 105 million.

Appendix

Balance Sheet

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R$ Million | | | | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q |

| Total Assets | | | | 47,327 | | 43,276 | | 9.4 | % | 42,836 | | 10.5 | % |

| Current Assets | | | | 41,147 | | 37,709 | | 9.1 | % | 36,898 | | 11.5 | % |

| Cash and Cash Equivalents | | | | 1,975 | | 1,405 | | 40.6 | % | 1,724 | | 14.5 | % |

| Financial Investments | | | | 1,078 | | 1,074 | | 0.4 | % | 1,122 | | -3.9 | % |

| Accounts Receivable | | | | 37,521 | | 34,570 | | 8.5 | % | 33,440 | | 12.2 | % |

| Derivative Financial Instruments | | | | 0 | | 0 | | n.a. | 0 | | n.a. |

| Receivables from Related Parties | | | | 4 | | 0 | | n.a. | 2 | | 103.3 | % |

| Inventories | | | | 26 | | 52 | | -49.7 | % | 33 | | -20.1 | % |

| Taxes Recoverable | | | | 379 | | 460 | | -17.6 | % | 421 | | -10.0 | % |

| Other Receivables | | | | 163 | | 149 | | 9.4 | % | 155 | | 5.4 | % |

| Non-current Assets | | | | 6,180 | | 5,567 | | 11.0 | % | 5,939 | | 4.1 | % |

| Judicial Deposits | | | | 50 | | 44 | | 12.6 | % | 50 | | 0.2 | % |

| Accounts Receivable | | | | 1,000 | | 731 | | 36.7 | % | 918 | | 8.9 | % |

| Receivables from related parties | | | | 28 | | 0 | | n.a. | 13 | | 109.2 | % |

| Other receivables | | | | 39 | | 16 | | 148.7 | % | 25 | | 54.6 | % |

| Deferred Income Tax | | | | 102 | | 103 | | -1.4 | % | 98 | | 3.9 | % |

| Investment | | | | 0 | | 2 | | n.a. | 2 | | n.a. |

| Property and Equipment | | | | 2,478 | | 2,672 | | -7.2 | % | 2,474 | | 0.2 | % |

| Intangible Assets | | | | 2,484 | | 1,999 | | 24.2 | % | 2,359 | | 5.3 | % |

| Total Liabilities and Equity | | | | 47,327 | | 43,276 | | 9.4 | % | 42,836 | | 10.5 | % |

| Current Liabilities | | | | 28,665 | | 28,287 | | 1.3 | % | 25,890 | | 10.7 | % |

| Payables to Third Parties | | | | 18,707 | | 14,947 | | 25.2 | % | 16,632 | | 12.5 | % |

| Trade Payables | | | | 439 | | 372 | | 18.2 | % | 465 | | -5.5 | % |

| Payables to Related Parties | | | | 78 | | 451 | | -82.6 | % | 74 | | 5.7 | % |

| Borrowings | | | | 193 | | 987 | | -80.5 | % | 292 | | -34.0 | % |

| Derivative Financial Instruments | | | | 28 | | 157 | | -82.1 | % | 33 | | -14.2 | % |

| Deposits | | | | 8,577 | | 10,795 | | -20.5 | % | 7,813 | | 9.8 | % |

| Salaries and Social Charges | | | | 334 | | 301 | | 11.0 | % | 276 | | 20.8 | % |

| Taxes and Contributions | | | | 83 | | 73 | | 12.9 | % | 83 | | -0.4 | % |

| Provision for Contingencies | | | | 70 | | 43 | | 64.0 | % | 62 | | 13.4 | % |

| Deferred Revenue | | | | 126 | | 132 | | -4.6 | % | 125 | | 0.7 | % |

| Other Liabilities | | | | 30 | | 29 | | 3.8 | % | 34 | | -12.7 | % |

| Non-current Liabilities | | | | 5,793 | | 3,477 | | 66.6 | % | 4,421 | | 31.0 | % |

| Payables to Third Parties | | | | 159 | | 0 | | n.a. | 127 | | 25.1 | % |

| Deferred Income Tax | | | | 1,755 | | 1,530 | | 14.7 | % | 1,666 | | 5.3 | % |

| Provision for Contingencies | | | | 6 | | 15 | | -56.5 | % | 7 | | -8.1 | % |

| Deposits | | | | 3,337 | | 1,843 | | 81.0 | % | 2,219 | | 50.4 | % |

| Deferred Revenue | | | | 18 | | 19 | | -5.4 | % | 18 | | 1.6 | % |

| Payables to related parties | | | | 284 | | 0 | | n.a. | 155 | | 83.5 | % |

| Other Liabilities | | | | 233 | | 70 | | 232.6 | % | 229 | | 2.0 | % |

| Equity | | | | 12,868 | | 11,512 | | 11.8 | % | 12,526 | | 2.7 | % |

| Share Capital | | | | 0 | | 0 | | 0.0 | % | 0 | | 0.0 | % |

| Capital Reserve | | | | 6,097 | | 6,089 | | 0.1 | % | 6,062 | | 0.6 | % |

| Retained earnings | | | | 7,403 | | 5,830 | | 27.0 | % | 6,992 | | 5.9 | % |

| Treasury Shares | | | | (610) | | (377) | | 61.9 | % | (506) | | 20.6 | % |

| Other Comprehensive Income | | | | 0 | | (9) | | -99.2 | % | (1) | | -93.6 | % |

| Equity Valuation Adjustments | | | | (22) | | (22) | | 0.0 | % | (22) | | 0.0 | % |

Basic and Diluted EPS | Third Quarter 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Net Income attributable to: | | | | | | | | |

| Owners of the Company | 411 | | 380 | | 8.0 | % | 385 | | 6.6 | % | 1,166 | | 1,097 | | 6.2 | % |

| Non-controlling interests | — | | — | | 0.0 | % | — | | 0.0 | % | — | | — | | 0.0 | % |

| Outstanding Common Shares1 | # Million | 321.8 | | 326.7 | | -1.5 | % | 323.5 | | -0.5 | % | 323.4 | | 327.5 | | -1.3 | % |

Common Shares1 diluted | # Million | 323.8 | | 328.9 | | -1.6 | % | 325.5 | | -0.5 | % | 325.6 | | 329.6 | | -1.2 | % |

| Basic Earnings per Common Share | R$ 1.28 | R$ 1.16 | 9.6 | % | R$ 1.19 | 7.2 | % | R$ 3.60 | R$ 3.35 | 7.6 | % |

| Diluted Earnings per Common Share | R$ 1.27 | R$ 1.16 | 9.7 | % | R$ 1.18 | 7.2 | % | R$ 3.58 | R$ 3.33 | 7.6 | % |

1. Weighted average number.

Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | R$ Million | 3Q23 | 3Q22 | Var. y/y | 2Q23 | Var. q/q | 9M23 | 9M22 | Var. y/y |

| Earnings before Income Taxes | 512 | | 425 | | 20.4 | % | 485 | | 5.5 | % | 1,433 | | 1,284 | | 11.6 | % |

| Expenses (Revenues) not affecting Cash | 826 | | 1,238 | | -33.2 | % | 602 | | 37.4 | % | 2,134 | | 3,026 | | -29.5 | % |

| Depreciation and Amortization | 346 | | 294 | | 17.7 | % | 326 | | 6.4 | % | 989 | | 824 | | 20.1 | % |

| Chargebacks | 165 | | 273 | | -39.4 | % | 122 | | 35.8 | % | 413 | | 793 | | -47.9 | % |

| Accrual of Provision for Contingencies | 10 | | 17 | | -42.6 | % | 4 | | 173.9 | % | 23 | | 28 | | -16.4 | % |

| Reversal of Taxes and Contributions | 0 | | 0 | | n.a. | 0 | | n.a. | 0 | | 0 | | n.a. |

| Share based Long Term Incentive Plan | 36 | | 37 | | -3.0 | % | 33 | | 9.6 | % | 109 | | 113 | | -3.6 | % |

| Loss on Disposal: PP&E/Intangible Assets | 77 | | 84 | | -8.0 | % | 68 | | 14.5 | % | 209 | | 189 | | 10.2 | % |

| Financial Instruments | 8 | | 0 | | n.a. | (9) | | n.a. | (2) | | 0 | | n.a. |

| Interest Accrued | 184 | | 509 | | n.a. | 59 | | 213.1 | % | 393 | | 1,063 | | -63.0 | % |

| Other Financial Cost, Net | (2) | | 23 | | n.a. | 0 | | n.a. | (1) | | 15 | | n.a. |

| Changes in Operating Assets/Liabilities | (1,037) | | (1,548) | | -33.0 | % | (1,088) | | -4.7 | % | (3,404) | | (5,160) | | -34.0 | % |

| Account Receivables | (5,386) | | (4,999) | | 7.7 | % | (668) | | 705.8 | % | (4,944) | | (14,955) | | -66.9 | % |

| Financial Investments | 16 | | 0 | | n.a. | (10) | | n.a. | 229 | | (210) | | n.a. |

| Inventories | 7 | | (4) | | n.a. | (11) | | n.a. | (13) | | (3) | | 411.5 | % |

| Taxes Recoverable | 59 | | 14 | | 318.4 | % | 61 | | -3.0 | % | 106 | | 103 | | 2.6 | % |

| Other Receivables | (23) | | 56 | | n.a. | (6) | | 278.1 | % | (8) | | 38 | | n.a. |

| Deferred Revenue | 1 | | (6) | | n.a. | 0 | | n.a. | 0 | | (29) | | -99.4 | % |

| Other Payables | (5) | | (1) | | 433.0 | % | 9 | | n.a. | 3 | | (35) | | n.a. |

| Payables to Third Parties | 2,082 | | 329 | | 533.4 | % | 22 | | 9390.5 | % | 768 | | 1,125 | | -31.7 | % |

| Trade Payables | (27) | | (146) | | -81.7 | % | 27 | | n.a. | (12) | | (220) | | -94.4 | % |

| Receivables/Payables to Related Parties | 110 | | 171 | | -35.6 | % | (332) | | n.a. | (297) | | (119) | | 149.6 | % |

| Deposits | 2,075 | | 2,992 | | -30.7 | % | (220) | | n.a. | 760 | | 9,097 | | -91.6 | % |

| Salaries and Social Charges | 56 | | 49 | | 14.3 | % | 71 | | -20.9 | % | 40 | | 41 | | -2.4 | % |

| Taxes and Contributions | 0 | | 9 | | -98.6 | % | (25) | | n.a. | (24) | | 24 | | n.a. |

| Provision for Contingencies | (2) | | (11) | | -83.8 | % | (6) | | -69.3 | % | (11) | | (17) | | -33.7 | % |

| Income Tax and Social Contribution paid | (19) | | (7) | | 183.1 | % | (47) | | -58.4 | % | (79) | | (87) | | -9.3 | % |

| Interest Income received | 690 | | 963 | | -28.3 | % | 511 | | 35.0 | % | 1,751 | | 2,526 | | -30.7 | % |

| Net Cash from Operating Activities | 972 | | 1,071 | | -9.2 | % | 464 | | 109.8 | % | 1,835 | | 1,589 | | 15.5 | % |

| Amount paid on Acquisitions | (31) | | 0 | | n.a. | 0 | | n.a. | (31) | | 0 | | n.a. |

| Purchases of Property and Equipment | (266) | | (247) | | 8.1 | % | (277) | | -3.9 | % | (692) | | (1,027) | | -32.6 | % |

| Purchases of Intangible Assets | (262) | | (256) | | 2.4 | % | (253) | | 3.7 | % | (775) | | (731) | | 6.0 | % |

| Acquisition of Financial Investments | 56 | | 4 | | 1387.9 | % | (22) | | n.a. | (120) | | 0 | | n.a. |

| Redemption of Financial Investments | 0 | | 0 | | n.a. | 0 | | n.a. | 0 | | 0 | | n.a. |

| Net Cash from Investing Activities | (504) | | (498) | | 1.2 | % | (553) | | -8.8 | % | (1,619) | | (1,758) | | -7.9 | % |

| Payment of Borrowings | (100) | | (250) | | -60.0 | % | 0 | | n.a. | (100) | | (250) | | -60.0 | % |

| Proceeds from Borrowings | 0 | | 0 | | n.a. | 100 | | n.a. | 300 | | 250 | | 20.0 | % |

| Payment of Borrowings Interest | (10) | | (8) | | 15.5 | % | 0 | | n.a. | (10) | | (15) | | -37.3 | % |

| Payment of Leases | (4) | | (4) | | -11.7 | % | (5) | | -20.8 | % | (13) | | (14) | | -9.8 | % |

| Acquisition of Treasury Shares | (105) | | (98) | | 7.1 | % | (98) | | 6.9 | % | (249) | | (192) | | 29.7 | % |

| Capital Increase | 0 | | 0 | | n.a. | 0 | | n.a. | 0 | | 0 | | n.a. |

| Net Cash from Financing Activities | (218) | | (361) | | n.a. | (3) | | n.a. | (71) | | (221) | | -67.9 | % |

| Increase (Decrease) in Cash Position | 251 | | 213 | | 17.9 | % | (92) | | n.a. | 146 | | (390) | | n.a. |

| Cash Position at the beginning of the Period | 1,724 | | 1,192 | | 44.6 | % | 1,816 | | -5.1 | % | 1,829 | | 1,794 | | 1.9 | % |

| Cash Position at the end of the Period | 1,975 | | 1,404 | | 40.6 | % | 1,724 | | 14.5 | % | 1,975 | | 1,405 | | 40.6 | % |

Non-GAAP disclosure

This press release includes certain non-GAAP measures. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. These non-GAAP measures are provided to enhance investors' overall understanding of our current financial performance and its prospects for the future. Specifically, we believe the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses, as the case may be, that may not be indicative of our core operating results and business outlook.

These measures may be different from non-GAAP financial measures used by other companies. The presentation of this non-GAAP financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered separately from, or as a substitute for, our financial information prepared and presented in accordance with IFRS as issued by the IASB. Non-GAAP measures have limitations in that they do not reflect all the amounts associated with our results of operations as determined in accordance with IFRS. These measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures.

Non-GAAP results consist of our GAAP results as adjusted to exclude the following items:

LTIP Expenses: This consists of expenses for equity awards under our two long-term incentive plans (LTIP and LTIP-Goals). We exclude LTIP expenses from our non-GAAP measures primarily because they are non-cash expenses and the related employer payroll taxes depend on our stock price and the timing and size of exercises and vesting of equity awards, over which management has limited to no control, and as such management does not believe these expenses correlate to the operation of our business.

M&A Expenses: This consists of expenses for mergers & acquisitions (“M&A”) transactions, including, among others, expenses for external consulting, accounting and legal services in connection with due diligence and negotiating M&A documentation for our acquisitions, as well as amortization and write-downs of the fair value of certain acquired assets. We exclude M&A expenses from our non-GAAP measures primarily because such expenses are non-recurring and do not correlate to the operation of our business.

Non-recurring Effects: This consists of one-time effects related to PagPhone sales, PagPhone inventory provisions, tax impairment, software disposals and development. We exclude non-recurring effects from our non-GAAP measures primarily because such items are non-recurring and do not correlate to the operation of our business.

Income Tax and Social Contribution on LTIP Expenses, M&A Expenses and Non-Recurring Adjustments: This represents the income tax effect related to the LTIP expenses, M&A expenses and non-recurring adjustments mentioned above.

For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, see the tables elsewhere in this press release under the following headings: “Income Tax and Social Contribution Reconciliation,” “Adjusted EBITDA and Non-GAAP Net Income Reconciliation,” “Reconciliation of Basic and diluted EPS to non-GAAP Basic and diluted EPS” and “Reconciliation of GAAP Measures to non-GAAP Measures.”

Earnings Call

PagSeguro Digital Ltd. (NYSE: PAGS) will host a conference call and earnings webcast on November 16, 2023 at 5:00 pm ET.

Event Details

HD Web Phone: Click here

Dial–in (Brazil): +55 (11) 3181-8565 or +55 (11) 4090-1621

Dial–in (US and other countries): +1 (412) 717-9627 | +1 (844) 204-8942

Password: PagSeguro Digital

Webcast: https://choruscall.com.br/pagseguro/3q23.htm

Contacts:

Investor Relations:

ir@pagseguro.com

investors.pagseguro.com

Media Press:

pagbank@xcom.net.br

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may,” or similar expressions are generally intended to identify forward-looking statements. We cannot guarantee that such statements will prove correct. These forward-looking statements speak only as of the date hereof and are based on our current plans, estimates of future events, expectations and trends (including trends related to the global and Brazilian economies and capital markets, as well as the continuing economic, financial, political and public health effects of the coronavirus, or the COVID-19, pandemic.) that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares, and are subject to several known and unknown uncertainties and risks, many of which are beyond our control. As consequence, current plans, anticipated actions and future financial position and results of operations may differ significantly from those expressed in any forward-looking statements in this press release. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented. In light of the risks and uncertainties described above, the future events and circumstances discussed in this press release might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements. To obtain further information on factors that may lead to results different from those forecast by us, please consult the reports we file with the U.S. Securities and Exchange Commission (SEC) and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in our annual report on Form 20-F.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 17, 2023

| | | | | | | | |

| PagSeguro Digital Ltd. |

| |

| By: | /s/ Artur Schunck |

| Name: | Artur Schunck |

| Title: | Chief Financial Officer,

Chief Accounting Officer and

Investor Relations Officer |